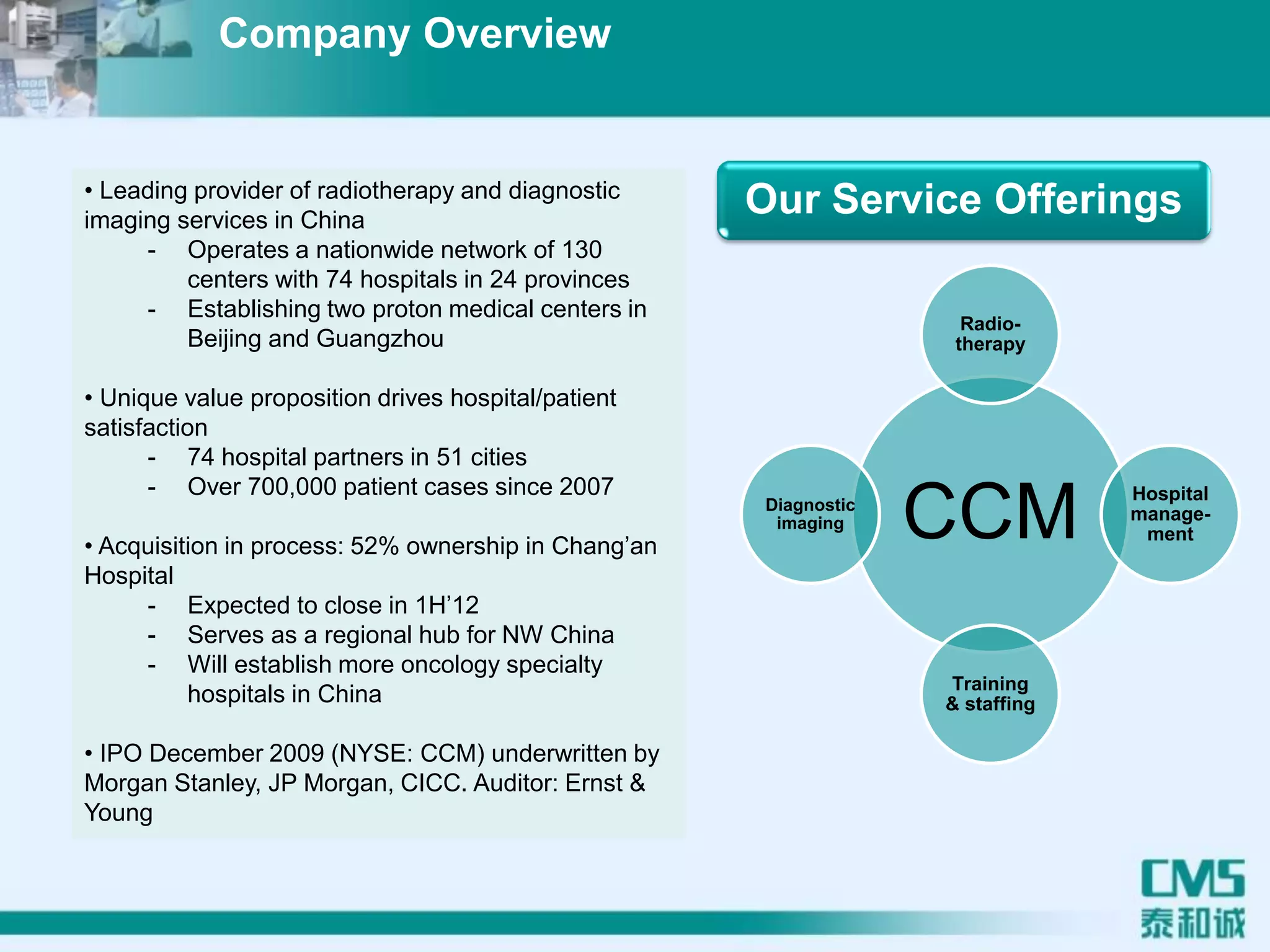

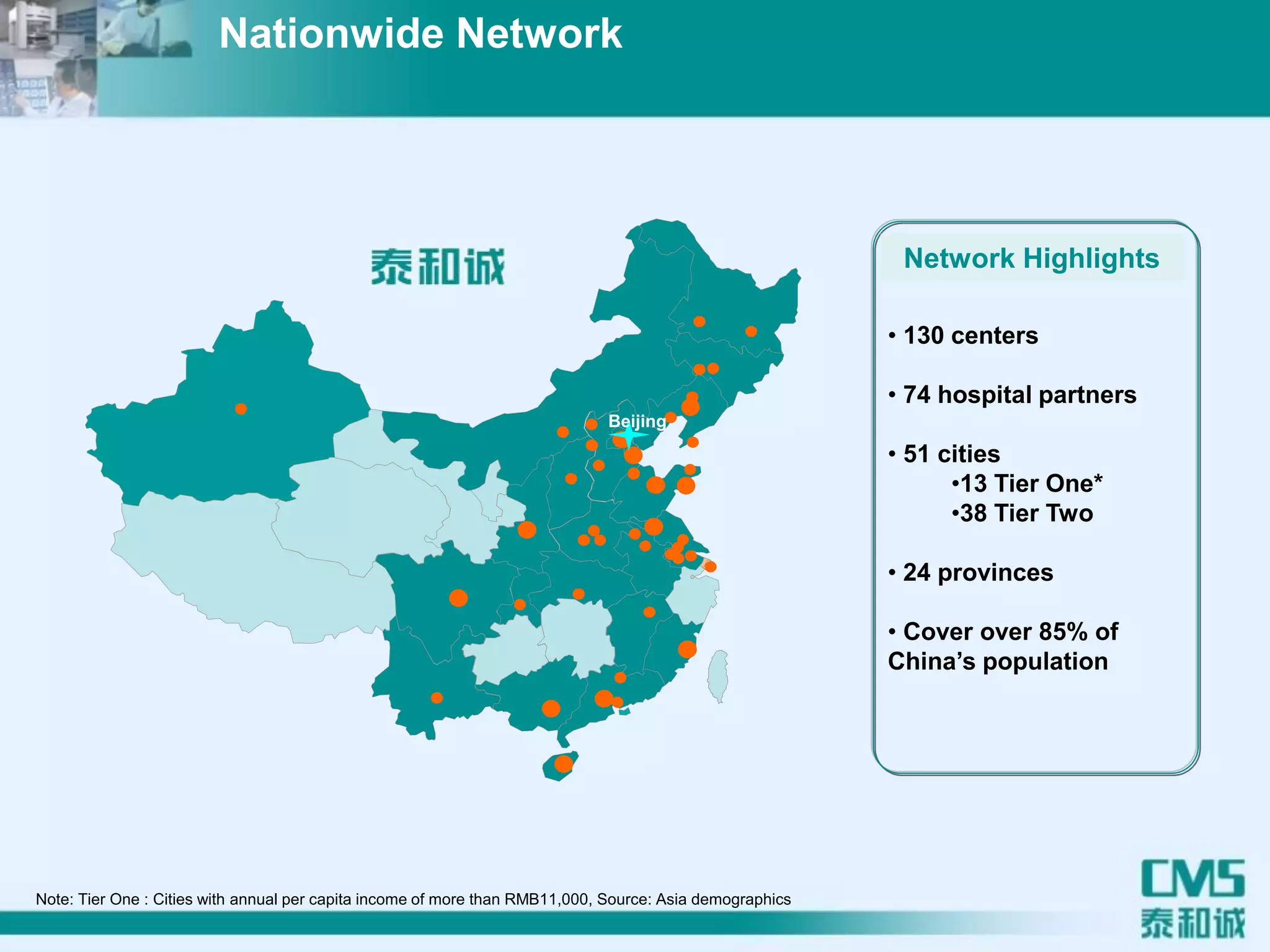

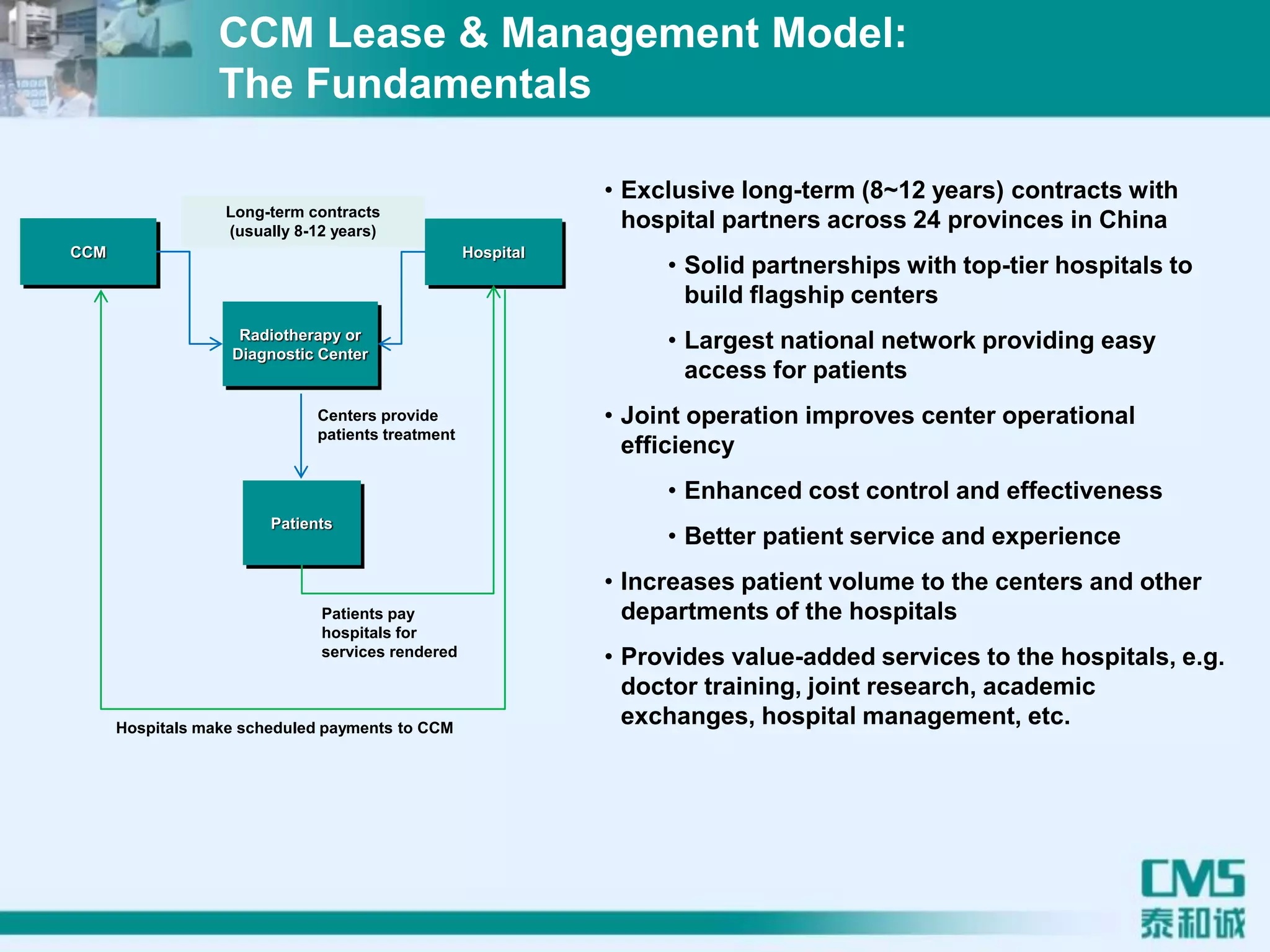

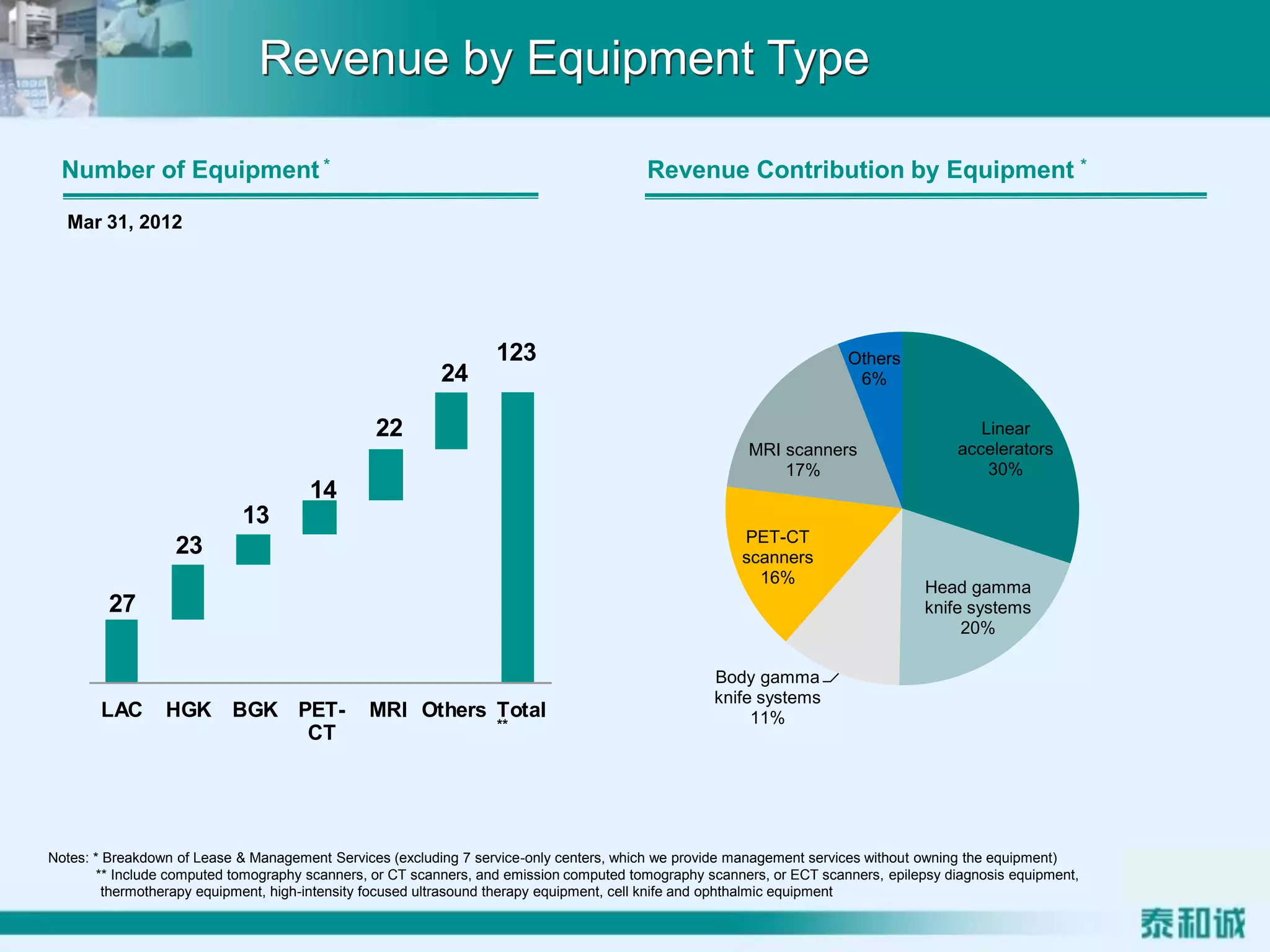

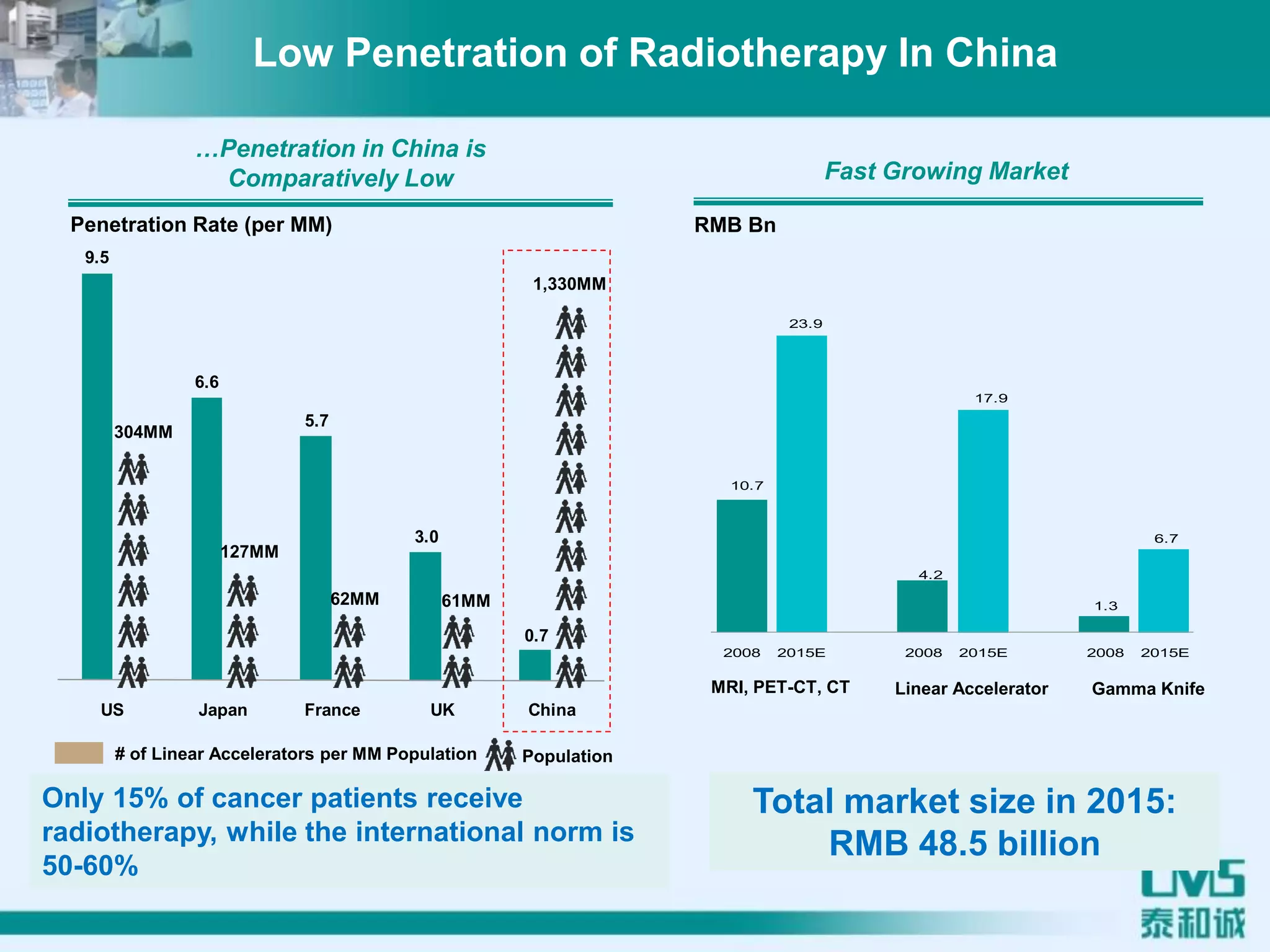

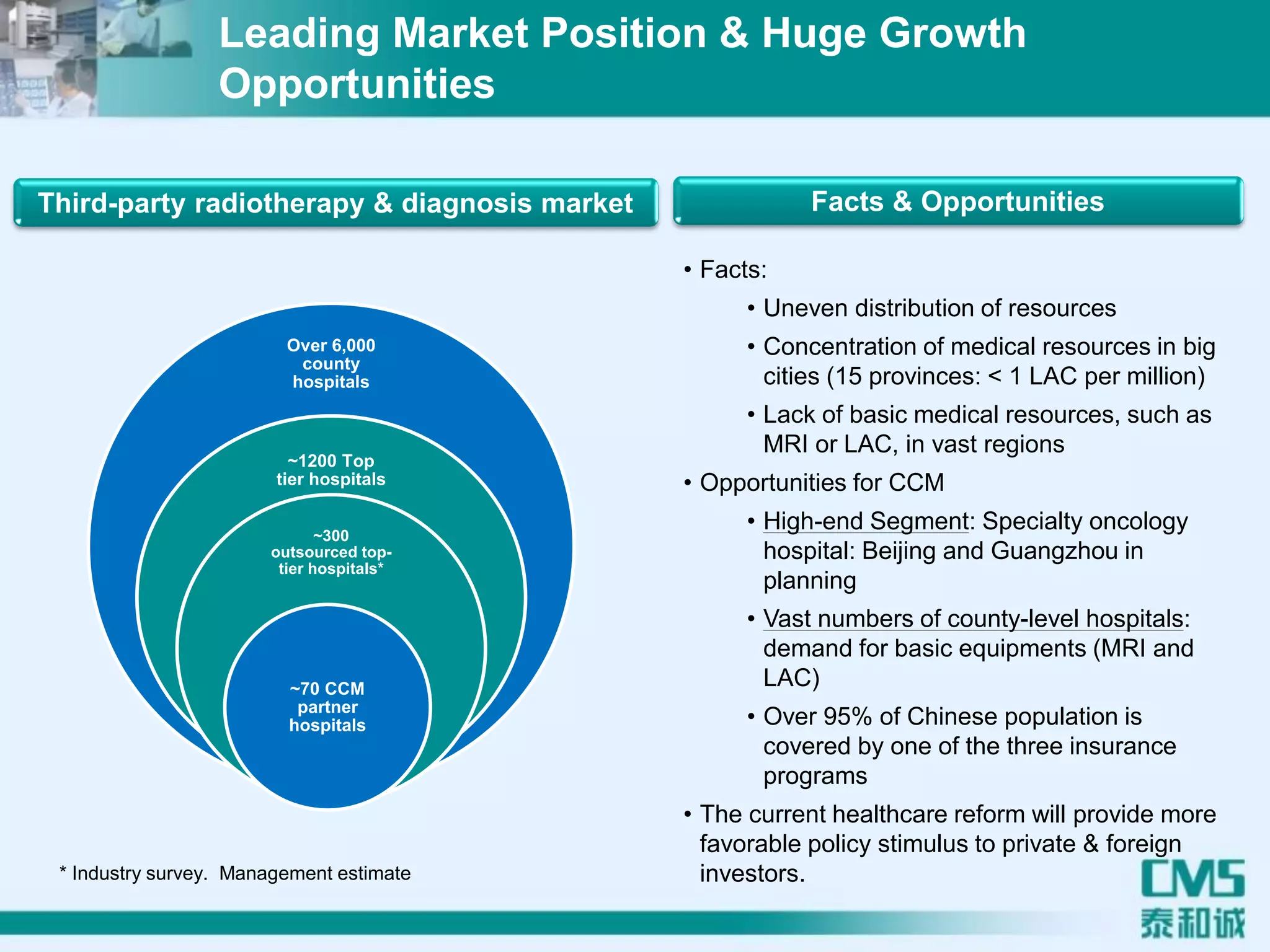

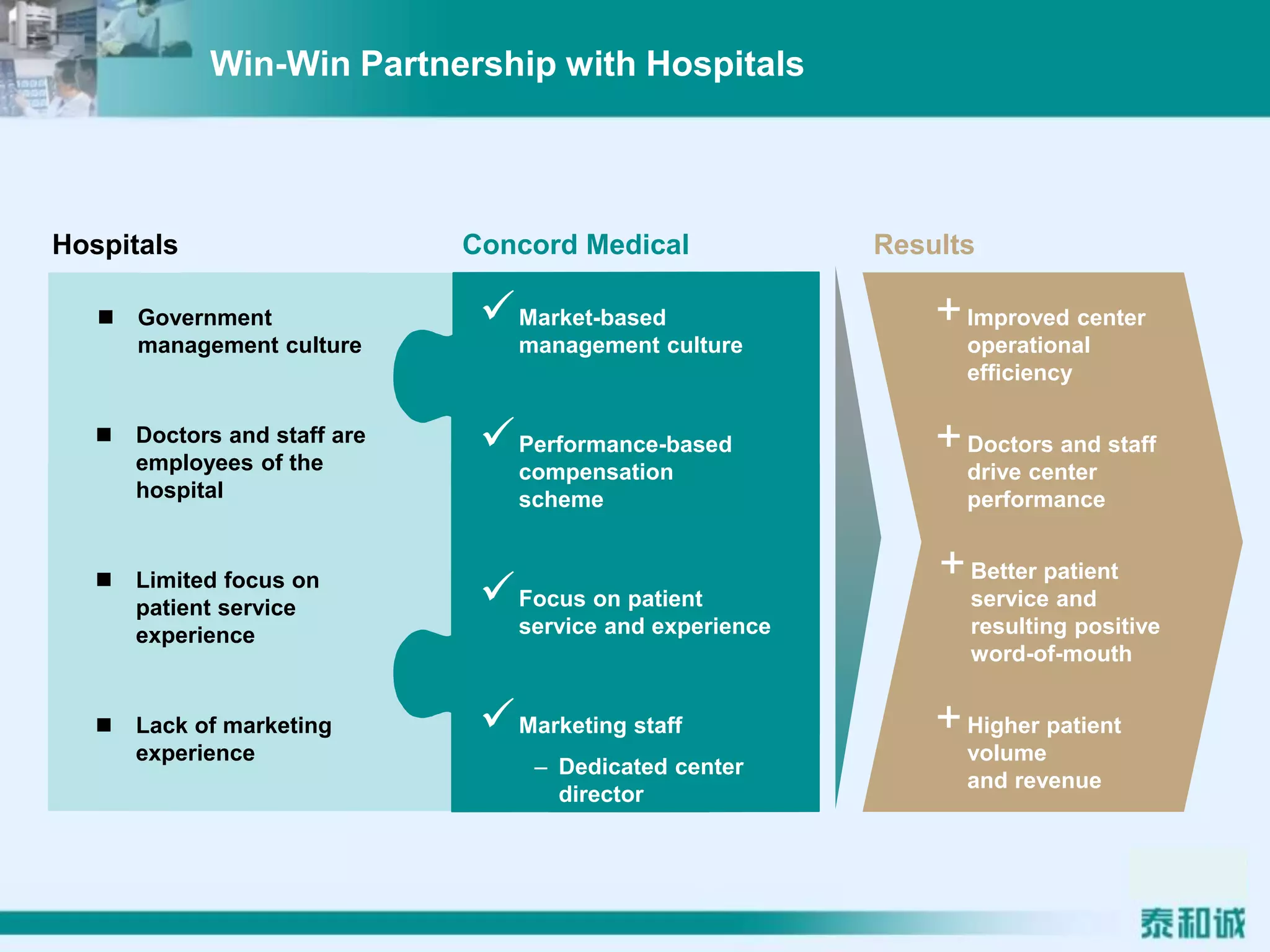

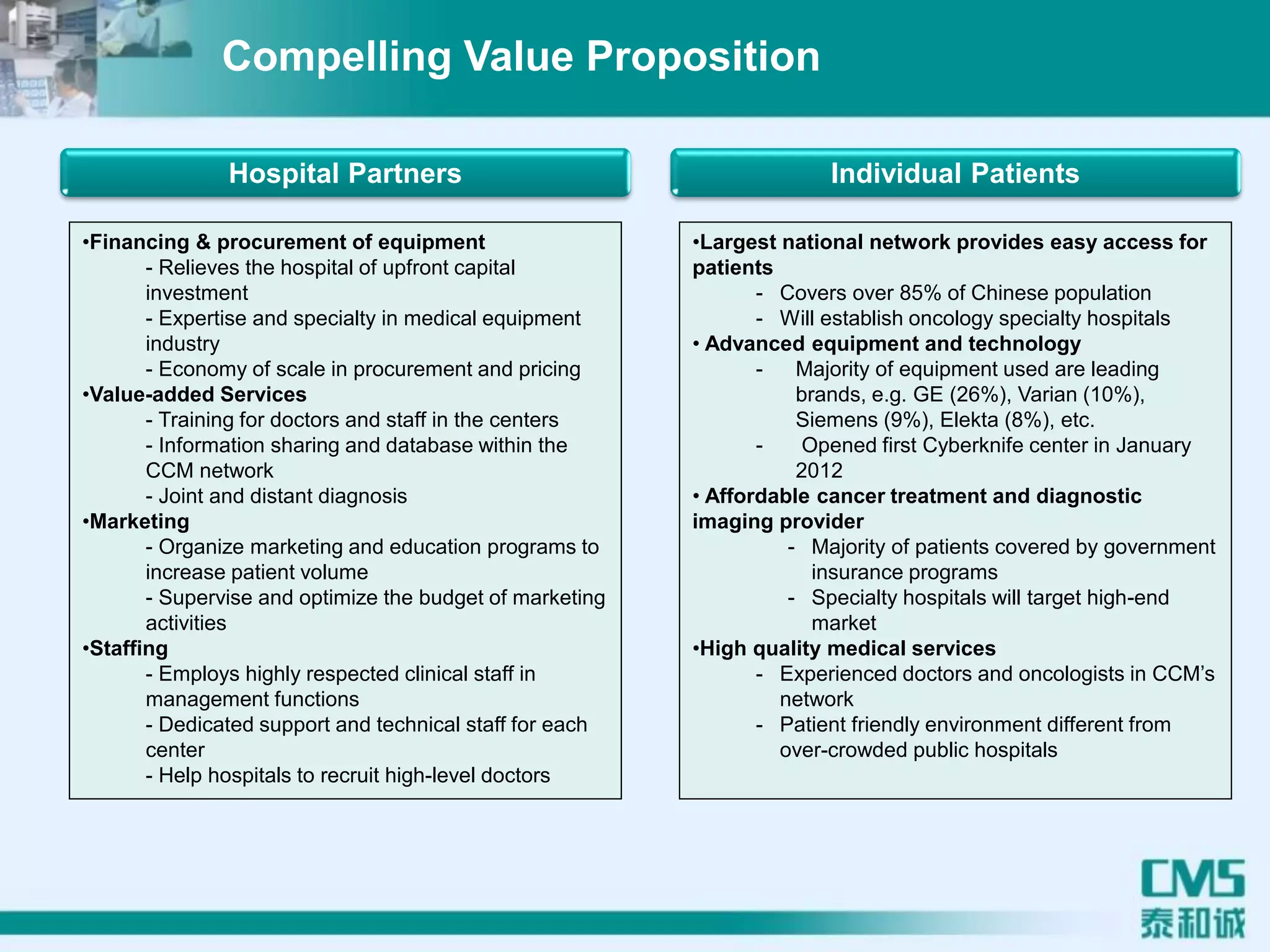

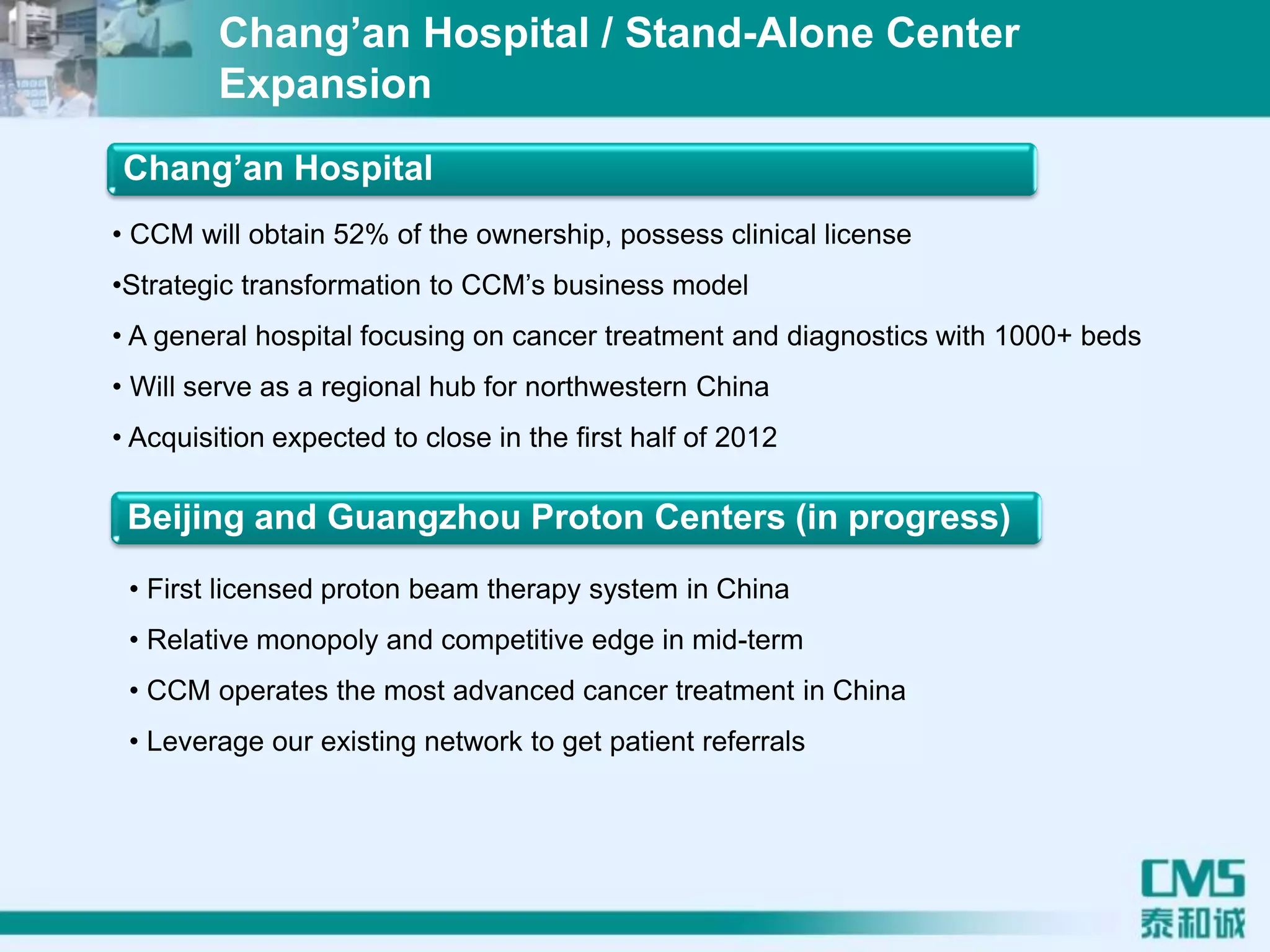

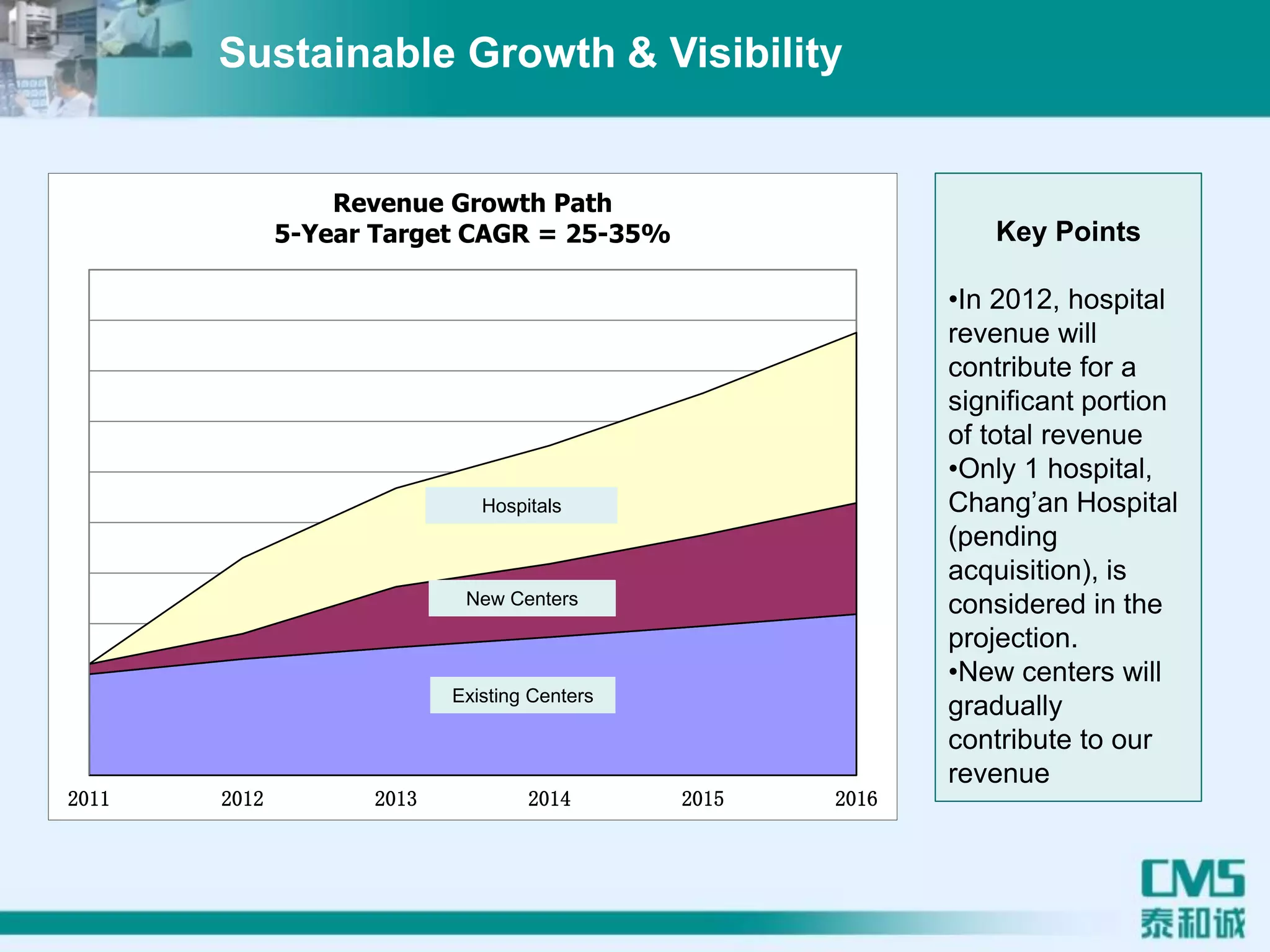

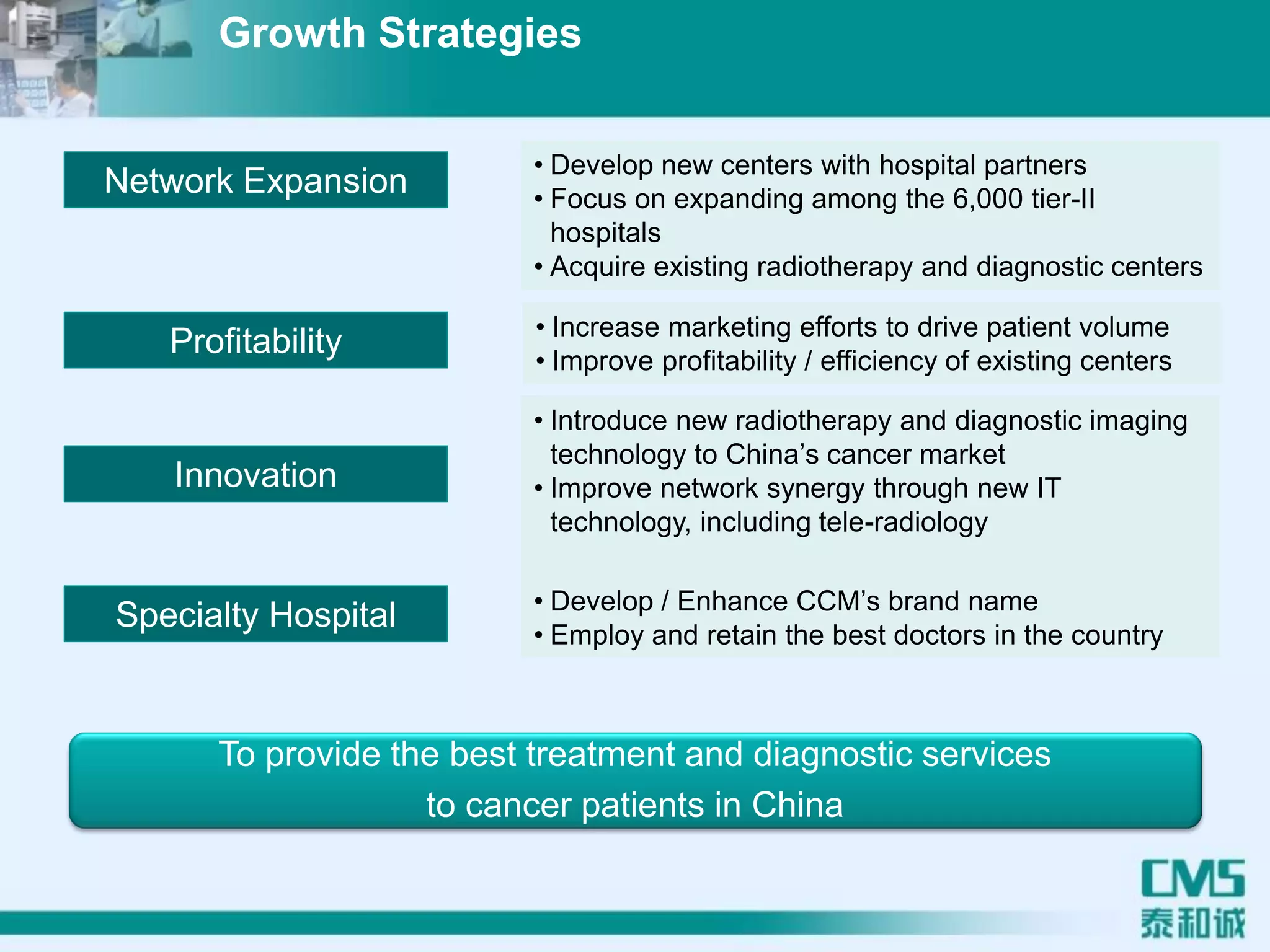

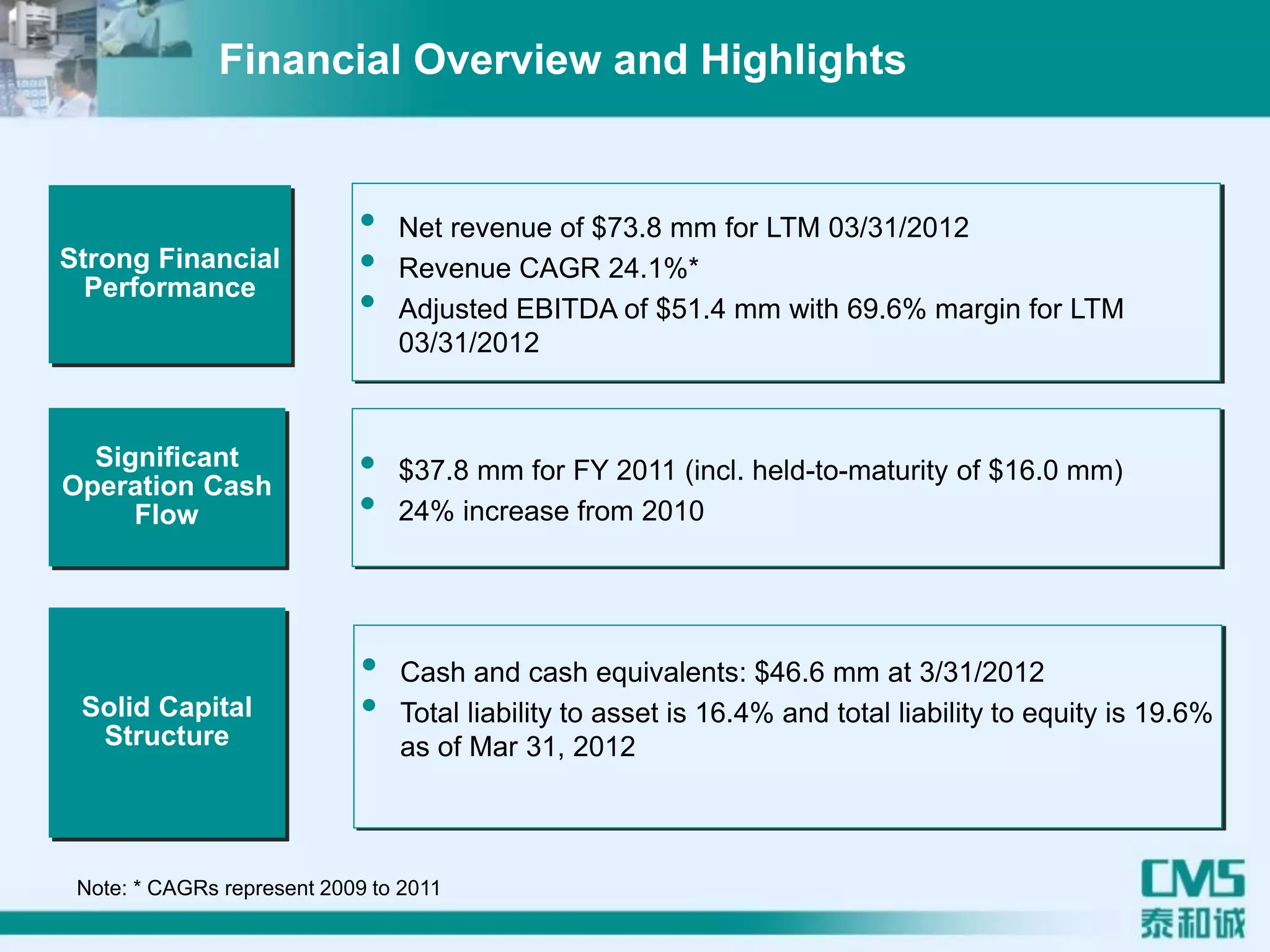

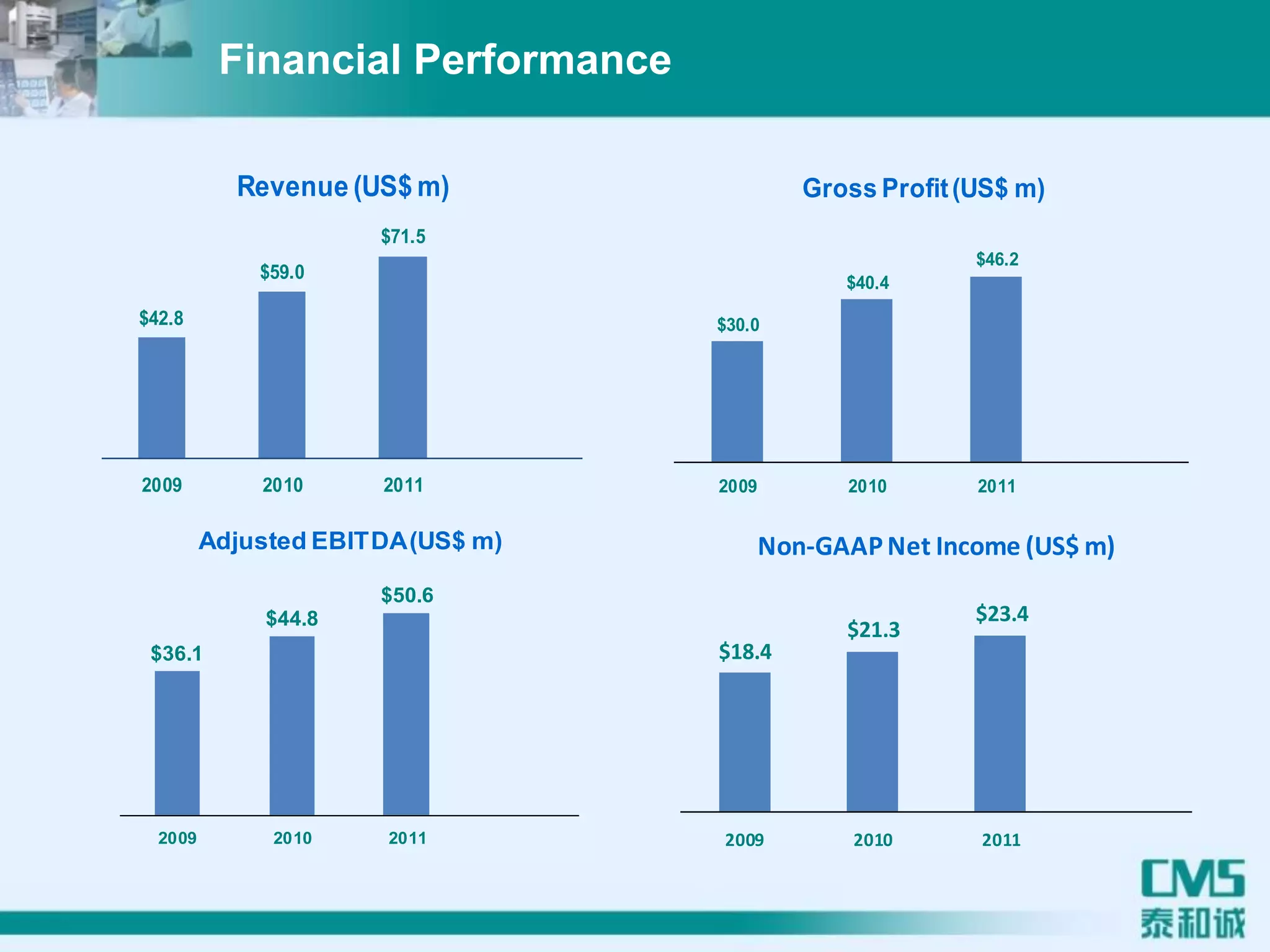

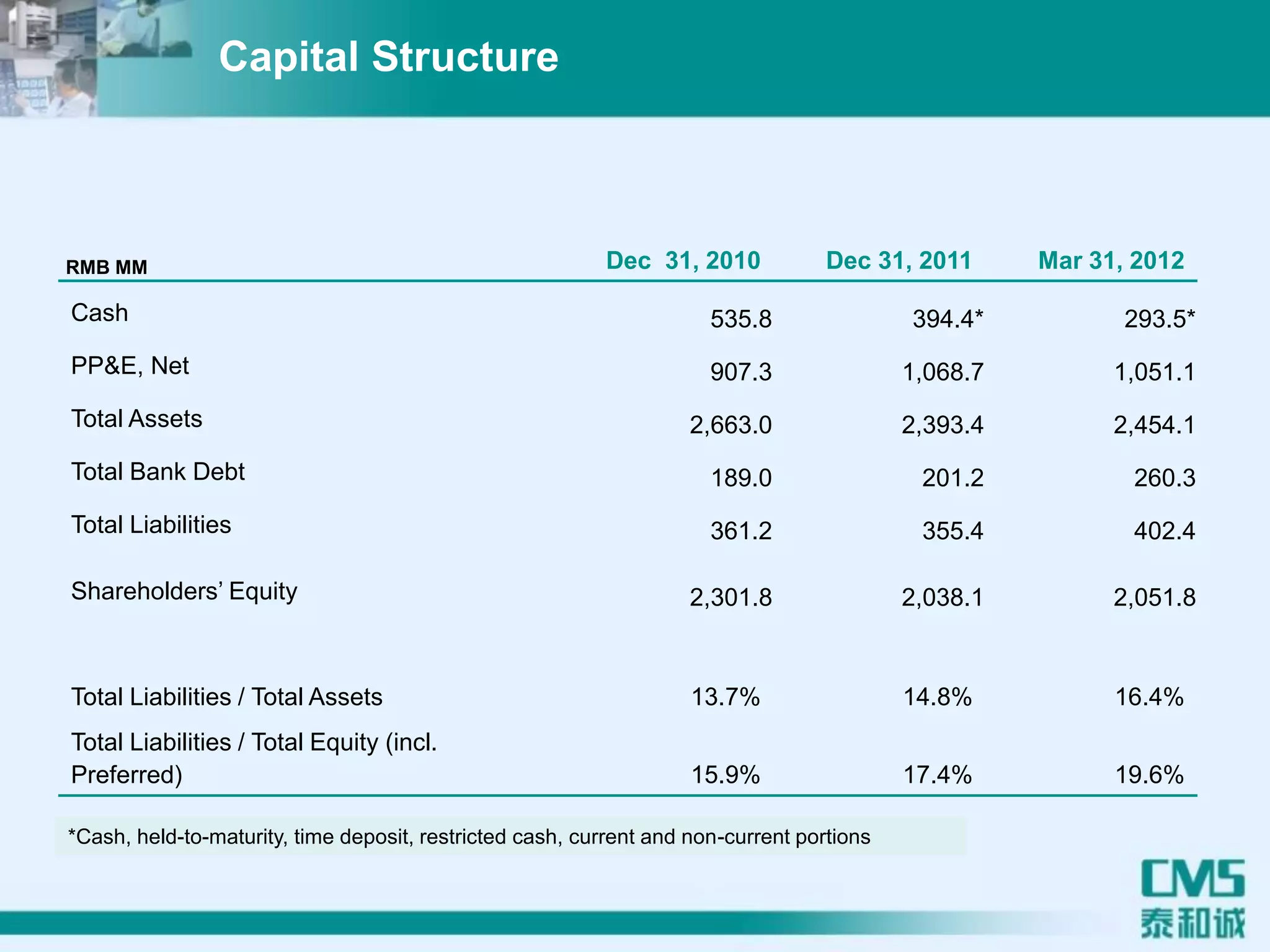

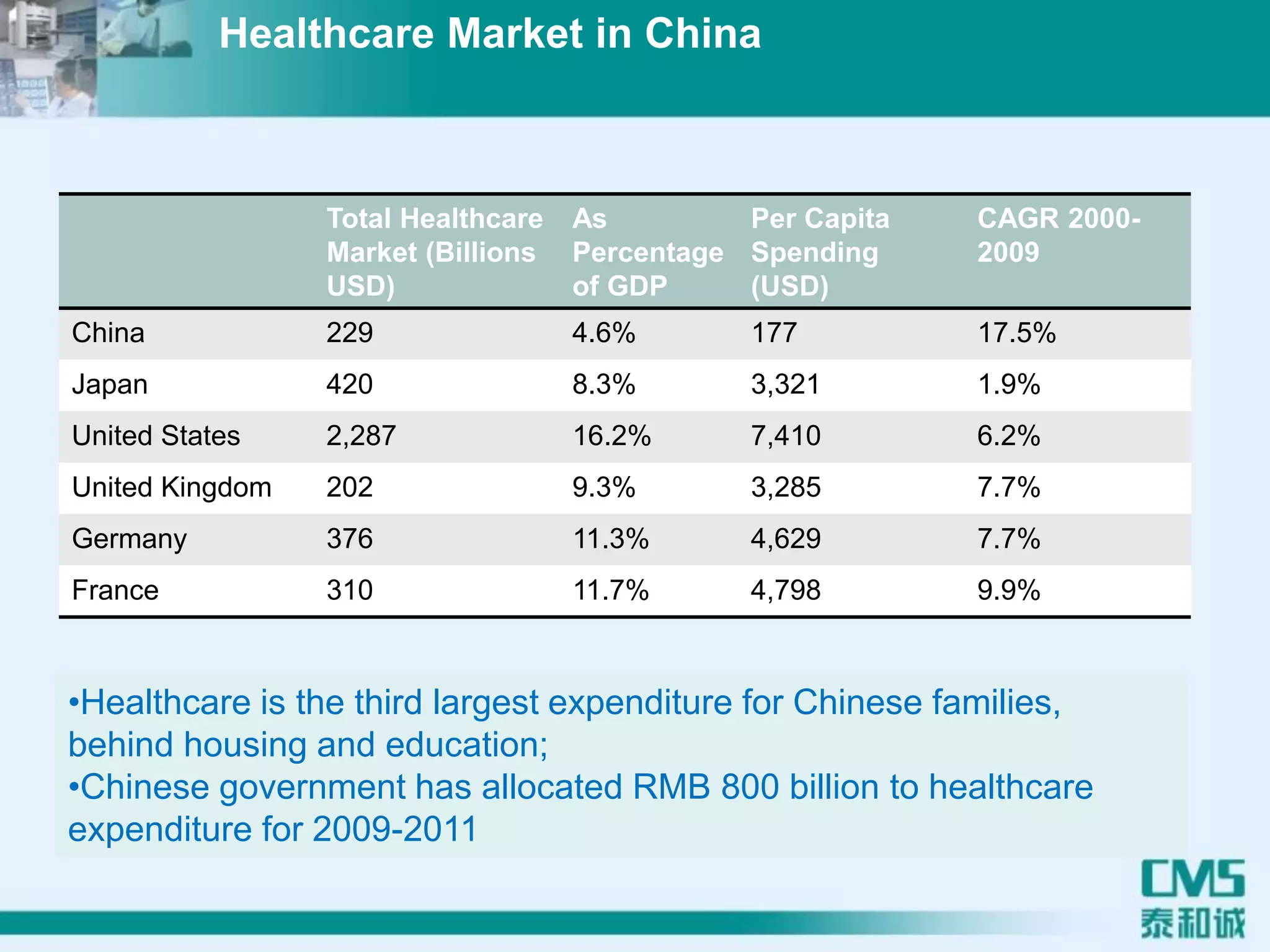

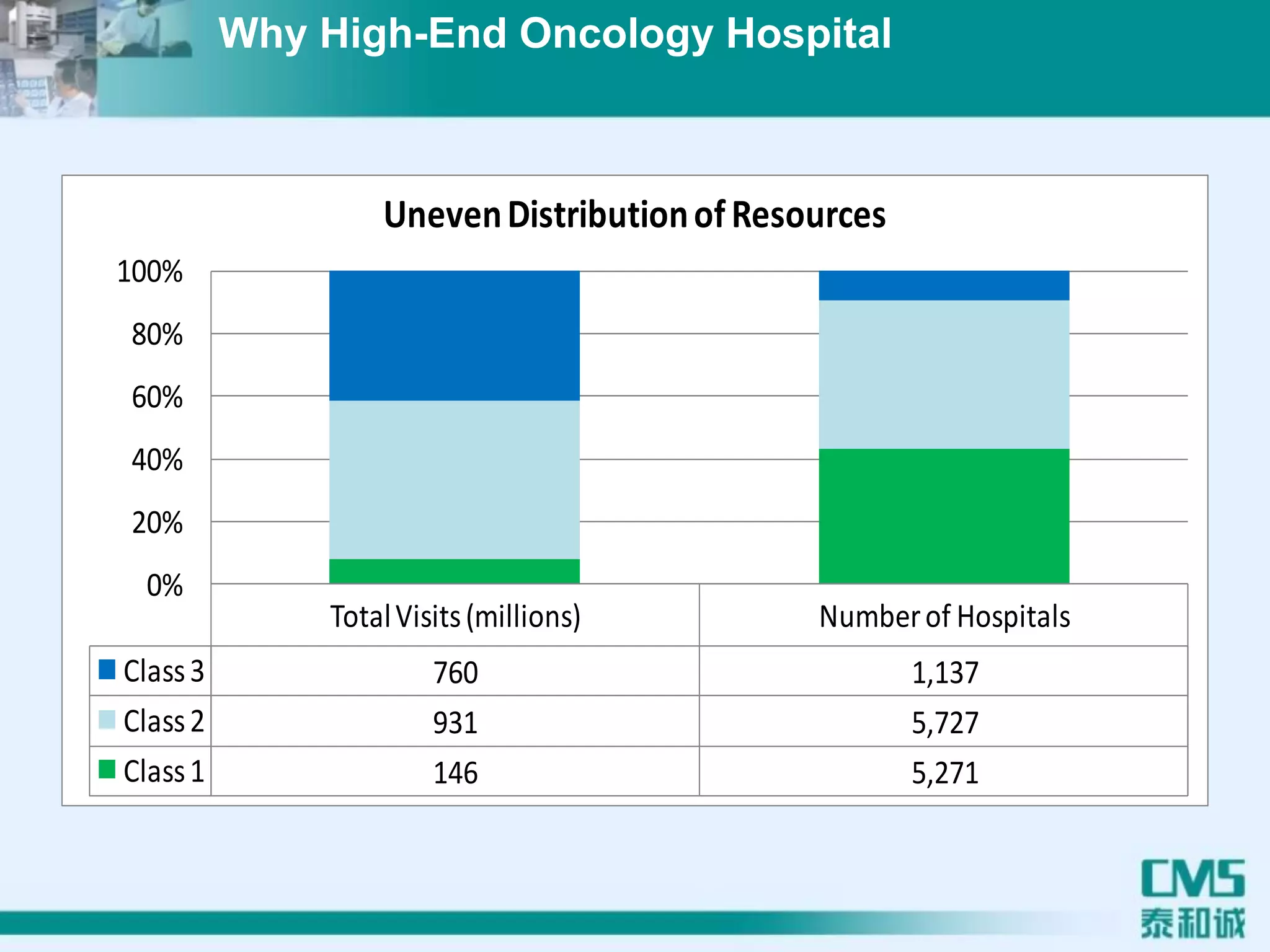

Concord Medical Services Holdings Ltd. is a leading provider of radiotherapy and diagnostic imaging services in China. It operates a nationwide network of 130 centers with 74 hospital partners in 24 provinces. The presentation highlights the company's strong growth, leading market position, and expansion strategies through network growth, new technology, and developing specialty cancer hospitals. Financial results show increasing revenue, profitability, and a solid capital structure to support continued growth.