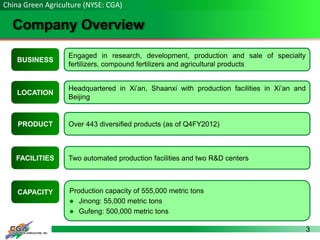

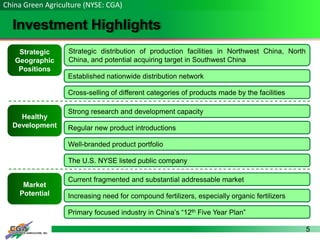

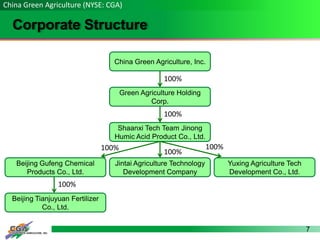

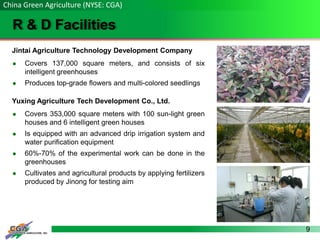

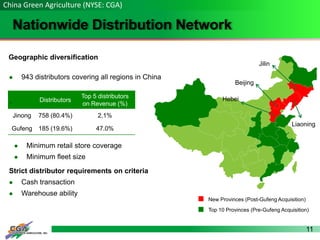

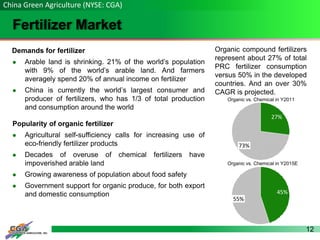

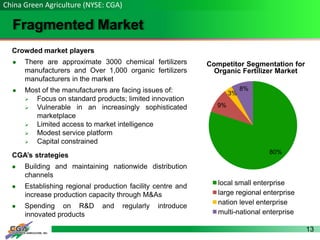

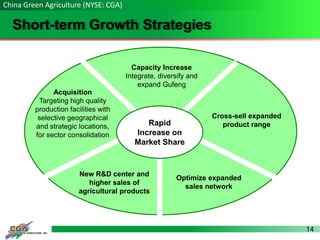

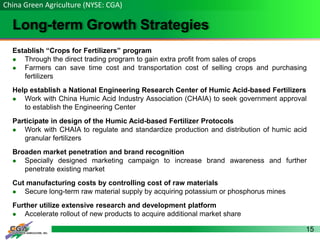

China Green Agriculture produces and sells over 400 types of fertilizers and agricultural products. It has two production facilities in Xi'an and Beijing with a total annual capacity of 555,000 metric tons. The company has established a nationwide distribution network of over 900 distributors. China Green Agriculture aims to increase market share and revenue through expanding production capacity, acquiring other companies, developing new products through research, and strengthening its distribution network. The management team has experience in the fertilizer industry and capital markets.