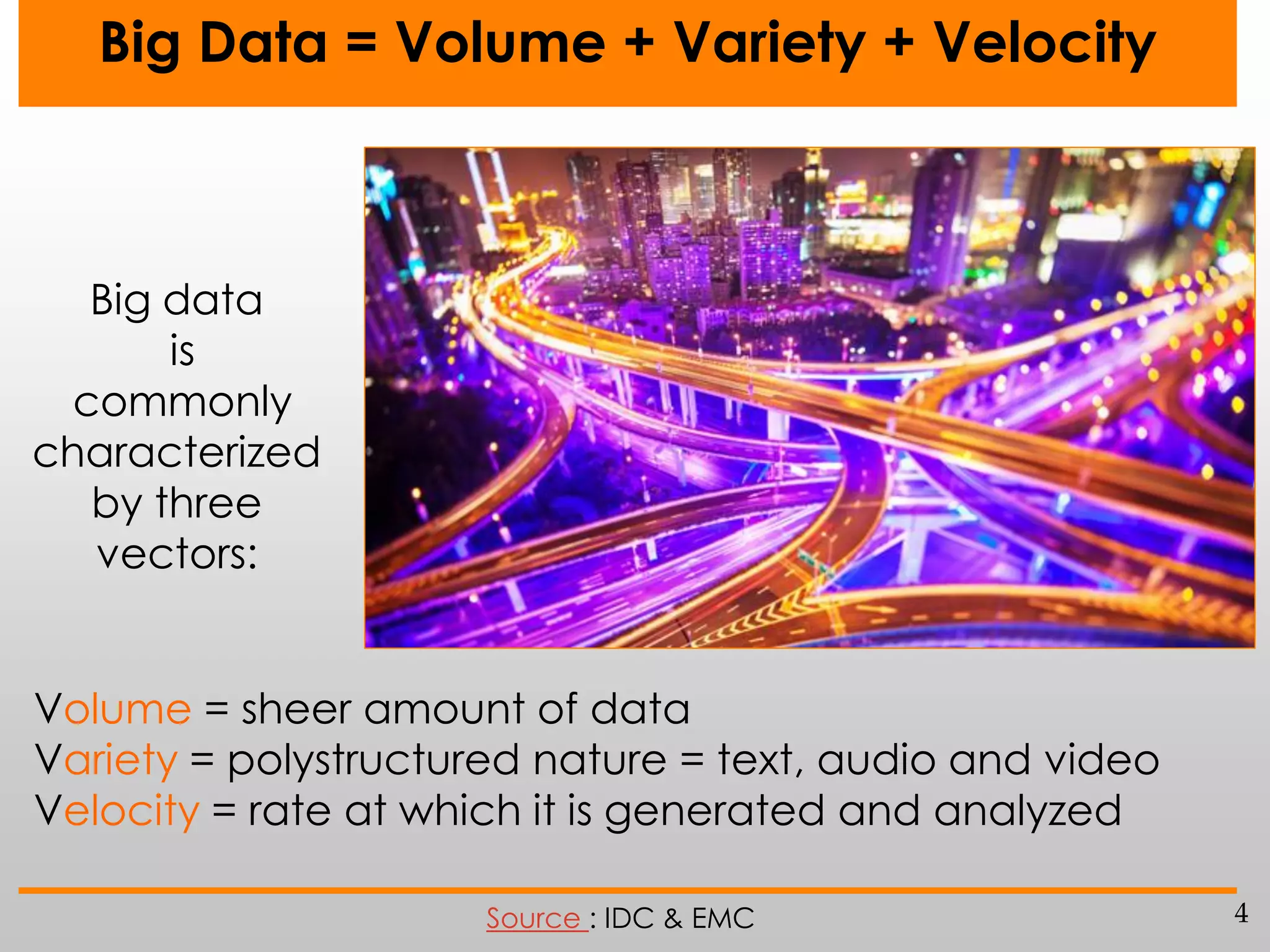

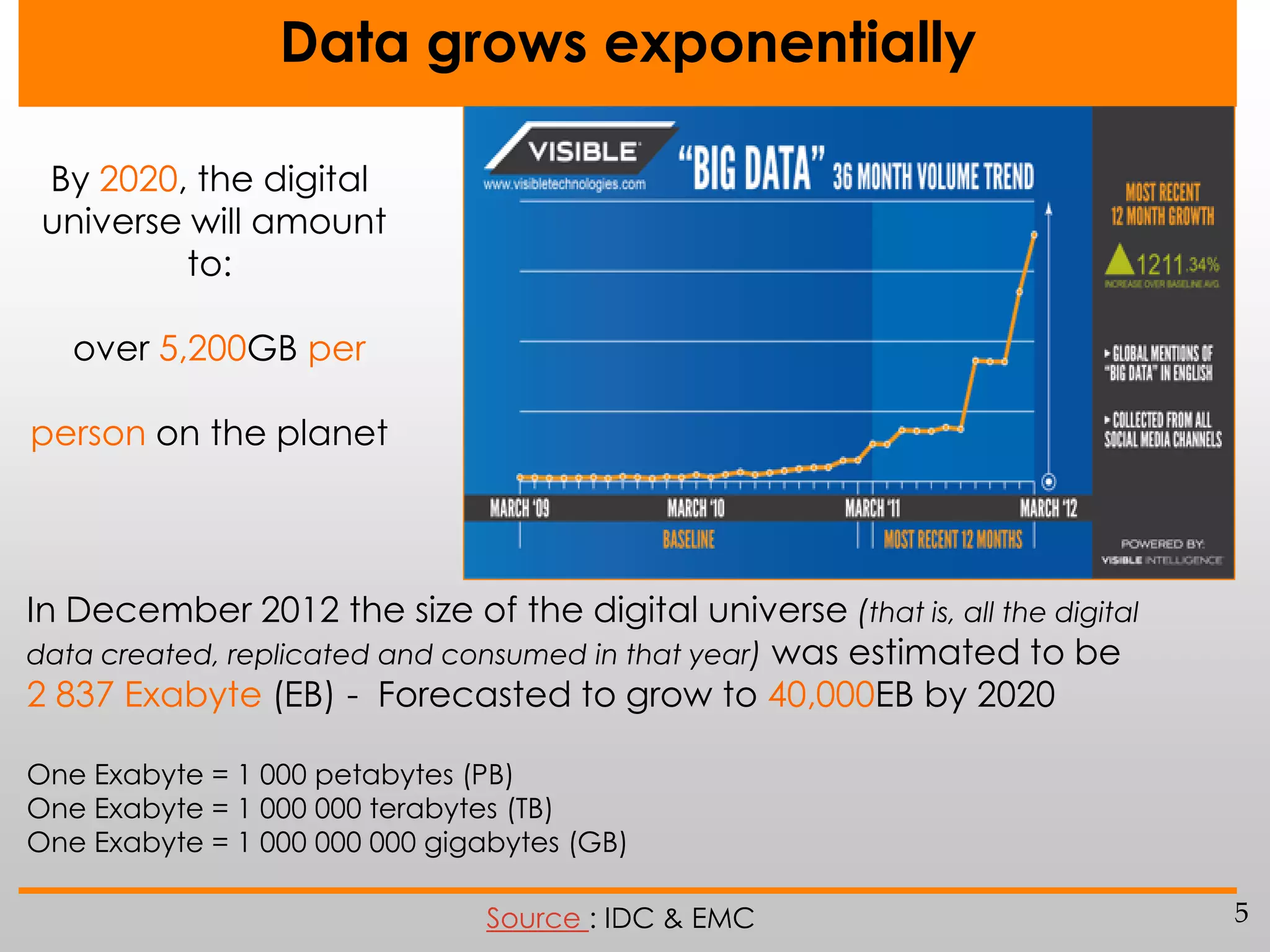

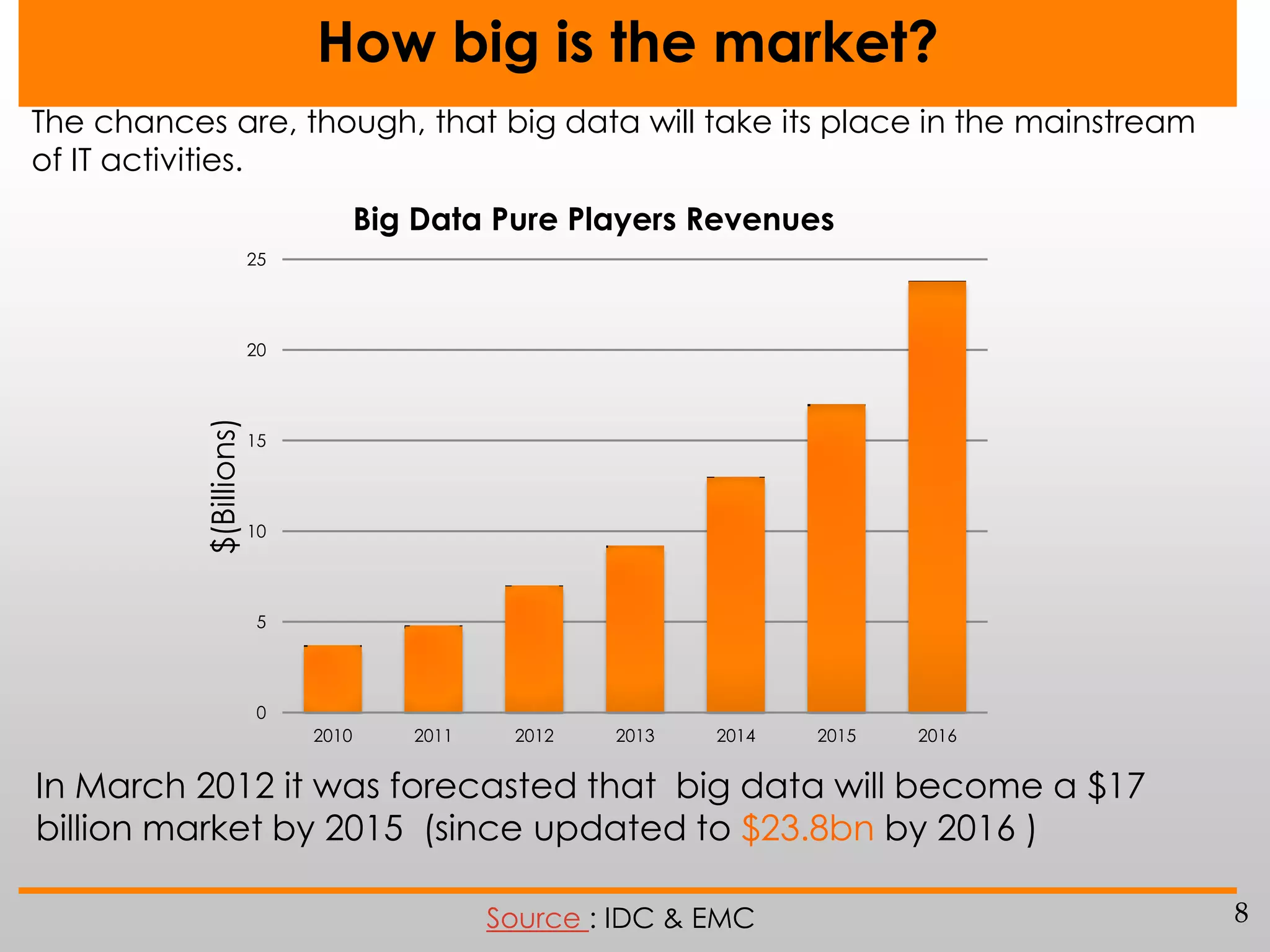

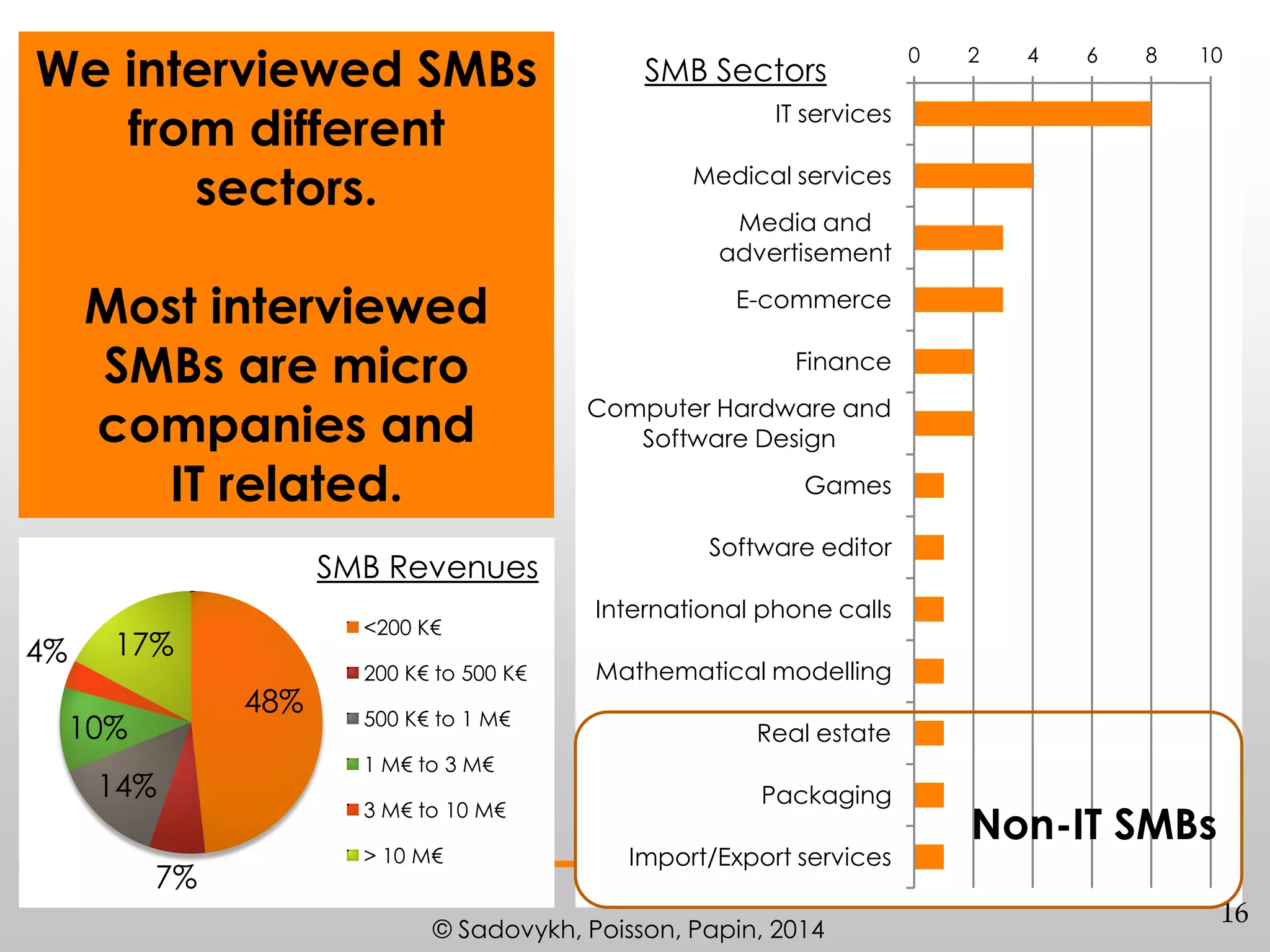

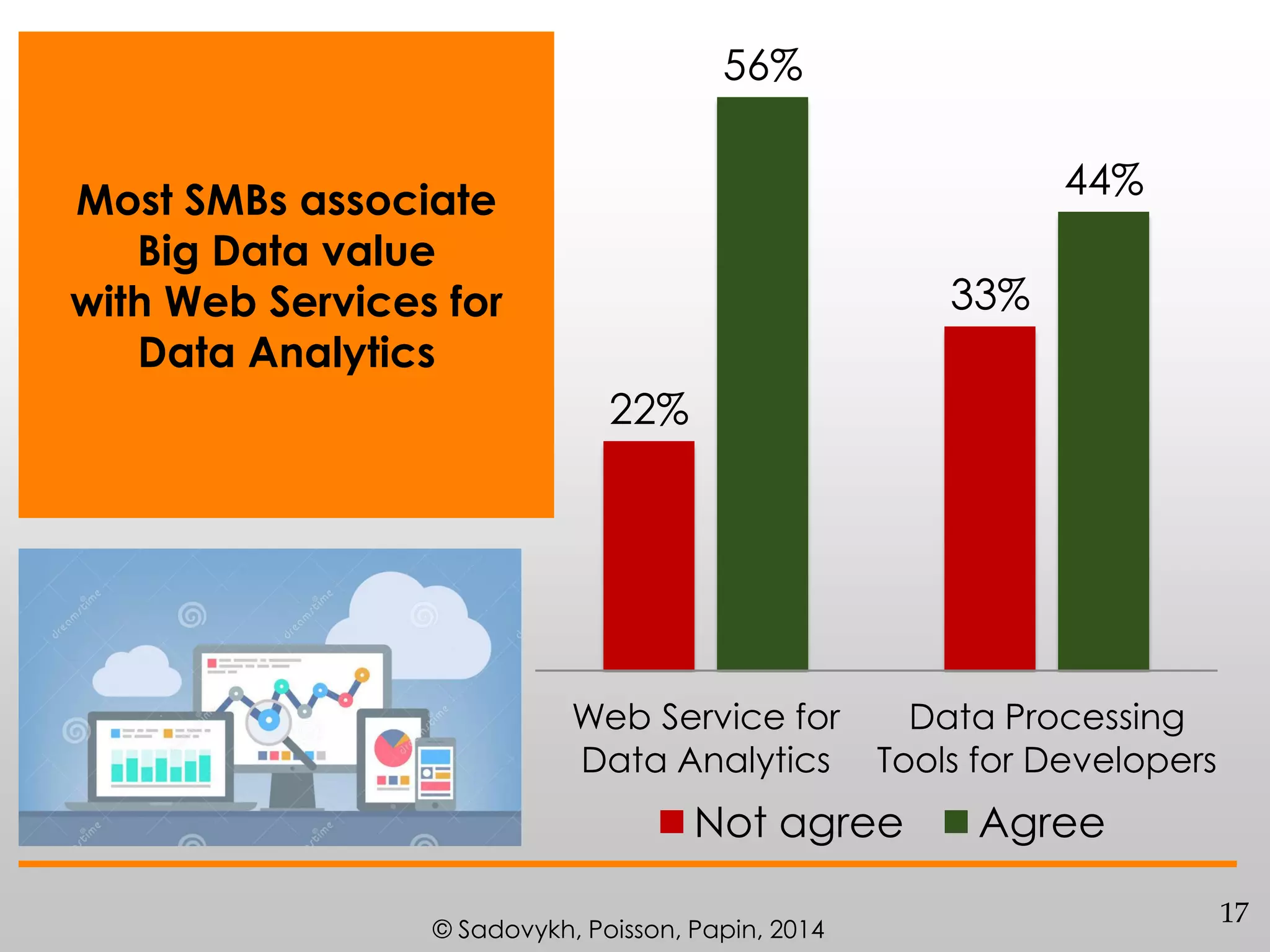

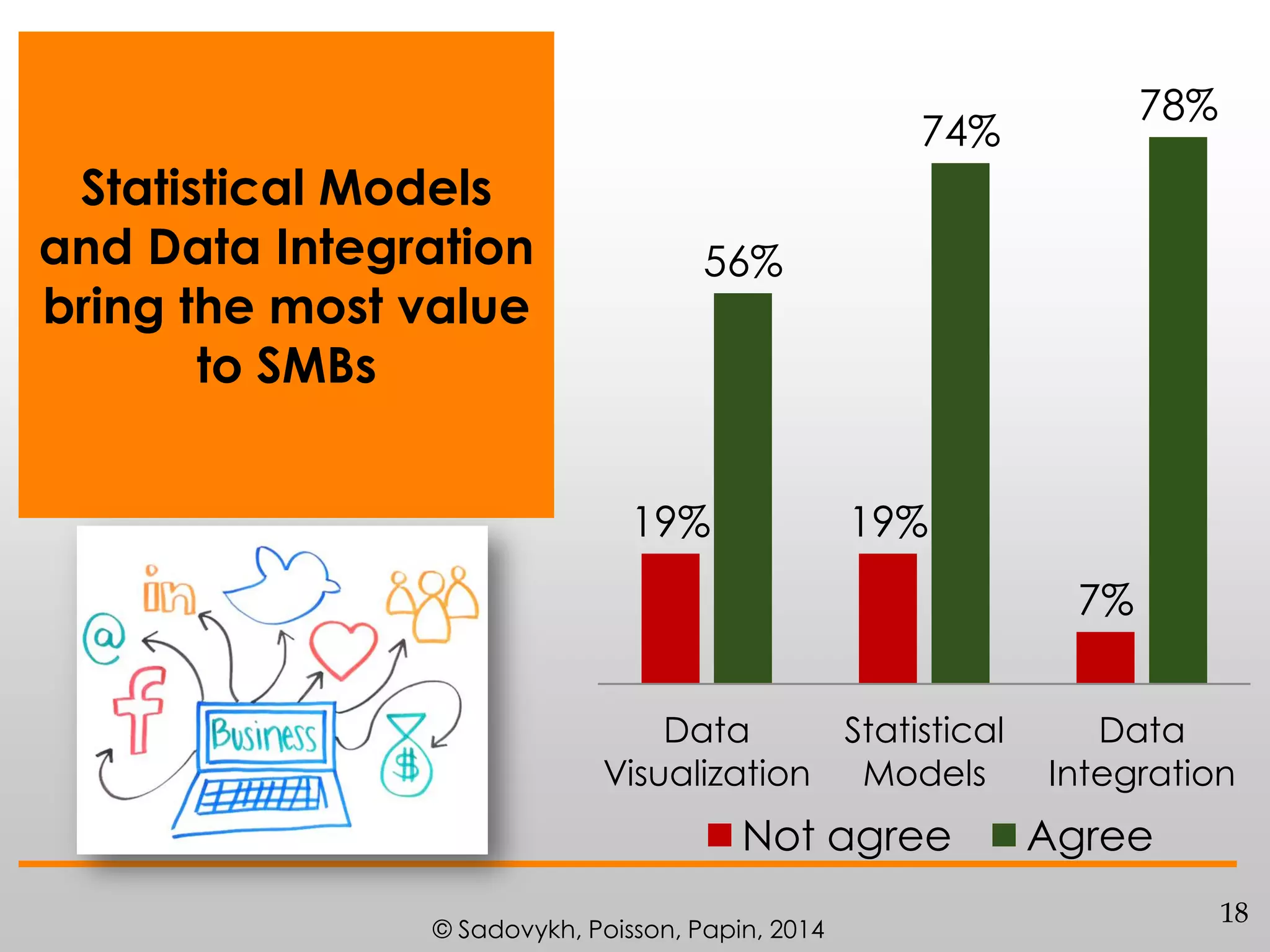

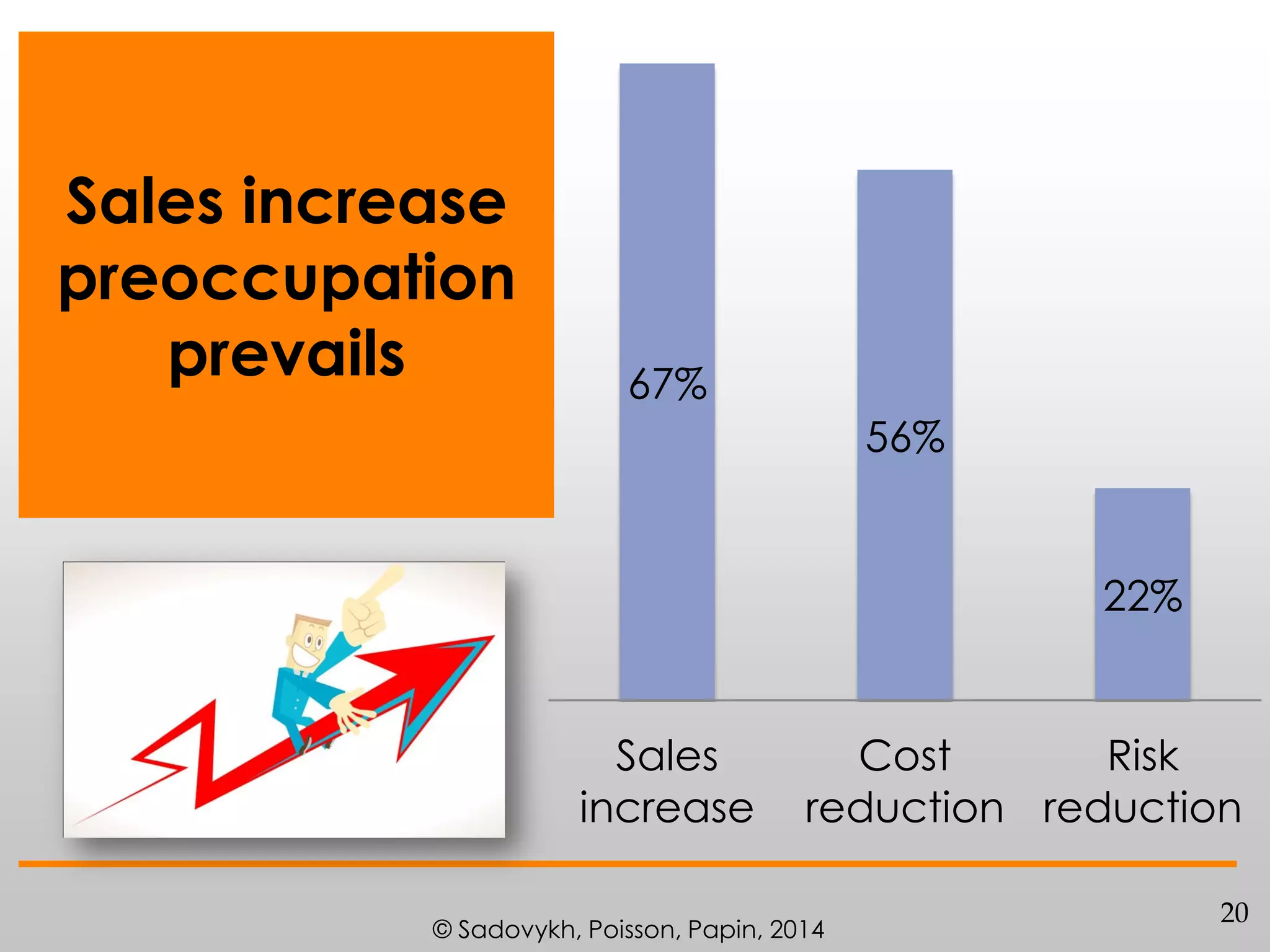

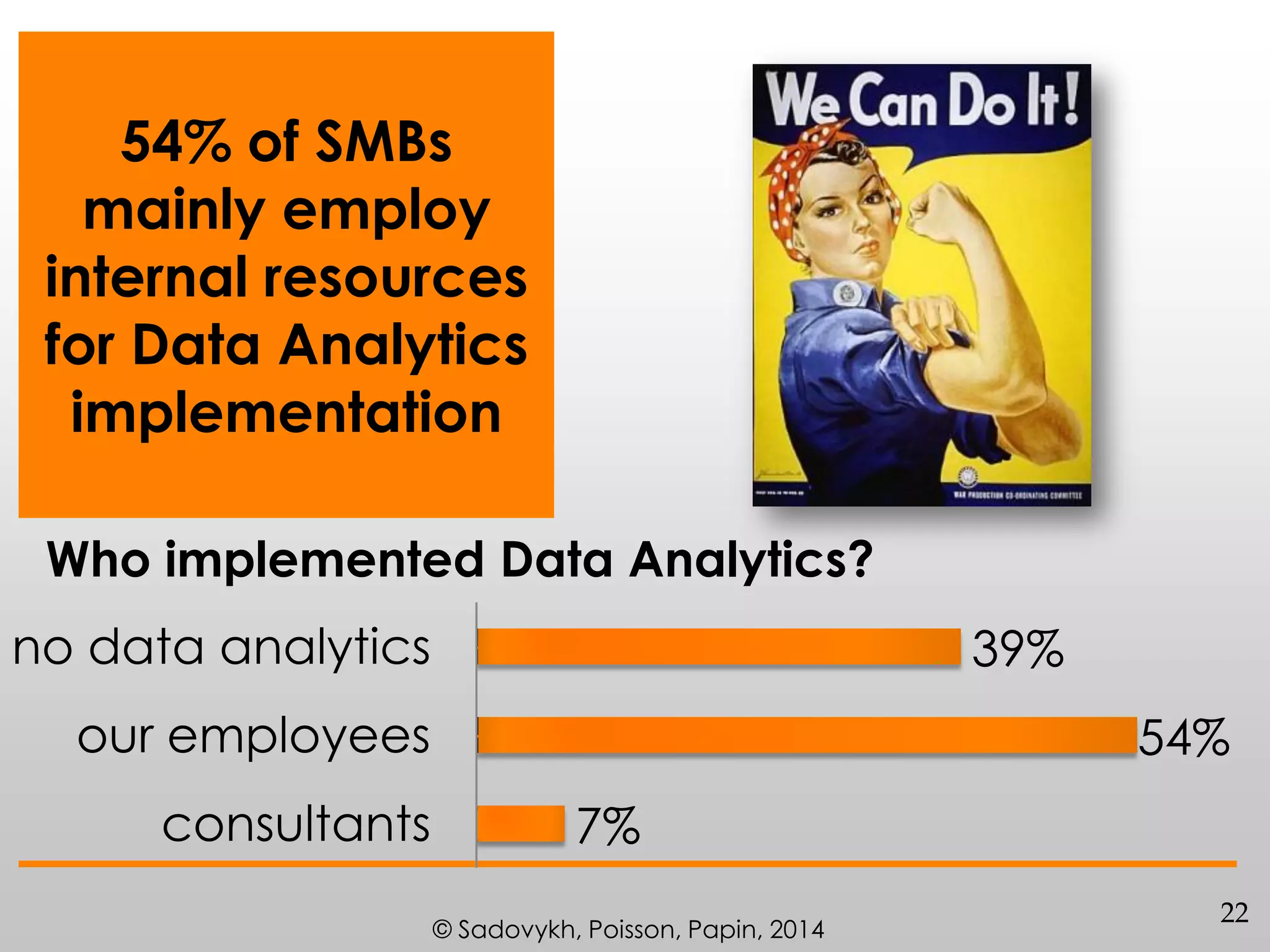

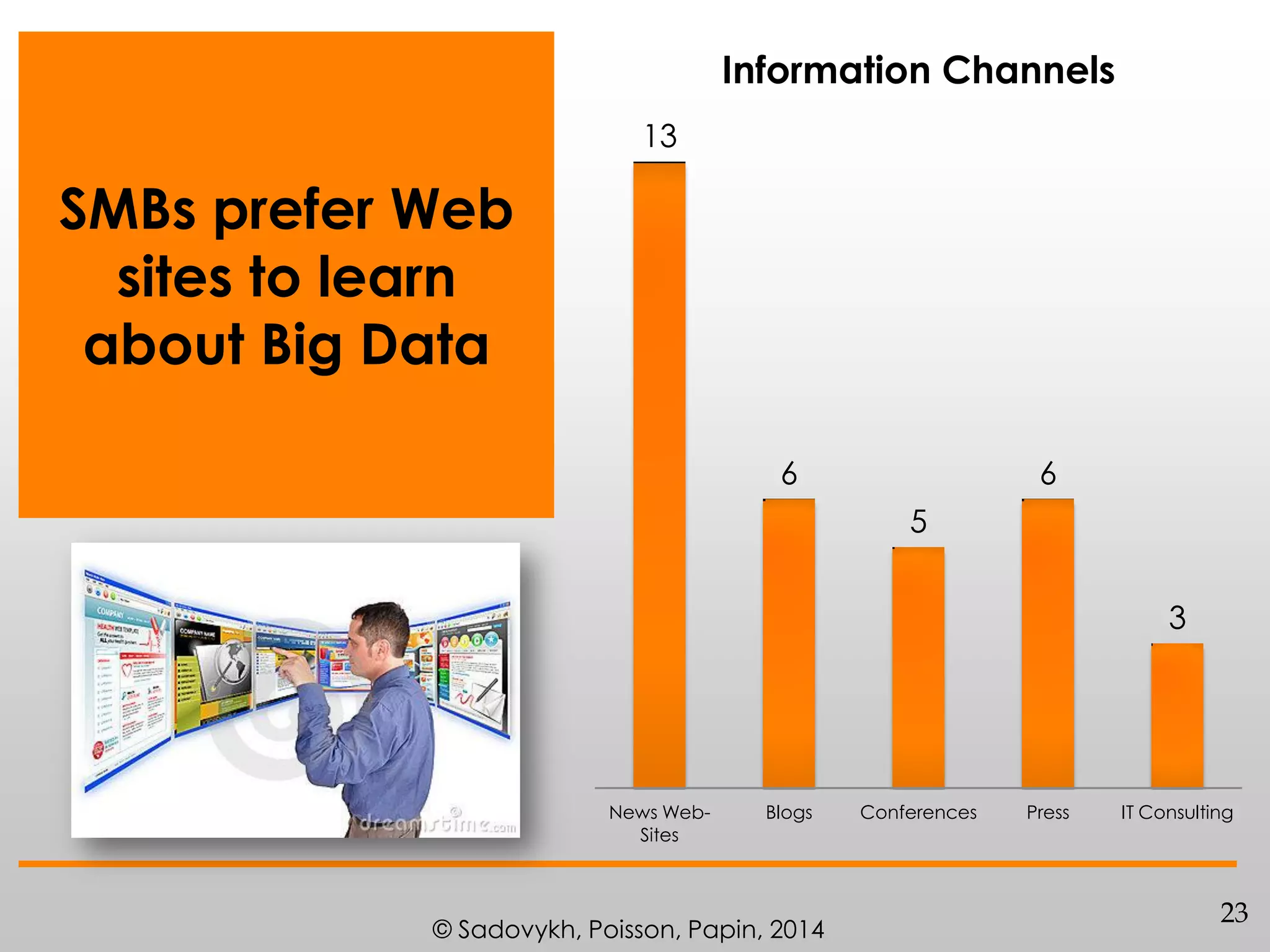

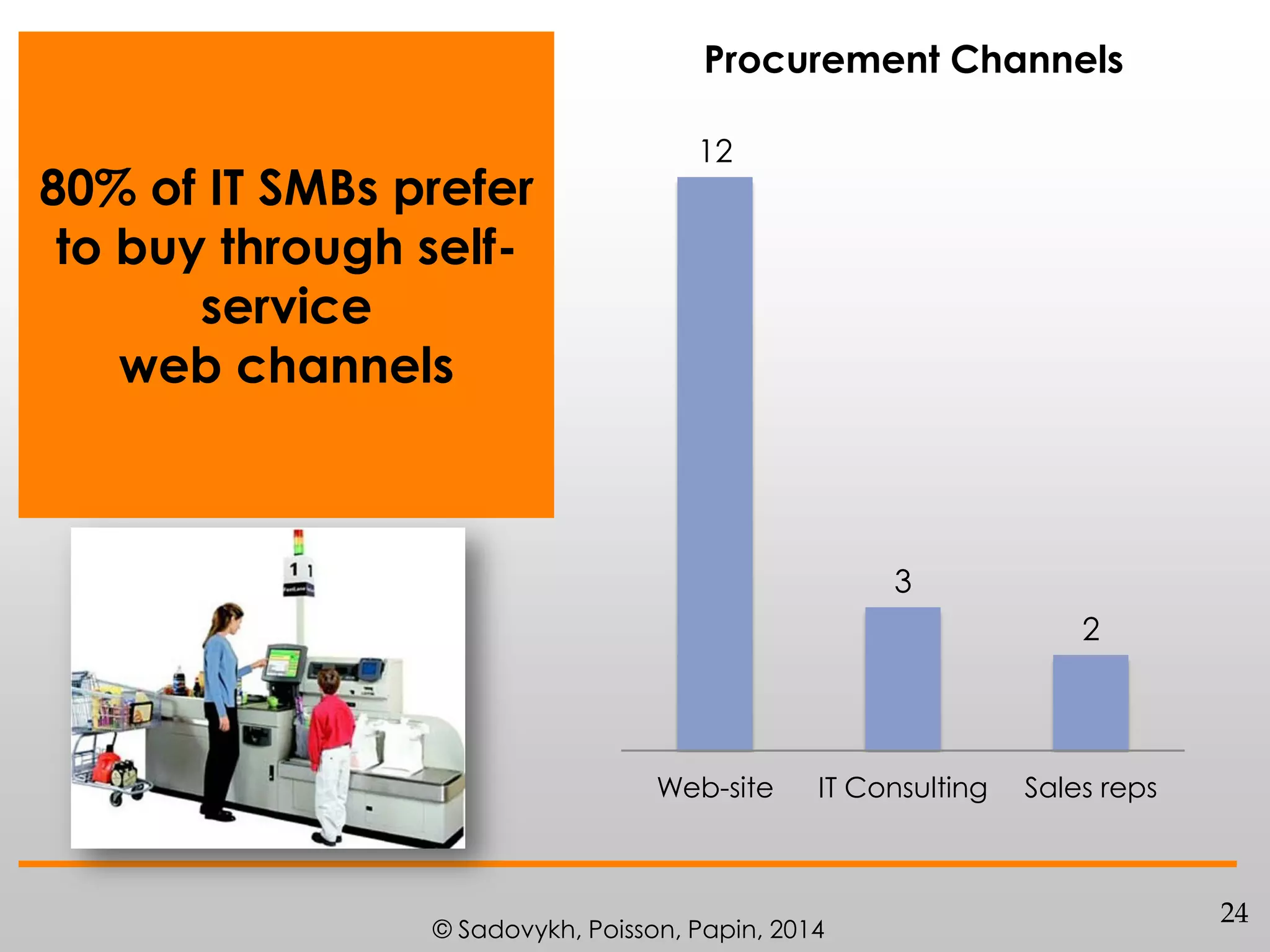

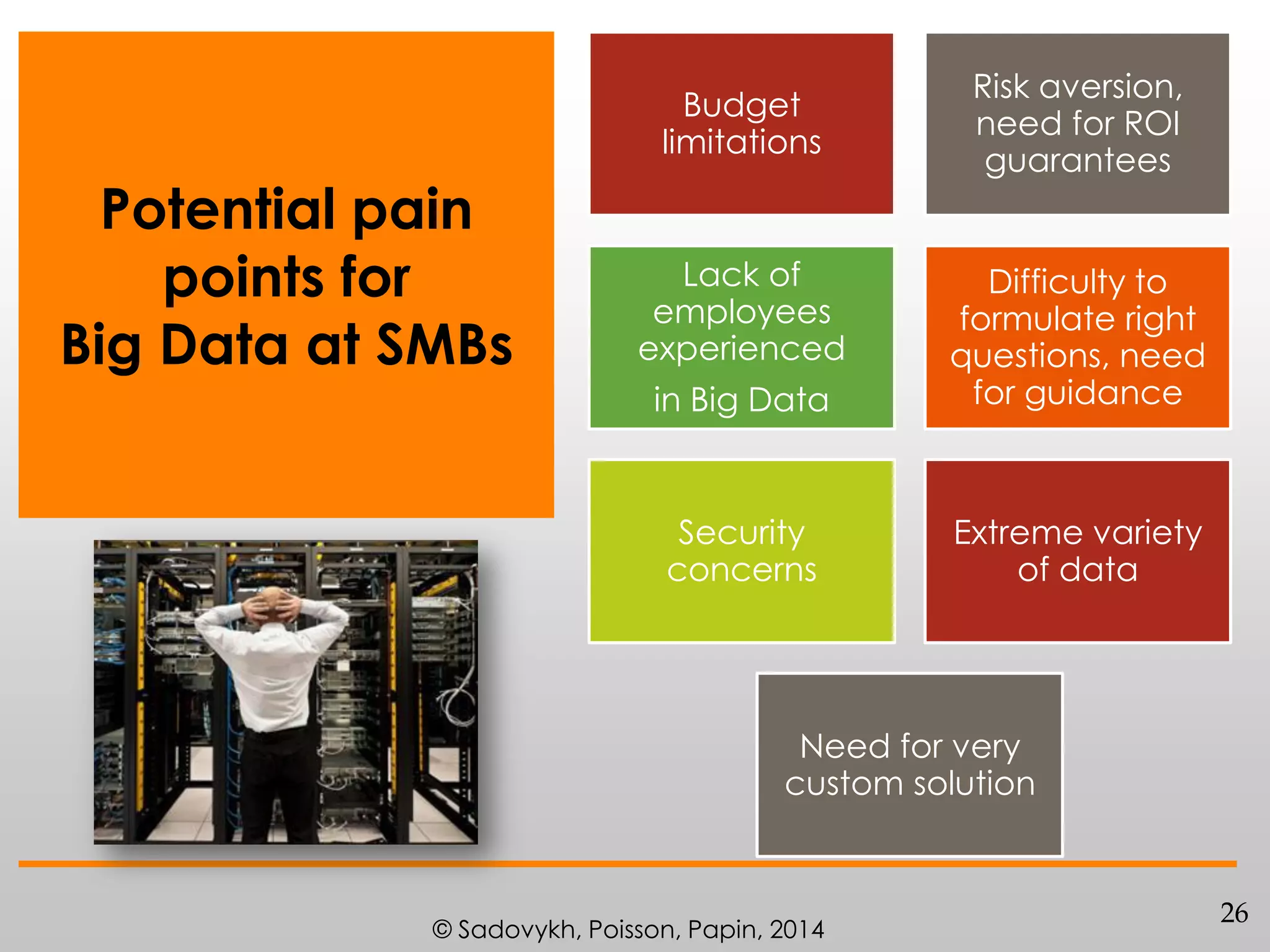

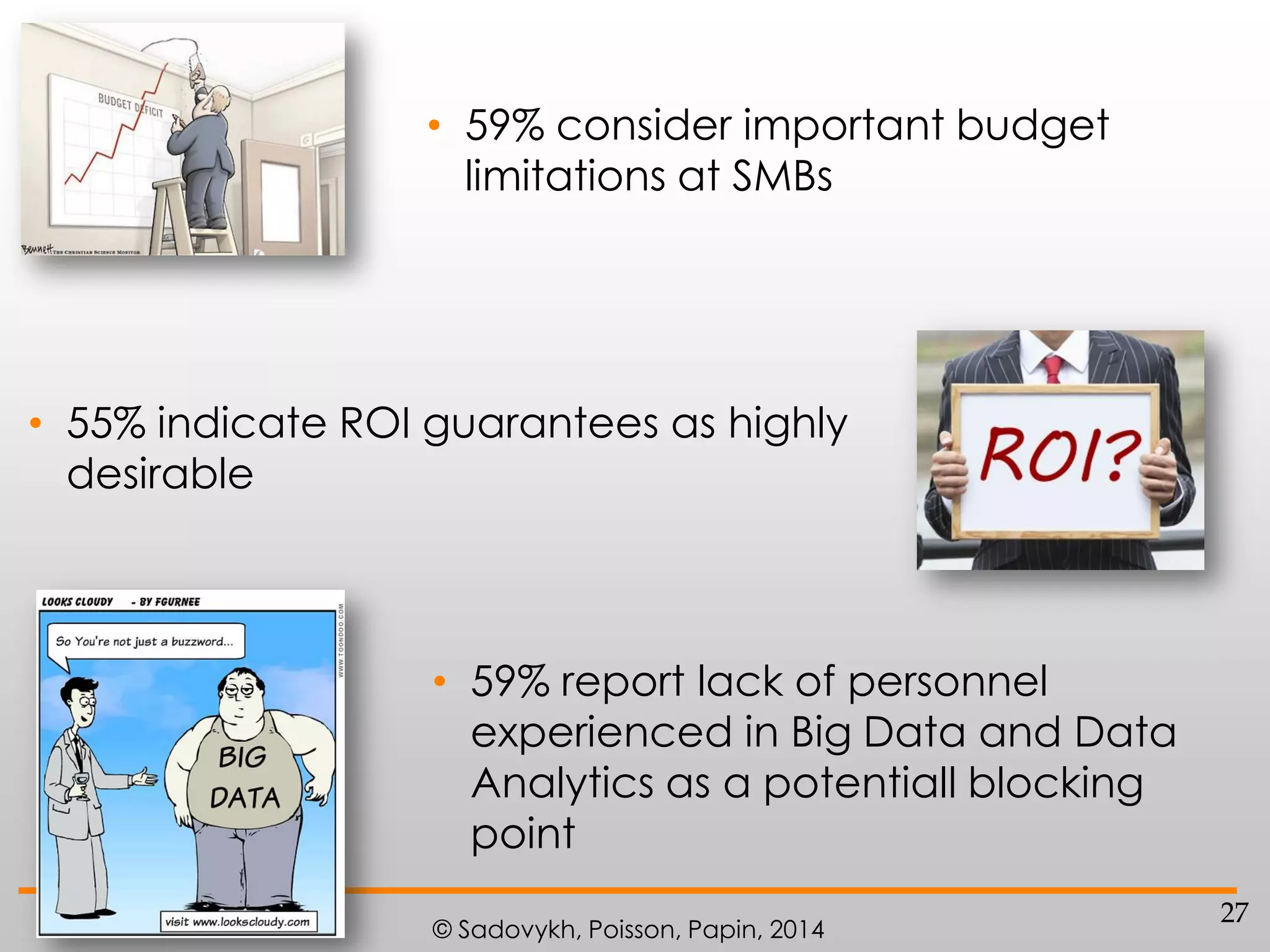

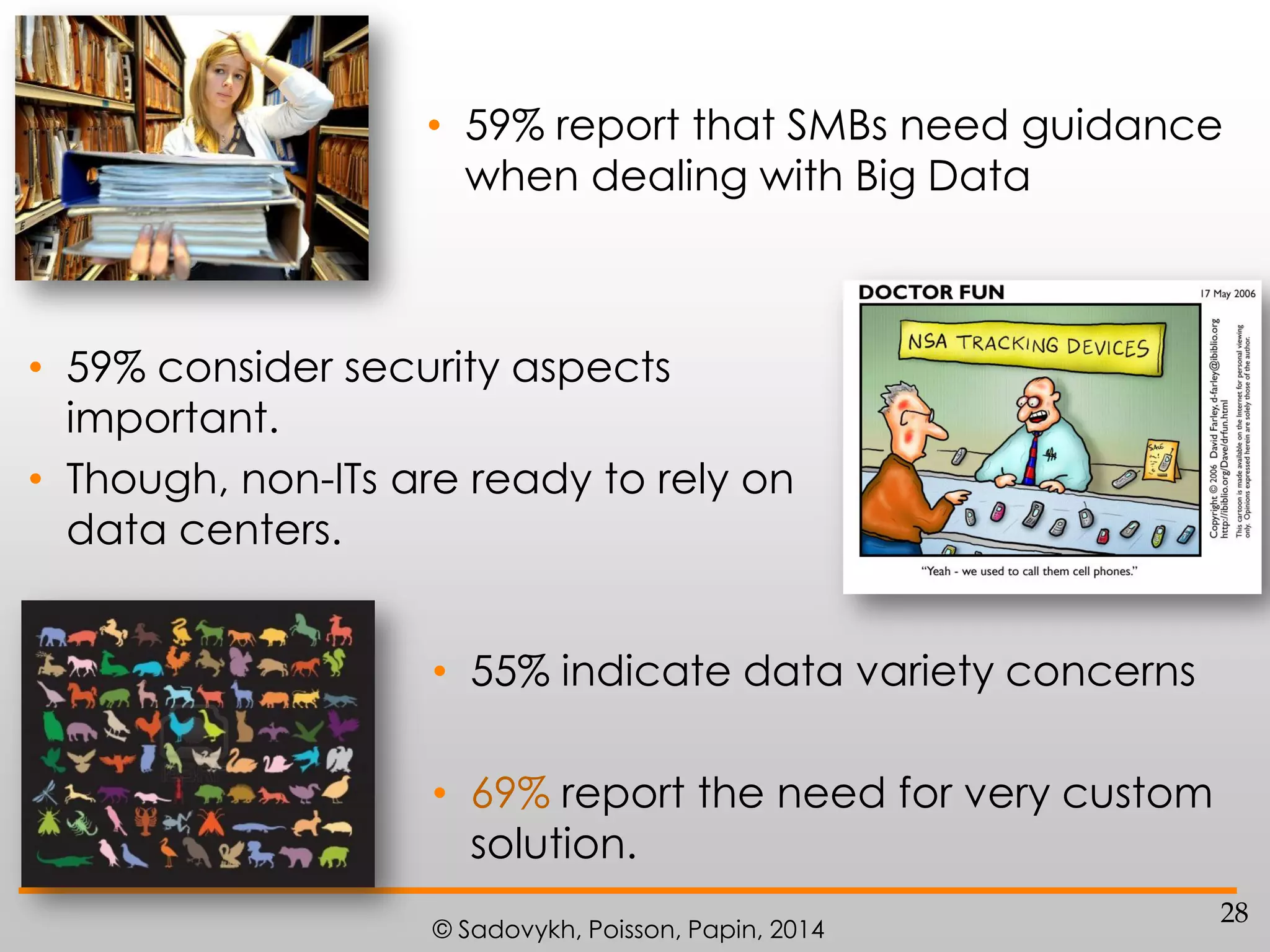

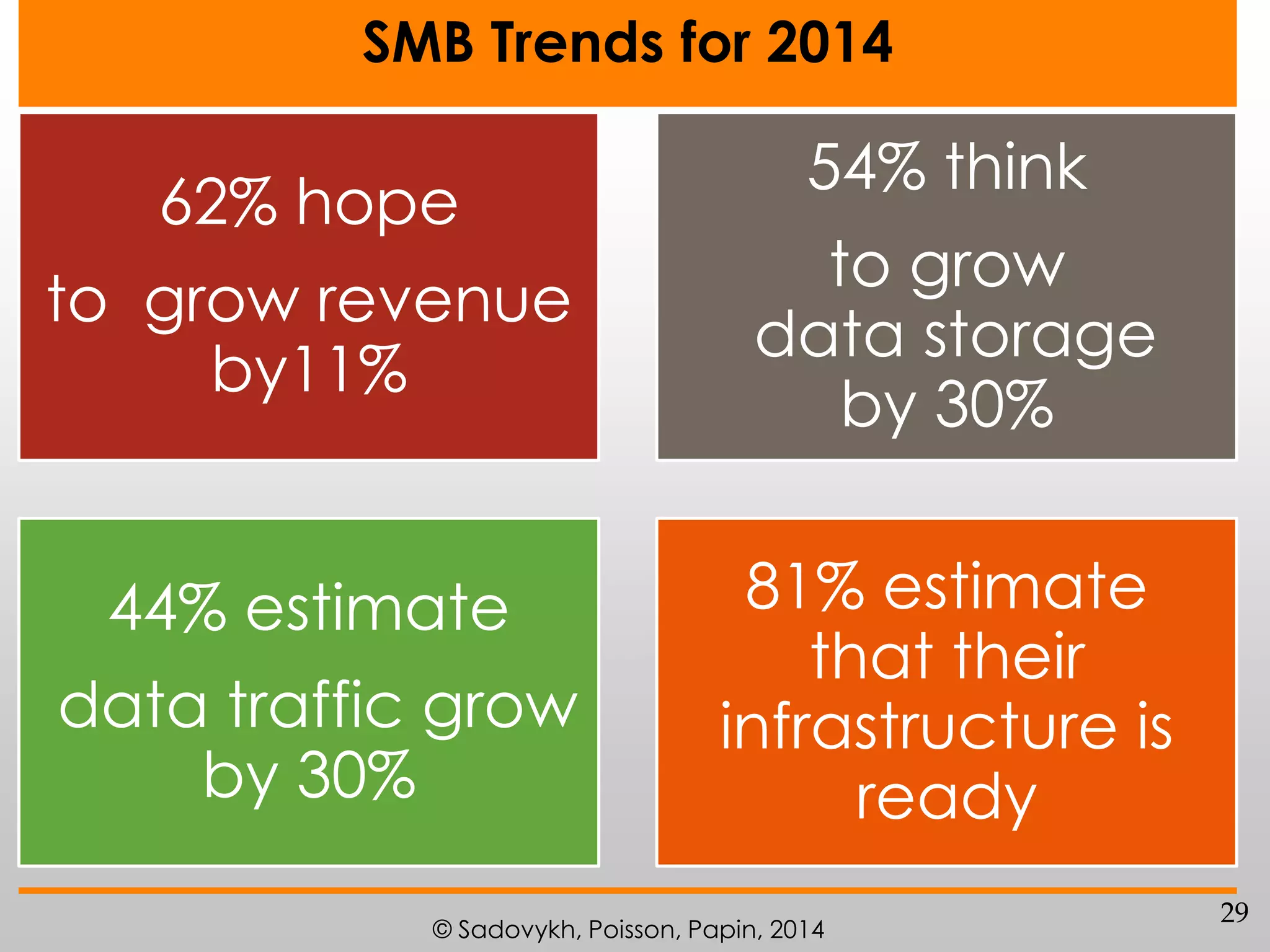

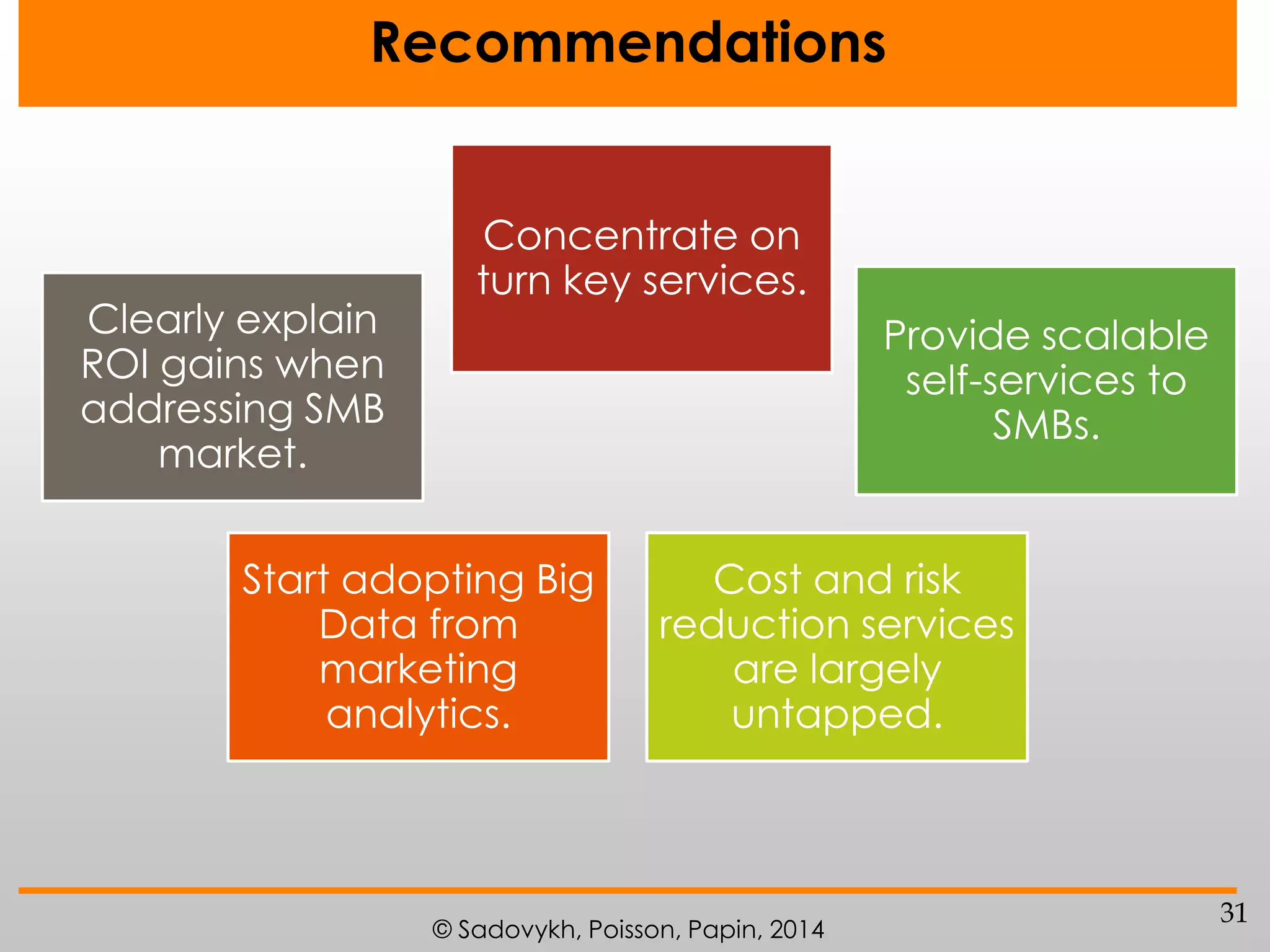

The document discusses the significance of big data for small and medium-sized businesses (SMBs) and the growth of the big data market, projected to reach $23.8 billion by 2016. It highlights key findings from a survey of 32 SMBs regarding their understanding of big data, associated challenges, and the value derived from data analytics services. Recommendations include providing scalable services and emphasizing the potential ROI of big data solutions for SMBs.