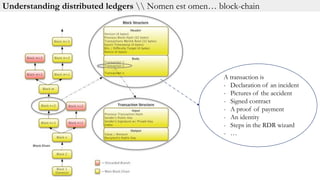

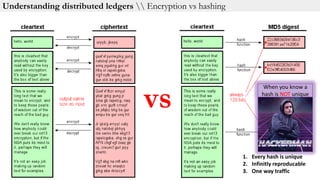

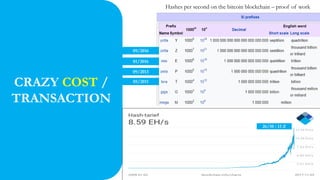

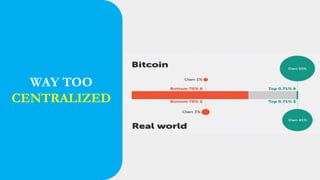

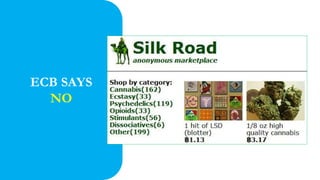

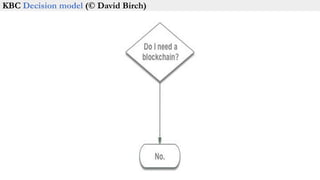

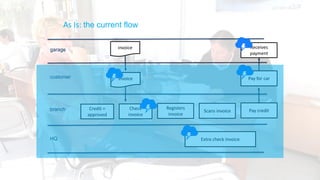

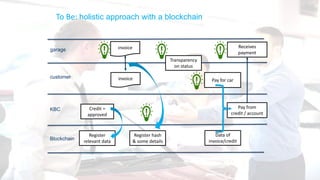

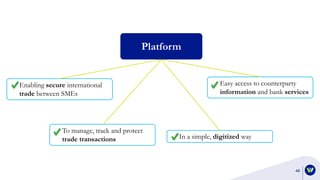

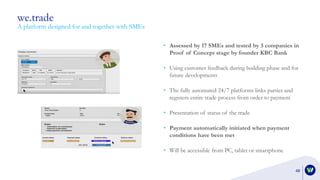

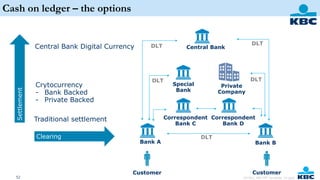

Koen Vingerhoets discusses the evolution and benefits of blockchain technology compared to Bitcoin, highlighting the significance of use cases in various sectors such as finance and trade. He emphasizes the importance of collaboration, regulatory considerations, and the shift from traditional methods to blockchain solutions for improved efficiency and transparency. Additionally, he introduces KBC's blockchain initiatives including we.trade, a platform to facilitate secure international trade for SMEs.