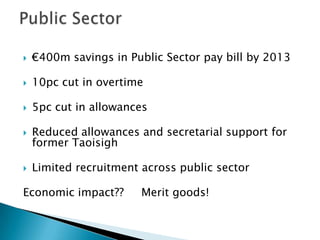

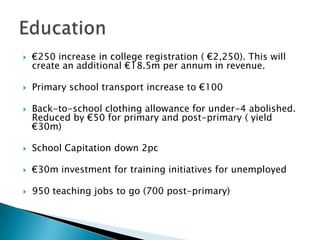

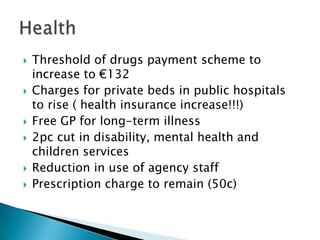

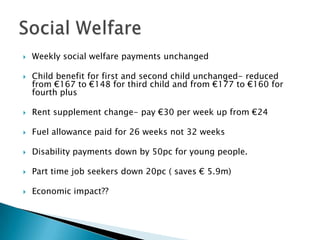

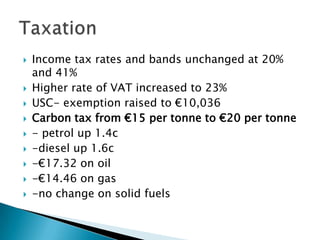

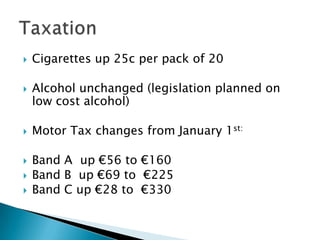

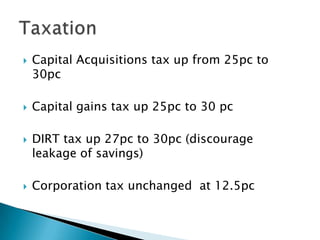

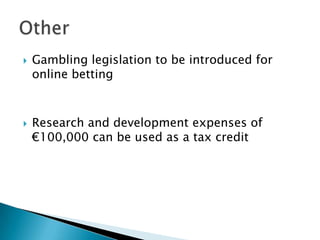

This document outlines the Irish budget for 2012 announced by Minister for Finance Michael Noonan and Minister for Public Spending & Reform Brendan Howlin. It includes cuts to public sector pay and allowances, increases in tuition fees and reductions in education and social welfare spending. It also increases taxes such as VAT, carbon tax, cigarette and alcohol taxes, and capital gains tax to reduce the deficit. The goal is to cut €3.5 billion in spending while stimulating growth to reduce unemployment which is currently over 14%.