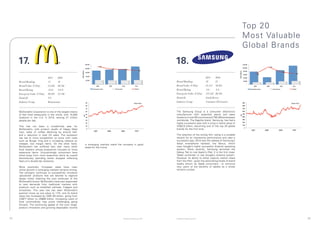

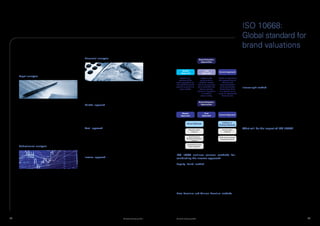

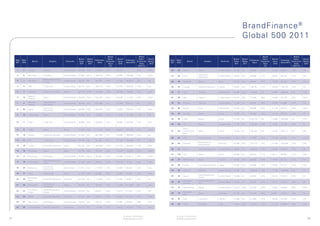

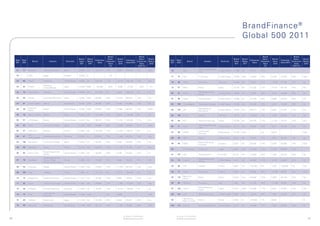

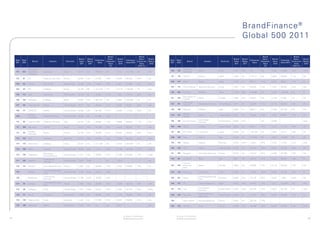

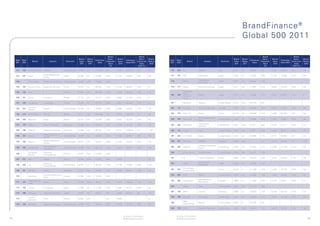

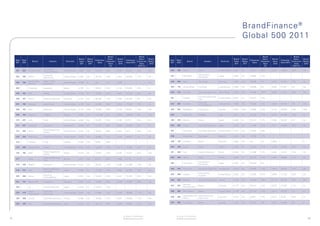

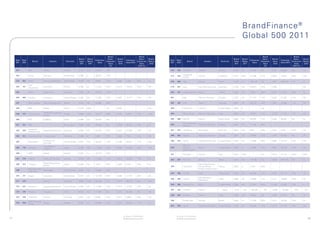

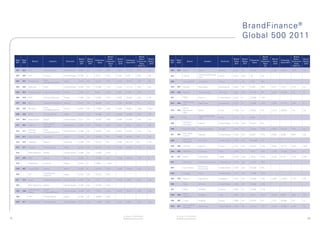

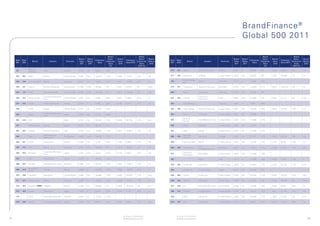

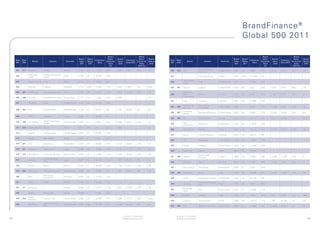

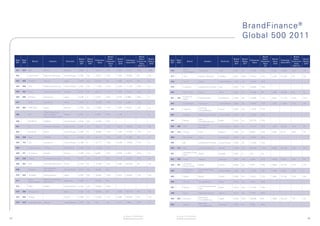

The document provides an overview of the annual BrandFinance® Global 500 report, which ranks the world's most valuable brands. Some key findings from the 2011 report include:

- The total brand value of the top 500 brands grew 14% to US$3,306 billion.

- Google overtook Walmart as the most valuable brand in the world, with a brand value of US$44.3 billion, up 22%.

- Technology brands like Microsoft, Apple and Samsung saw significant brand value increases, while retail and consumer goods brands declined.

- The banking sector recovered the most, with a total brand value increase of US$90 billion.

- Emerging markets like South America performed strongly, while growth