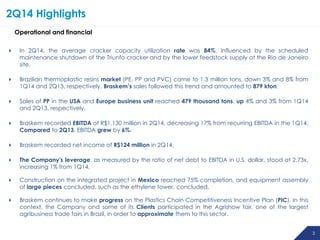

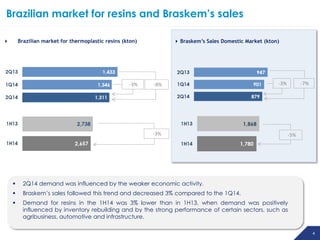

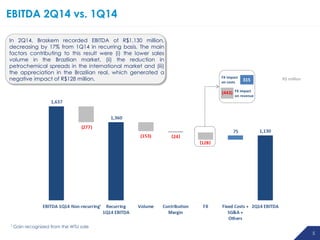

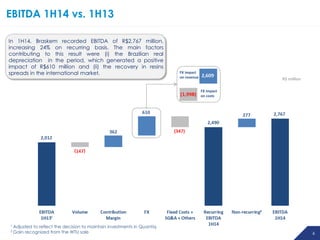

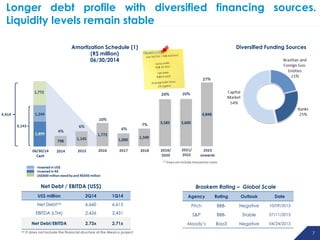

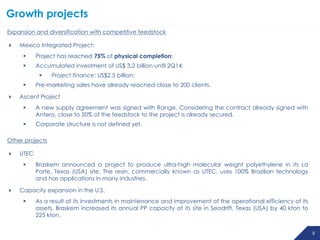

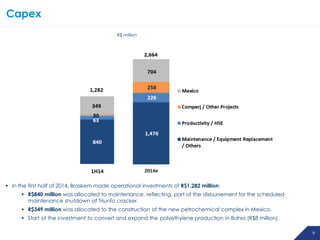

Braskem held its 2Q14 earnings conference call on August 08, 2014 in São Paulo. The presentation included forward-looking statements and disclaimers. In 2Q14, Braskem's average cracker capacity utilization was 84% and EBITDA was R$1,130 million, down 17% from 1Q14 due to lower sales volumes, reduced petrochemical spreads, and currency appreciation. Construction of Braskem's integrated Mexico project was 75% complete. Braskem continues to focus on its growth projects and priorities including the Mexico project, Ascent project, renewing its naphtha supply contract, and maintaining financial health.