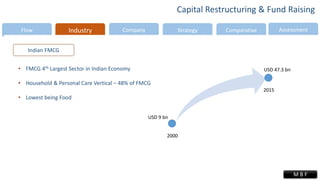

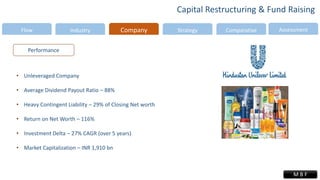

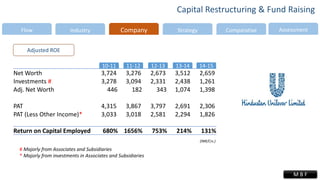

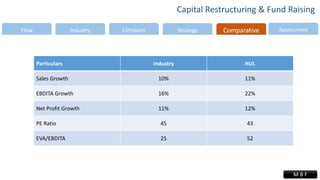

The document discusses Hindustan Unilever Ltd's capital structuring and fund raising. It summarizes HUL's financial performance, noting that it is an unleveraged company with a high dividend payout ratio and return on net worth. The document also analyzes HUL's investments, noting they have grown at a 27% CAGR over 5 years. Finally, the document discusses an potential acquisition of REI Agro Ltd in the food processing sector to extend HUL's food portfolio.