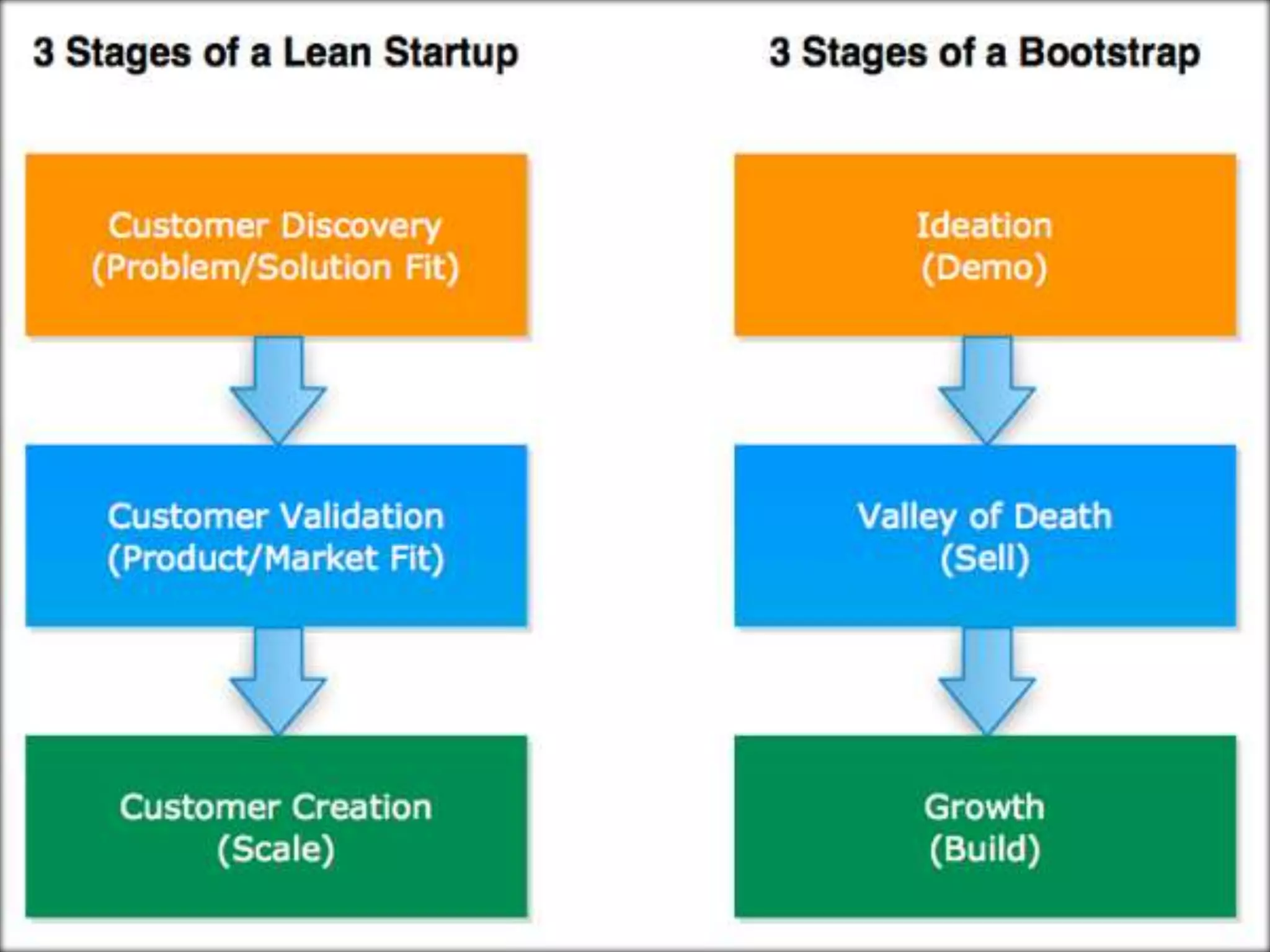

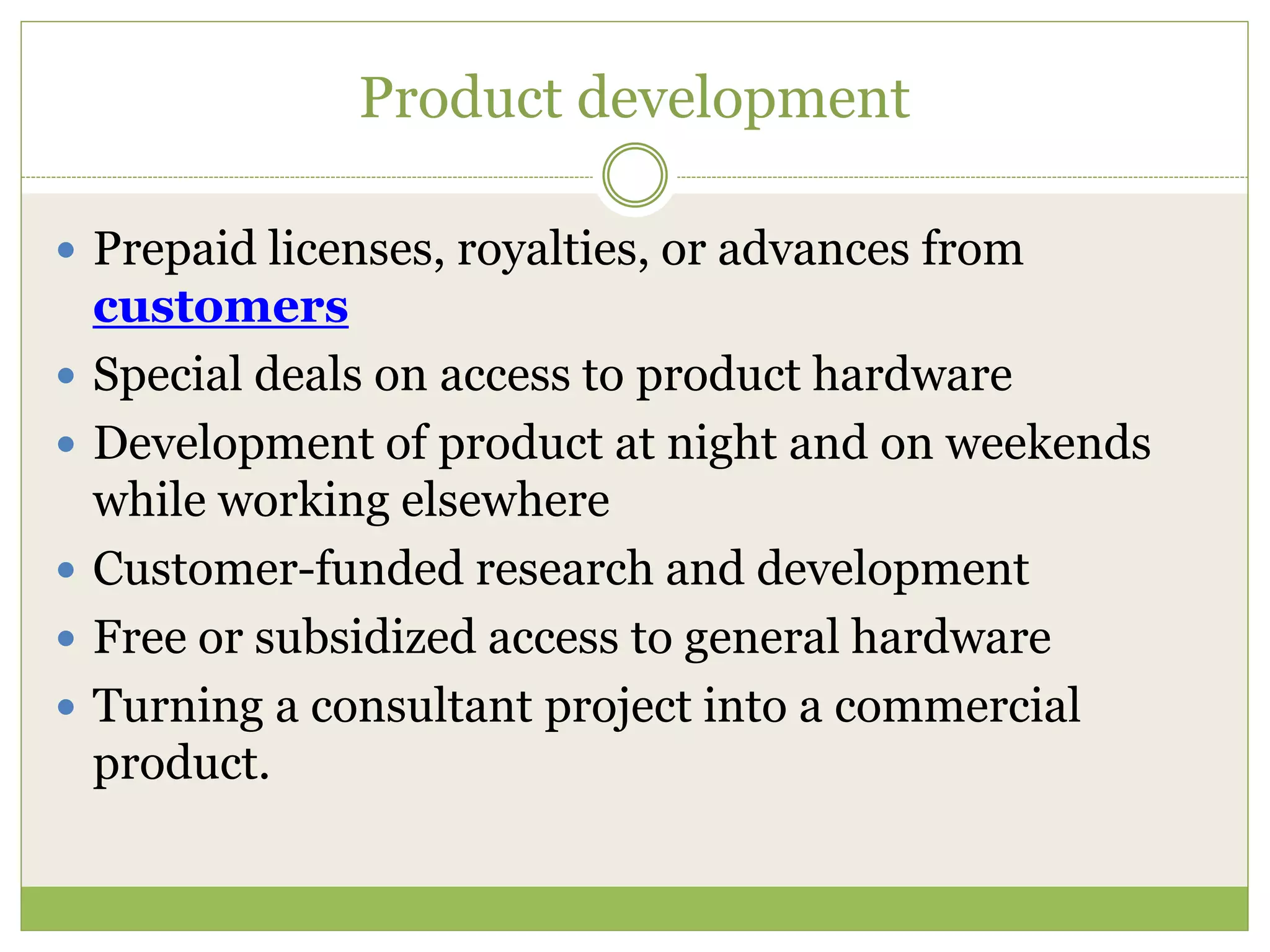

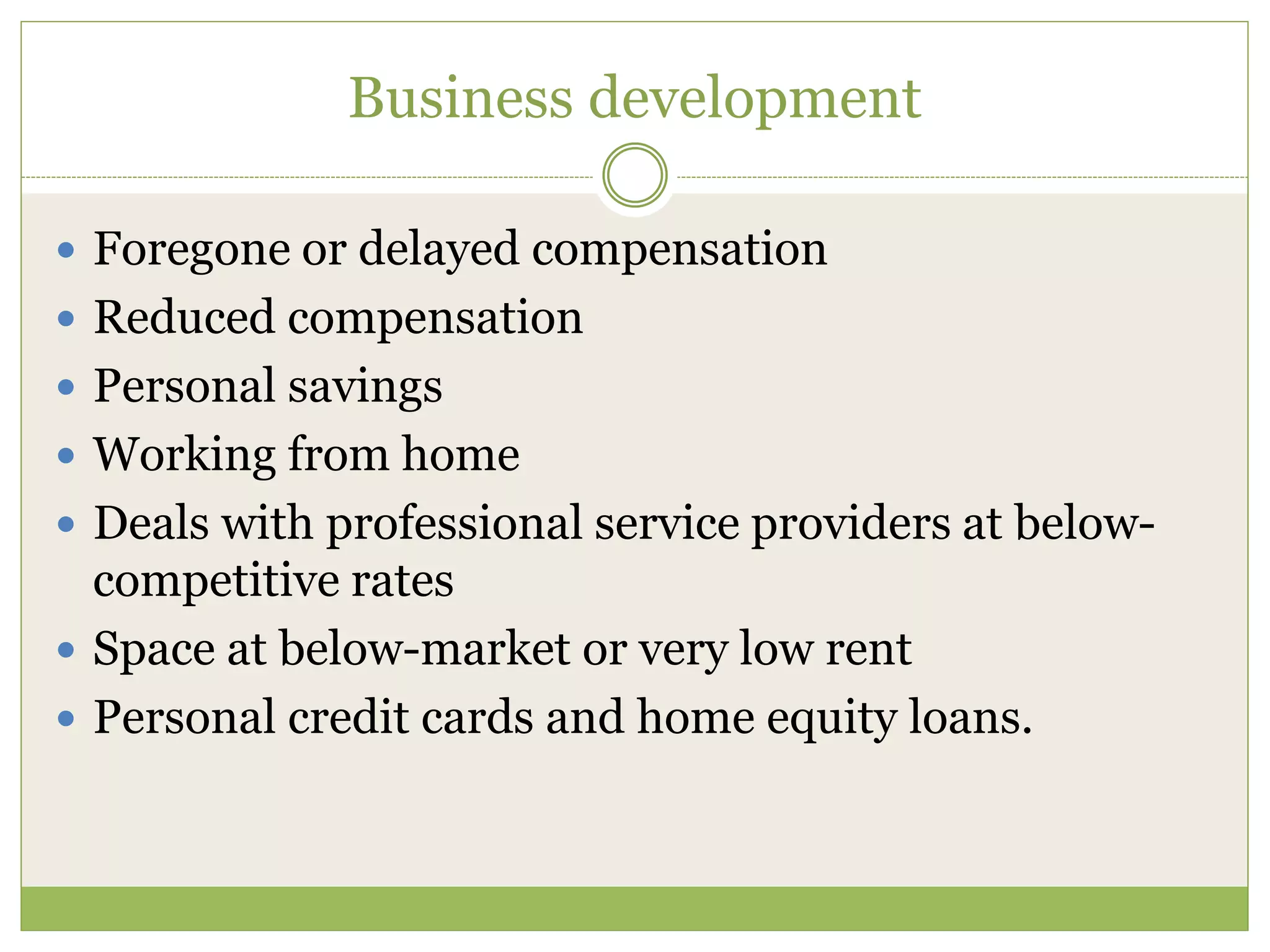

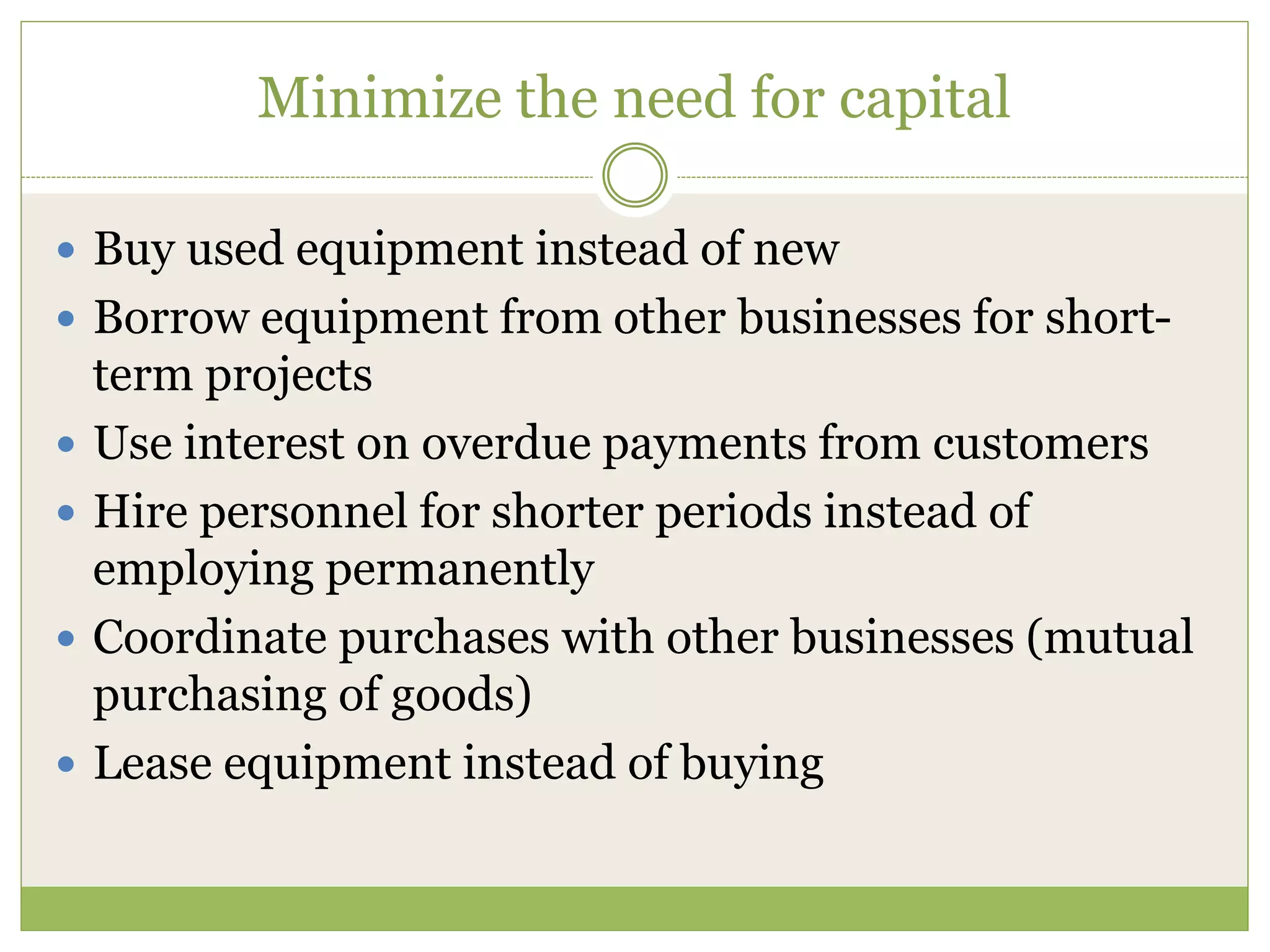

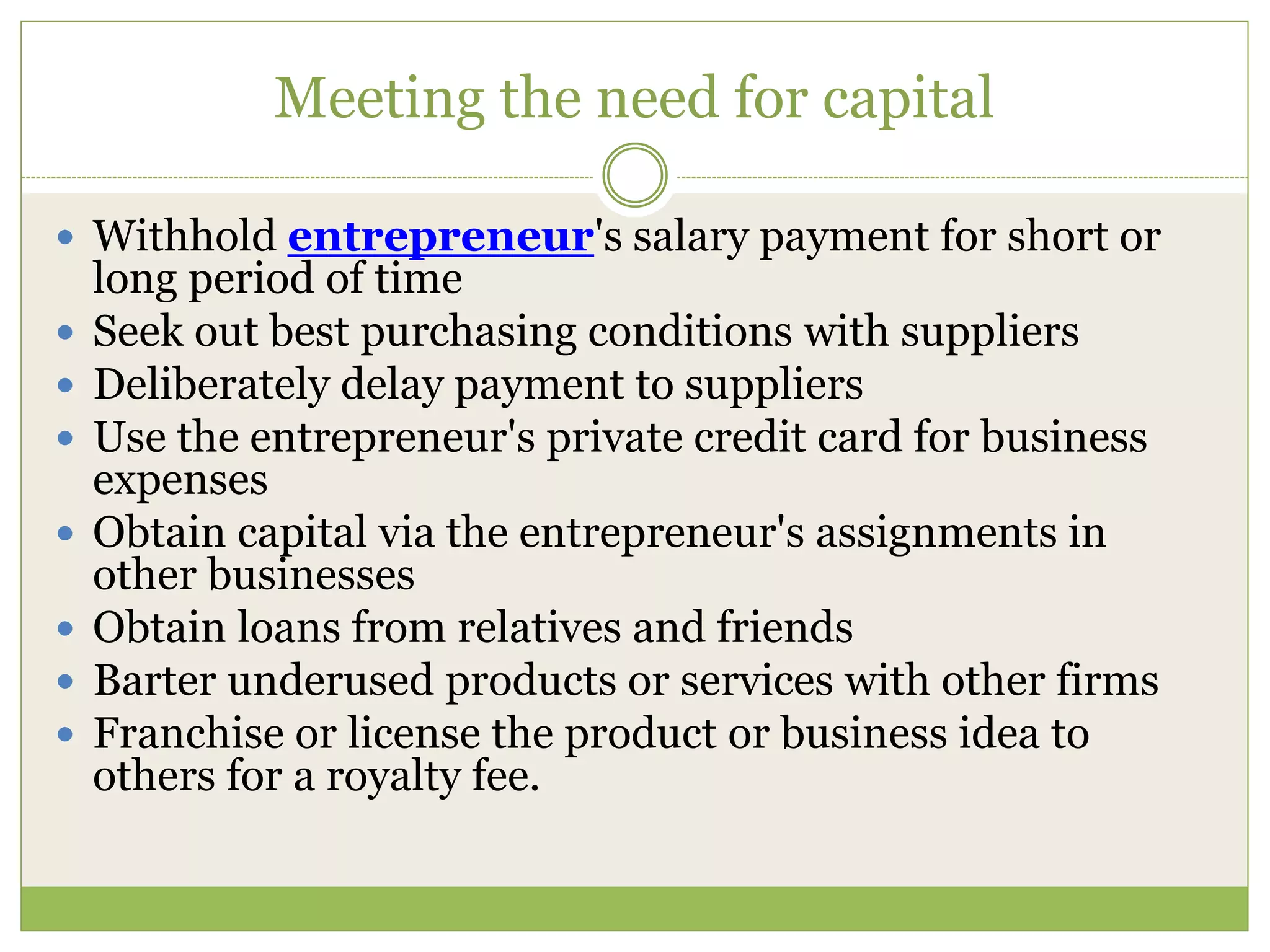

The document discusses bootstrapping in entrepreneurship, emphasizing that it involves starting a business with minimal capital, often through personal finances or revenue generated from the business itself. It outlines strategies for bootstrapping, such as testing the market, maintaining a small team, and utilizing various financing methods like trade credit and factoring. Additionally, it highlights the benefits and disadvantages of bootstrapping, along with a SWOT analysis evaluating strengths, weaknesses, opportunities, and threats in business development.