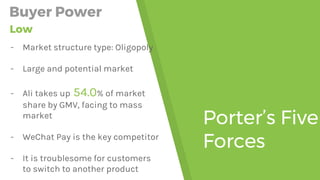

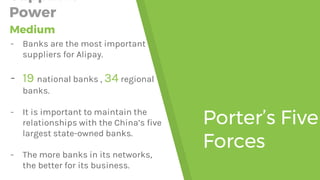

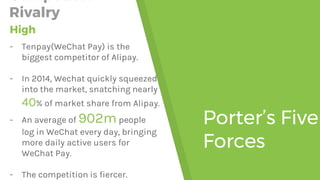

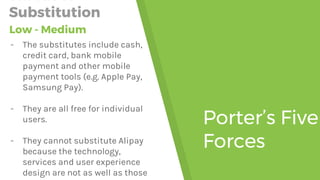

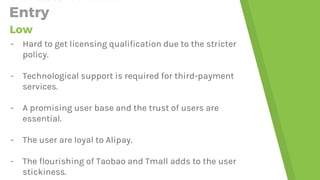

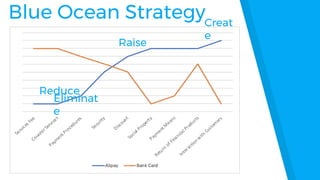

The document presents a SWOT analysis for Alipay, highlighting its market dominance with a 54% share, competitive advantages from large user bases and technology, but facing threats from competitors like WeChat Pay and market barriers such as strict regulations. It emphasizes the importance of maintaining strong relationships with banks and the loyalty of users bolstered by platforms like Taobao and Tmall. Additionally, it notes challenges in developing social communities and the risk of privacy issues.