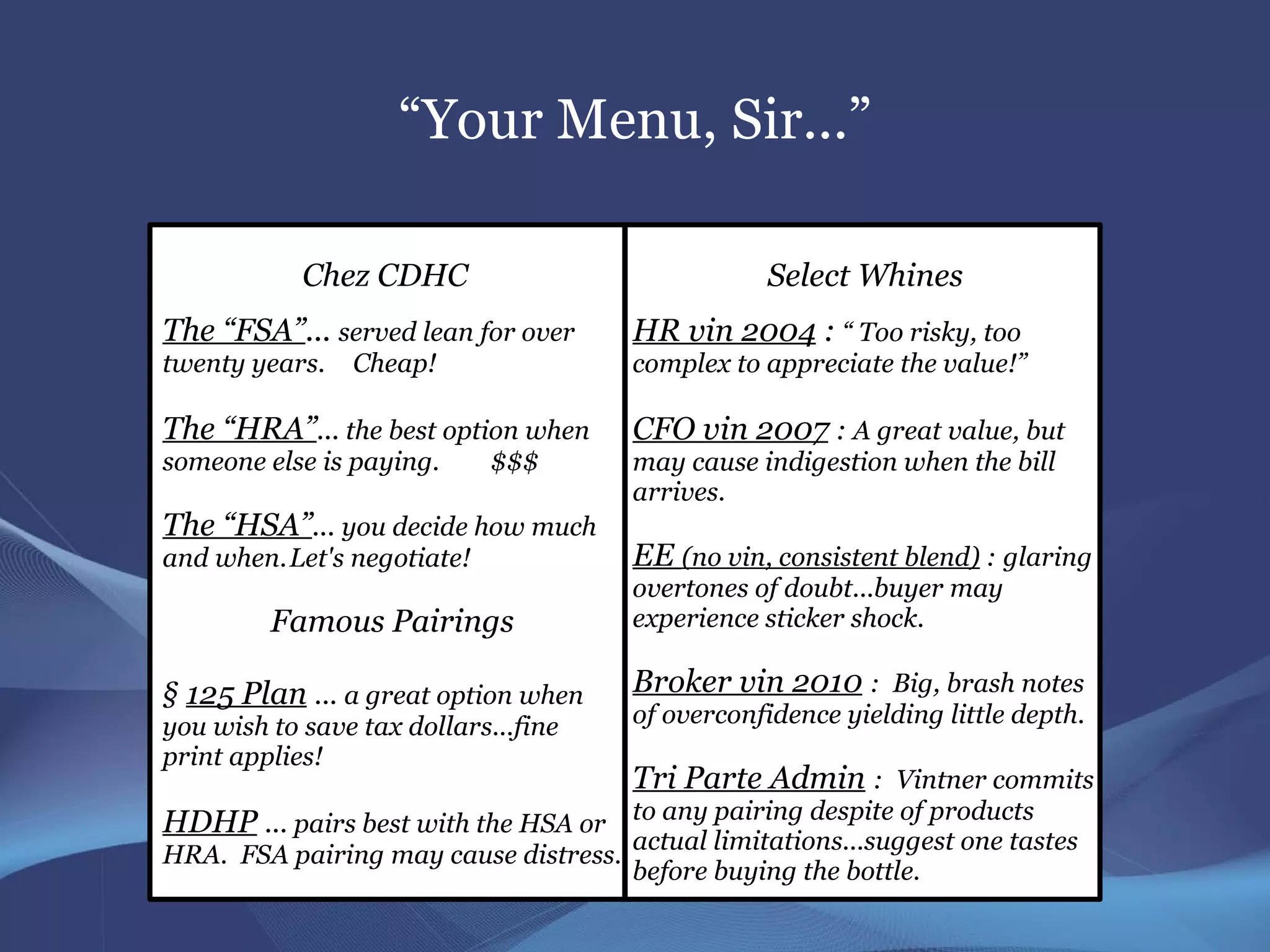

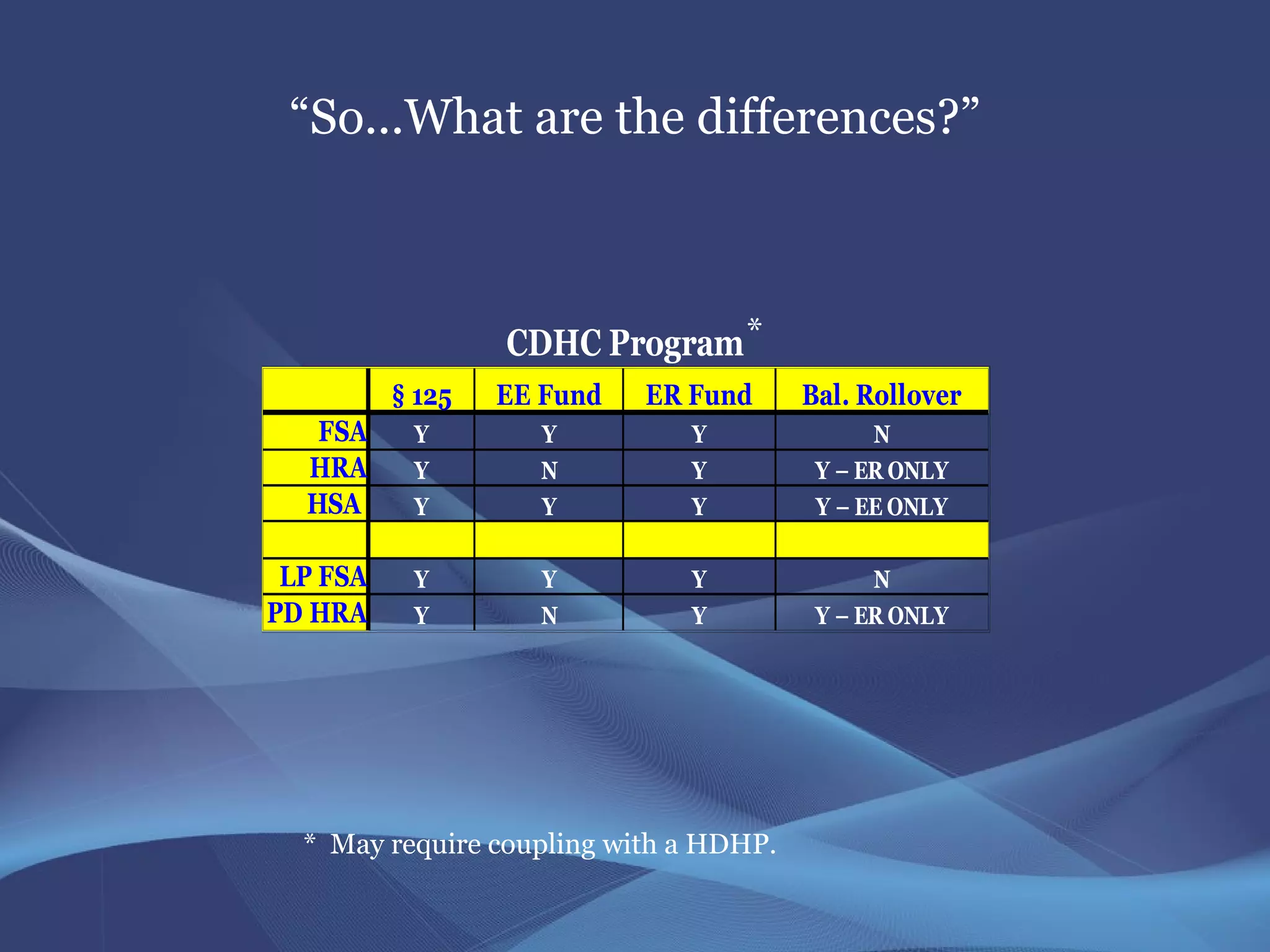

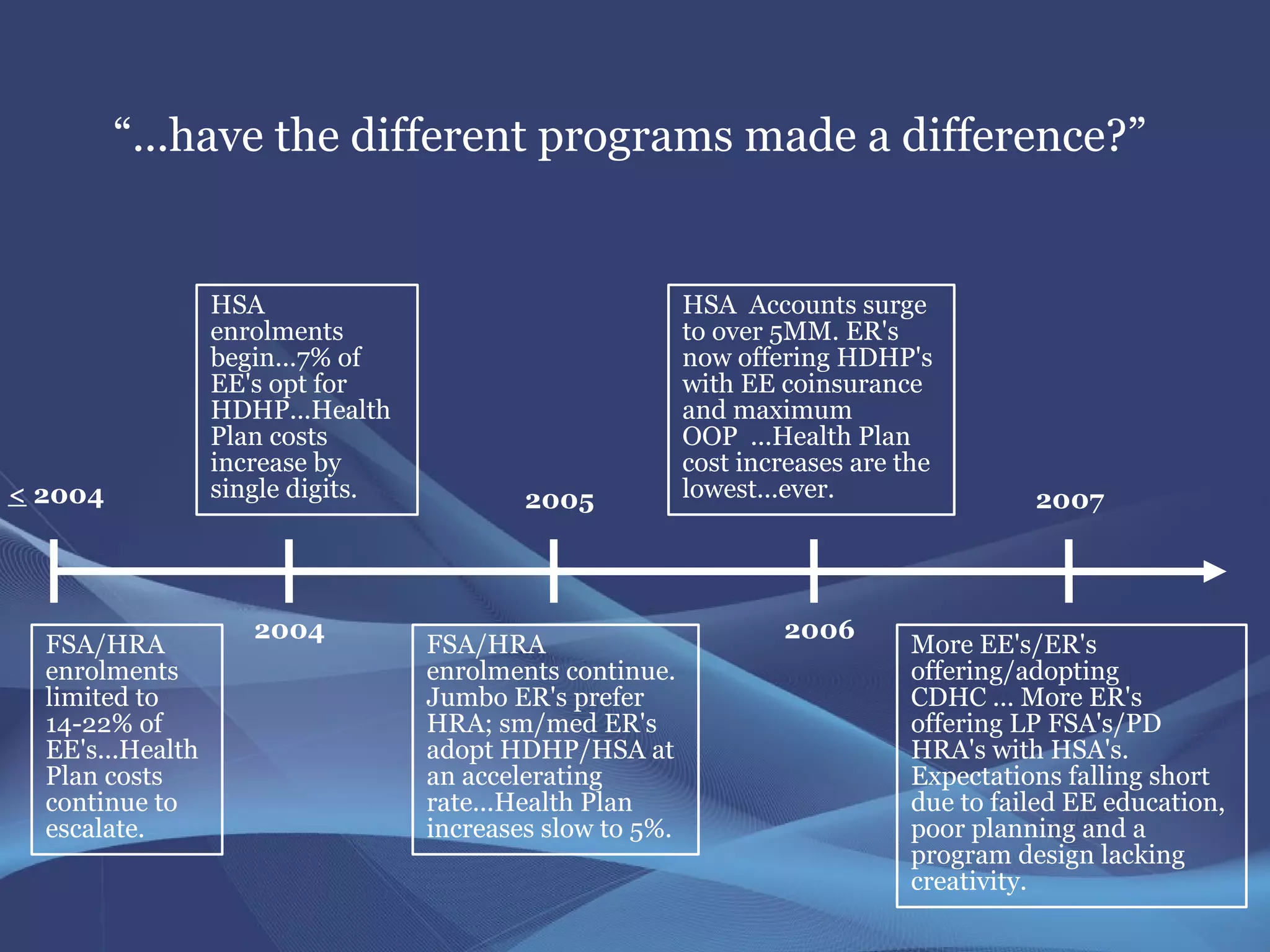

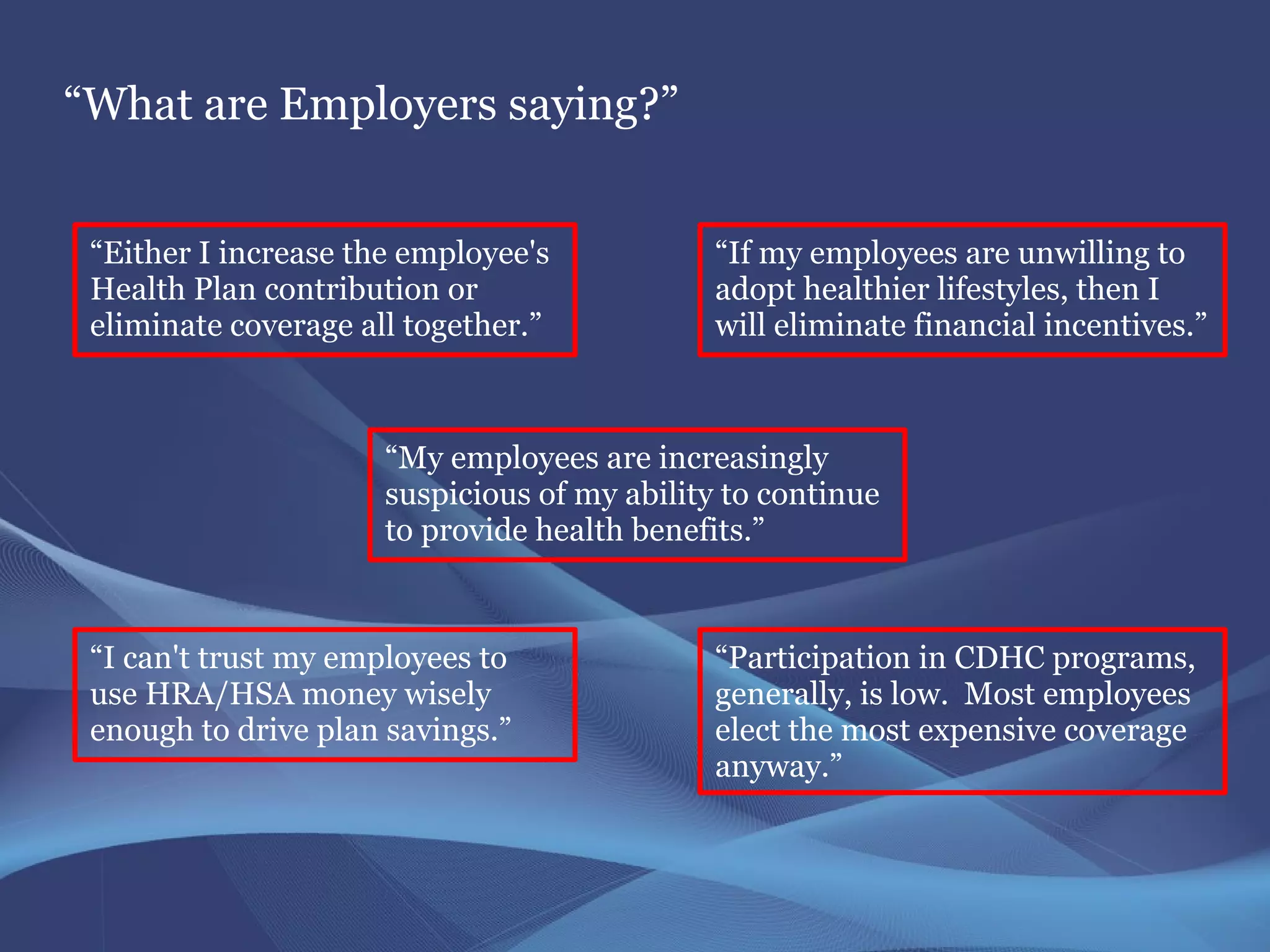

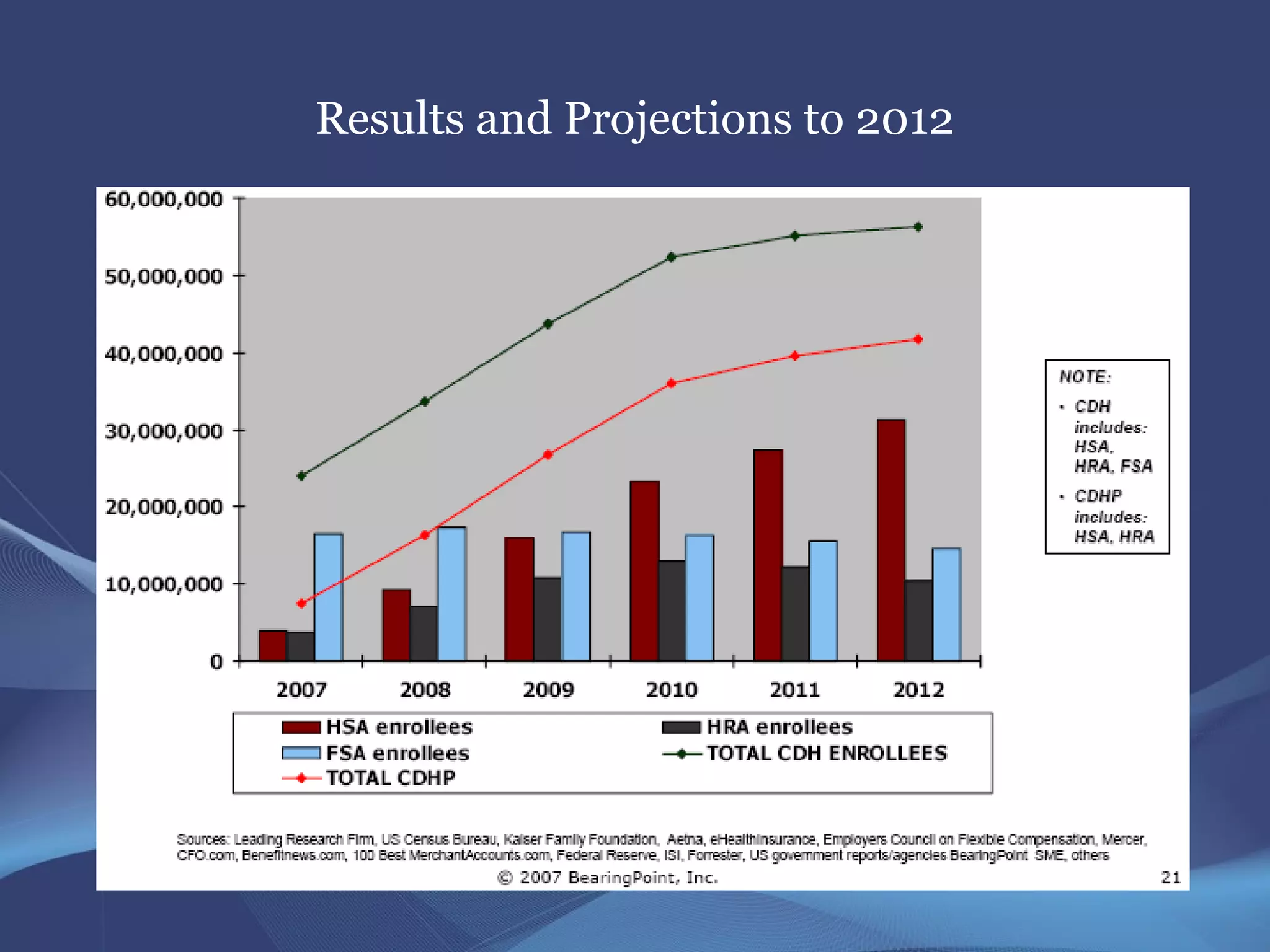

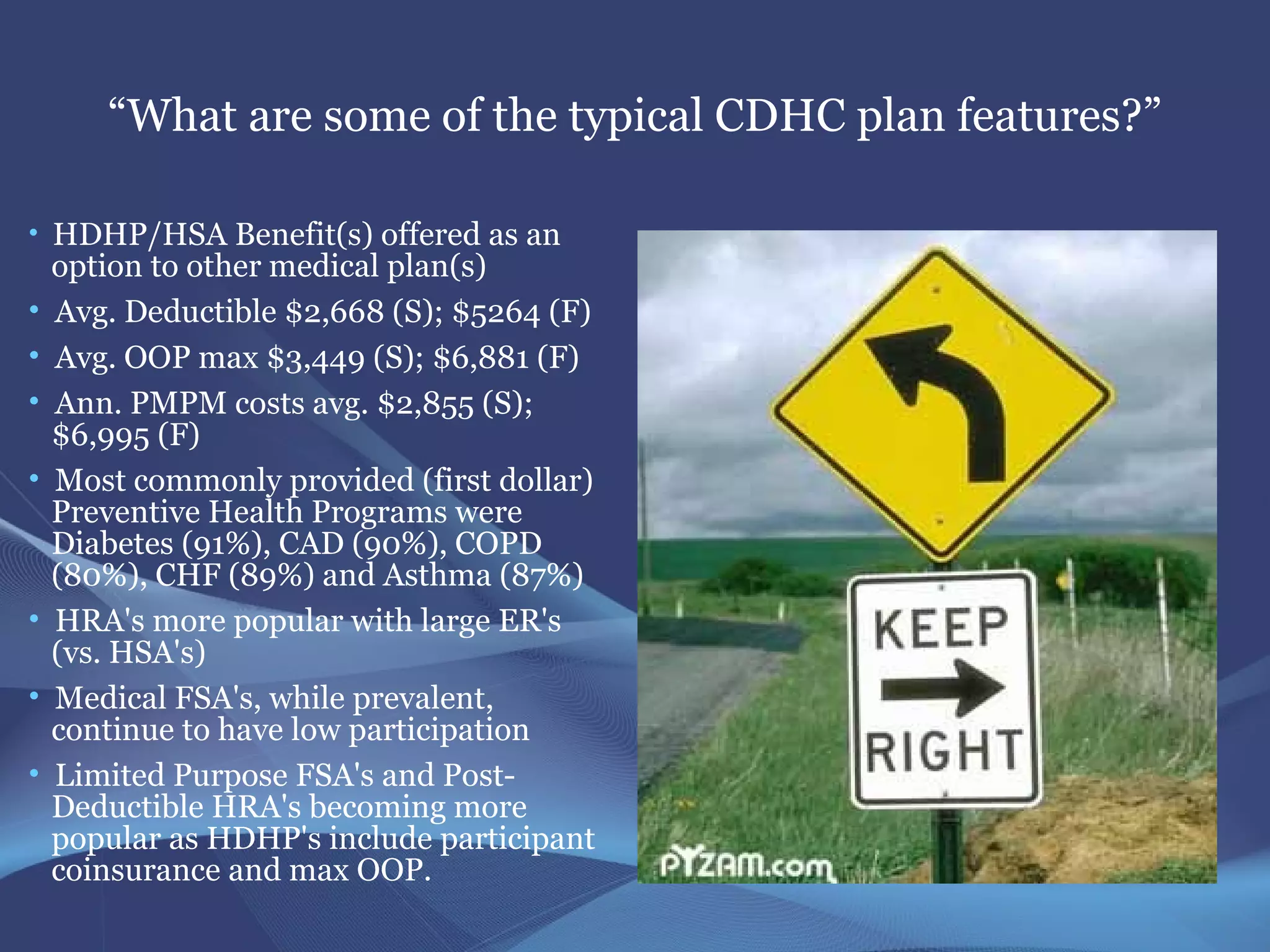

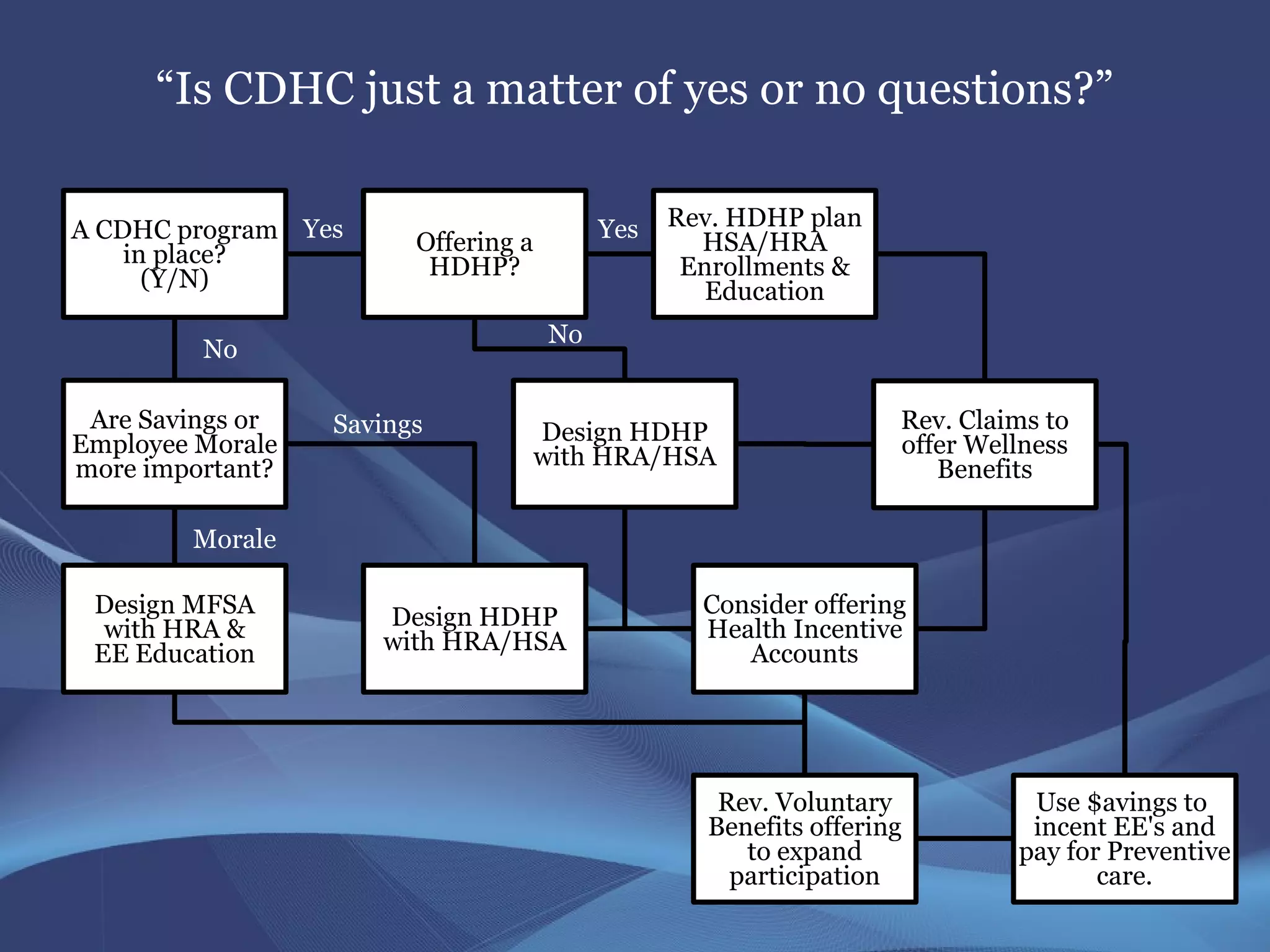

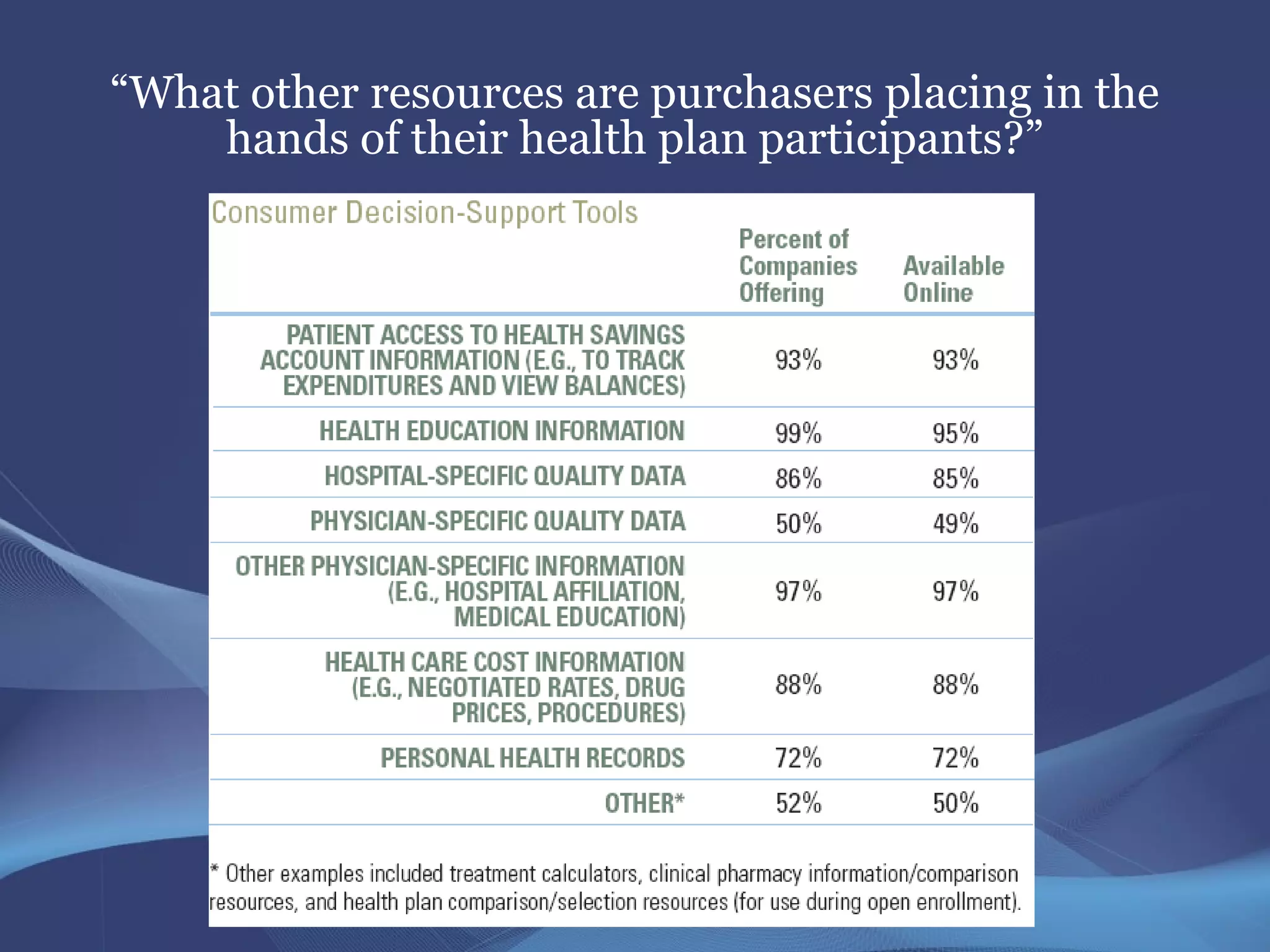

The document discusses Consumer Driven Health Care (CDHC) and its implications for employers and employees, highlighting various plans like HRAs, FSAs, and HSAs. It outlines challenges and opportunities faced in implementing CDHC programs, such as employee participation, cost management, and the necessity for tailored education and communication strategies. Additionally, it emphasizes the importance of understanding market responses, evaluating consumer behavior, and designing effective health benefit plans to optimize employee engagement and satisfaction.