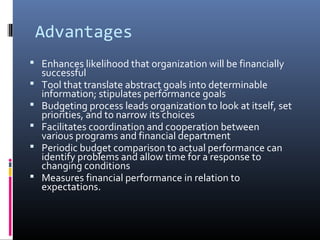

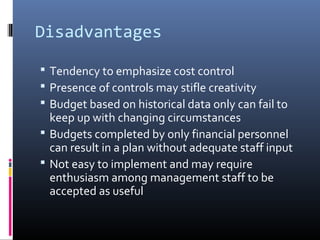

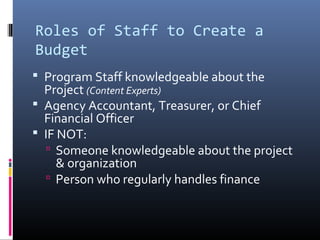

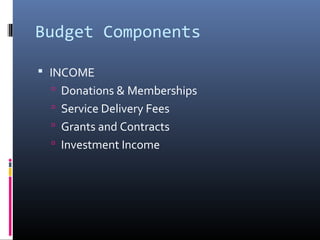

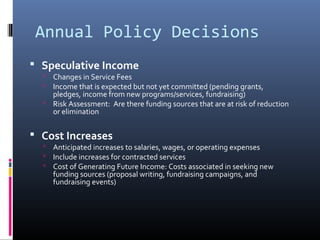

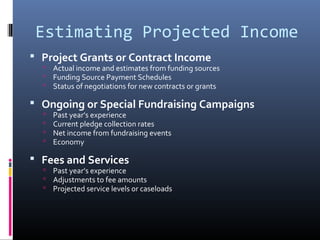

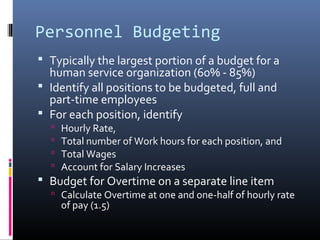

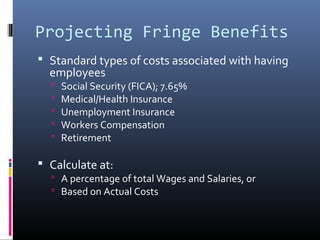

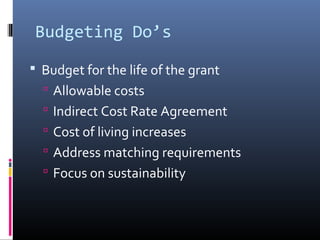

This document provides guidance on developing an organizational budget. It defines a budget as a numerical expression of goals that measures financial performance. Benefits include establishing goals, identifying work, projecting resources, and controlling spending. Budgets can track income/expenses, plan capital additions, monitor cash flow, and provide personnel projections. Developing a budget requires input from content experts, accountants, and those who handle finances. Key components include income from various sources and expenses like personnel, benefits, supplies, and indirect charges. The document outlines steps for estimating income and expenses to create a comprehensive budget.