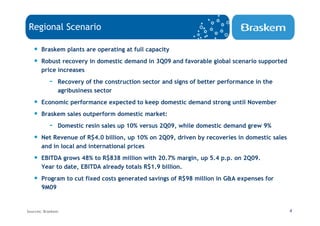

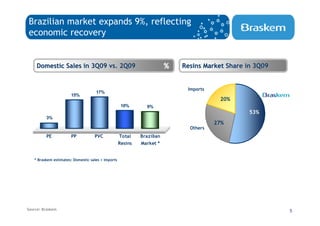

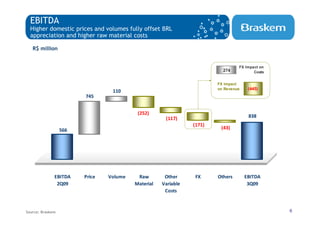

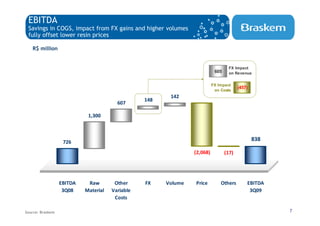

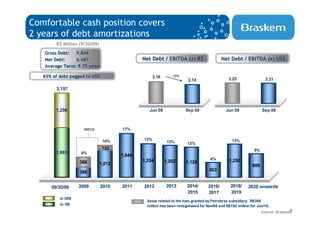

This document summarizes Braskem's 3Q09 earnings conference call. It discusses Braskem's financial performance in 3Q09, including higher revenues and EBITDA driven by recovery in domestic sales and prices. However, resin spreads declined in September due to lower raw material prices, new capacity, and weaker Chinese demand. Braskem has a comfortable cash position and is prioritizing financial health, productivity improvements, and selective growth opportunities through the economic downturn.