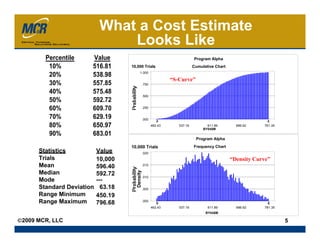

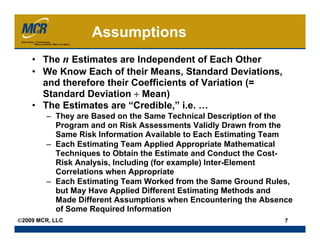

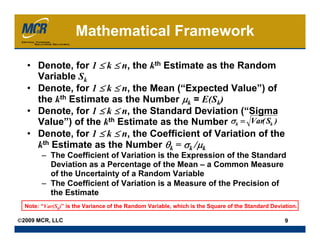

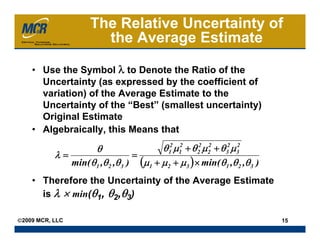

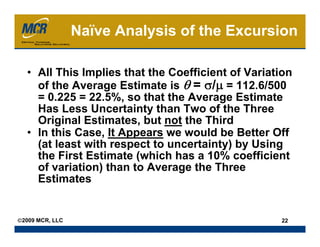

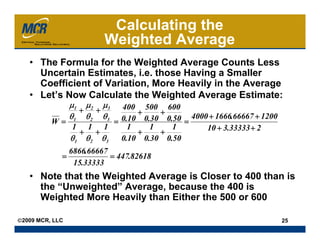

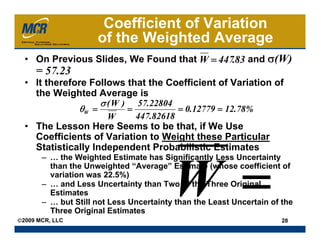

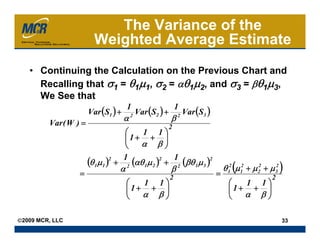

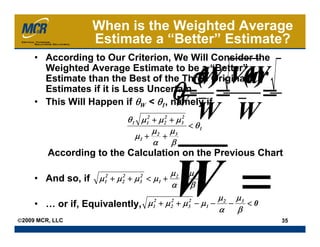

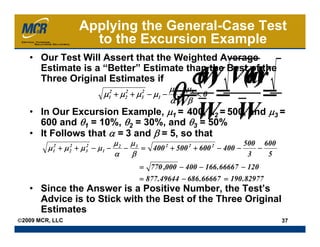

Combining multiple independent probabilistic estimates of a project or system can reduce overall uncertainty compared to using the individual estimates alone. The paper presents a mathematical framework for combining estimates based on their means and standard deviations. It shows that the combined estimate will have lower variance than any individual estimate. A numerical example is provided to illustrate combining three independent estimates.