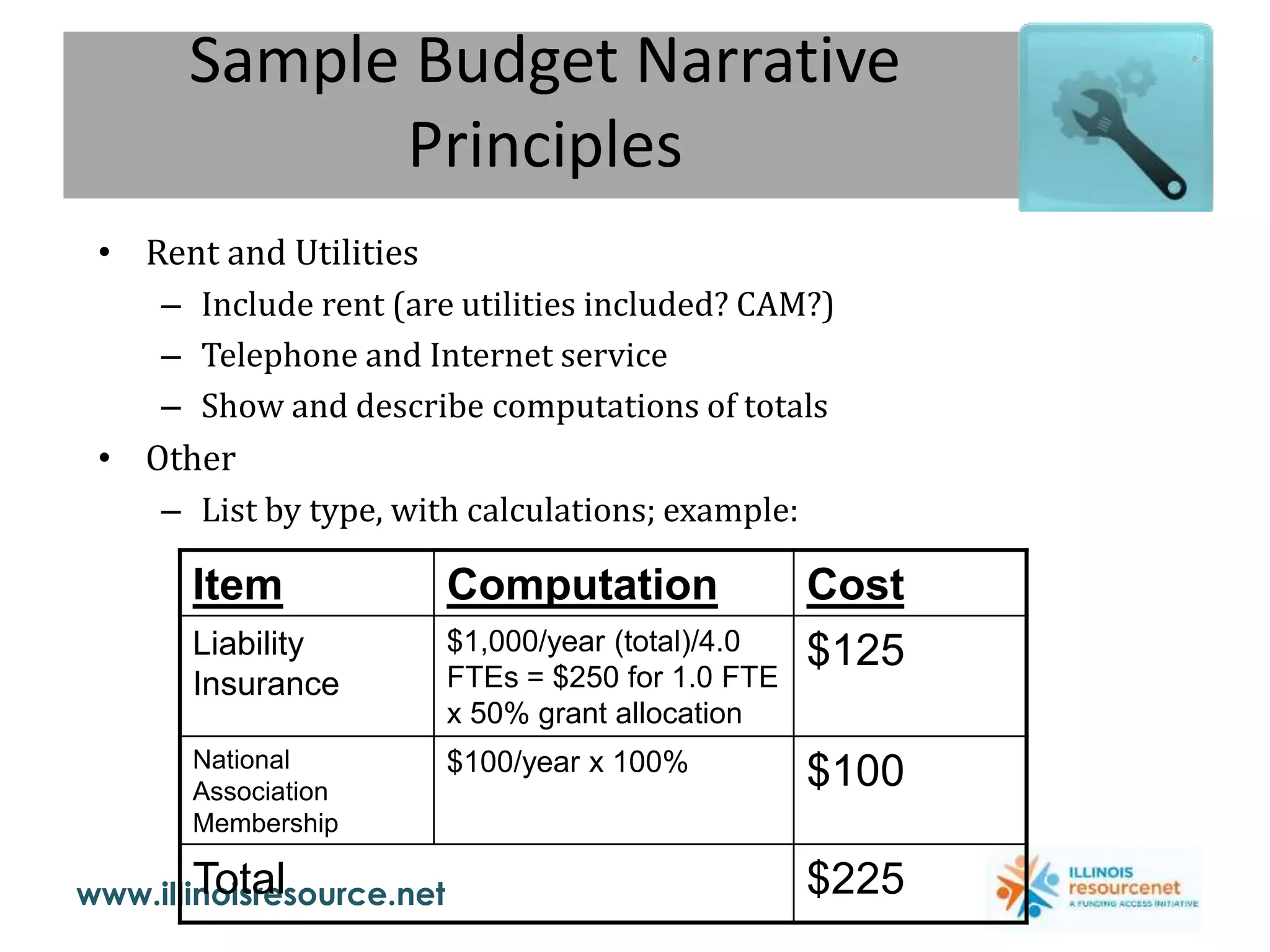

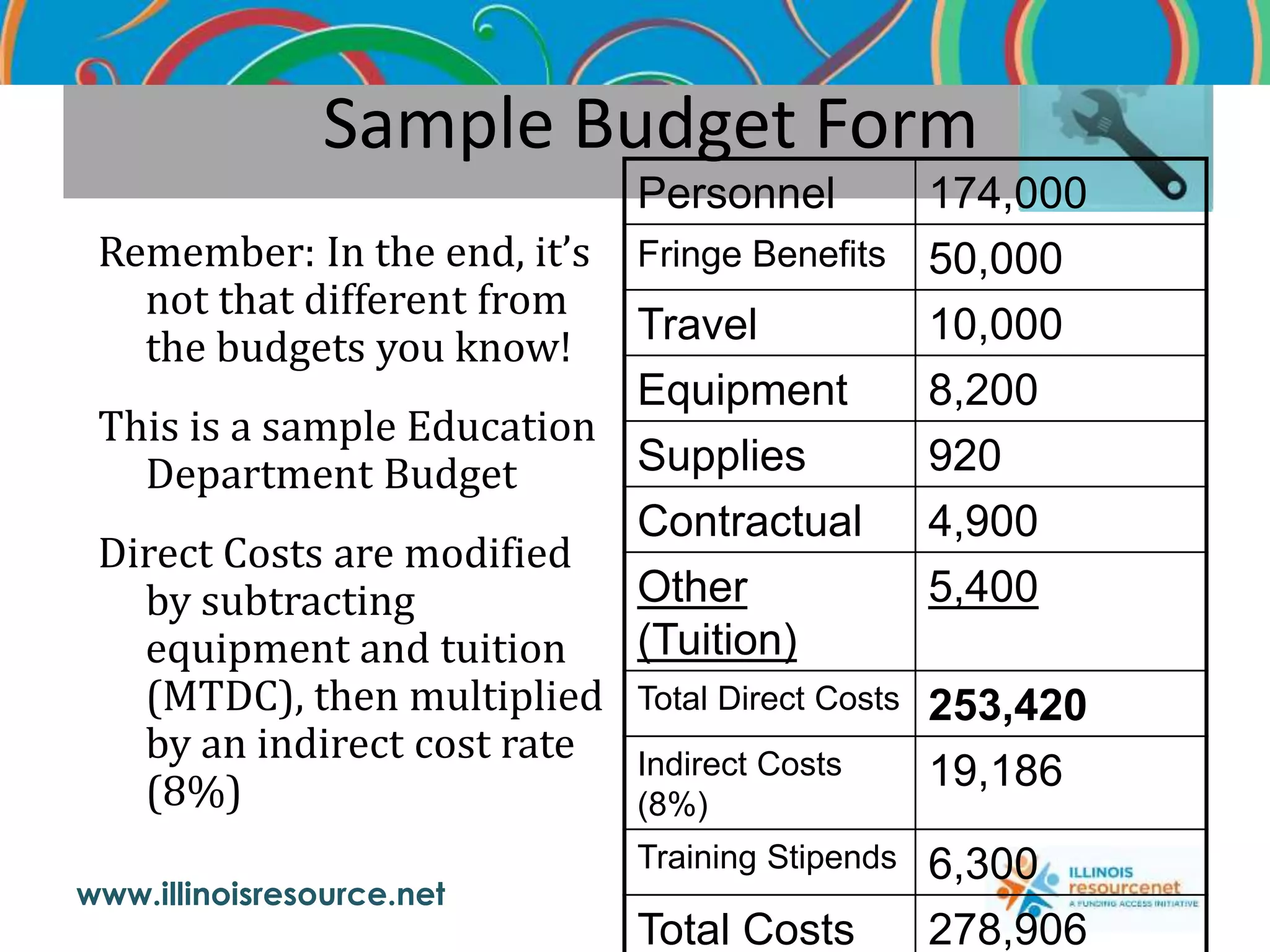

The document outlines the key principles and requirements for preparing federal grant budgets, including financial management thresholds, allowable costs, and budgeting narratives. It emphasizes the importance of systematic financial recordkeeping, monitoring, and compliance with federal regulations. Additionally, it discusses direct and indirect costs, matching and cost-sharing requirements, and the creation of a detailed budget narrative for grant proposals.