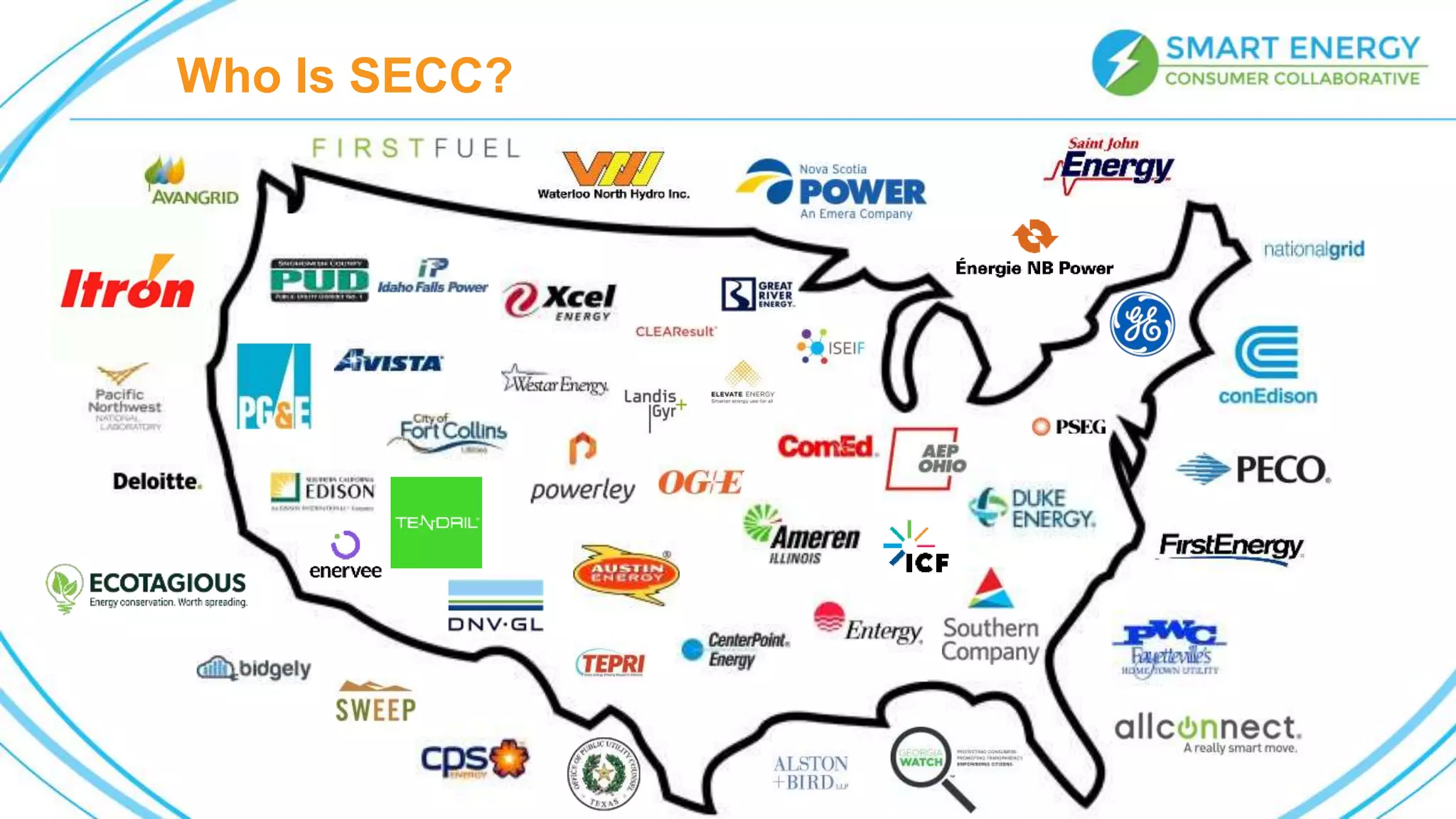

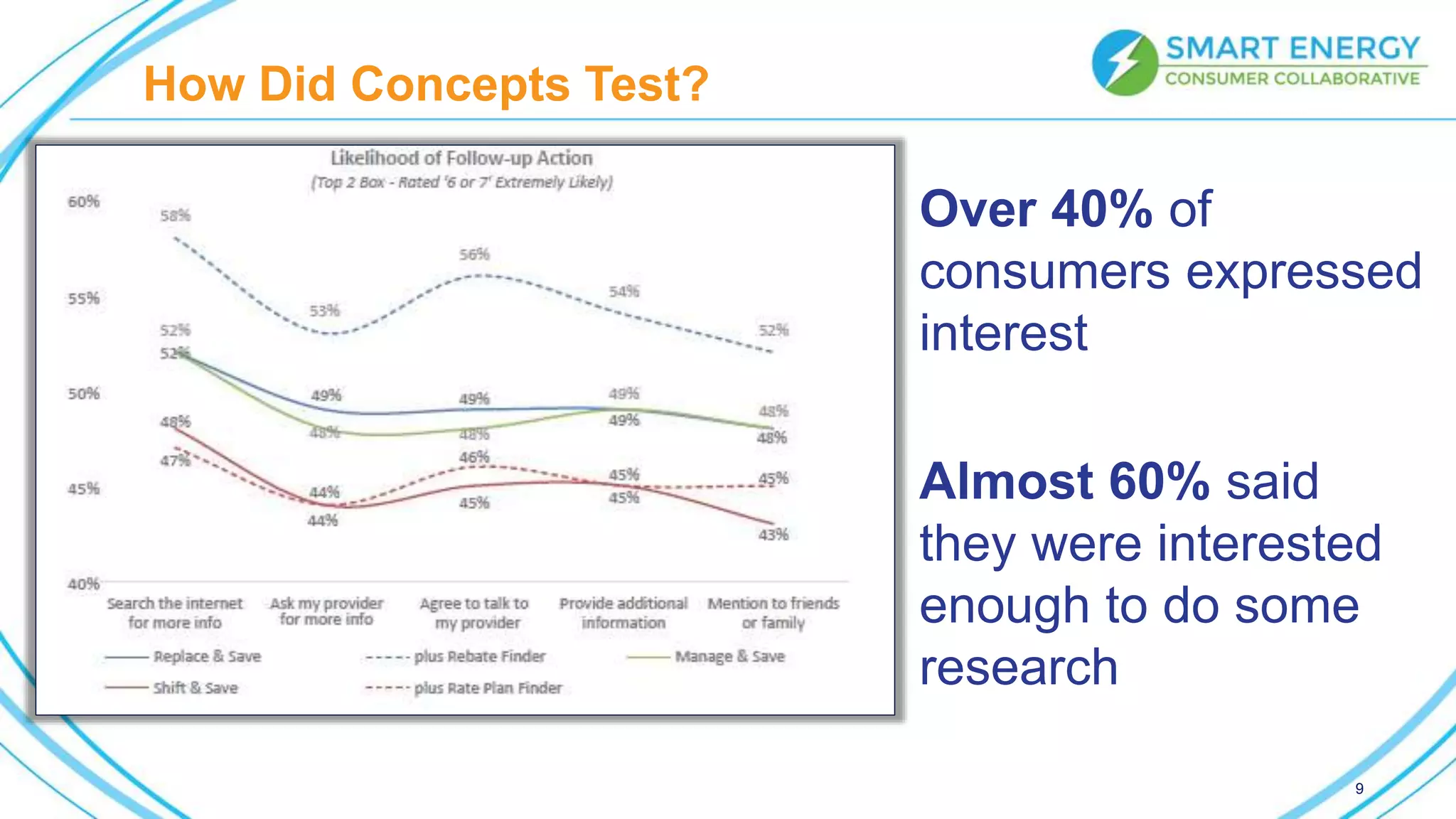

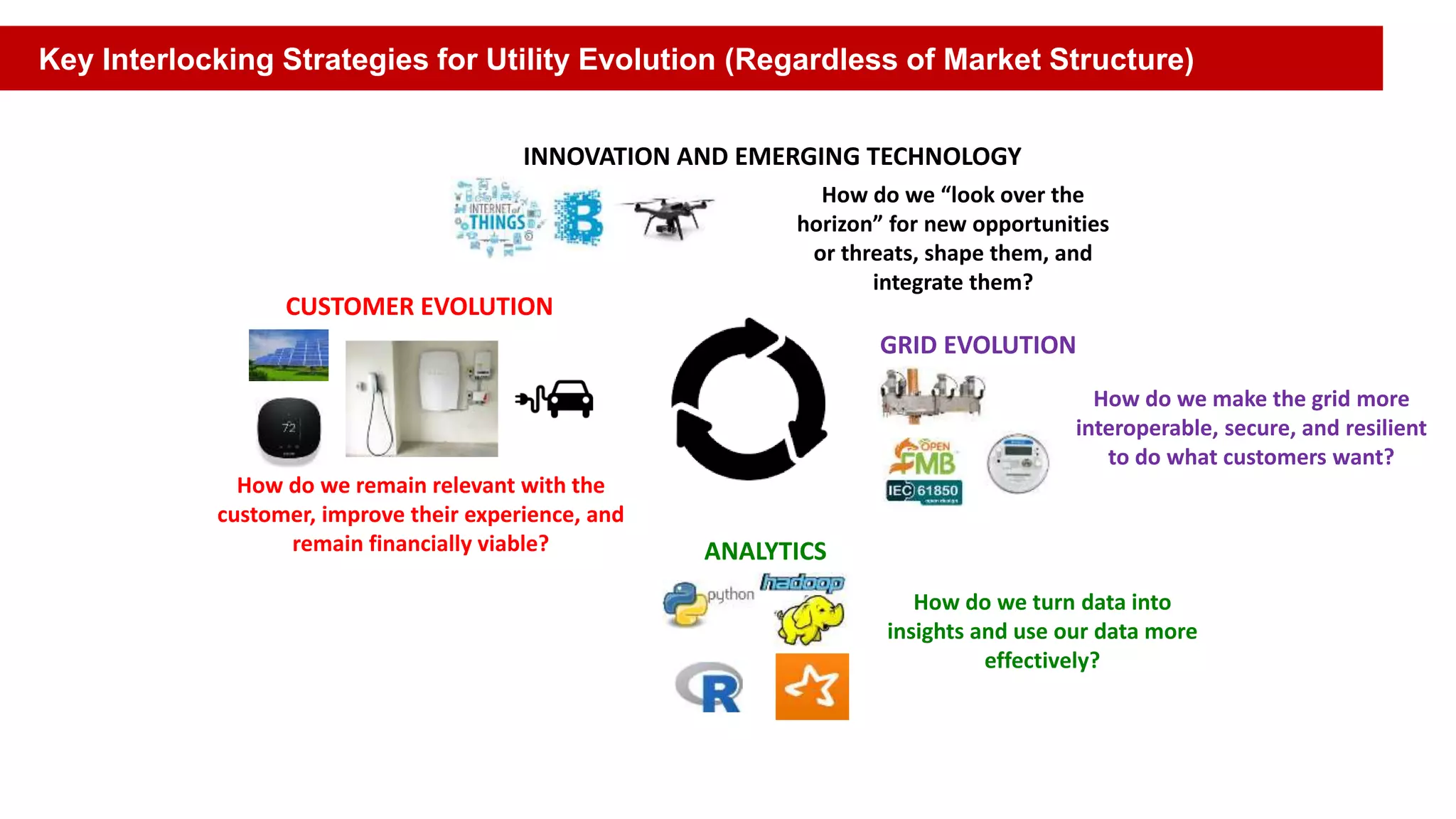

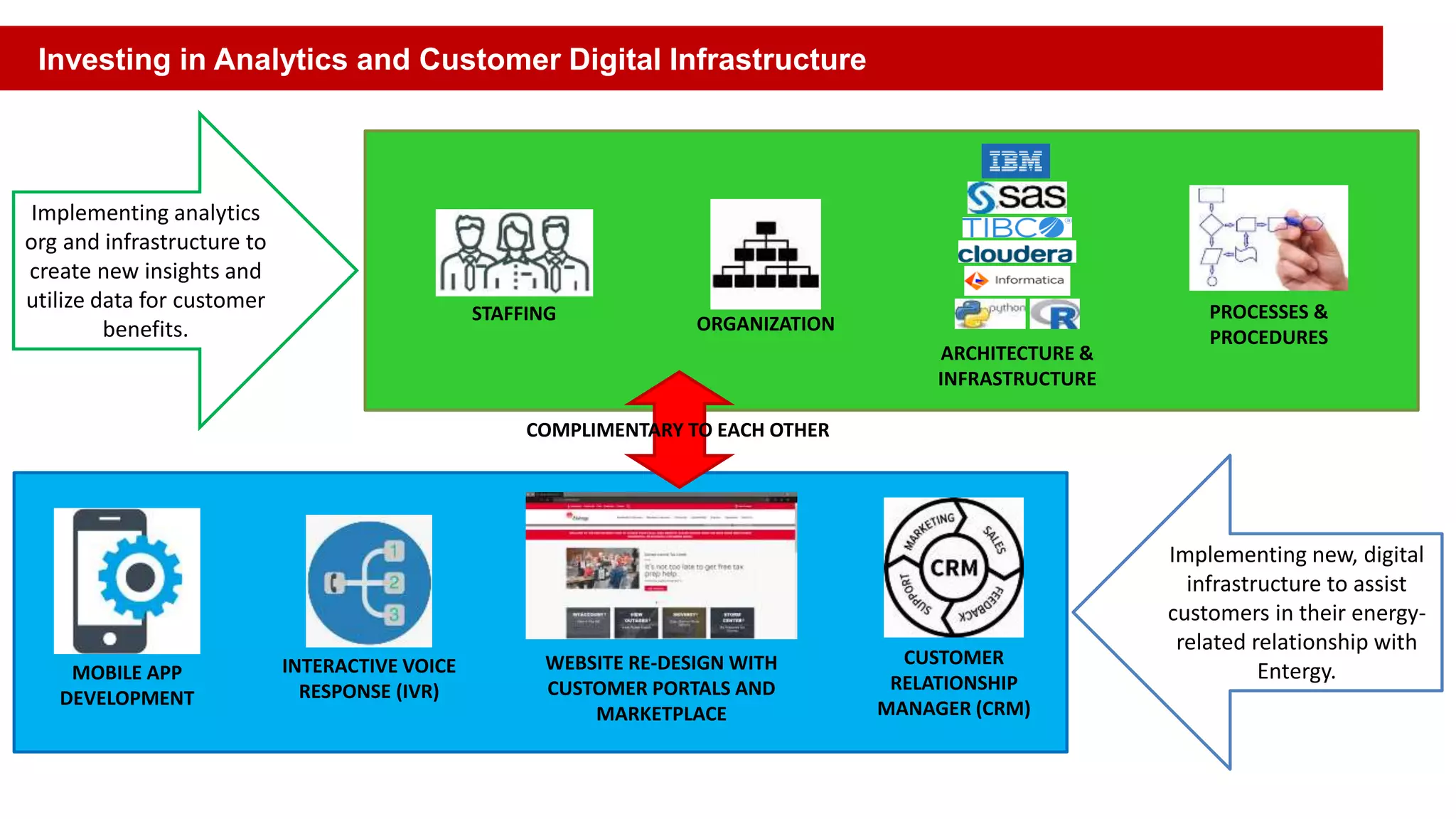

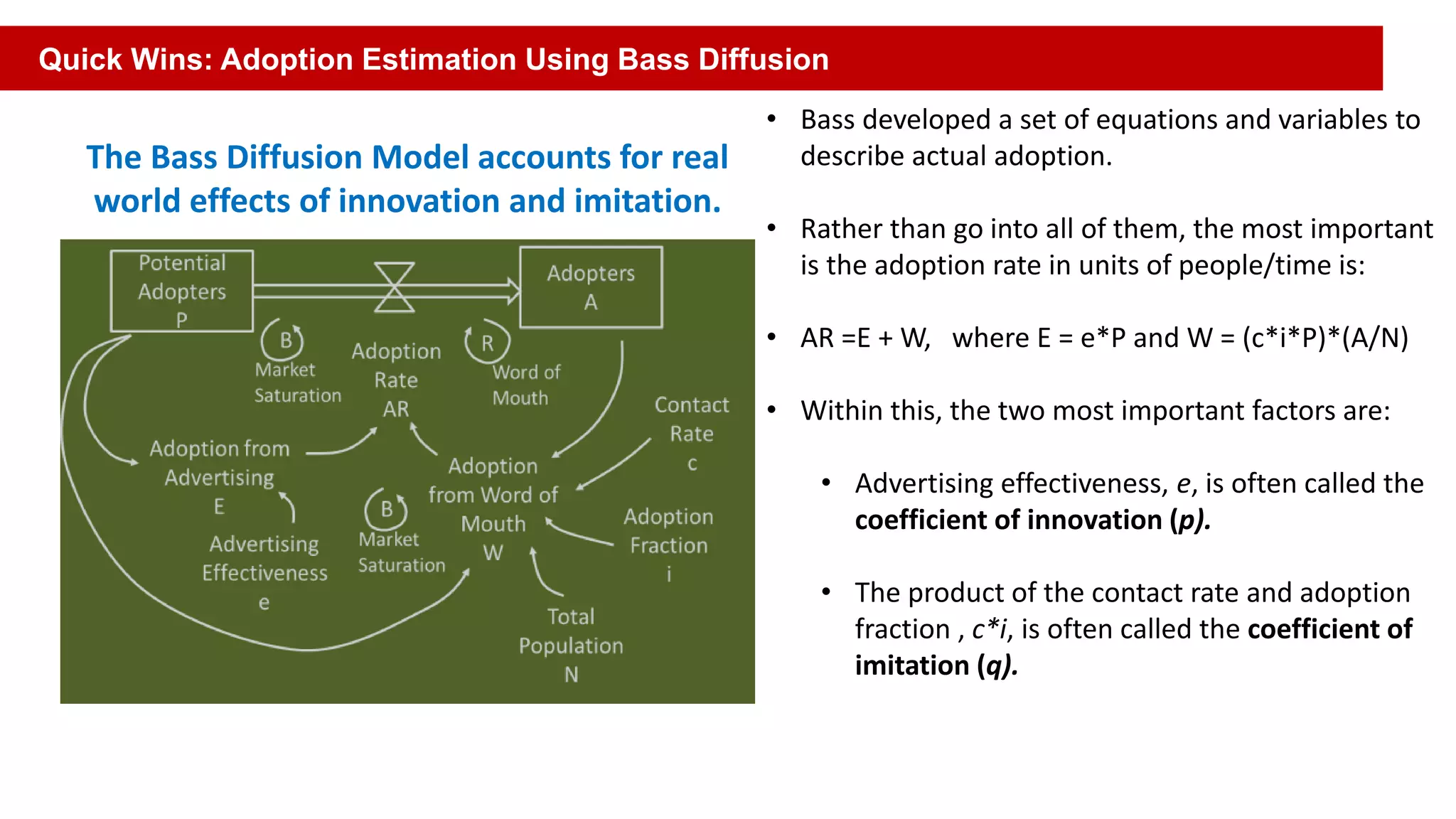

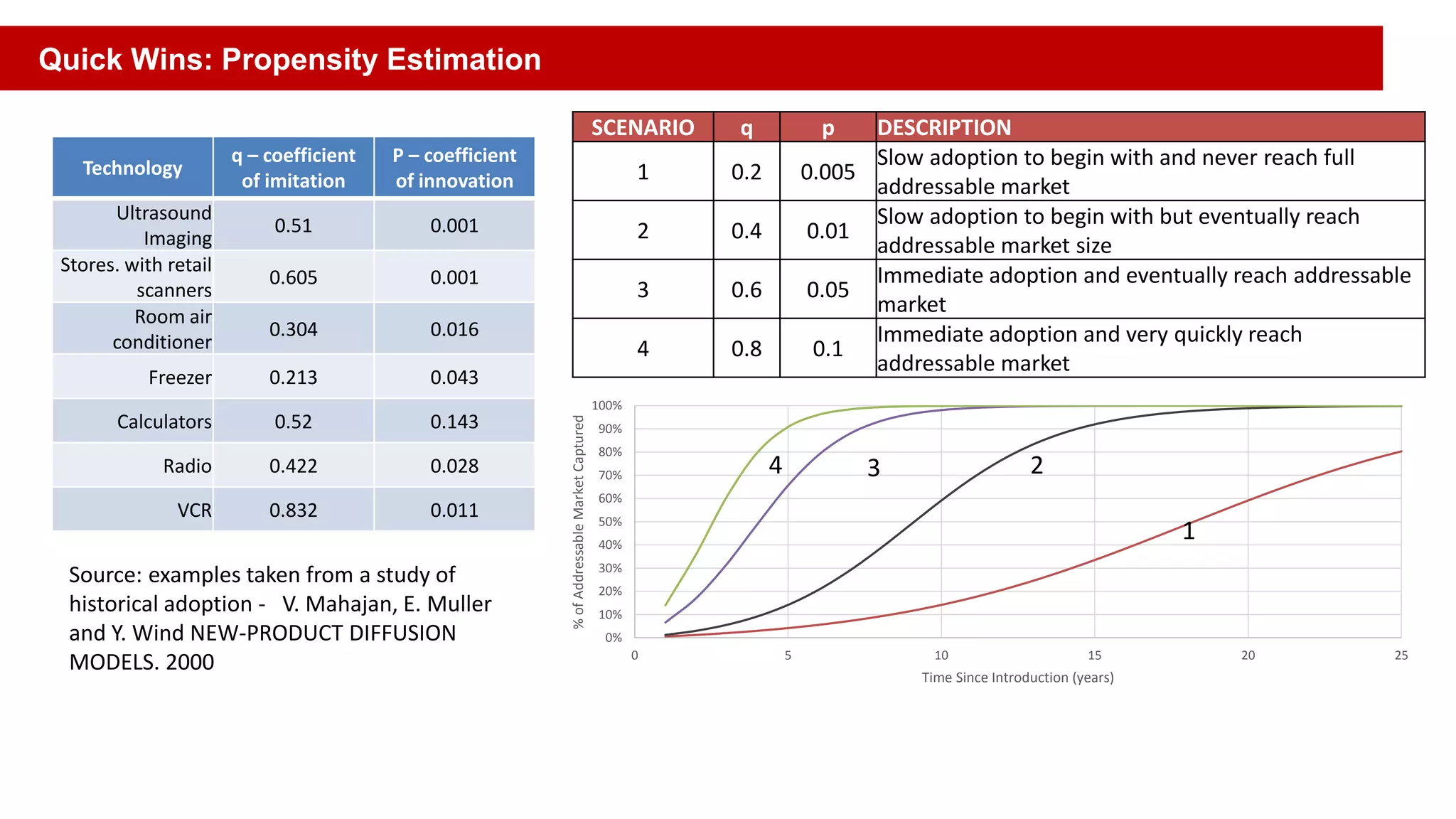

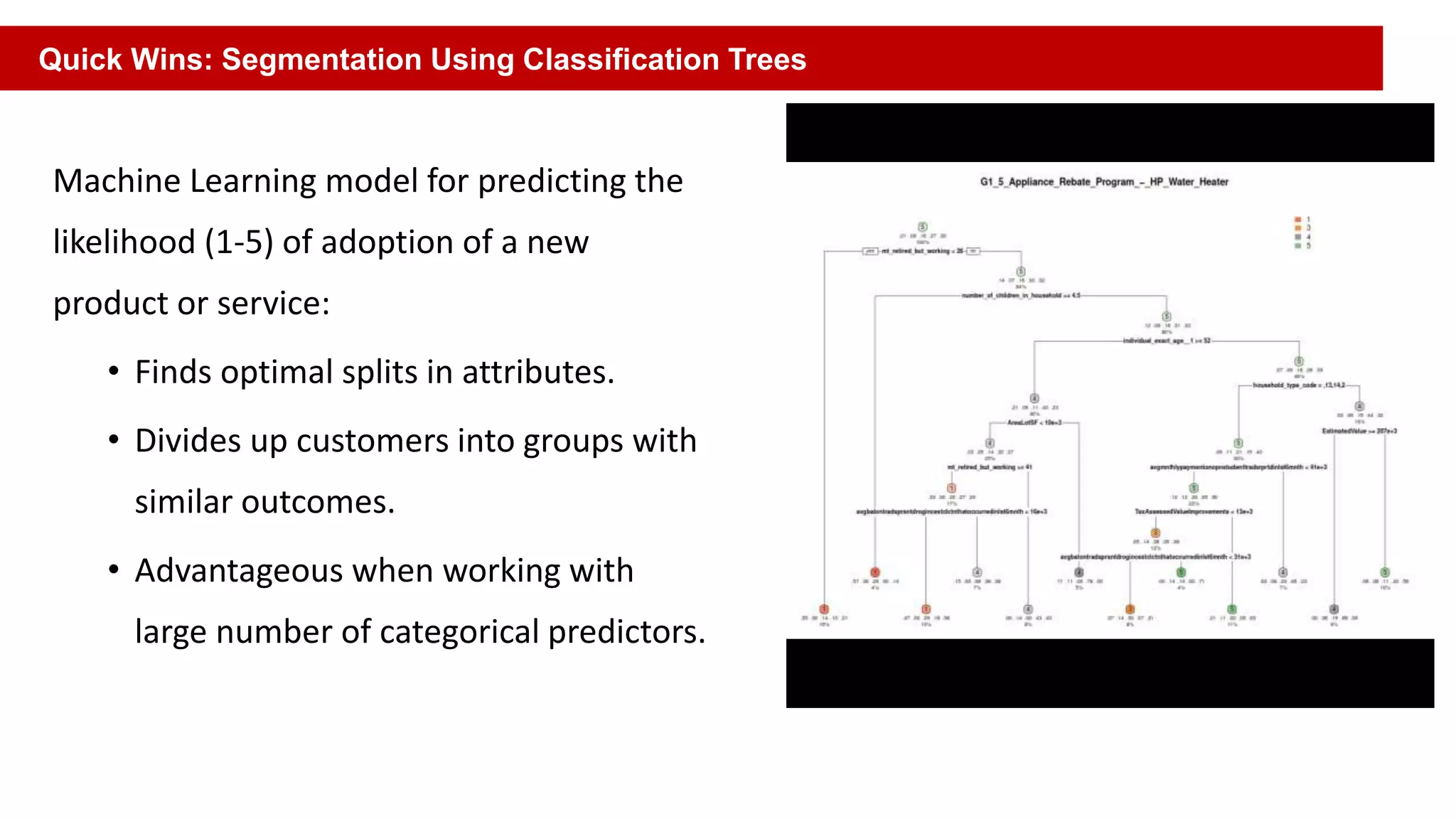

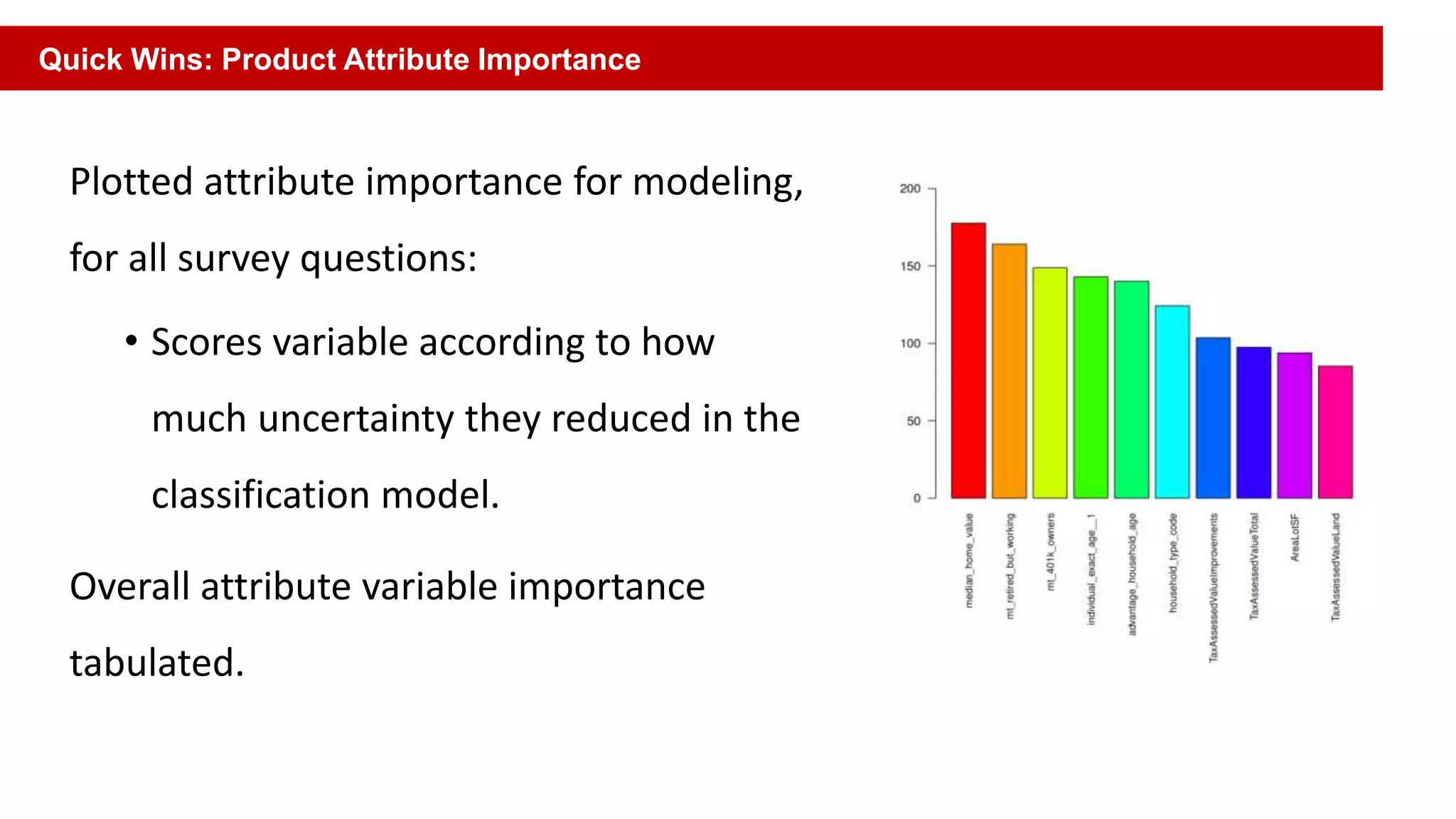

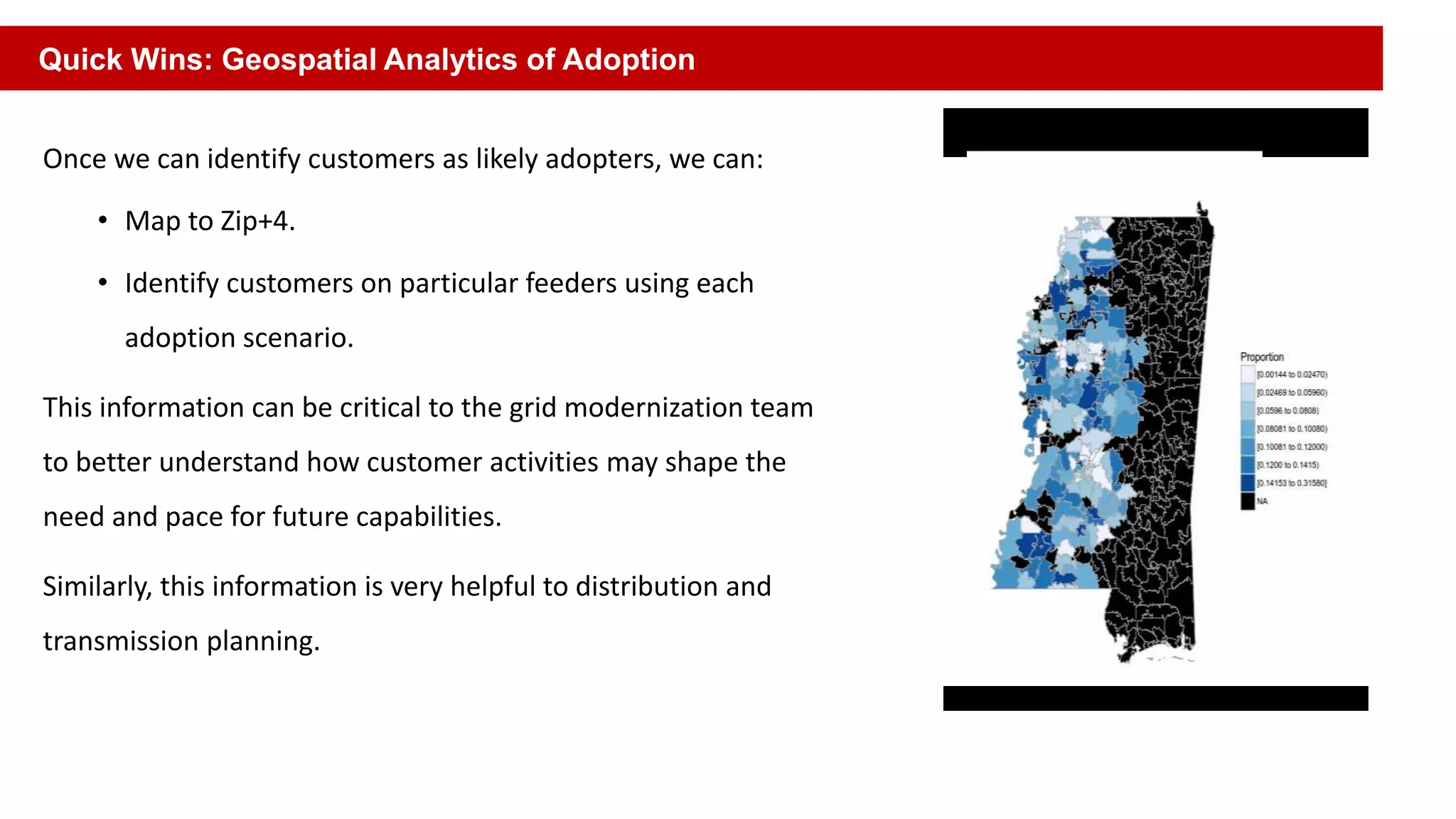

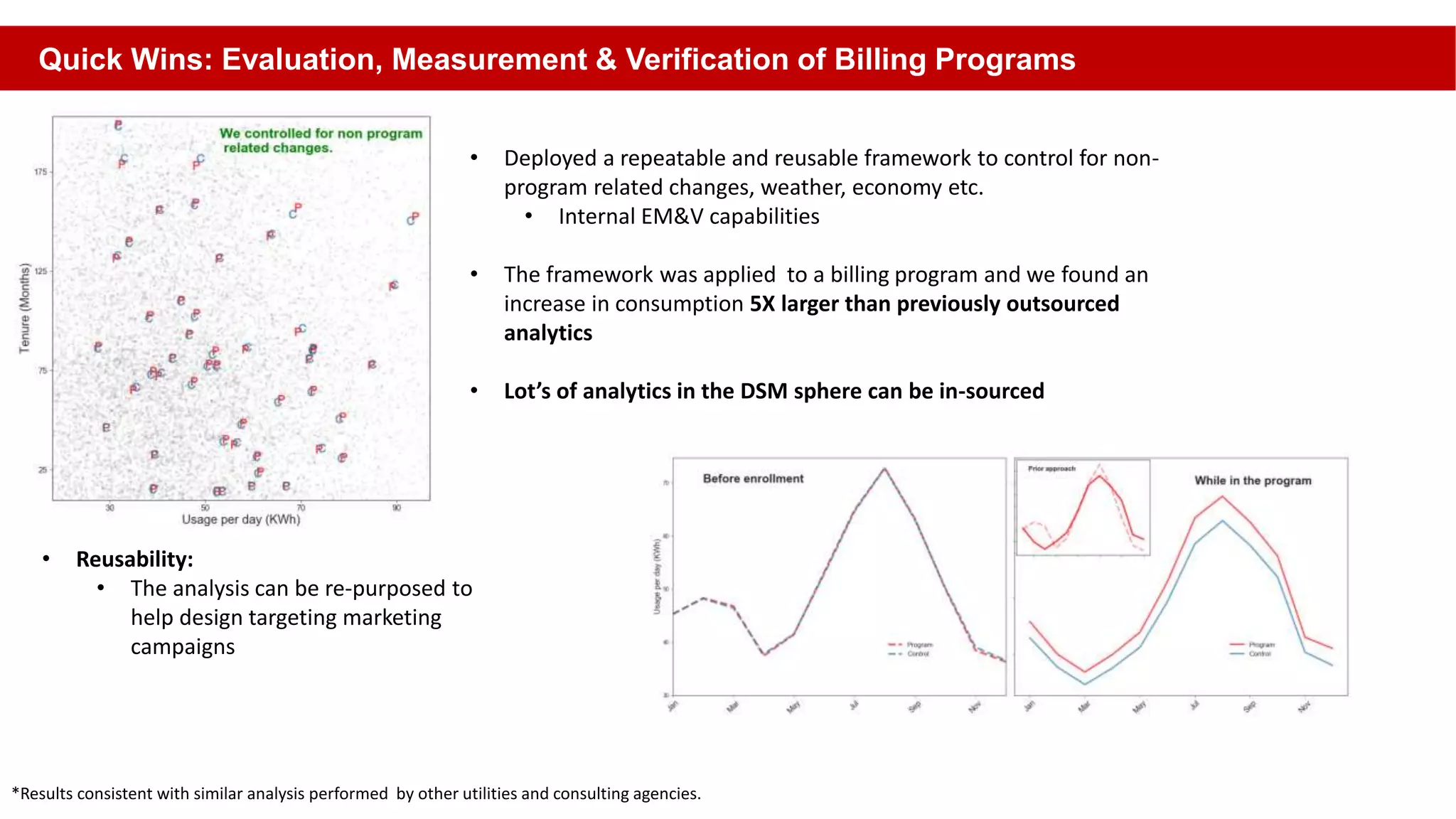

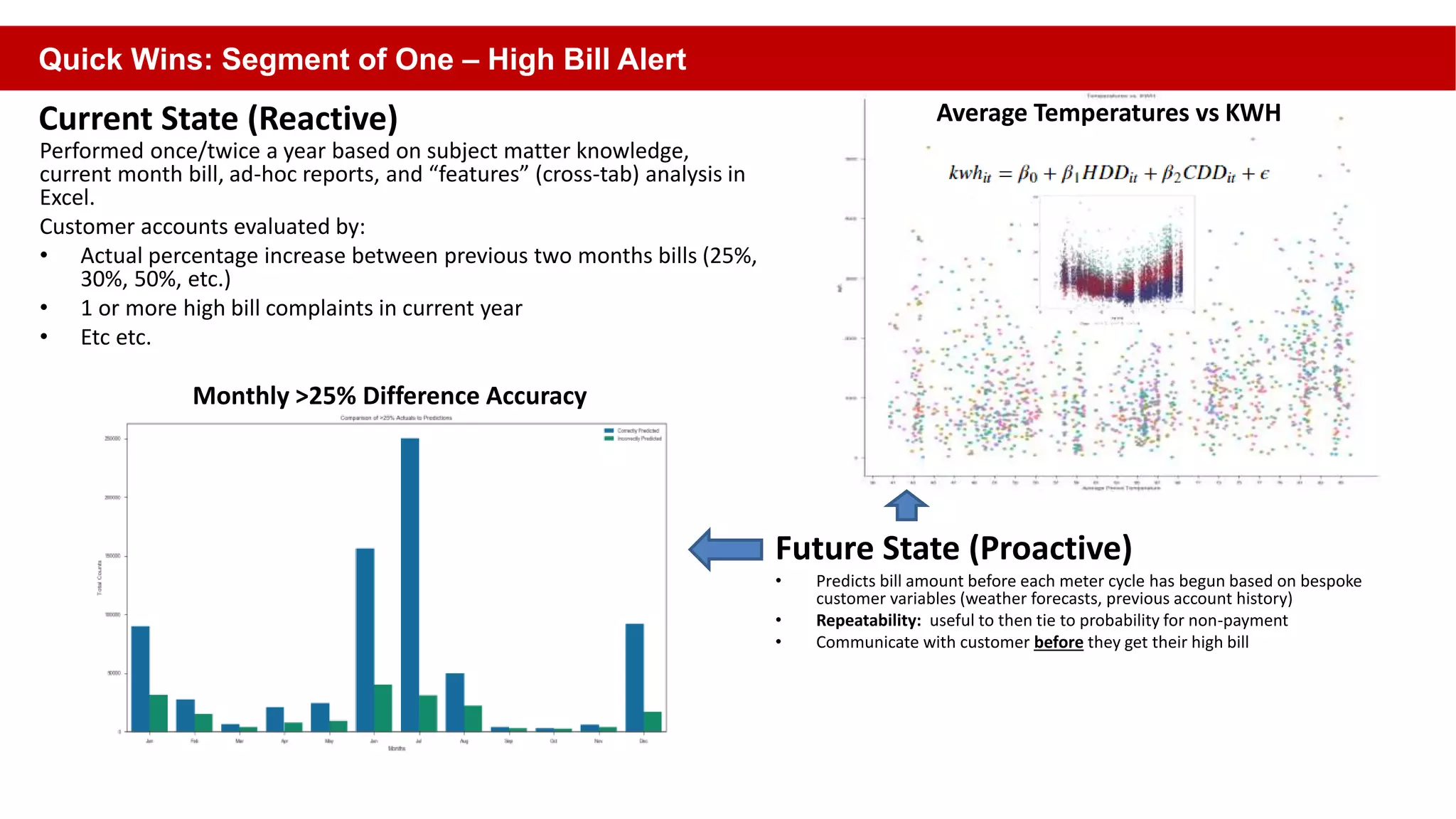

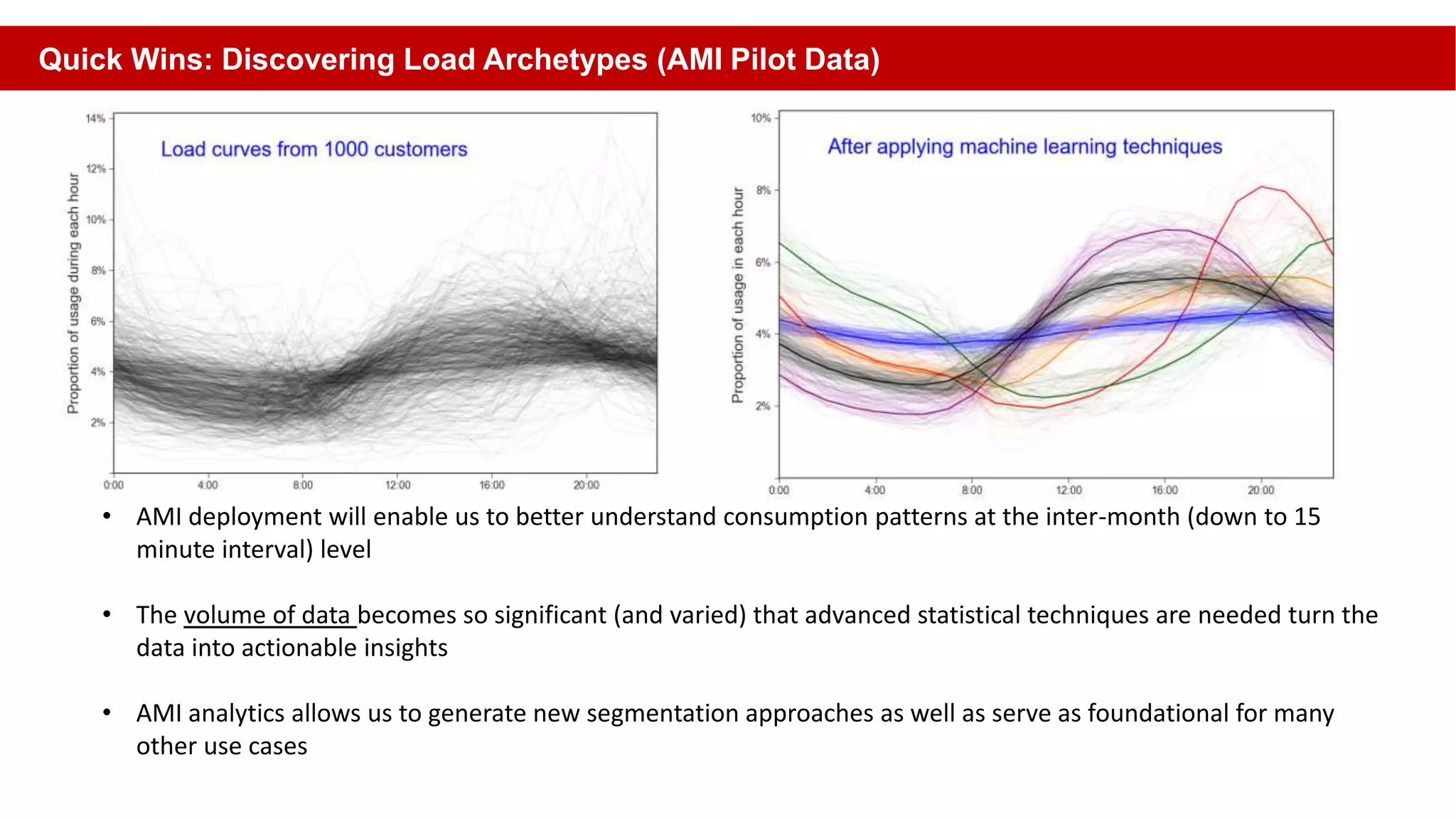

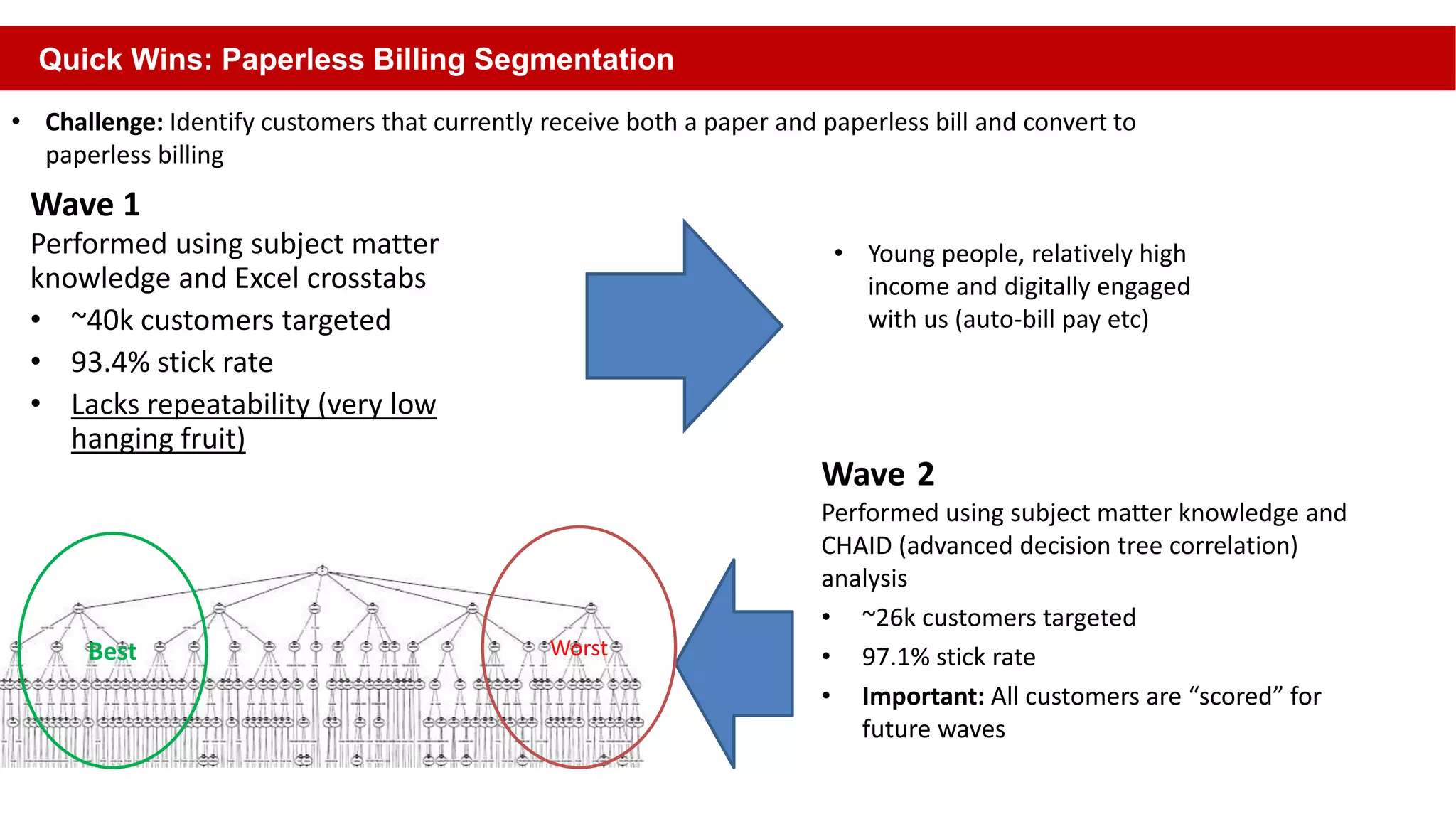

The document discusses the importance of data analytics in energy consumption and how consumer preferences are evolving, showcasing various tools for energy savings and management. Key concepts include the integration of personalization and quantification in services offered to residential customers, alongside the need for utility companies like Entergy to innovate beyond traditional value propositions. The narrative emphasizes the significance of technology, customer insights, and data utilization in shaping future energy services and improving customer experience.