Embed presentation

Download to read offline

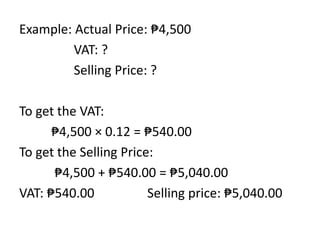

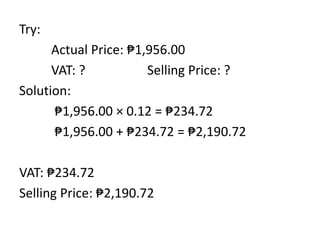

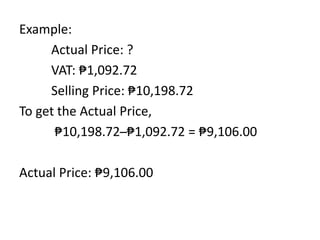

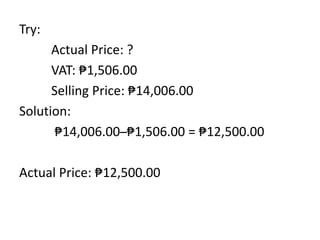

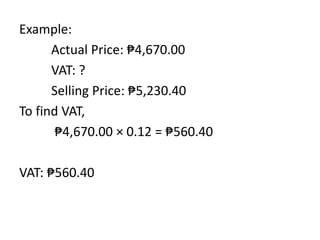

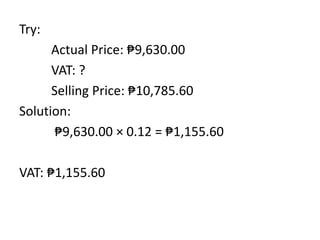

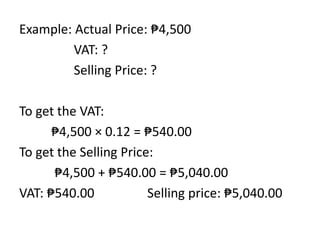

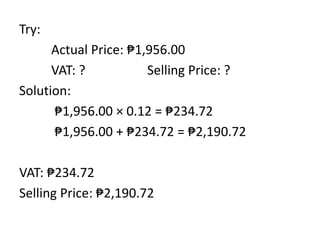

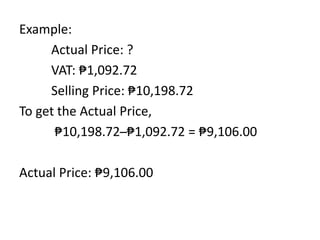

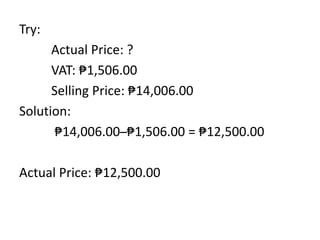

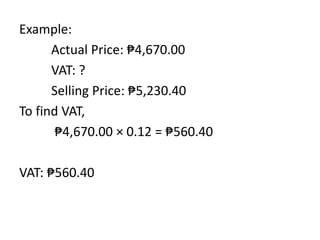

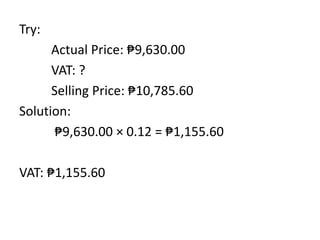

Value Added Tax (VAT) is an indirect tax equal to 12% of the price of a good or commodity. The document provides examples of calculating VAT on actual prices, finding the VAT amount when given the selling price, and calculating the actual price when given the VAT amount and selling price. All calculations involve multiplying the actual price by 12% to get the VAT and adding the VAT to the actual price to get the selling price.