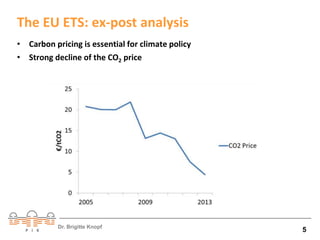

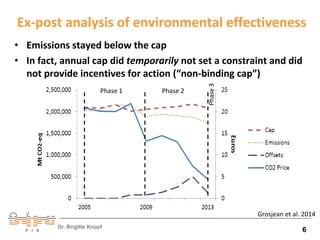

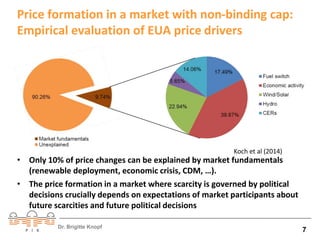

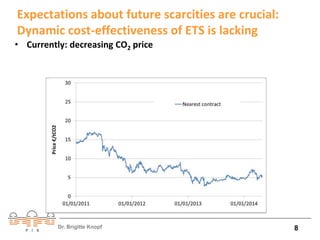

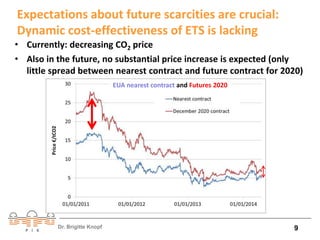

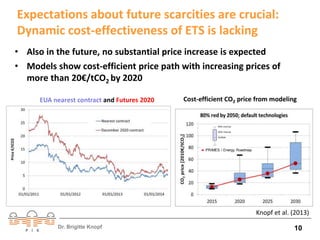

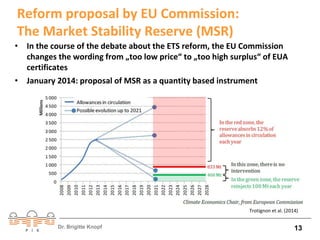

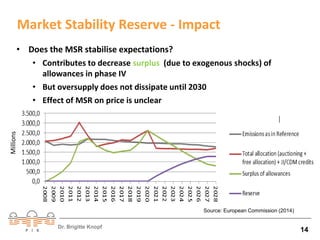

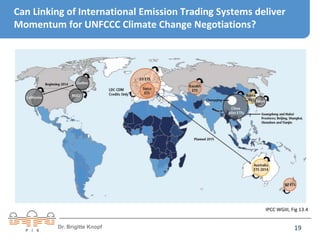

The document discusses reform options for the EU Emissions Trading System (EU ETS). It summarizes that while the EU ETS has kept emissions below caps, it lacks dynamic efficiency to ensure long-term cost-effectiveness due to low and decreasing carbon prices. The proposed Market Stability Reserve is seen as insufficient and uncertain in its impact. Alternatively, Euro-CASE proposes a comprehensive reform package including setting a price collar to stabilize expectations, expanding the ETS to more sectors, additional policy tools to spur innovation, and addressing carbon leakage through international linking of carbon markets. Without reform, fragmented climate policies risk higher costs.

![Scientific Background: New IPCC Report 2014

• There are multiple mitigation pathways

that are likely to limit warming to below

2°C relative to pre-industrial levels.

• These scenarios […] are characterized by

40% to 70% global anthropogenic GHG

emissions reductions by 2050 compared

to 2010, and emissions levels near zero or

below in 2100.

• In the majority of low‐concentration

stabilization scenarios […] fossil fuel

power generation without CCS is phased

out almost entirely by 2100.

www.mitigation2014.org

IPCC Synthesis Report (2014)

Dr. Brigitte Knopf 2](https://image.slidesharecdn.com/brigitteknopf2014-11-13helsinkiets-141120014400-conversion-gate01/85/Brigitte-knopf-2014-11-13-helsinki-ets-2-320.jpg)