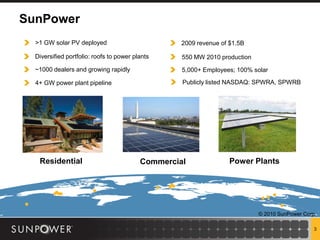

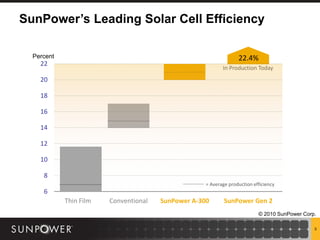

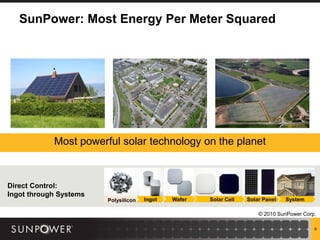

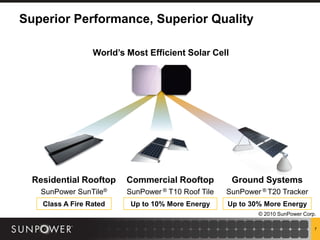

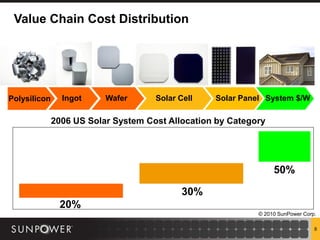

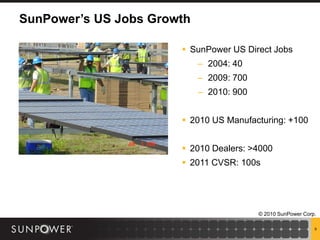

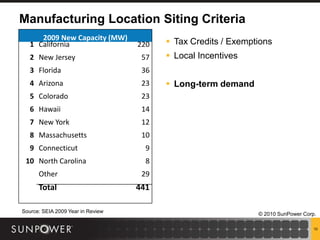

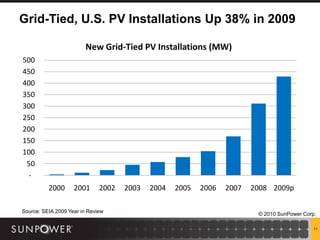

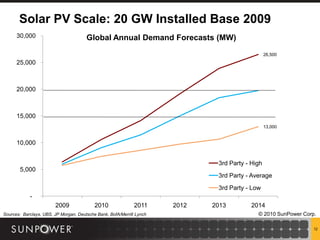

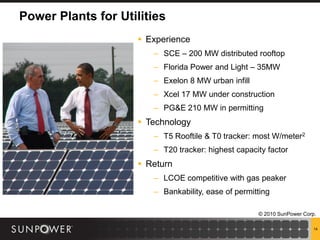

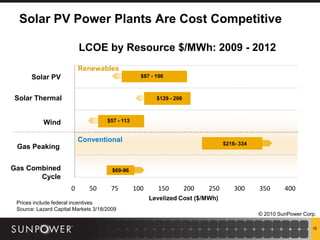

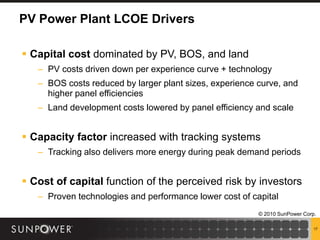

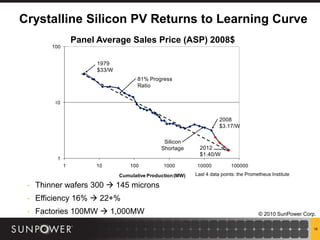

The document presents an overview of SunPower's operations and future expectations as of April 2010, including financial forecasts, manufacturing plans, and industry challenges. It highlights the company's focus on high-efficiency solar cells, its growth in U.S. jobs and manufacturing, and its competitive positioning in the solar power market. The document emphasizes potential risks and uncertainties affecting the implementation of SunPower's cost reduction roadmap and production ramp plans.