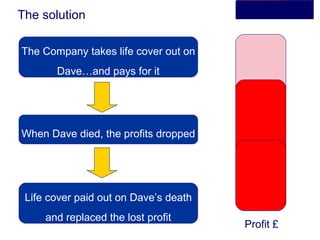

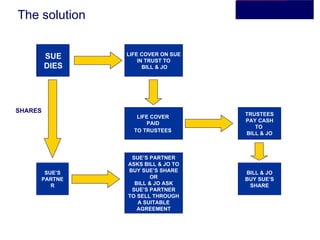

This document discusses how life insurance can help protect businesses from losses that occur due to the death or critical illness of important employees or business owners. It provides examples of how a business suffered when the top salesman Dave died and was unable to be quickly replaced, and when business owner Sue died and her partner wanted to cash out rather than remain involved in the business. It notes that around 1 in 3 male business owners and 1 in 4 female business owners will suffer a critical illness or die before age 65. Taking out life insurance that pays out to the business can replace lost profits and allow the purchase of shares from a deceased owner's partner so the business can continue as before.