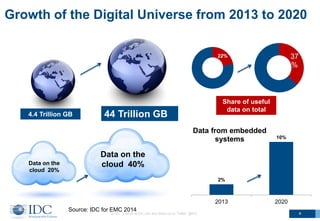

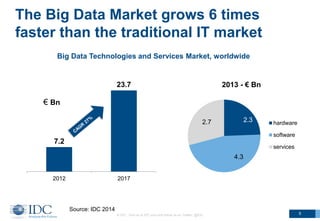

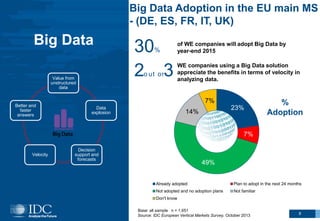

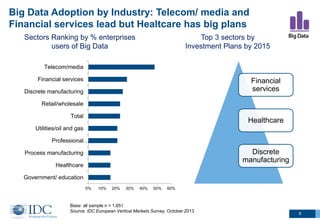

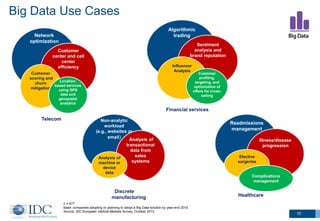

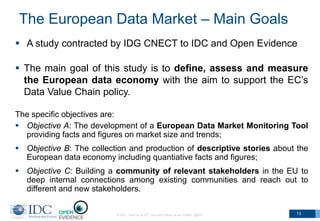

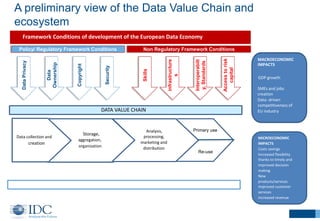

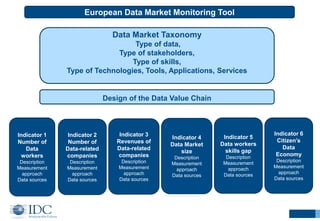

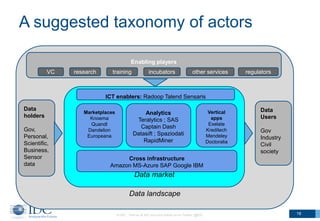

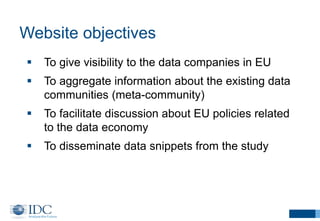

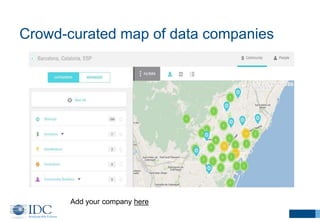

The 2014 NESSI summit discussed the rapid growth of the European big data market, highlighting key trends, challenges in measuring the market, and the need for a collaborative community effort. The adoption of big data technologies is accelerating, particularly in the UK, Germany, and France, with sectors like financial services and healthcare leading investment plans. Additionally, the summit emphasized the importance of addressing data privacy issues and developing a European data market monitoring tool to support economic policies.