Basic bclte heads up

The document discusses the Electronic Statement of Receipts and Expenditures (E-SRE), which is the Philippines' official reporting system for local government fiscal and financial matters. It provides an upgraded, electronic version of the Statement of Income and Expenditure (SIE) system. Key points include: - E-SRE was created by the Bureau of Local Government Finance, Asian Development Bank, and World Bank to establish a comprehensive, reliable financial tracking and reporting system for local governments. - Local governments must submit E-SRE reports quarterly by set deadlines to provide financial performance monitoring and assessment. - E-SRE data is used by various government agencies and organizations for purposes like policymaking, planning,

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Similar to Basic bclte heads up

Similar to Basic bclte heads up (20)

Recently uploaded

Recently uploaded (20)

Basic bclte heads up

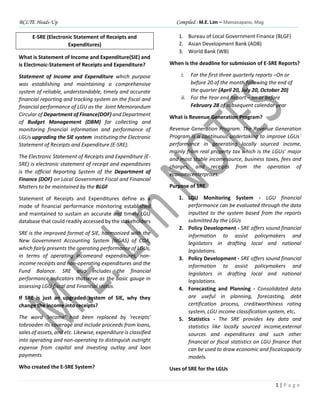

- 1. BCLTE Heads-Up Compiled : M.E. Lim – Mamasapano, Mag 1 | P a g e E-SRE (Electronic Statement of Receipts and Expenditures) What is Statement of Income and Expenditure(SIE) and is Electrnoic-Statement of Receipts and Expenditure? Statement of Income and Expenditure which purpose was establishing and maintaining a comprehensive system of reliable, understandable, timely and accurate financial reporting and tracking system on the fiscal and financial performance of LGU as the Joint Memorandum Circular of Department of Finance(DOF) and Department of Budget Management (DBM) for collecting and monitoring financial information and performance of LGUs upgrading the SIE system instituting the Electronic Statement of Receipts and Expenditure (E-SRE). The Electronic Statement of Receipts and Expenditure (E- SRE) is electronic statement of receipt and expenditures is the official Reporting System of the Department of Finance (DOF) on Local Government Fiscal and Financial Matters to be maintained by the BLGF Statement of Receipts and Expenditures define as a mode of financial performance monitoring established and maintained to sustain an accurate and timely LGU database that could readily accessed by the stakeholders SRE is the improved format of SIE, harmonized with the New Government Accounting System (NGAS) of COA, which fairly presents the operating performance of LGUs, in terms of operating incomeand expenditures, non- income receipts and non-operating expenditures and the Fund Balance. SRE also includes the financial performance indicators thatserve as the basic gauge in assessing LGU fiscal and Financial status. If SRE is just an upgraded system of SIE, why they change the income into receipts? The word ‘income’ had been replaced by ‘receipts’ tobroaden its coverage and include proceeds from loans, sales of assets, and etc. Likewise, expenditure is classified into operating and non-operating to distinguish outright expense from capital and investing outlay and loan payments Who created the E-SRE System? 1. Bureau of Local Government Finance (BLGF) 2. Asian Development Bank (ADB) 3. World Bank (WB) When is the deadline for submission of E-SRE Reports? i. For the first three quarterly reports –On or before 20 of the month following the end of the quarter (April 20, July 20, October 20) ii. For the Year end Report – on or before February 28 of subsequent calendar year What is Revenue Generation Program? Revenue Generation Program. The Revenue Generation Program is a continuous undertaking to improve LGUs´ performance in generating locally sourced income, mainly from real property tax which is the LGUs’ major and most stable incomesource, business taxes, fees and charges, and receipts from the operation of economicenterprises. Purpose of SRE 1. LGU Monitoring System - LGU financial performance can be evaluated through the data inputted to the system based from the reports submitted by the LGUs 2. Policy Development - SRE offers sound financial information to assist policymakers and legislators in drafting local and national legislations. 3. Policy Development - SRE offers sound financial information to assist policymakers and legislators in drafting local and national legislations. 4. Forecasting and Planning - Consolidated data are useful in planning, forecasting, debt certification process, creditworthiness rating system, LGU income classification system, etc. 5. Statistics - The SRE provides key data and statistics like locally sourced income,external sources and expenditures and such other financial or fiscal statistics on LGU finance that can be used to draw economic and fiscalcapacity models. Uses of SRE for the LGUs

- 2. BCLTE Heads-Up Compiled : M.E. Lim – Mamasapano, Mag 2 | P a g e • The SRE serves as a basis of financial information/data that are significant in the decision-making process of LGUs. • The SRE can be used as a tool in forecasting revenues and estimating expenditures during the budget preparation process. • It can also be utilized to monitor the fiscal and economic state of a LGU. • The SRE reports containing the itemized monthly collections anddisbursements of the LGU concerned may be posted and published in compliance with Section 513 of the LGC. • The SRE is used by Development Partners a precaution before grants are given to LGUs. Users of SRE 1. Department of Finance (DOF) 2. Department of Interior and Local Government (DILG) 3. Municipal Development Fund Office (MDFO) 4. National Economic and Development Authority (NEDA) 5. National Telecommunications Regulatory Commission (NTRC) 6. Senate and Congress 7. Department of Budget and Management (DBM) 8. Bangko Sentral ng Pilipinas (BSP) 9. International Monetary Fund (IMF) 10. Potential Donors (ADB/WB) 11. Financial Institutions 12. Researchers/Academe 13. Local Government Unit (LGU) REAL PROPERTY TAX Real Property Tax - Revenues of the Local Government Units are earned from their local and external sources. One of these local sources is the Real Property Tax (RPT). RPT is a property tax that is paid yearly. It is imposed on all types of real properties including lands, buildings, improvements, and machinery. To avoid excessive use of such authority, limitations were established by setting specific percentages for the ceiling and base rates.] Who is responsible for the tax payment? Responsible for the payment is the owner or administrator of the property. How much should be paid? The RPT rate for the cities and municipalities in Metro Manila is two percent (2%) while for provinces it is one percent (1%). To compute for RPT, the RPT rate is multiplied by the assessed value of the property. Assessed value is the fair market value of the real property multiplied by the assessment level. It is synonymous with taxable value. On the other hand, the assessment level is the percentage applied to the fair market value to determine the taxable value of the property. It shall be fixed through ordinances imposed by the city or provincial government. It can be as high as twenty percent (20%) for residential land and fifty percent (50%) for commercial and industrial lands. LGUs may levy and collect an annual tax of one percent (1%) on the assessed value of the real property which shall be in addition to the basic real property tax. The collection shall be accrued to the Special Education Fund (SEF). Moreover, at the rate not exceeding five percent (5%) of the assessed value of the property may be imposed annually as an additional ad valorem tax on idle lands. What happens when RPT is not paid? Failure to pay the RPT on the schedule will result in having penalties. Late payments shall subject the taxpayers to the payment interest at the rate of two percent (2%) per month on the unpaid amount to a maximum of seventy- two (72%) percent or thirty-six (36) months. Where can owners pay? The Treasurer’s Office of the LGU is responsible for the collection of RPT. Are there exempted properties? The following are exempted from the tax: 1. Charitable institutions; 2. Charitable institutions;

- 3. BCLTE Heads-Up Compiled : M.E. Lim – Mamasapano, Mag 3 | P a g e 3. Churches; 4. Cooperatives; 5. All lands that are exclusively used for religious, charitable or educational purposes; 6. Those that are used by local water districts; 7. Government-owned or controlled corporations; and machinery and equipment are used for pollution control and environmental protection 8. Government-owned or controlled corporations; and machinery and equipment are used for pollution control, and environmental protection are exempted from the tax. 9. Machinery and equipment are used for pollution control and environmental protection What are the terminologies that property owners need to know and understand? 1. Ad Valorem Tax is a levy on real property determined on the basis of a fixed proportion of the value of the property. 2. Assessment Level is the percentage applied to the fair market value to determine the taxable value of the property. 3. Assessed Value is the fair market value of the real property multiplied by the assessment level. It is synonymous with taxable value. 4. Commercial Land is land devoted principally to the object of profit and is not classified as agricultural, industrial, mineral, timber, or residential land. 5. Fair Market Value is the price at which a property may be sold by a seller who is not compelled to sell and bought by a buyer who is not compelled to buy. 6. Improvement is a valuable addition made to a property or an amelioration in its condition, amounting to more than a mere repair or replacement of parts involving capital expenditures and labor, which is intended to enhance its value, beauty or utility or to adapt it for new or further purposes. 7. Industrial Land is land devoted principally to industrial activity as capital investment and is not classified as agricultural, commercial, timber, mineral or residential land. 8. Machinery embraces machines, equipment, mechanical contrivances, instruments, appliances or apparatus which may or may not be attached, permanently or temporarily, to the real property. It includes the physical facilities for production, the installations and appurtenant service facilities, those which are mobile, self- powered or self-propelled, and those not permanently attached to the real property which are actually, directly, and exclusively used to meet the needs of the particular industry, business or activity and which by their very nature and purpose are designed for, or necessary to its manufacturing, mining, logging, commercial, industrial or agricultural purposes. 9. Residential Land is a land principally devoted to habitation.