The document discusses two business models for managing insurance contracts:

1) The asset liability management (ALM) business model, which focuses on matching asset and liability cash flows over the life of insurance contracts. Measurement should be based on discounted expected cash flows.

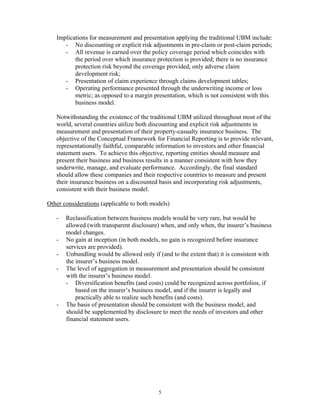

2) The underwriting business model (UBM), which is focused on underwriting results like premiums, claims, and expenses on an undiscounted basis. This model is typical for short-duration property/casualty contracts.

The document argues that measurement and presentation of insurance contracts should be based on the insurer's business model to provide a meaningful reflection of performance.