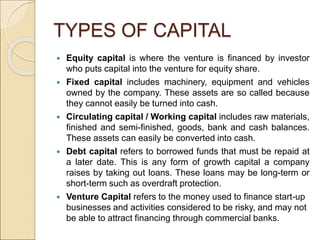

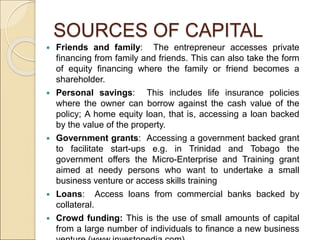

This document discusses capital requirements for businesses. It defines capital as assets like machinery and equipment needed for production as well as money needed for investment. Not having enough capital can cause businesses to fail. There is no single best method for raising capital, but questions about how much is needed, how much the owner can contribute, and how to convince others to invest must be considered. The ability to plan financial needs plays a role in raising money. Lenders want to see the owner's financial commitment to reduce risk of abandonment. Different businesses require varying amounts and types of capital, which can come from equity investment, debt like loans, or alternative sources such as friends, grants, or venture capitalists.