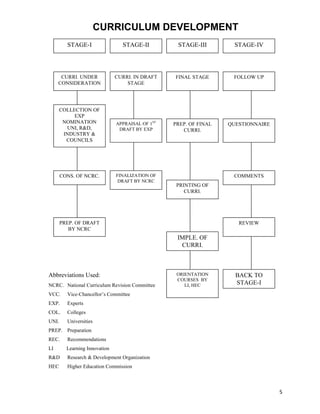

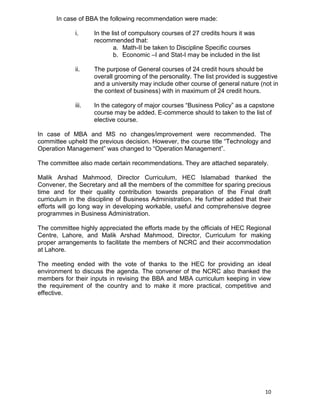

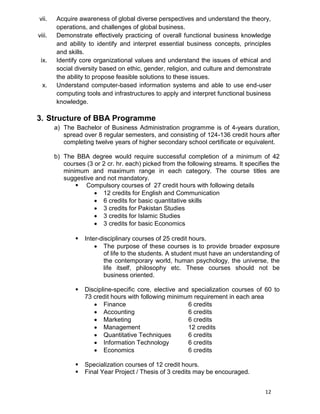

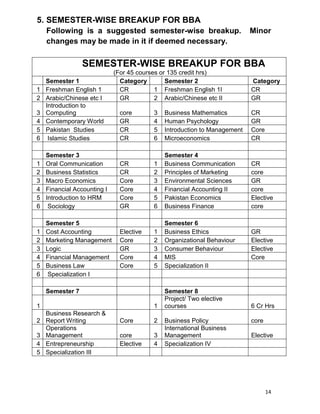

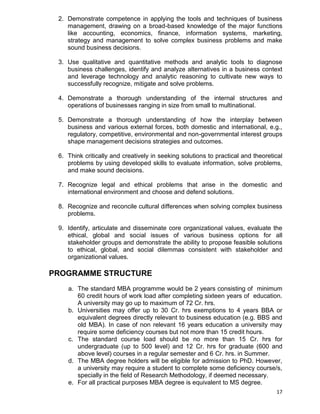

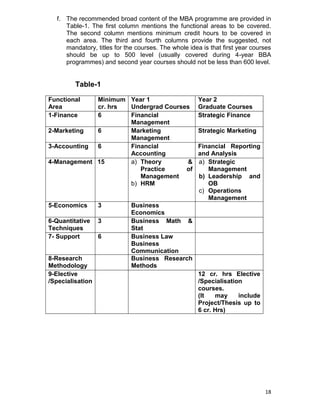

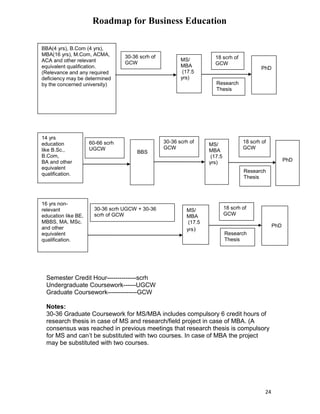

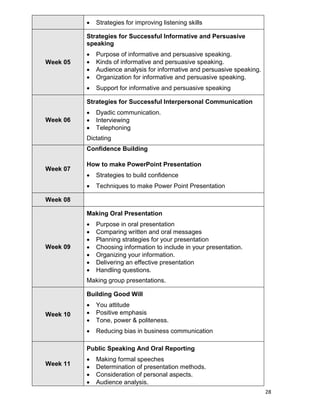

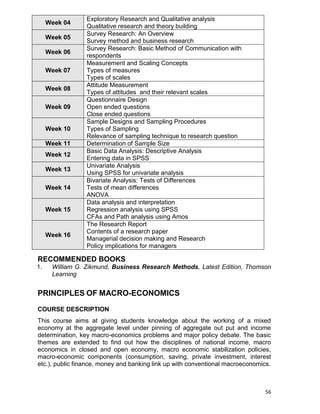

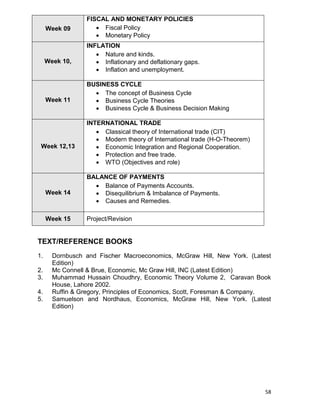

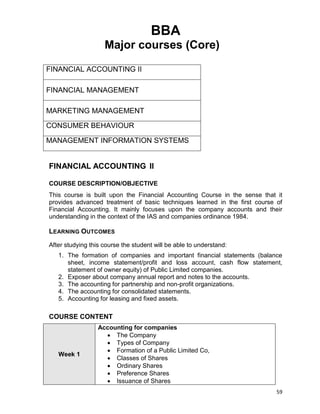

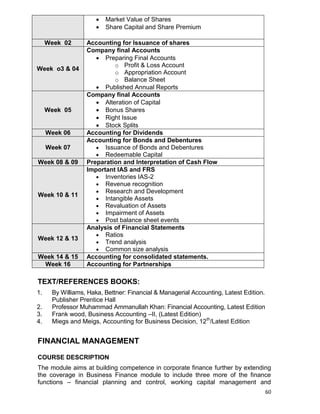

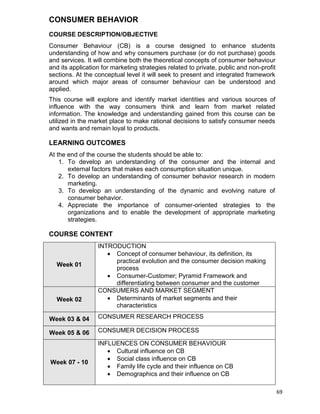

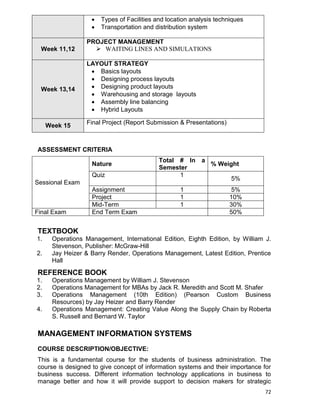

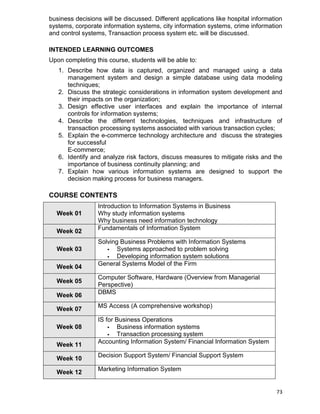

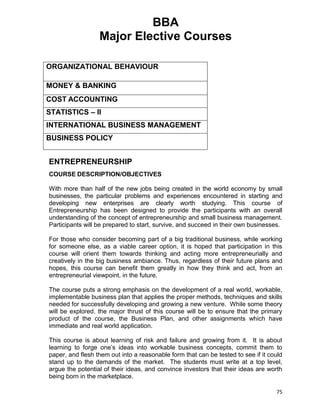

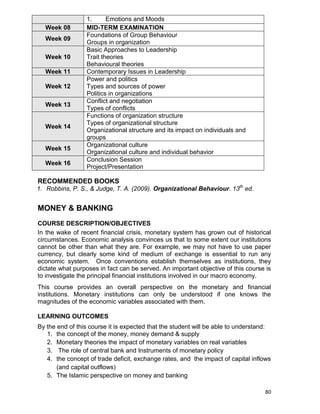

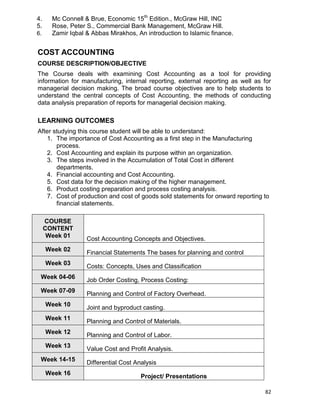

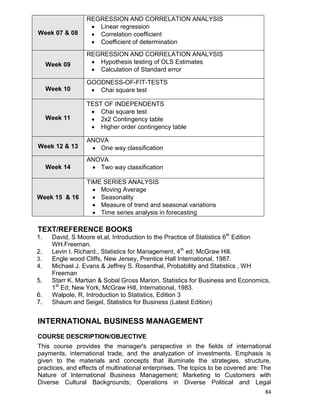

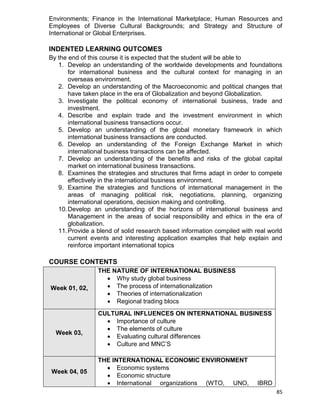

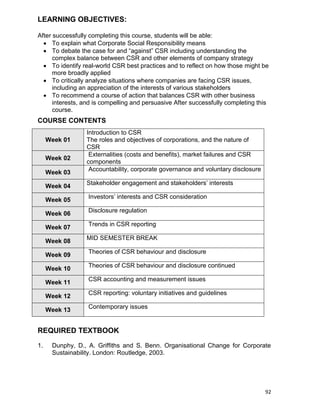

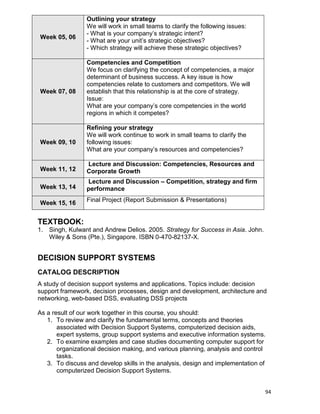

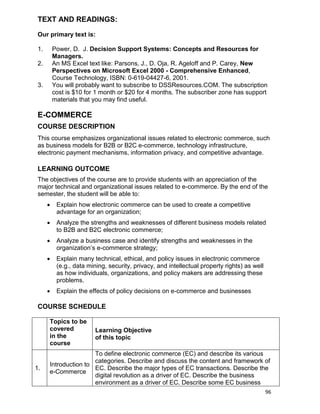

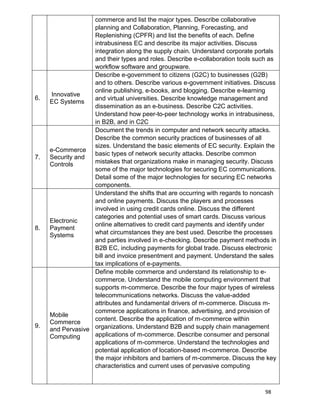

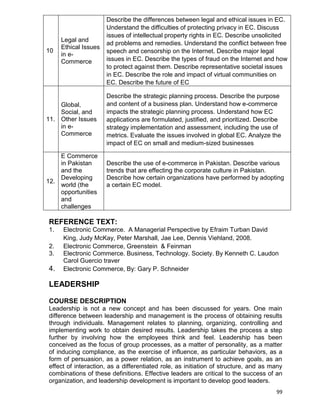

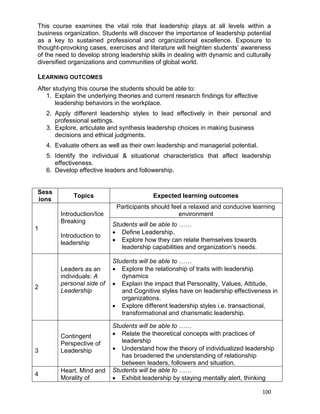

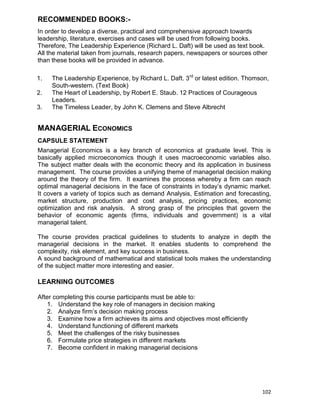

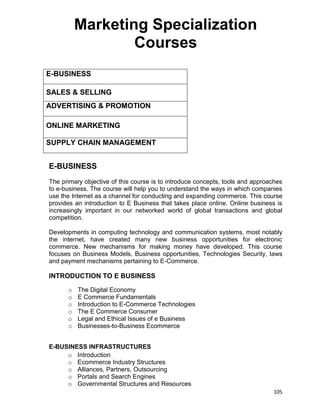

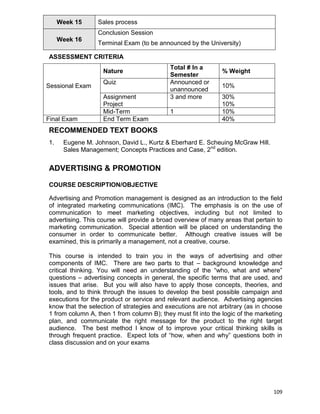

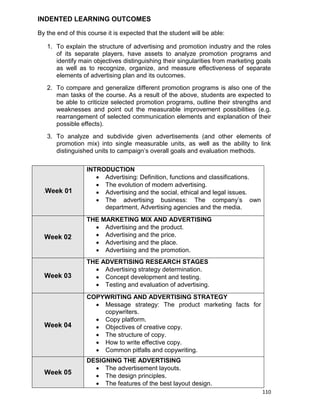

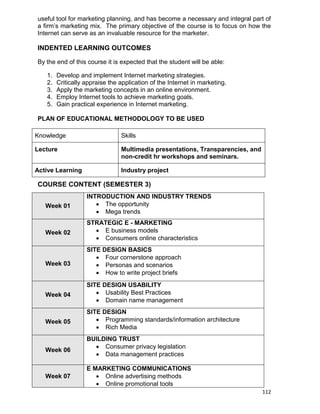

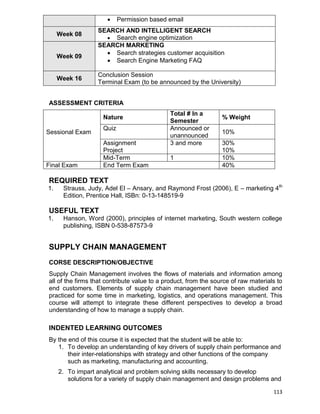

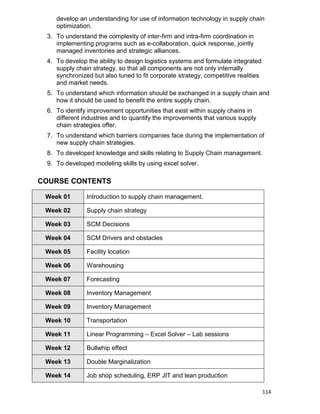

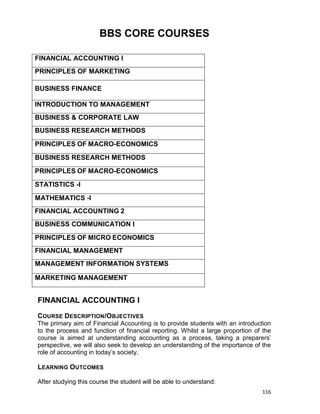

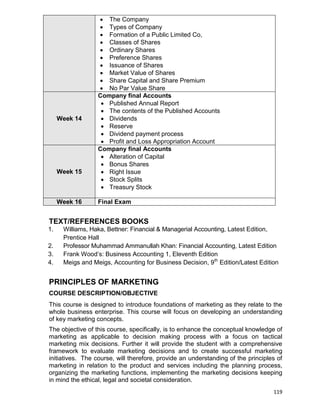

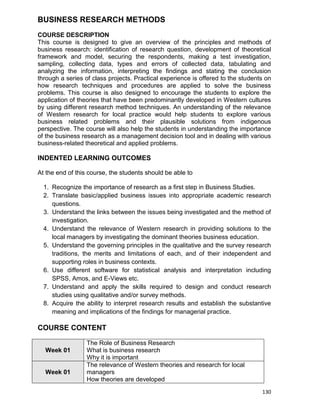

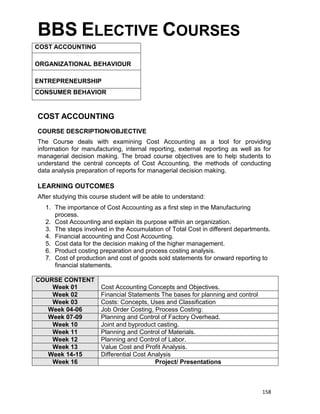

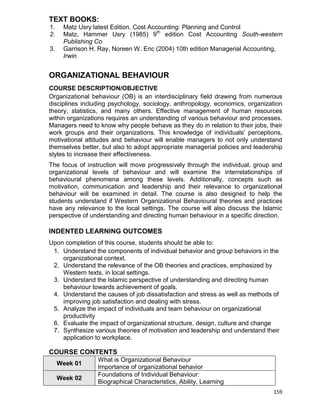

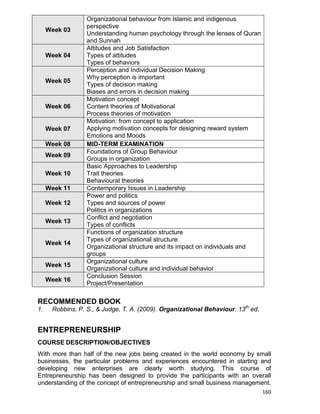

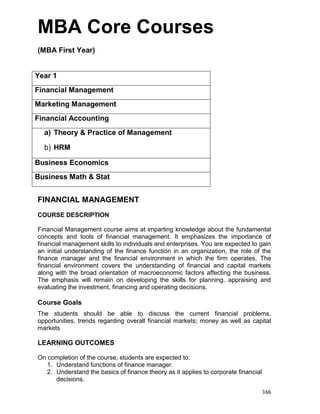

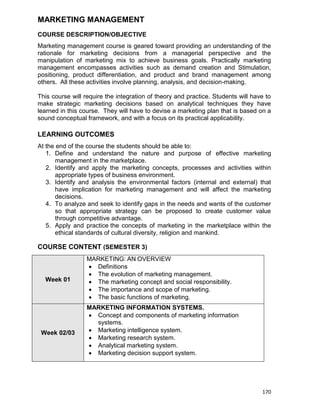

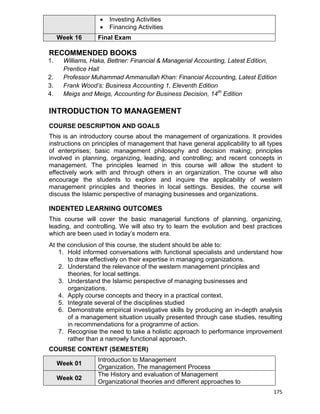

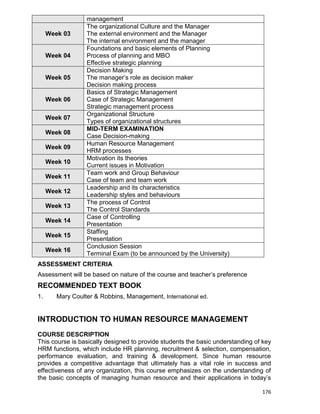

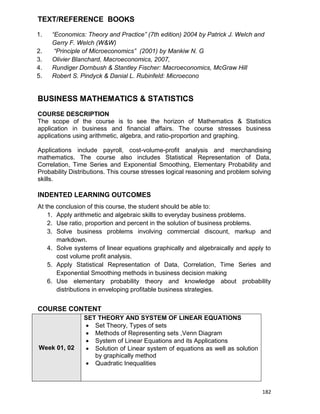

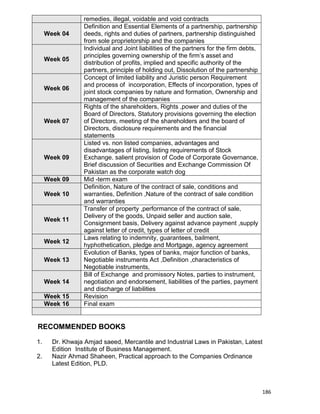

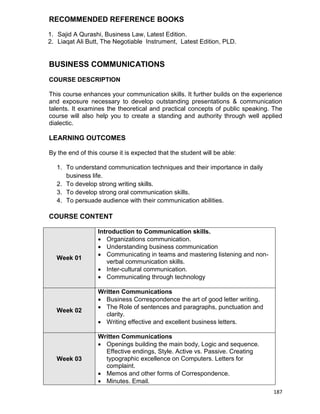

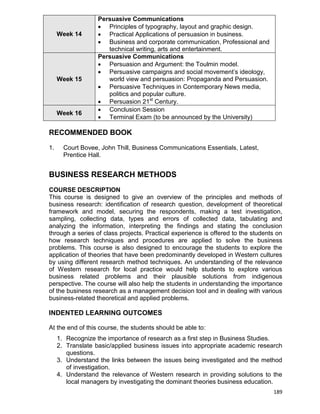

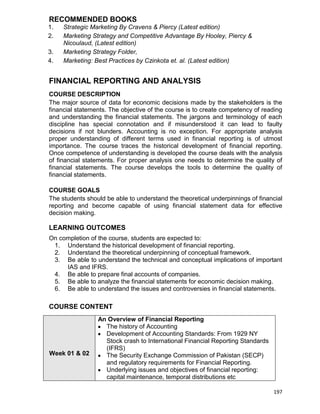

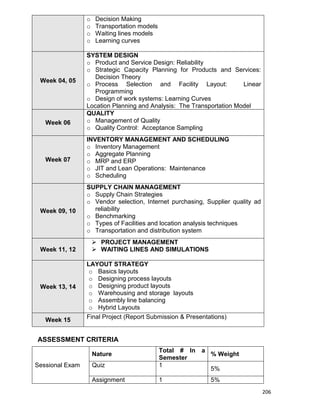

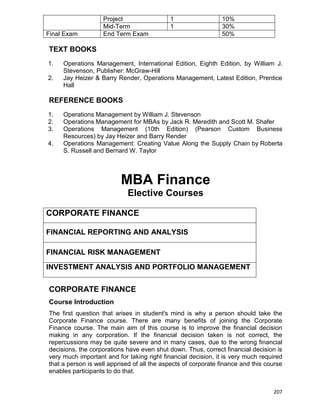

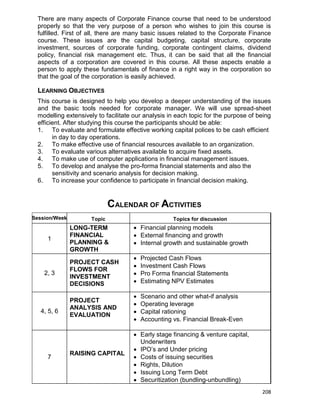

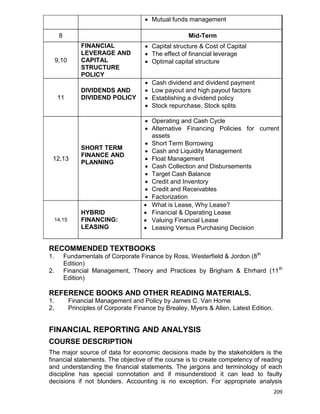

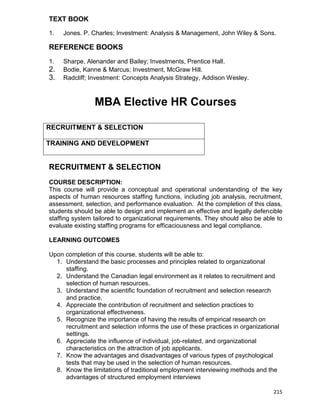

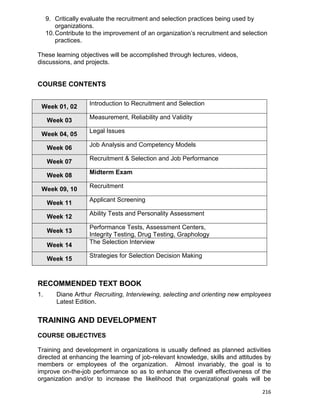

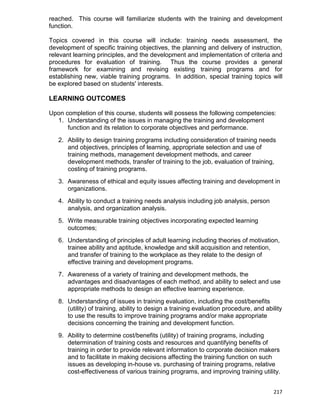

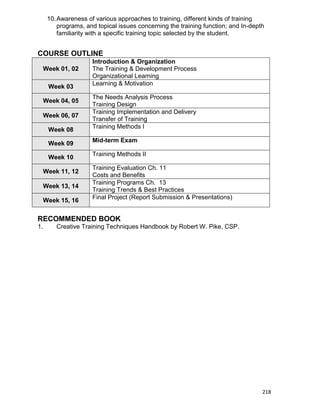

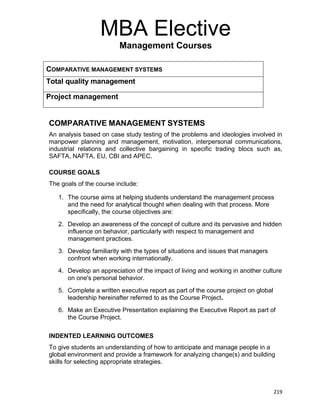

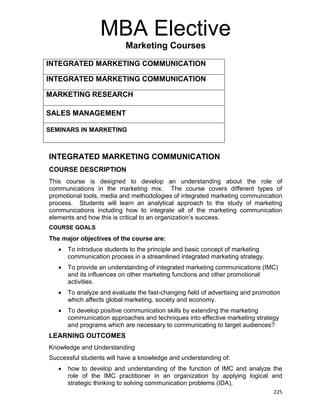

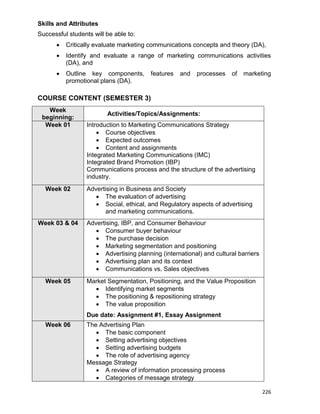

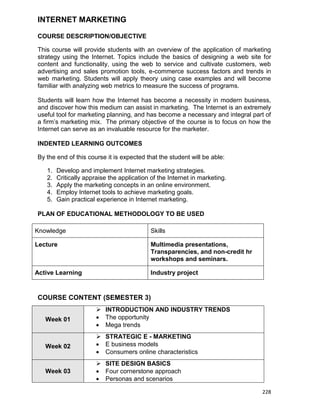

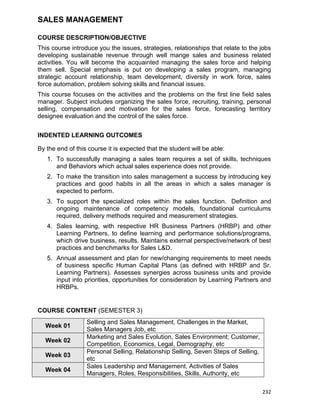

This document outlines the curriculum for Bachelor of Business Administration (BBA), Bachelor of Business Studies (BBS), Master of Business Administration (MBA), and Master of Science in Management Sciences (MS) programs in Pakistan. It provides the program objectives, structures, course outlines, and recommendations from a meeting of the National Curriculum Revision Committee on Business Administration. Key details include the objectives of the 4-year BBA program, learning outcomes, program structures and semester-wise course breakdowns for the BBA, BBS, MBA, and MS. It also lists the course outlines for compulsory, core, elective and specialization courses for each program.