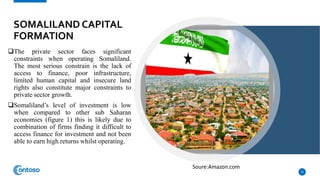

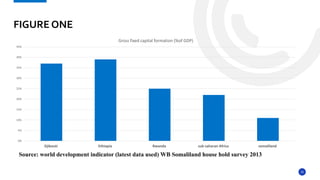

This document discusses capital accumulation and economic growth in Somaliland. It begins with introducing capital accumulation as the growth of wealth through investments and profits. It then discusses the relevance of capital formation, including increasing productivity, national income, employment, and technological progress. Some reasons for low capital formation in developing countries are also examined, such as low incomes, lack of demand and supply of capital, and small market sizes. The sources of capital formation include savings, taxation, borrowing, and foreign investment. The document notes that capital formation in Somaliland is low compared to other countries due to constraints on the private sector like access to finance and infrastructure. It concludes by thanking the reader.