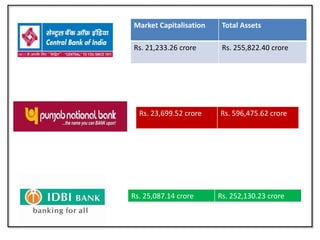

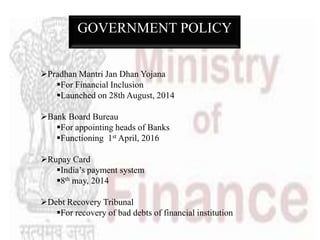

This document provides an overview of the banking sector in India. It discusses the meaning and phases of banking, and the important contributions and role of banking in the Indian economy, such as capital formation, credit creation, and financing the government. It also examines the competitive scenario in commercial and investment banks. The major players in the Indian banking sector are analyzed based on their market capitalization and total assets. The relationships between banking and other sectors like education are also covered. The document concludes with future prospects of growth in the Indian banking sector.