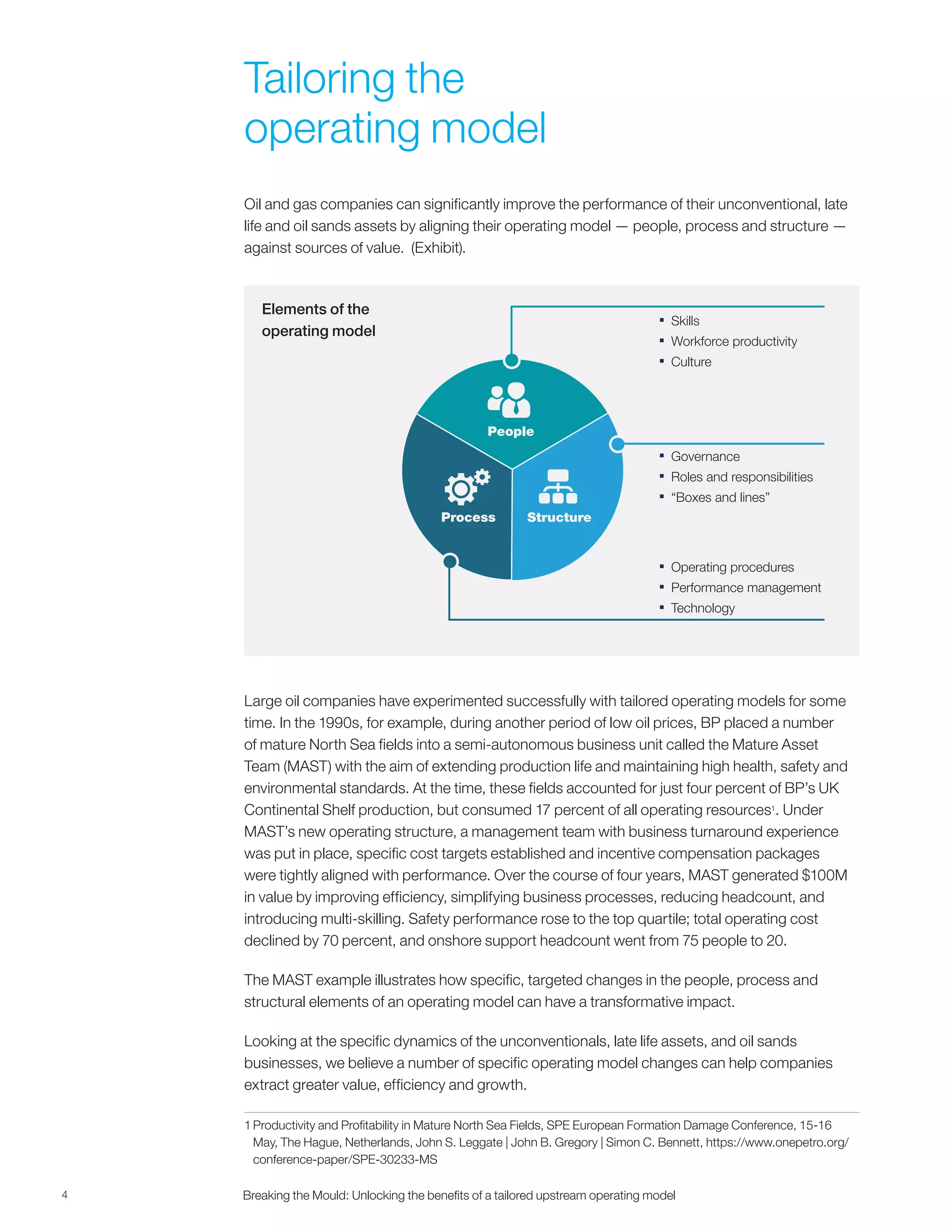

This document discusses how large oil companies can improve performance in unconventional assets, late life assets, and oil sands by tailoring their operating models. It provides examples of how operating models have been successfully tailored in the past for mature North Sea fields. For unconventionals, the document recommends moving to an asset-centric structure with local decision making, simplifying processes, and adopting a performance culture that encourages continuous improvement. Process changes include using more industry standards and empowering local asset managers. The goal is to allow for rapid decisions close to operations and factory-style drilling approaches to reduce costs.