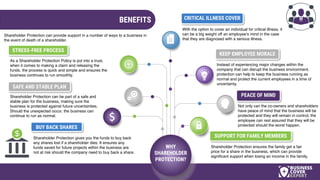

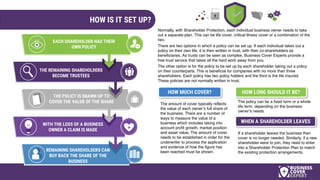

Shareholder protection is a life insurance policy designed to provide a lump sum to a business in the event of a shareholder's death or terminal illness, helping to keep control within the company and ensuring a fair price for the deceased shareholder's shares. Without such protection, shares can pass to the deceased's estate, risking business stability and introducing undesirable buyers. The guide emphasizes the importance of having a clear shareholder protection plan to mitigate risks associated with the unexpected loss of a shareholder.