The document summarizes accounting concepts related to partnerships in 3 chapters. It includes:

1) An assignment classification table that matches learning objectives, questions, exercises and problems to the appropriate level of difficulty and estimated completion time.

2) A description table that provides more details on specific problems, exercises and their difficulty level and time allotment.

3) A correlation chart that maps the chapter's study objectives, questions, and exercises to Bloom's Taxonomy and whether they involve concepts (C), principles (P), procedures (S) or applications (A).

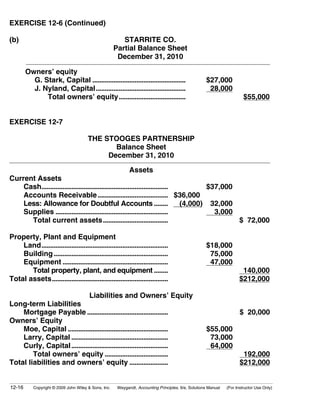

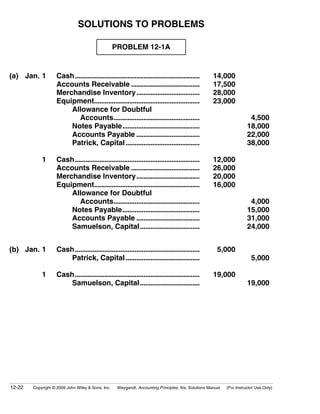

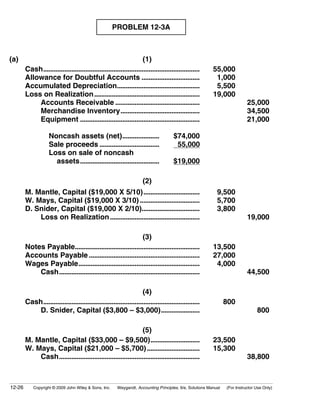

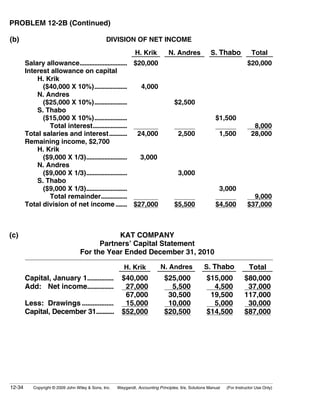

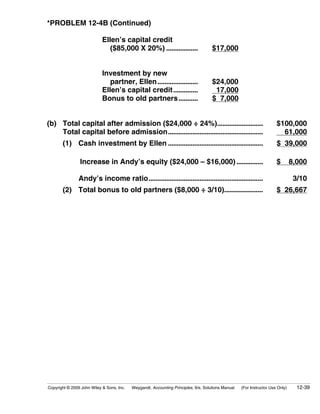

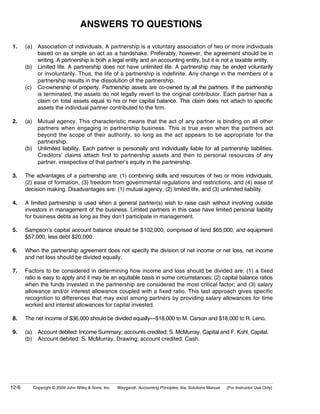

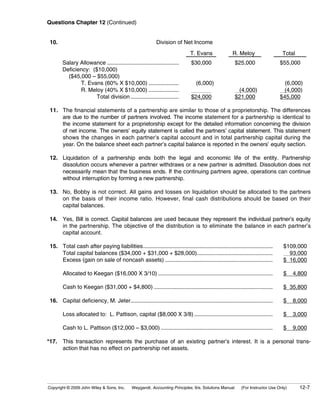

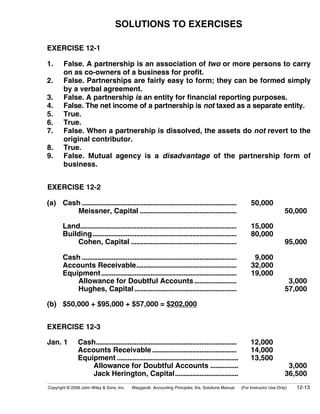

![BRIEF EXERCISE 12-5

Division of Net Income

Joe Sam Total

Salary allowance .............................................. $15,000 $10,000 $25,000

Interest allowance............................................ 7,000 5,000 12,000

Remaining deficiency, ($9,000):

[($25,000 + $12,000) – $28,000]

Joe ($9,000 X 50%) ................................ (4,500)

Sam ($9,000 X 50%)................................ (4,500)

Total remainder ............................... (9,000)

Total division of net income......................... $17,500 $10,500 $28,000

BRIEF EXERCISE 12-6

A, Capital......................................................................................... 8,000

L, Capital ......................................................................................... 7,000

F, Capital ......................................................................................... 4,000

Cash......................................................................................... 19,000

*BRIEF EXERCISE 12-7

Cox, Capital.................................................................................... 10,000

Day, Capital ........................................................................... 10,000

*BRIEF EXERCISE 12-8

Cash.................................................................................................. 52,000

Menke, Capital (50% X $11,900*)............................................. 5,950

Hibbett, Capital (50% X $11,900) ............................................. 5,950

Kosko, Capital (45% X $142,000).................................... 63,900

*[($40,000 + $50,000 + $52,000) X 45%] – $52,000 = $11,900.

12-10 Copyright © 2009 John Wiley & Sons, Inc. Weygandt, Accounting Principles, 9/e, Solutions Manual (For Instructor Use Only)](https://image.slidesharecdn.com/chapter12accountingforpartnerships-121018111920-phpapp02/85/Chapter-12-accounting-for-partnerships-10-320.jpg)

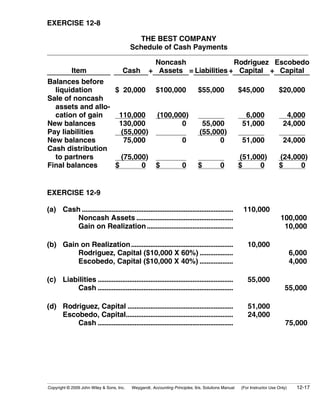

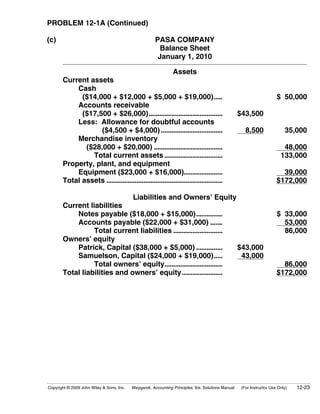

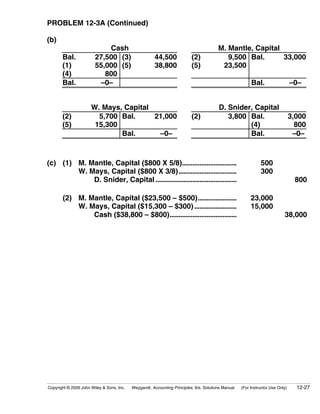

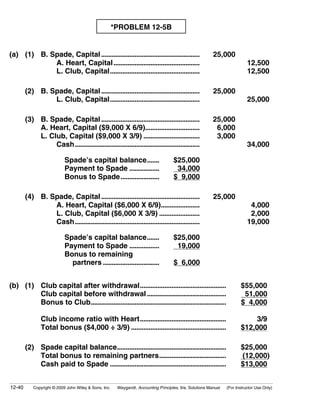

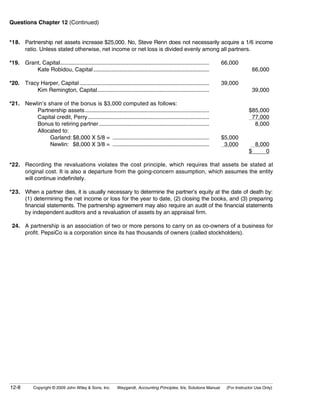

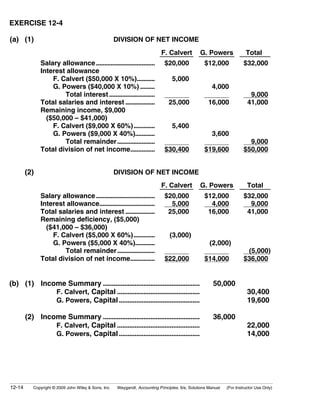

![EXERCISE 12-5

(a) Income Summary................................................................ 70,000

O. Guillen, Capital ($70,000 X 45%)...................... 31,500

K. Williams, Capital ($70,000 X 55%) ................... 38,500

(b) Income Summary................................................................ 70,000

O. Guillen, Capital

[$30,000 + ($15,000 X 45%)] .............................. 36,750

K. Williams, Capital

[$25,000 + ($15,000 X 55%)] .............................. 33,250

(c) Income Summary................................................................. 70,000

O. Guillen, Capital....................................................... 36,000

K. Williams, Capital .................................................... 34,000

Guillen: [$40,000 + $6,000 – ($20,000 X 50%)]

Williams: [$35,000 + $9,000 – ($20,000 X 50%)]

(d) Guillen: $60,000 + $36,000 – $18,000 = $78,000

Williams: $90,000 + $34,000 – $24,000 = $100,000

EXERCISE 12-6

(a) STARRITE CO.

Partners’ Capital Statement

For the Year Ended December 31, 2010

G. Stark J. Nyland Total

Capital, January 1 ....................... $20,000 $18,000 $38,000

Add: Net income ........................ 15,000 15,000 30,000

35,000 33,000 68,000

Less: Drawings........................... 8,000 5,000 13,000

Capital, December 31................. $27,000 $28,000 $55,000

Copyright © 2009 John Wiley & Sons, Inc. Weygandt, Accounting Principles, 9/e, Solutions Manual (For Instructor Use Only) 12-15](https://image.slidesharecdn.com/chapter12accountingforpartnerships-121018111920-phpapp02/85/Chapter-12-accounting-for-partnerships-15-320.jpg)