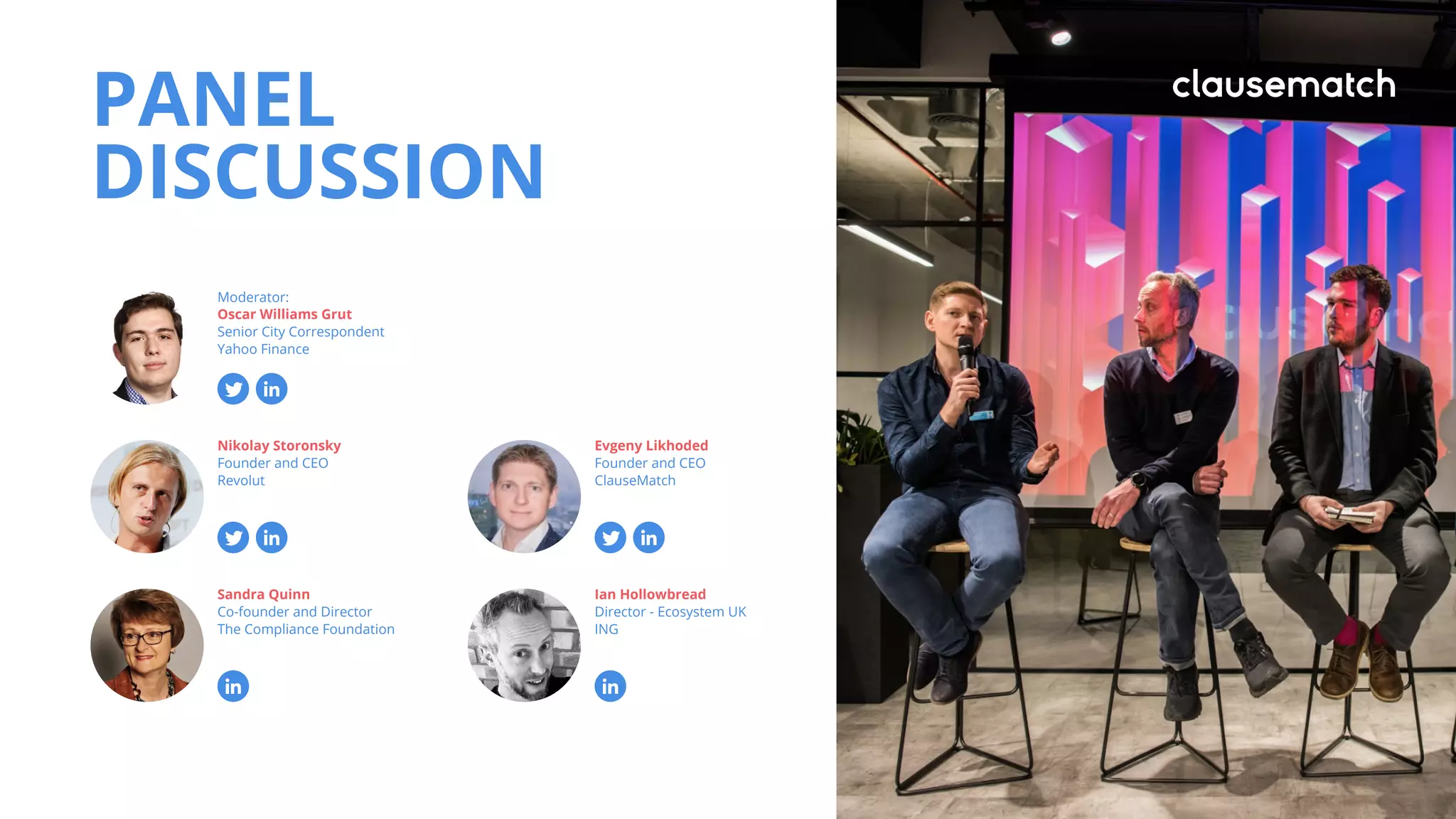

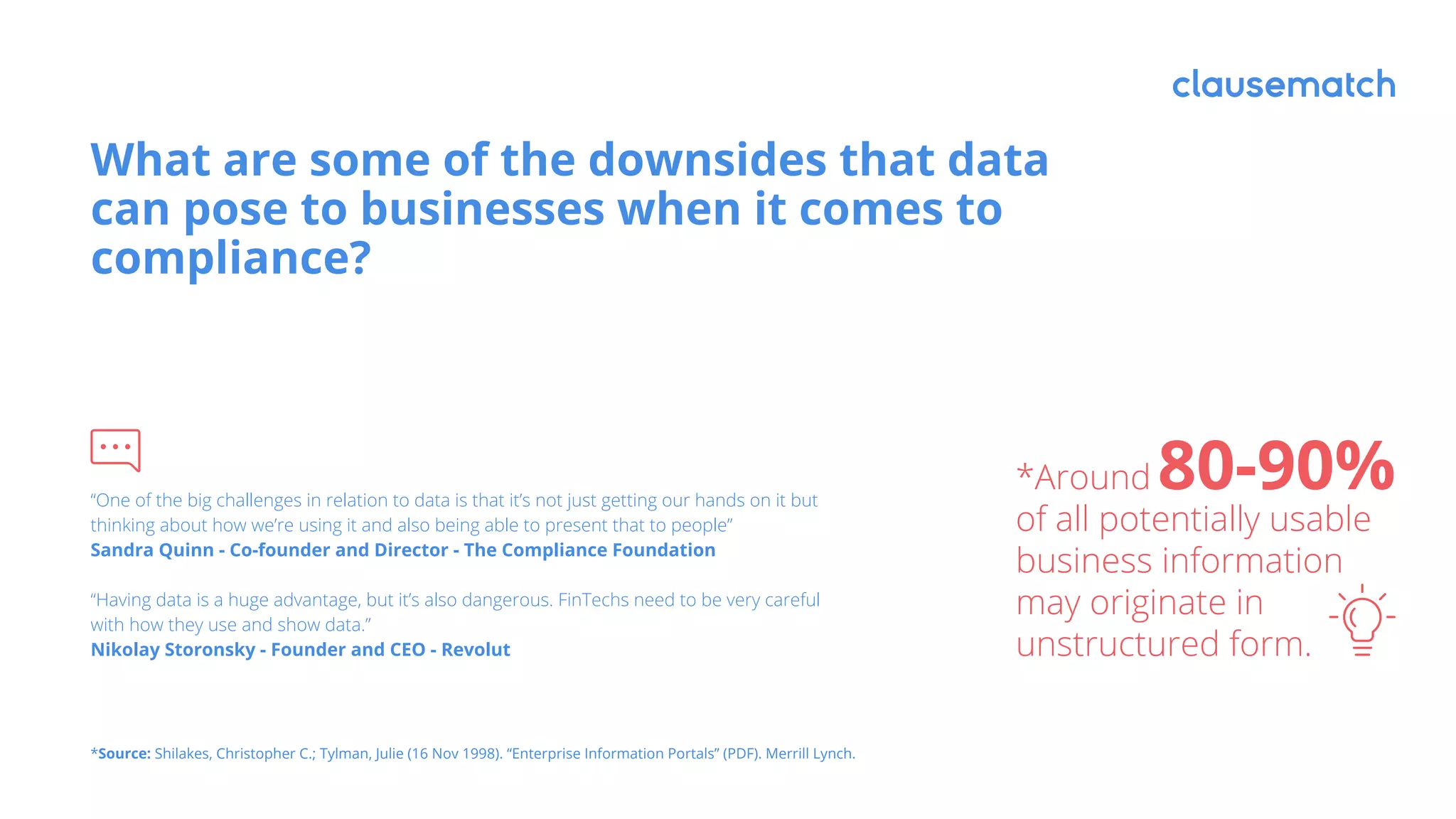

The panel discussion highlighted the challenges and advantages of data use in compliance for banks and fintechs. Key points included the importance of data protection, the risks of organized crime, and the competitive advantage of automating compliance processes. Both sectors can learn from each other to improve technology integration and regulatory practices.