The document provides an overview of recent and upcoming work by the Basel Committee on Banking Supervision (BCBS). Key points include:

- The BCBS work program is structured around policy development, ensuring balance in regulations, monitoring implementation, and supervision effectiveness.

- Upcoming BCBS papers and guidance will address topics like Pillar 3 disclosures, expected credit losses, derivatives margin requirements, and corporate governance.

- The BCBS ensures harmonization and consistency of Basel standards through the Regulatory Consistency Assessment Program.

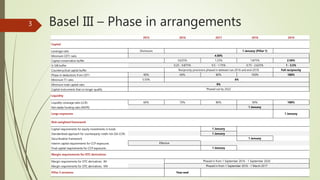

- Major upcoming revisions include the capital standards (Basel IV expected by 2019), credit risk weighting approaches, market risk framework, and interest rate risk in the banking book.

![• Bank exposures = Risk weightings based on external ratings and qualitative criteria.

[Previously 20% to 150%] RWA lowered for A+/A- bank to 50% to 30%

• Corporate exposures = Risk weightings based on external ratings and qualitative criteria.

[Previously 20% to 150%] BBB reduced to 75% and for SMEs 85%

• Equity and subordinated debts now range from 150% to 400% [Previously 100%]

• Retail loans = Risk weightings as either 75% or 100% for retail loans and other loans except

for transactors which is proposed at 45%. [Previously 75%]

• Residential real estate = Risk weightings based on Loan To Value (LTV) ratio ranging from

40% to 100% [Previously 35%] – SAMA looking to reduce RWA from 100% to 50%

• Commercial real estate = Risk weightings based on Loan To Value (LTV) ratio ranging from

40% to 100% [Previously 100%]

• Off balance sheet exposures = Increase in Credit Conversion Factors CCF (percentages

designed to convert the off-balance sheet items to credit equivalent assets on which risk

weightings will be applied) from 0% to 10% and 40% [Previously 0% to 100%]

• Paper to be finalised towards end of 2016

21 Standardised approach for credit risk](https://image.slidesharecdn.com/a8d62eec-af57-4d41-b394-f0e953e6aa79-170125123704/85/Basel-future-development-21-320.jpg)