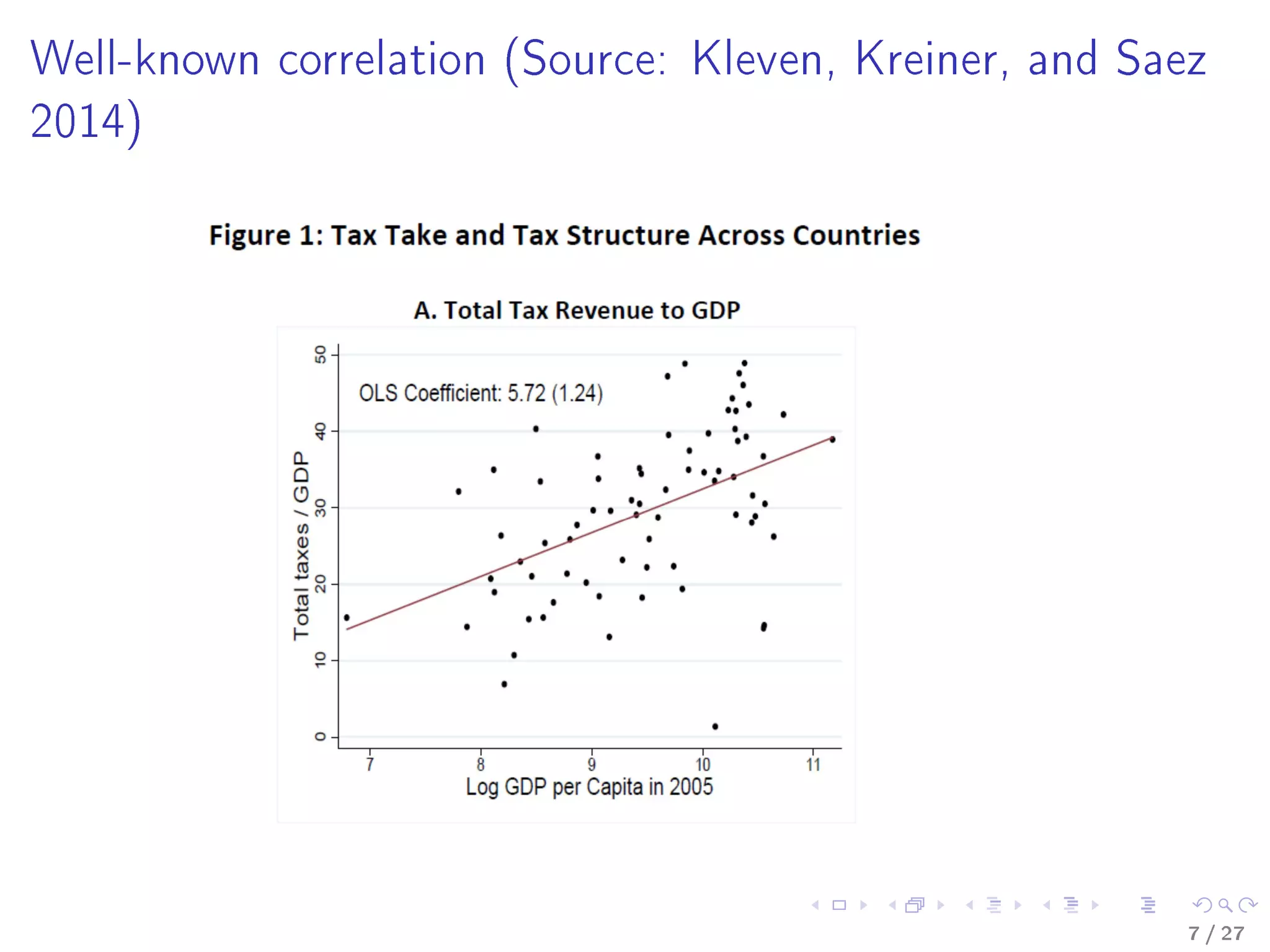

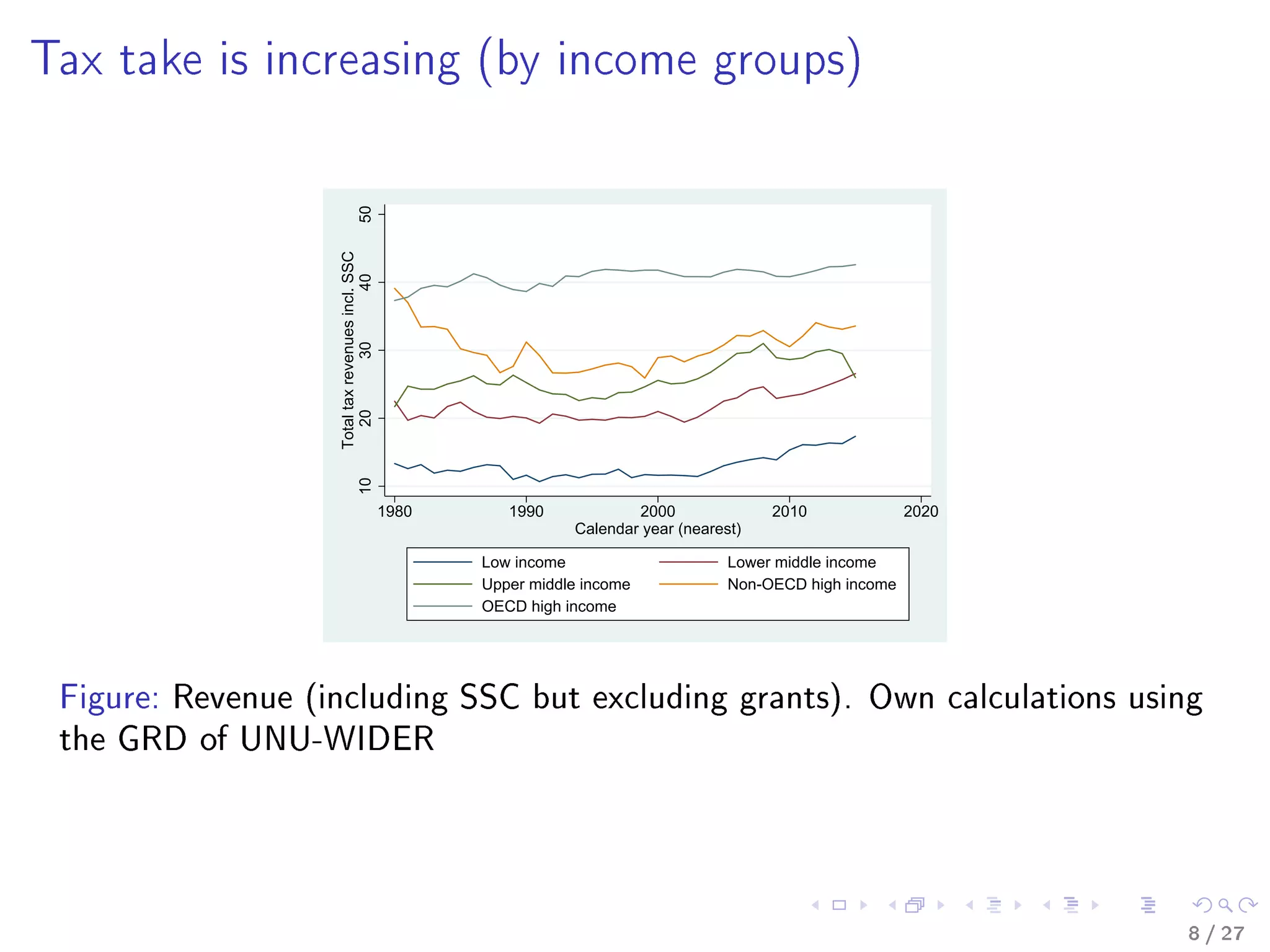

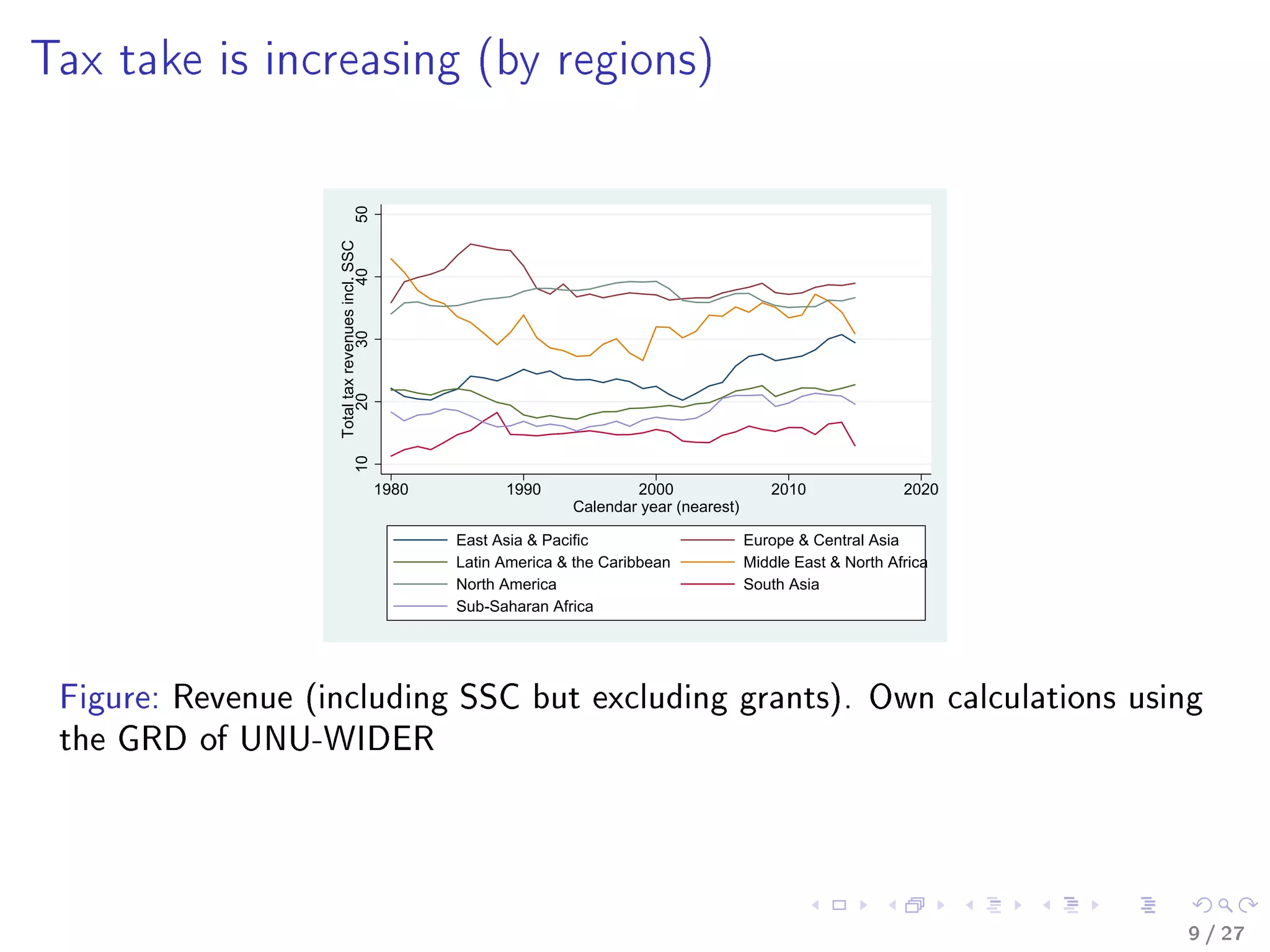

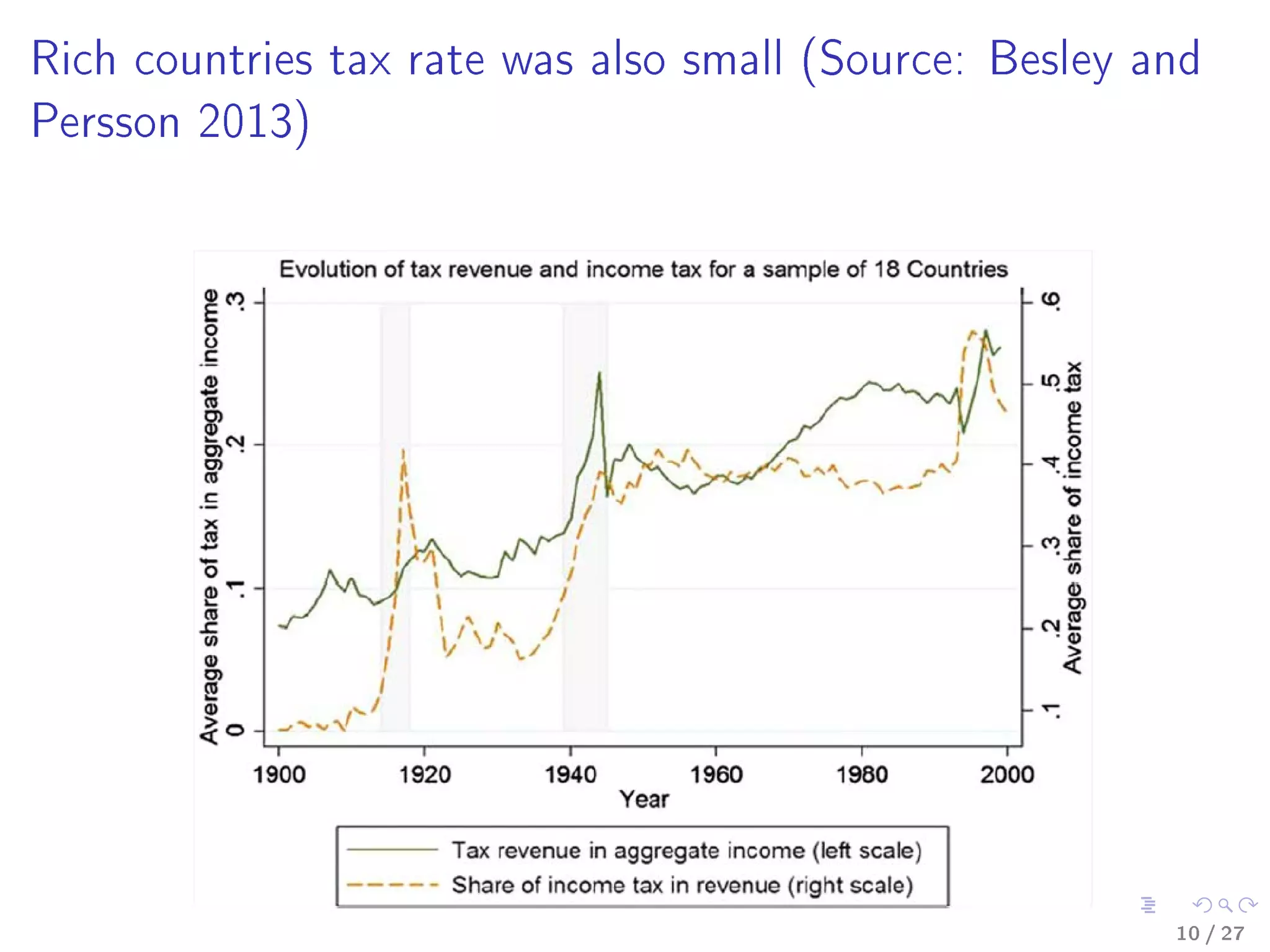

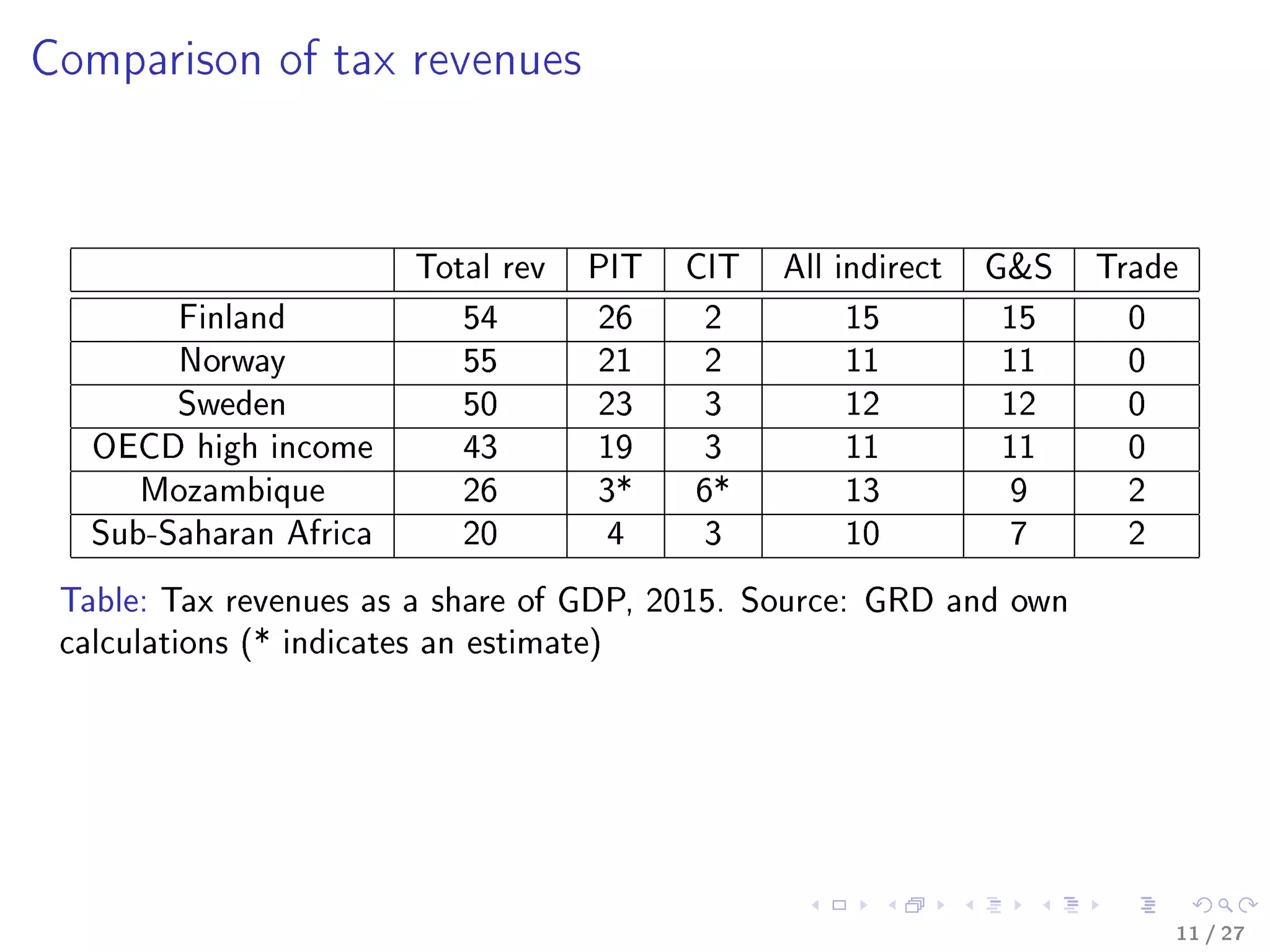

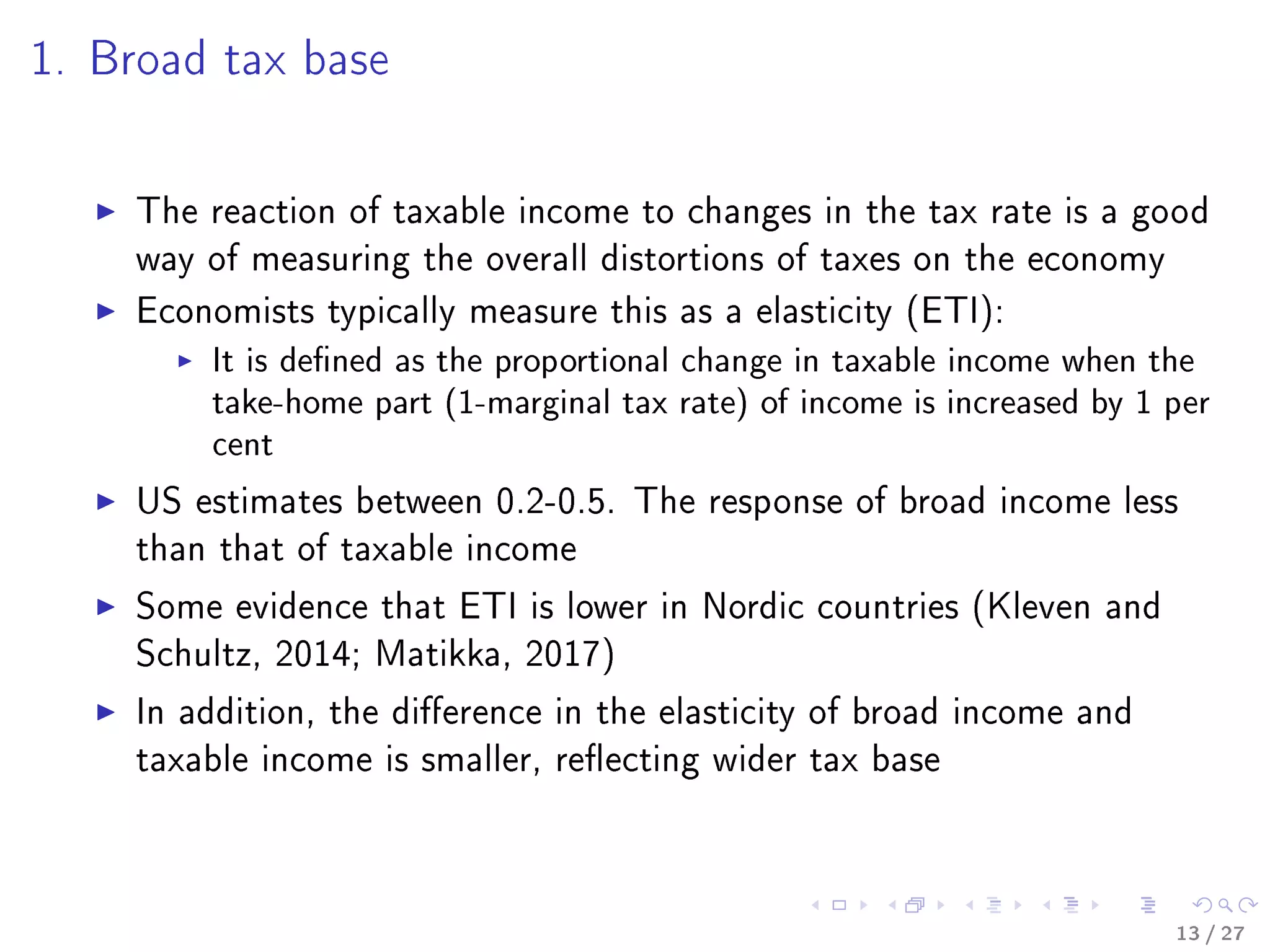

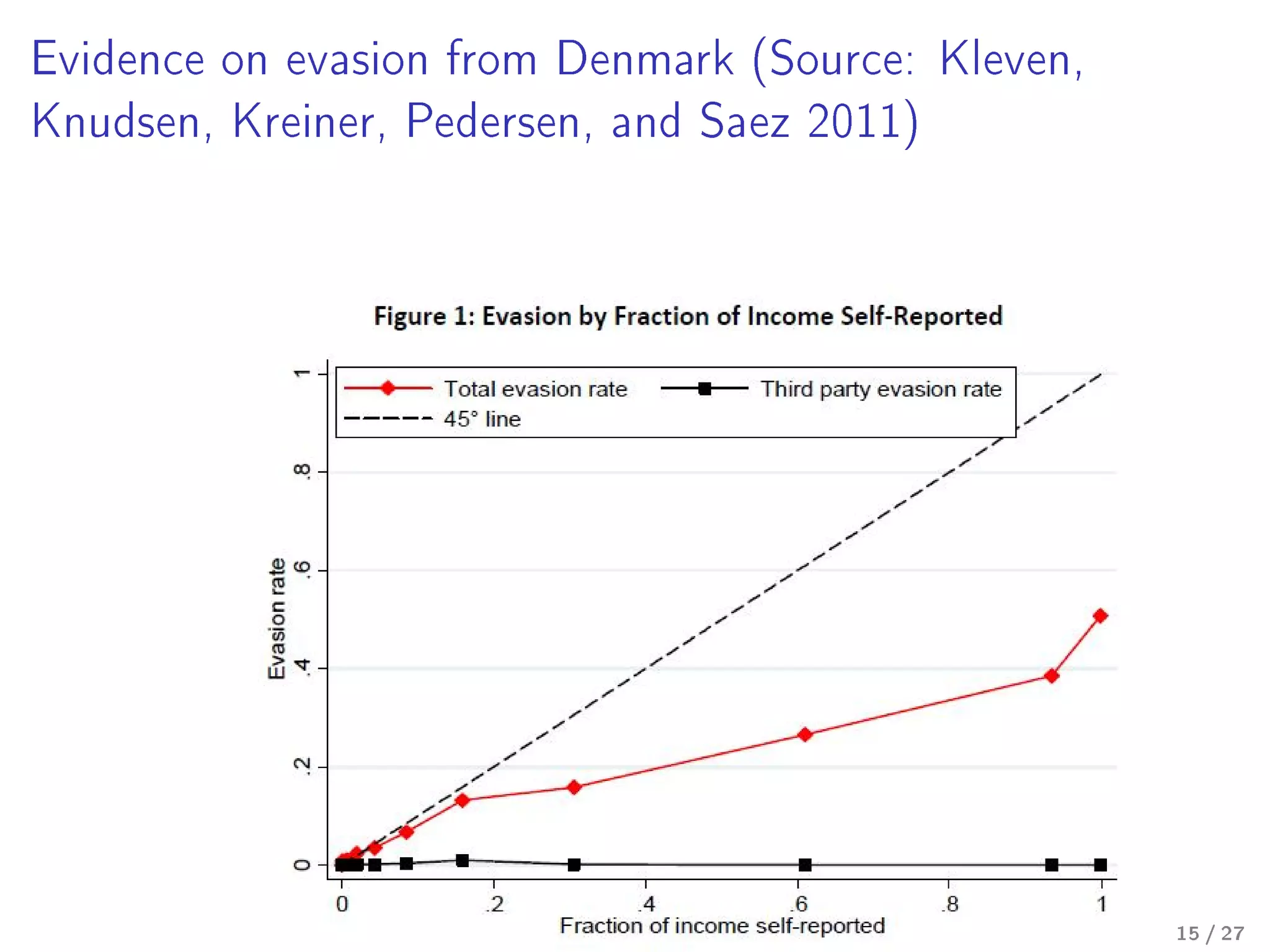

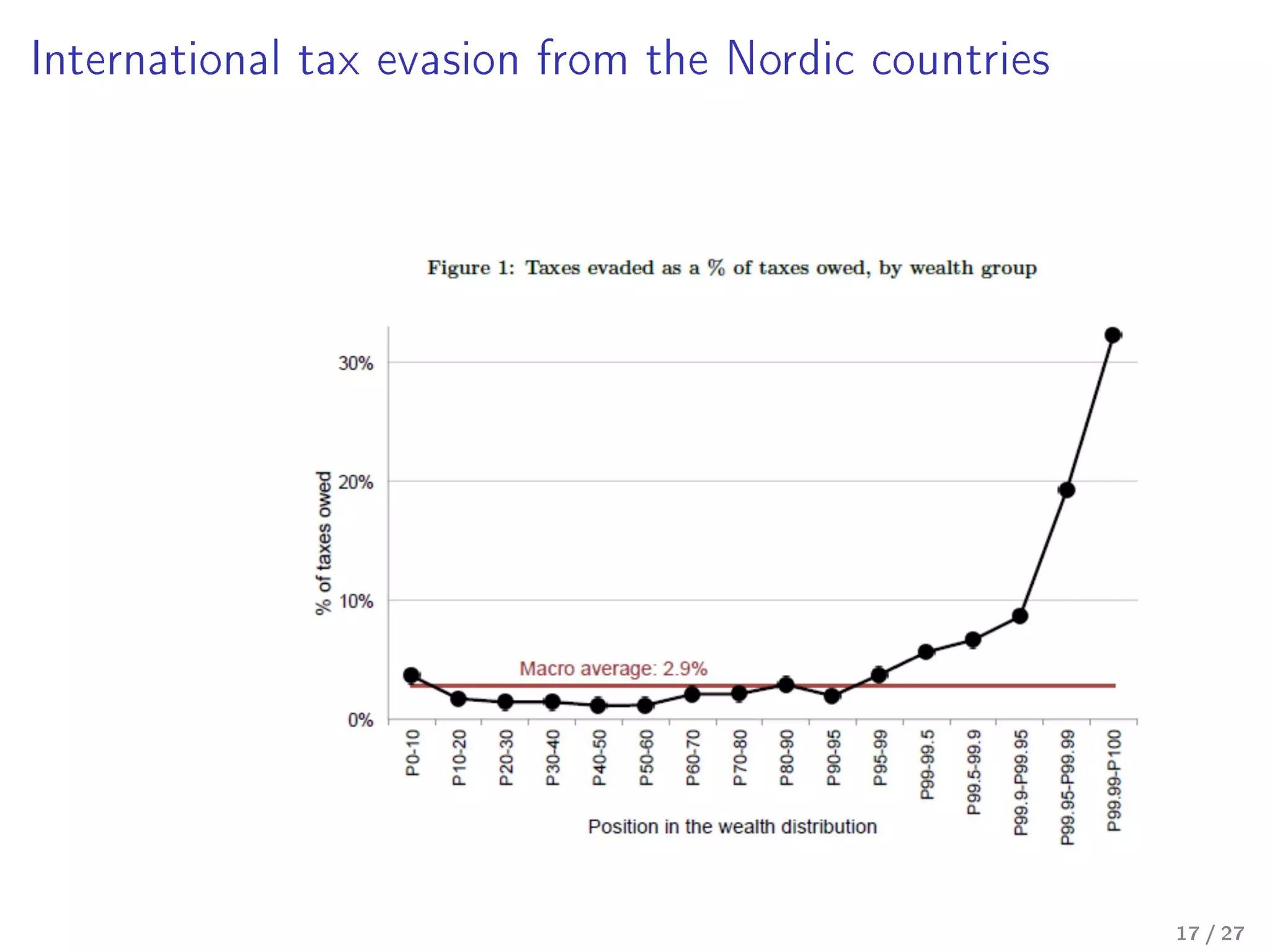

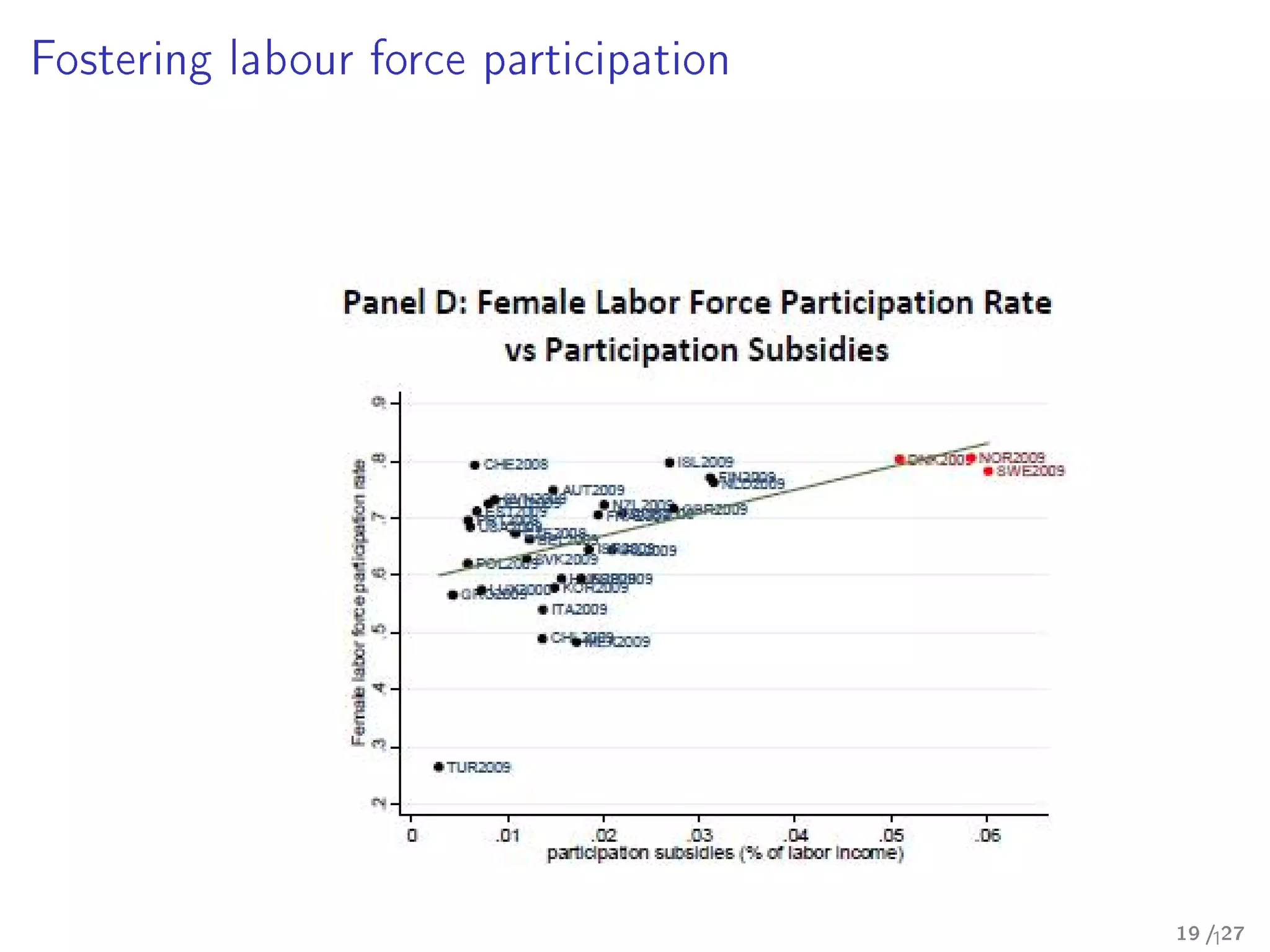

The document discusses the high tax systems in Nordic countries and their implications for improving tax capacity in developing nations like Mozambique. Key features of Nordic tax systems include a broad tax base, extensive third-party reporting to reduce tax evasion, and social programs that encourage labor force participation. It suggests that while the Nordic model may not be directly exportable, lessons can be learned for tax reforms in other countries.