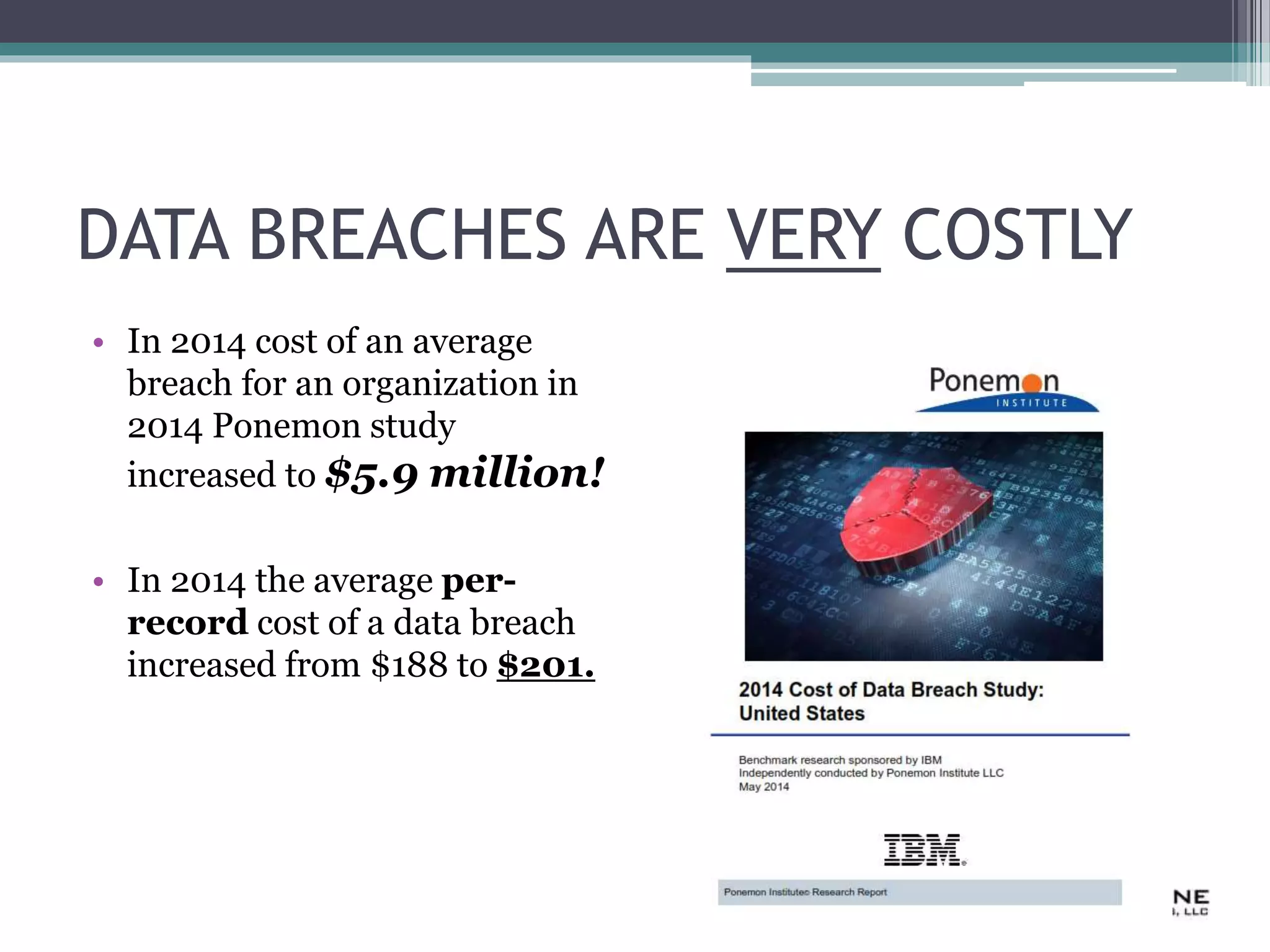

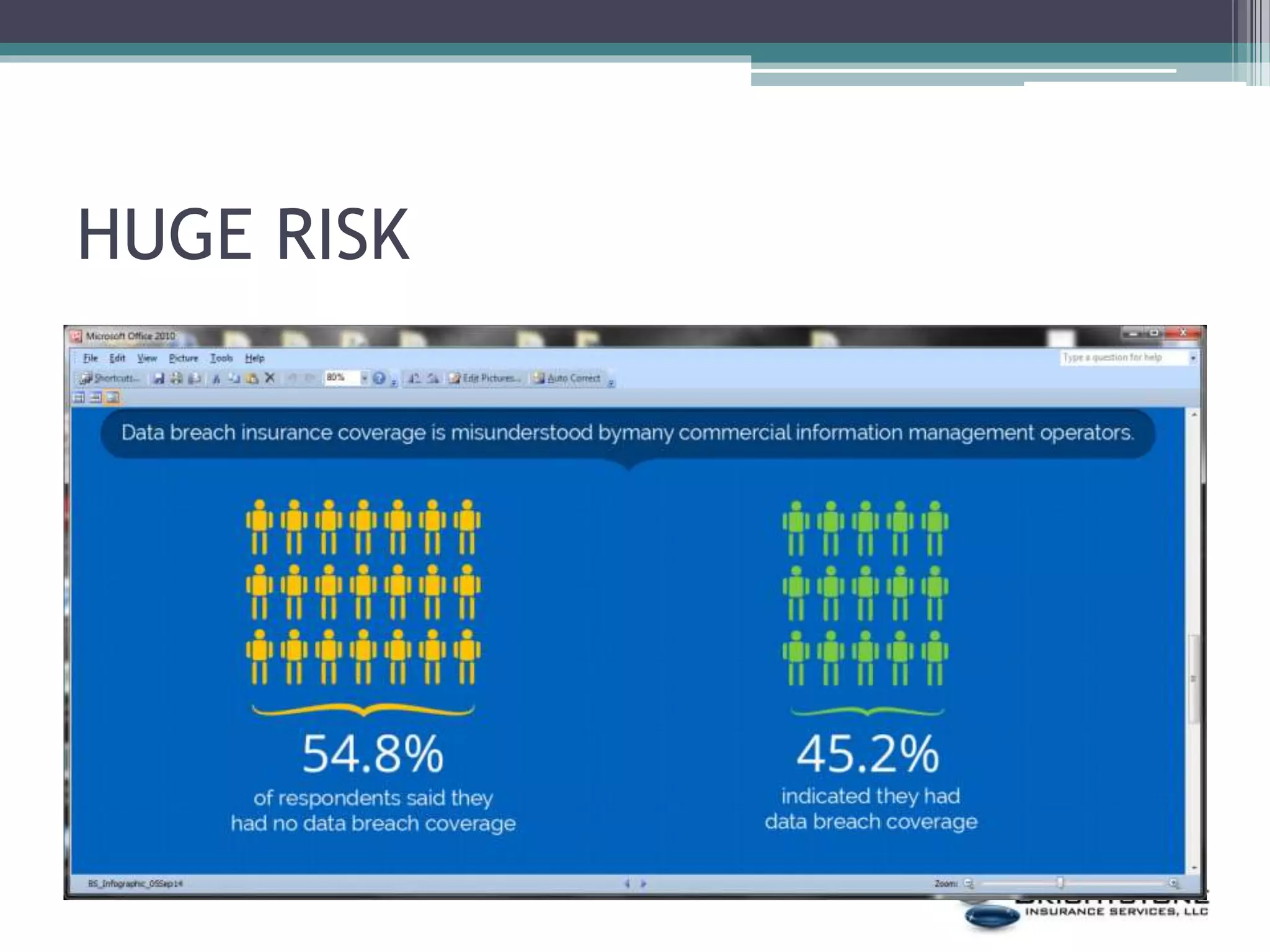

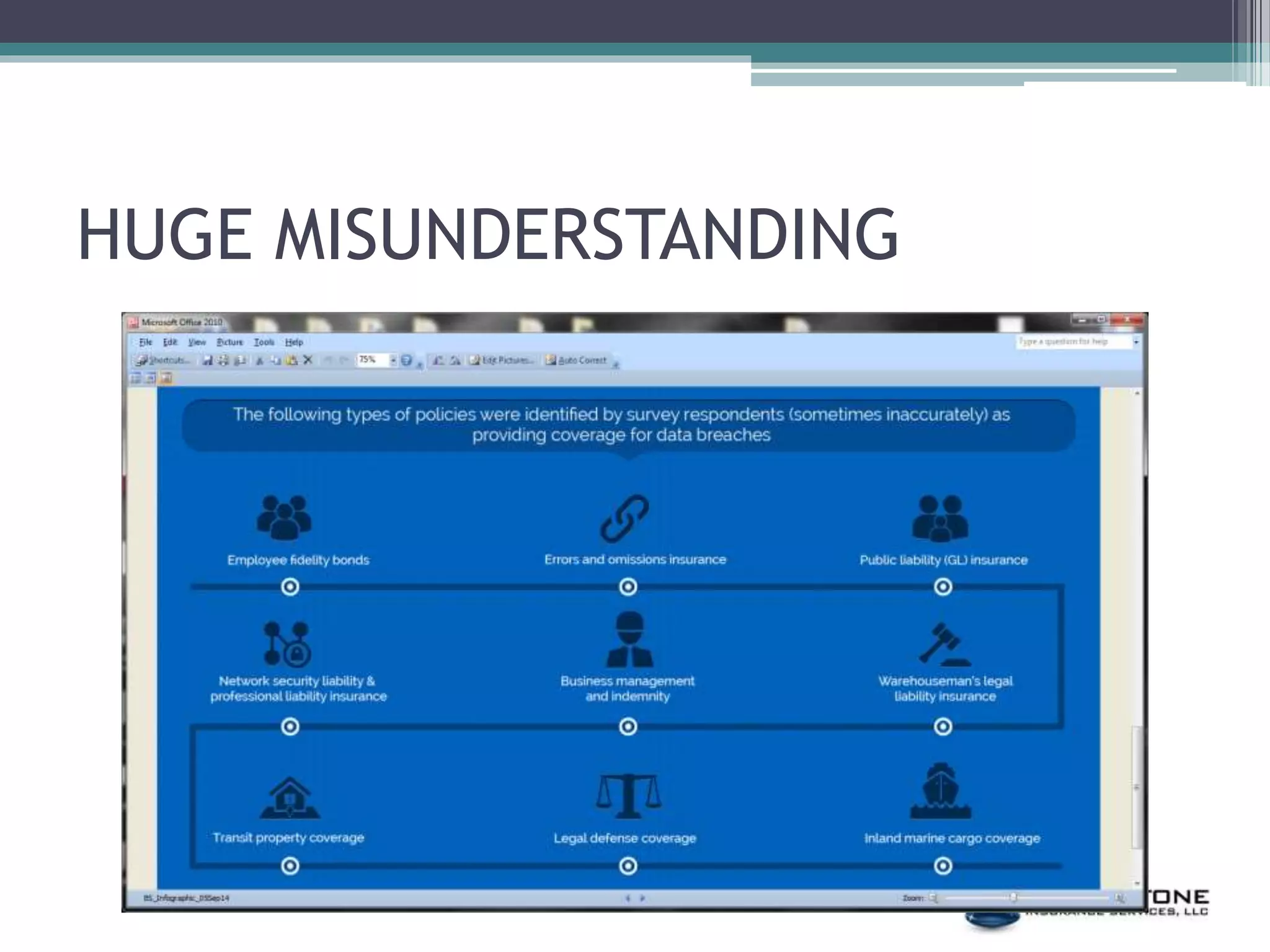

The document discusses the increasing costs of data breaches, highlighting that the average breach cost was $5.9 million in 2014 and outlining the need for Errors and Omissions (E&O) insurance as general liability policies typically exclude coverage for data breaches. It emphasizes the critical coverage elements such as notification expenses, rogue employee protection, and fines, along with strategies for mitigating risks, including training and encryption. Furthermore, it provides guidance on handling breaches under a cyber policy and recommends consulting with experts for insurance assessment and compliance preparation.