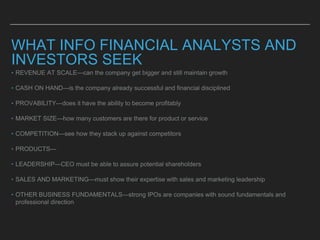

Snapchat went public in 2017 through an initial public offering (IPO) that raised $3.4 billion. To prepare for the IPO, Snapchat had to disclose financial and business information to regulators and conduct a roadshow to pitch potential investors. On its first day of trading, Snapchat's stock price jumped 44% above the IPO price of $17 per share. However, Snapchat has faced some challenges as a public company, such as failing to meet revenue expectations in its first quarterly earnings report, which caused its stock price to drop 20%.