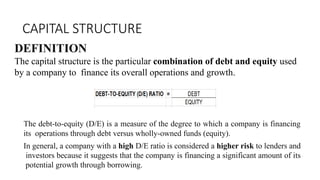

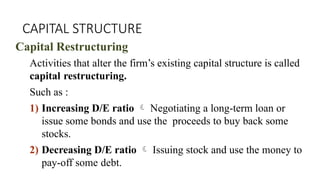

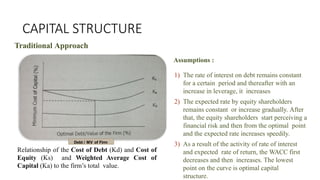

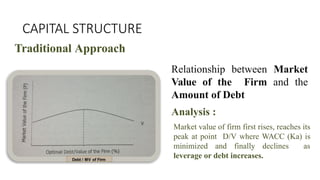

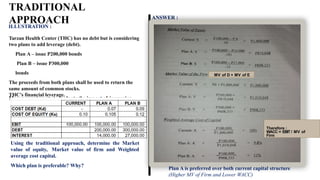

The document outlines the concept of capital structure, which is the combination of debt and equity a company uses to finance its operations. It discusses optimal capital structures and the effects of changes to capital structure, such as increasing or decreasing the debt-to-equity ratio. Additionally, it examines the traditional approach to capital structure, including its assumptions and relationships between market value, cost of debt, and weighted average cost of capital.