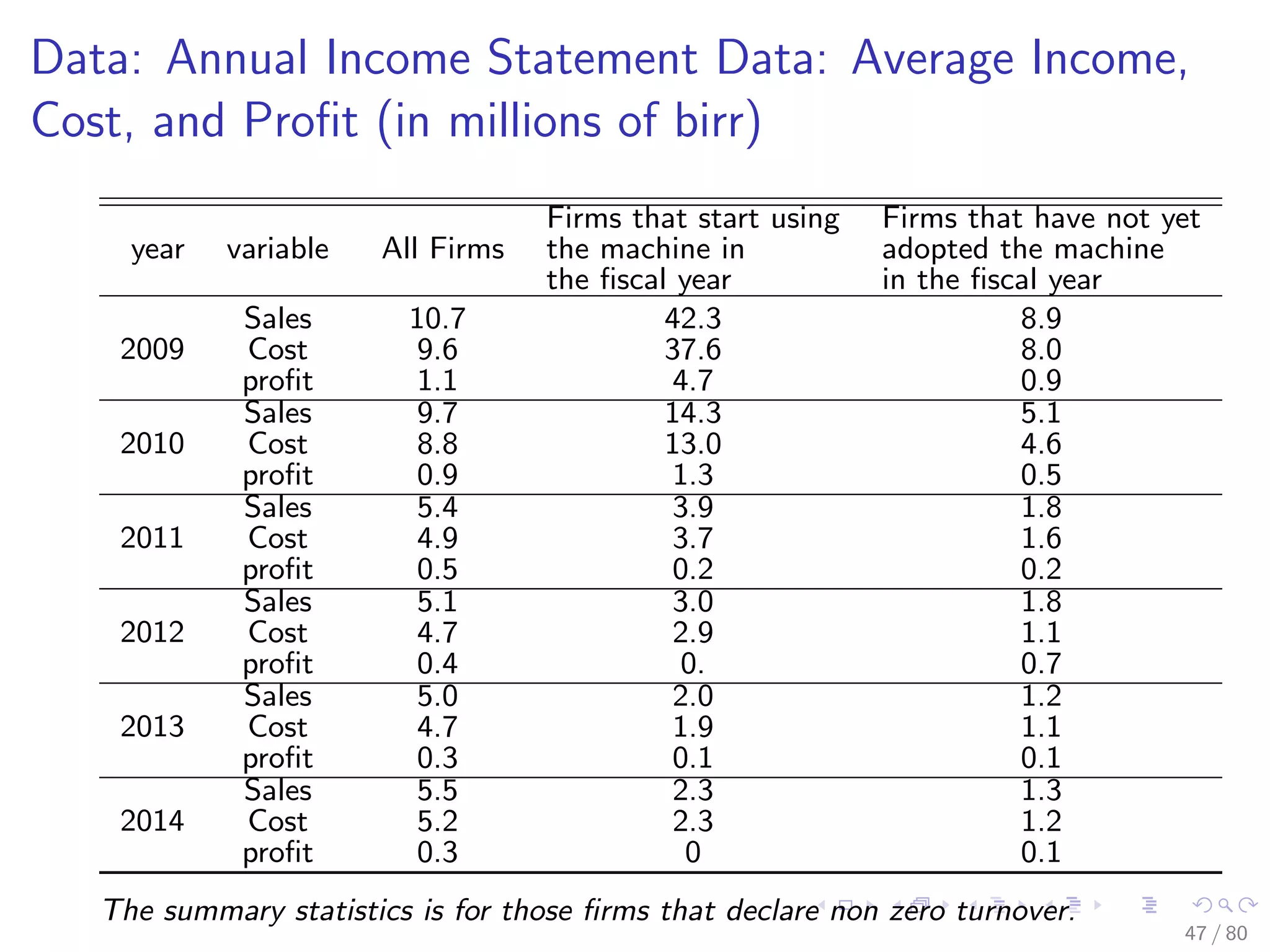

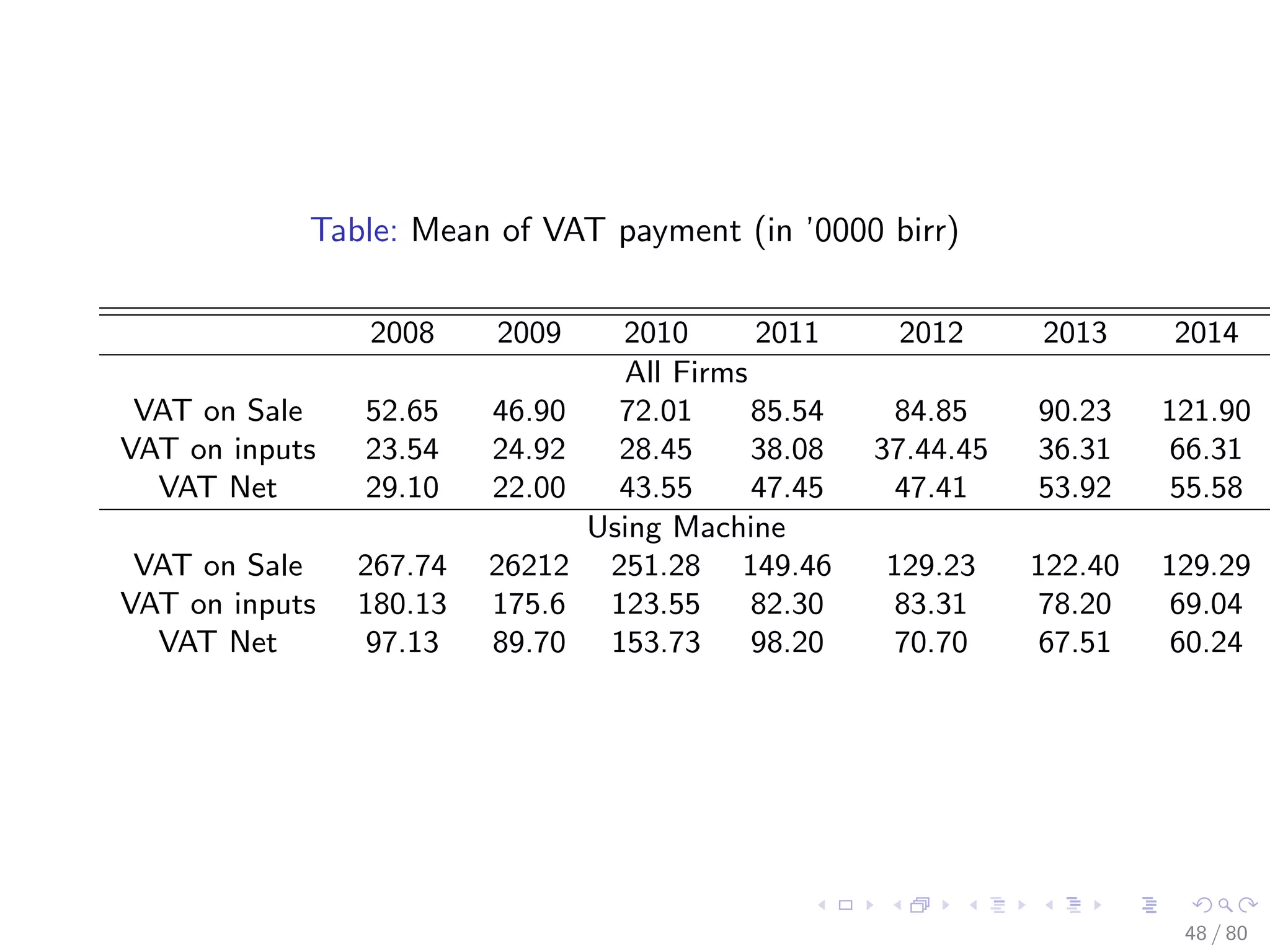

The document explores the relationship between tax compliance and the use of ICTs in Ethiopia, investigating whether investments in tax administration can enhance tax-to-GDP ratios through improved enforcement and information availability. It critiques previous studies for their limitations and proposes a comprehensive study that extends existing research by analyzing income tax reporting changes post the introduction of electronic sales registration machines. Through a randomized control experiment, the authors aim to validate that these machines enhance compliance and assess potential shifts in tax evasion practices.

![Motivation

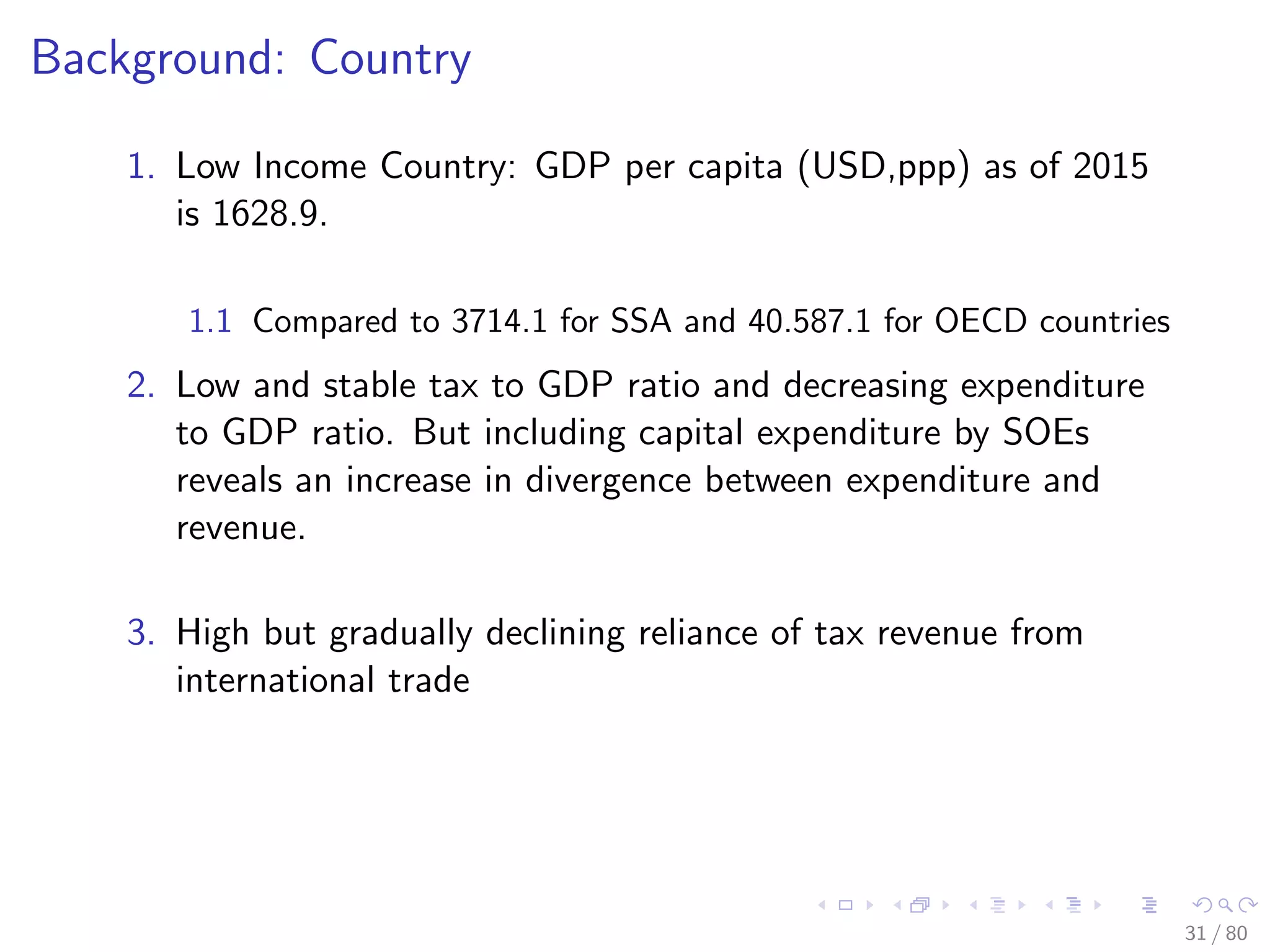

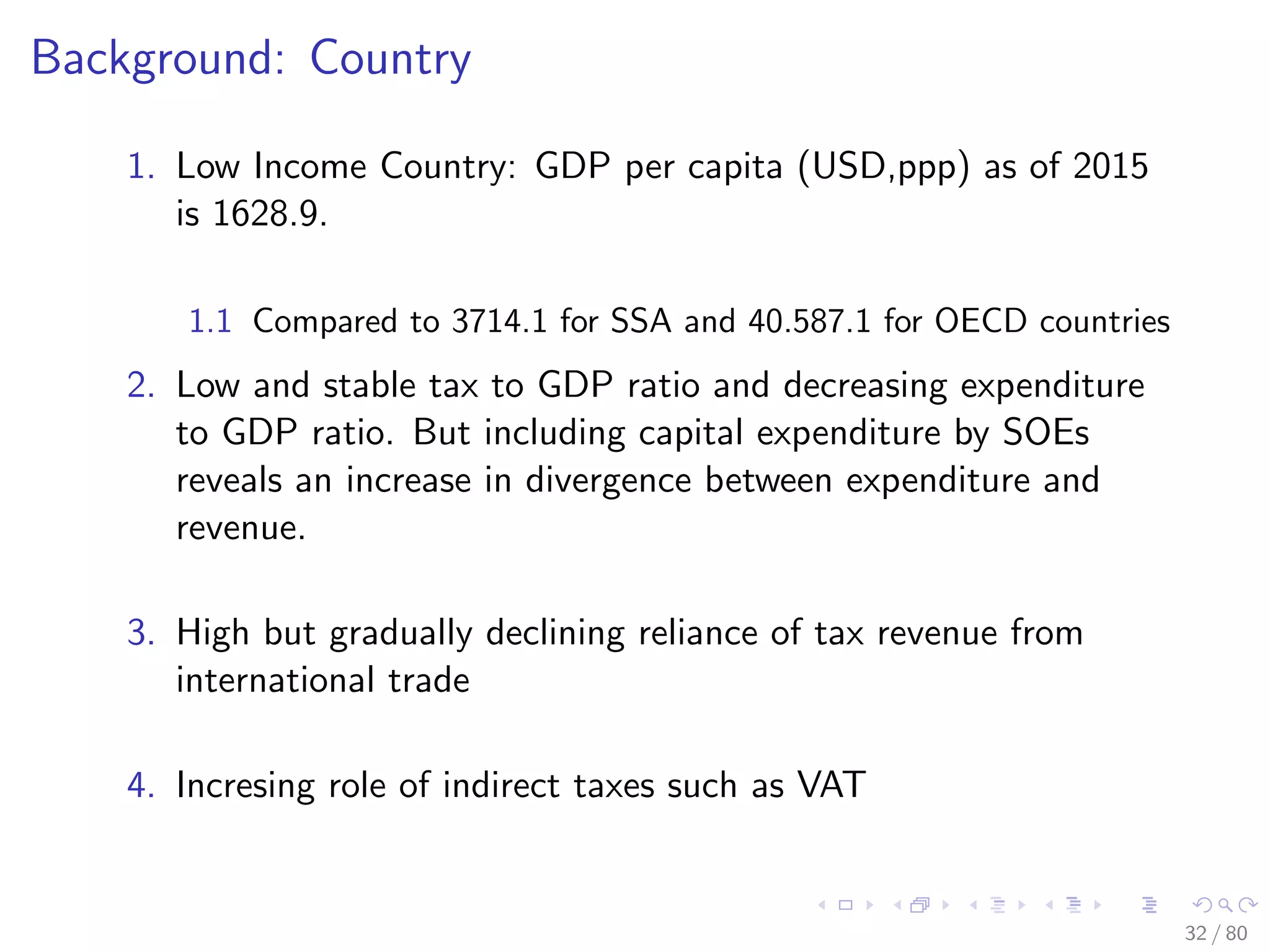

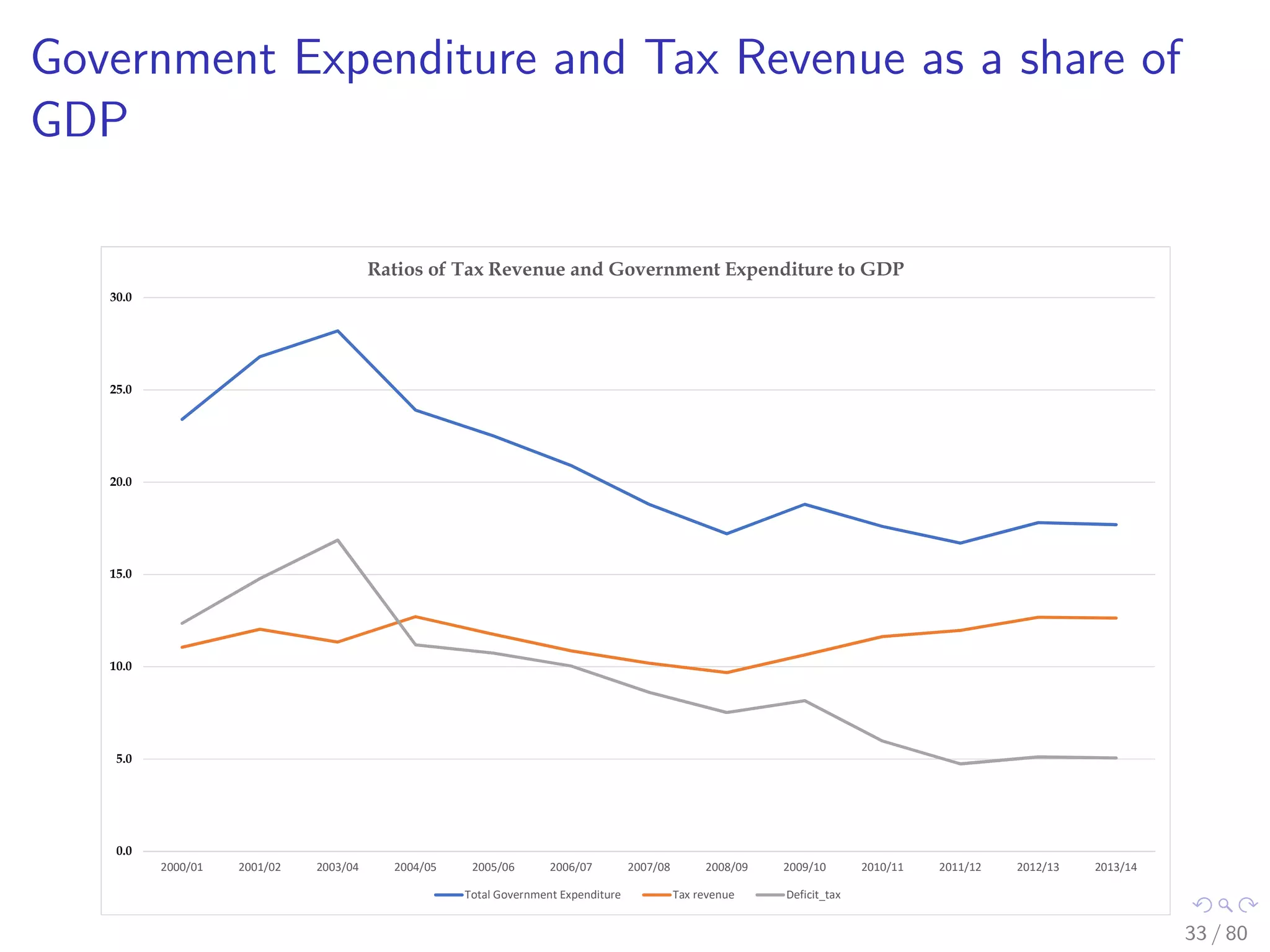

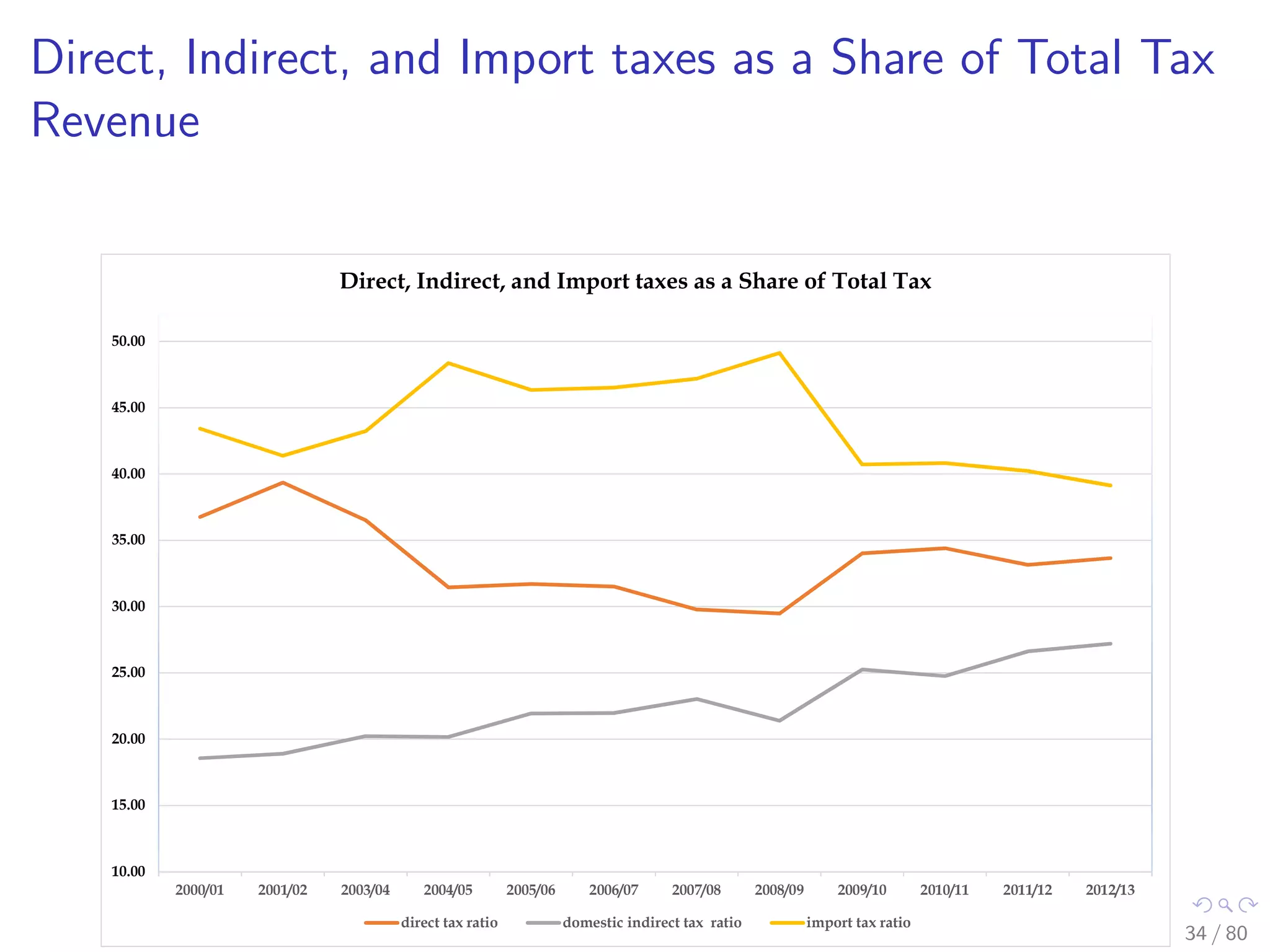

Tax to GDP ratio increases as GDP increases

[ Besley and Persson, 2014].

3 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-3-2048.jpg)

![Motivation

Tax to GDP ratio increases as GDP increases

[ Besley and Persson, 2014].

Why?

4 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-4-2048.jpg)

![Motivation

Tax to GDP ratio increases as GDP increases

[ Besley and Persson, 2014].

Why?

Extensive Margin: Inclusion of previously missing firms in to

the tax system

Less informality because of the need to work with in the

increasingly important formal financial markets

5 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-5-2048.jpg)

![Intensive Margin

Intensive Margin: Higher taxes from firms already in the tax

system (i.e higher tax compliance)

1. partly to do trust and norm [Kleven, 2014]

7 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-7-2048.jpg)

![Intensive Margin

Intensive Margin: Higher taxes from firms already in the tax

system (i.e higher tax compliance)

1. partly to do trust and norm [Kleven, 2014]

2. Partly due to increased institutional capacity to enforce rules

(such as audit)

8 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-8-2048.jpg)

![Intensive Margin

Intensive Margin: Higher taxes from firms already in the tax

system (i.e higher tax compliance)

1. partly to do trust and norm [Kleven, 2014]

2. Partly due to increased institutional capacity to enforce rules

(such as audit)

3. Since audit rates are low, the observed high compliance can

not be explained by higher institutional capacity

9 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-9-2048.jpg)

![Intensive Margin

Intensive Margin: Higher taxes from firms already in the tax

system (i.e higher tax compliance)

1. partly to do trust and norm [Kleven, 2014]

2. Partly due to increased institutional capacity to enforce rules

(such as audit)

3. Since audit rates are low, the observed high compliance can

not be explained by higher institutional capacity

4. Mostly explained by increased availability of third party

information [Kleven, et al., 2011] due to the development of

financial markets enabling tracing transactions more easily and

also withholding by firms.

They find negligible evasion on individual income subjected to

third party informaiton whereas self reported income is

subjected to significant evasion. As most individual income is

subjected to third party information in Denmark, the overall

evasion is negligible. 10 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-10-2048.jpg)

![Motivation, ctd

The difference in the extensive and intensive margin of

taxation between developed and developing countries implies

optimal tax in developing countries is different from developed

ones [Gordon and Li, 2009]

11 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-11-2048.jpg)

![Motivation, ctd

The difference in the extensive and intensive margin of

taxation between developed and developing countries implies

optimal tax in developing countries is different from developed

ones [Gordon and Li, 2009]

Increasing taxation through the extensive margin requires

significance degree of formalization (increased share of firms

in the formal sector) which requires , among other things,

significant development of the financial system.

12 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-12-2048.jpg)

![Motivation: IT and public service

[Lewis-Faupel, et al., 2016]The introduction of e-procurement

improves road quality but not speed of completion (India) and

reduced delays in project completion (Indonesia)

15 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-15-2048.jpg)

![Motivation: IT and public service

[Lewis-Faupel, et al., 2016]The introduction of e-procurement

improves road quality but not speed of completion (India) and

reduced delays in project completion (Indonesia)

[Muralidharan, et al., 2016] find that the introduction of

biometrically authenticated payments infrastructure

(”Smartcards”) in India leads to a faster, more predictable,

and less corrupt NREGS payments process without adversely

affecting program access. It is also cost effective and

beneficiaries overwhelmingly preferred it.

16 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-16-2048.jpg)

![Motivation: Shifting evasion

Another strand of the literature shows that there may be a

limit to how much tax compliance may be achieved through

the introduction of ICT.

Recent literature shows that when third party information is

not complete, shifting of evasion to the area not covered by

third party information (for instance by increasing costs when

third party information is used for verifying sales

[Carrillo, et al. , fortcoming])

18 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-18-2048.jpg)

![Existing study on Ethiopia

[Ali, et al., 2015] investigates whether there is an increase in

VAT declaration due to the introduction of the electonic sales

registration machine

19 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-19-2048.jpg)

![Existing study on Ethiopia

[Ali, et al., 2015] investigates whether there is an increase in

VAT declaration due to the introduction of the electonic sales

registration machine

This paper, however, has several limitations.

20 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-20-2048.jpg)

![Existing study on Ethiopia

[Ali, et al., 2015] investigates whether there is an increase in

VAT declaration due to the introduction of the electonic sales

registration machine

This paper, however, has several limitations.

1. Uses data only on those firms declaring VAT

21 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-21-2048.jpg)

![Existing study on Ethiopia

[Ali, et al., 2015] investigates whether there is an increase in

VAT declaration due to the introduction of the electonic sales

registration machine

This paper, however, has several limitations.

1. Uses data only on those firms declaring VAT

2. Doesn’t ditinguish between gross VAT declaration and net VAT

decalration (firms could increase VAT declaration from sale but

compensate it by increasing VAT they paid for inputs)

22 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-22-2048.jpg)

![Existing study on Ethiopia

[Ali, et al., 2015] investigates whether there is an increase in

VAT declaration due to the introduction of the electonic sales

registration machine

This paper, however, has several limitations.

1. Uses data only on those firms declaring VAT

2. Doesn’t ditinguish between gross VAT declaration and net VAT

decalration (firms could increase VAT declaration from sale but

compensate it by increasing VAT they paid for inputs)

3. Doesn’t investigate the response of firms in terms of

declarations for income tax purposes (i.e., sales, cost, profit)

23 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-23-2048.jpg)

![Empirical Results: Reported Turnover and Costs fixed

effects model

Table: The response of firms to machine Introducton: declaration of

turnover and cost and profit tax (all cohorts)

All firms profit declaring firms

Turnover Cost Turnover Cost profit

post 0.51∗∗∗

0.49∗∗∗

0.40∗∗∗

0.44∗∗∗

0.28∗∗∗

[0.01] [0.01] [0.01] [0.01] [0.01]

time fixed effect Yes Yes Yes Yes Yes

R-squared 0.10 0.11 0.12 0.11 0.06

N 212928 212928 187886 187886 187886

Standard errors in brackets

∗

p < 0.1, ∗∗

p < 0.05, ∗∗∗

p < 0.01

Firm and time fixed effect are included in all regressions

58 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-58-2048.jpg)

![Empirical Results: Reported Turnover and Costs fixed

effects model 2

Table: The response of firms to machine Introducton: declaration of

turnover and cost and profit tax (all cohorts using firms that adopt the

machine by 2016 as controls)

All firms profit declaring firms

Turnover Cost Turnover Cost profit

post 0.46∗∗∗

0.44∗∗∗

0.34∗∗∗

0.37∗∗∗

0.22∗∗∗

[0.01] [0.01] [0.01] [0.01] [0.01]

time fixed effect Yes Yes Yes Yes Yes

R-squared 0.12 0.13 0.15 0.13 0.07

N 168588 168588 146249 146249 146249

Standard errors in brackets

∗

p < 0.1, ∗∗

p < 0.05, ∗∗∗

p < 0.01

Firm and time fixed effect are included in all regressions

This is a result restrcting the sample to firms that have adopted the machine

by 2016.

59 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-59-2048.jpg)

![Empirical Results: Reported Turnover and Costs fixed

effects model 2011 cohort

Table: The response of firms to machine Introducton: declaration of

turnover and cost and profit tax (2011 cohort)

All firms profit declaring firms

Turnover Cost Turnover Cost profit

post 0.28∗∗∗

0.26∗∗∗

0.25∗∗∗

0.28∗∗∗

0.19∗∗∗

[0.03] [0.03] [0.02] [0.02] [0.03]

time fixed effect Yes Yes Yes Yes Yes

R-squared 0.14 0.14 0.18 0.17 0.05

N 47110 47110 30024 30024 30024

Standard errors in brackets

∗

p < 0.1, ∗∗

p < 0.05, ∗∗∗

p < 0.01

Firm and time fixed effect are included in all regressions

This is a result comparing firms that adopt in 2011 with those that adopt in

later years

60 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-60-2048.jpg)

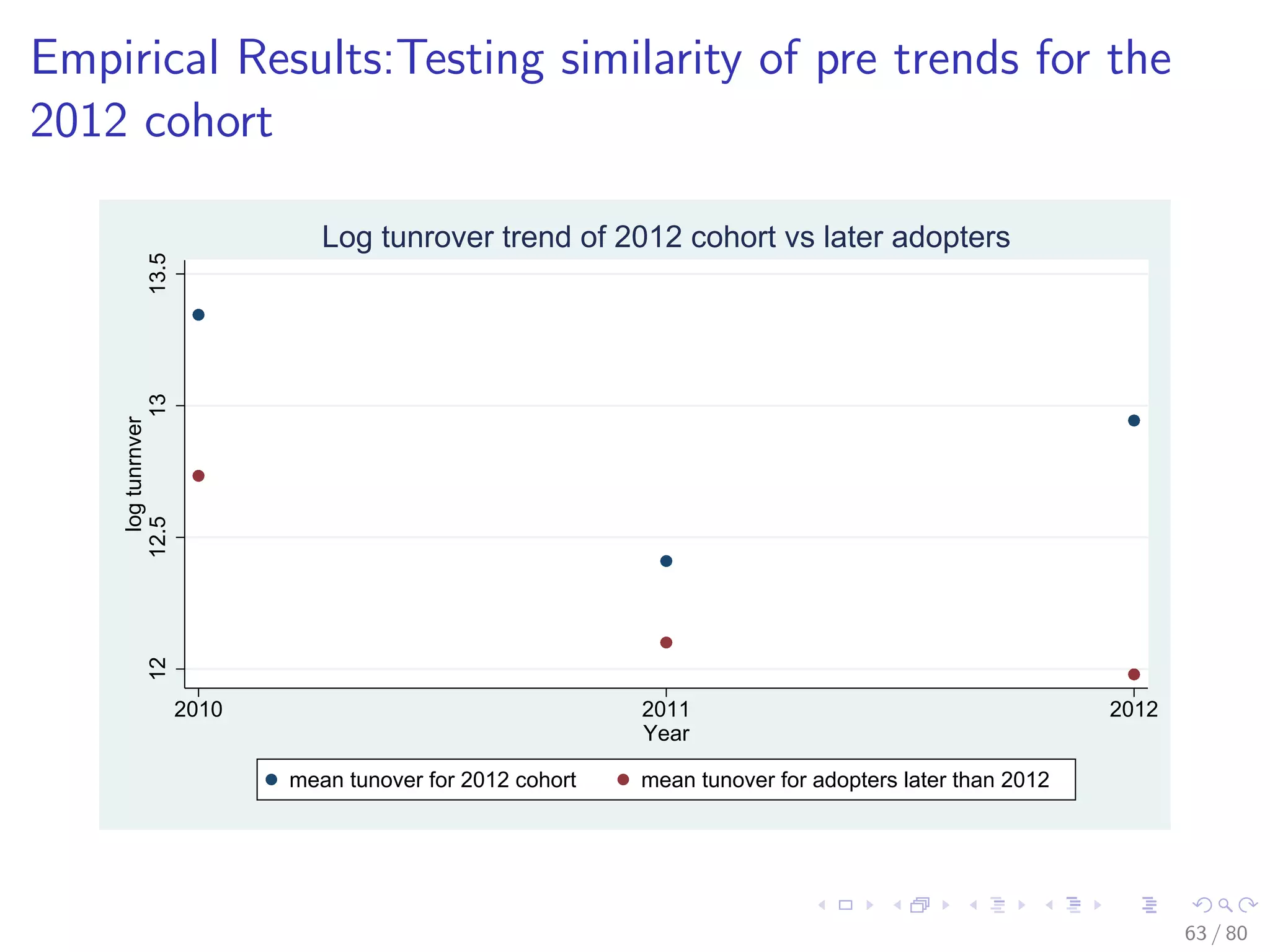

![Empirical Results: Reported Turnover and Costs fixed

effects model 2012 cohort

Table: The response of firms to machine Introducton: declaration of

turnover and cost and profit tax (2012 cohort)

All firms profit declaring firms

Turnover Cost Turnover Cost profit

post 0.64∗∗∗

0.61∗∗∗

0.49∗∗∗

0.53∗∗∗

0.36∗∗∗

[0.02] [0.02] [0.02] [0.02] [0.02]

time fixed effect Yes Yes Yes Yes Yes

R-squared 0.09 0.08 0.07 0.06 0.04

N 59977 59977 53790 53790 53790

Standard errors in brackets

∗

p < 0.1, ∗∗

p < 0.05, ∗∗∗

p < 0.01

Firm and time fixed effect are included in all regressions

This is a result comparing firms that adopt in 2012 with those that adopt in

later years

61 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-61-2048.jpg)

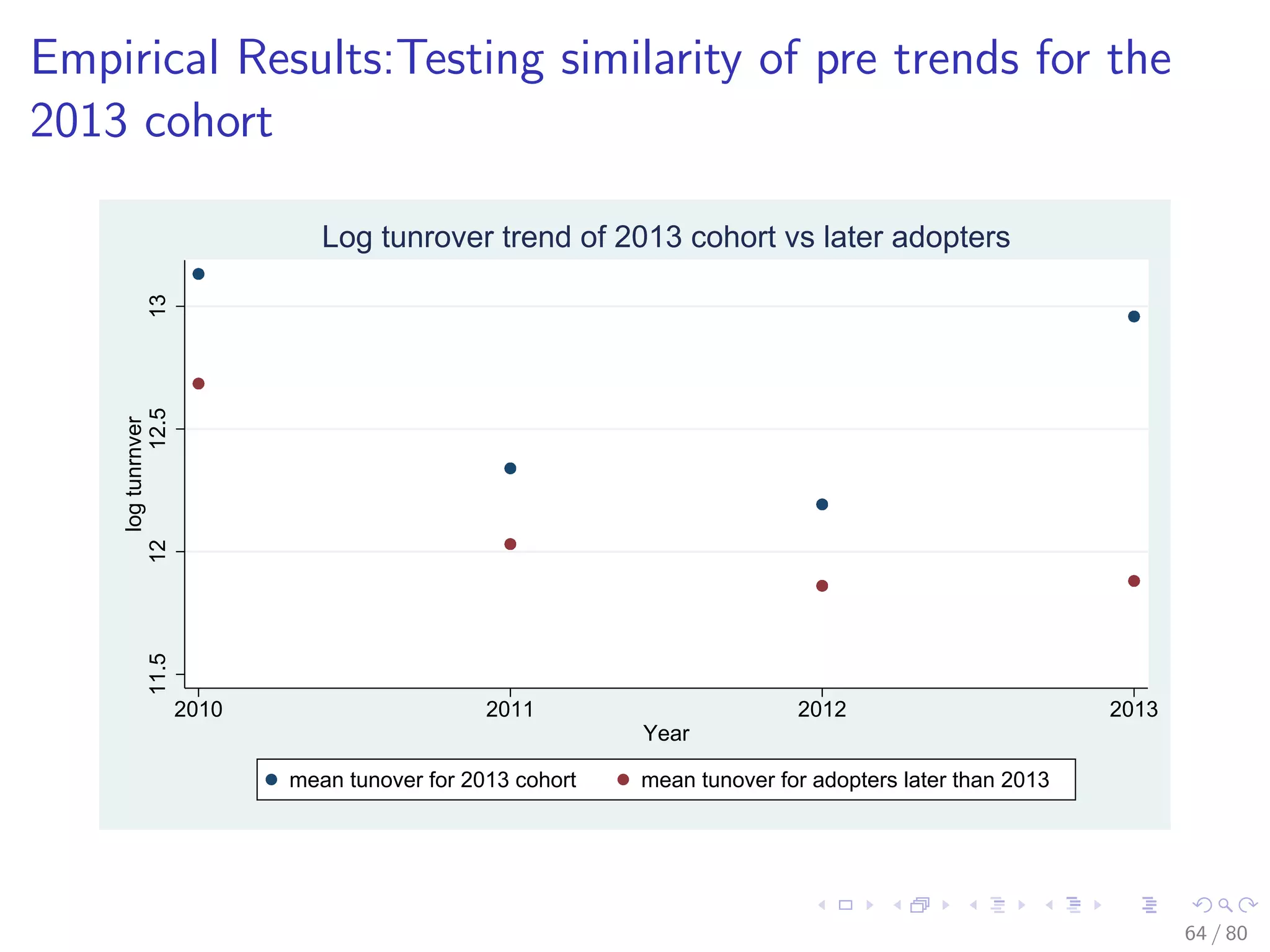

![Empirical Results: Reported Turnover and Costs fixed

effects model 2013 cohort

Table: The response of firms to machine Introducton: declaration of

turnover and cost and profit tax (2013 cohort)

All firms profit declaring firms

Turnover Cost Turnover Cost profit

post 0.56∗∗∗

0.56∗∗∗

0.48∗∗∗

0.54∗∗∗

0.33∗∗∗

[0.02] [0.02] [0.02] [0.02] [0.02]

time fixed effect Yes Yes Yes Yes Yes

R-squared 0.09 0.08 0.08 0.07 0.04

N 74594 74594 67452 67452 67452

Standard errors in brackets

∗

p < 0.1, ∗∗

p < 0.05, ∗∗∗

p < 0.01

Firm and time fixed effect are included in all regressions

This is a result comparing firms that adopt in 2013 with those that adopt in

later years

62 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-62-2048.jpg)

![Experiment Design

3120 firms in Addis Ababa (not in category C) were selected

randomly in 2013/14 [Shimeles, et al., 2017]

1000 control firms.

Two kinds of letters are sent to the firms (one cautioning

about audit and the other encouraging compliance).

The letters were sent in June 2014 just before the tax

declaration time (theerfore after all economic activity is done).

The resulting payments of profit tax for the treated group and

the 1000 control group firms are compared to analyze the

impact of treatment and machine use.

68 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-68-2048.jpg)

![Hypothesis

There is a finding in the literature that if there is already a

paper trail, increased enforcement through issuance of a letter

doesn’t have an effect [Pomeranz, 2015]

If sales registration machine has increased the paper trail and

thereofre compliance, we expect no or smaller effect of the

letter on these firms.

69 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-69-2048.jpg)

![Experiment result: Basic Result

Table: The response of profit tax to treatment

Persuasion 0.31***

[0.108]

Coercion 0.38***

[0.097]

Constant 8.40***

[0.4]

R-squared 0.237

N 2,255

Standard errors in brackets

*** p < 0.01 , ** p < 0.05 , * p< 0.1

70 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-70-2048.jpg)

![Experiment result: Response of machine users to treatment

Table: The Impact of Treatment on Profit Tax: Differences between

machine users and non users

A B C

Treated 0.11 0.20*** 0.04

[0.11] [0.07] [0.08]

Not users of ESRM -1.40*** -0.66***

[0.13] [0.11]

treat non esrm 0.74*** 0.31**

[0.18] [0.14]

Individual -0.58*** -0.53***

[0.09] [0.10]

Top 25 % in turnover 2.93*** 2.89***

[0.08] [0.08]

Constant 8.96*** 8.90*** 9.18***

[0.12] [0.12] [0.13]

R-squared 0.494 0.216 0.506

N 2,112 2,255 2,112

Standard errors in brackets

*** p < 0.01 , ** p < 0.05 , * p< 0.1

72 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-72-2048.jpg)

![Experiment result: Response of machine users to treatment

Table: The Impact of Treatment on Turnover: Differences between

machine users and non users

Turnover (A) Turnover(B)

Treated 0.01 -0.06

[0.10] [0.07]

Not users of ESRM -0.94*** -0.59***

[0.13] [0.09]

treat non esrm 0.37** 0.26**

[0.17] [0.12]

Individual -0.27***

[0.08]

Top 25 % in turnover 3.24***

[0.06]

Constant 12.84*** 12.62***

[0.11] [0.11]

R-squared 0.234 0.645

N 2,102 2,102

Robust standard errors in parentheses

*** p<0.01 , ** p<0.05 , * p<0.1 73 / 80](https://image.slidesharecdn.com/3-171116091339/75/Hide-and-Seek-Taxpayers-responses-to-increased-enforcement-through-ICTs-Evidence-from-Natural-and-Field-Experiments-in-Ethiopia-73-2048.jpg)