Embed presentation

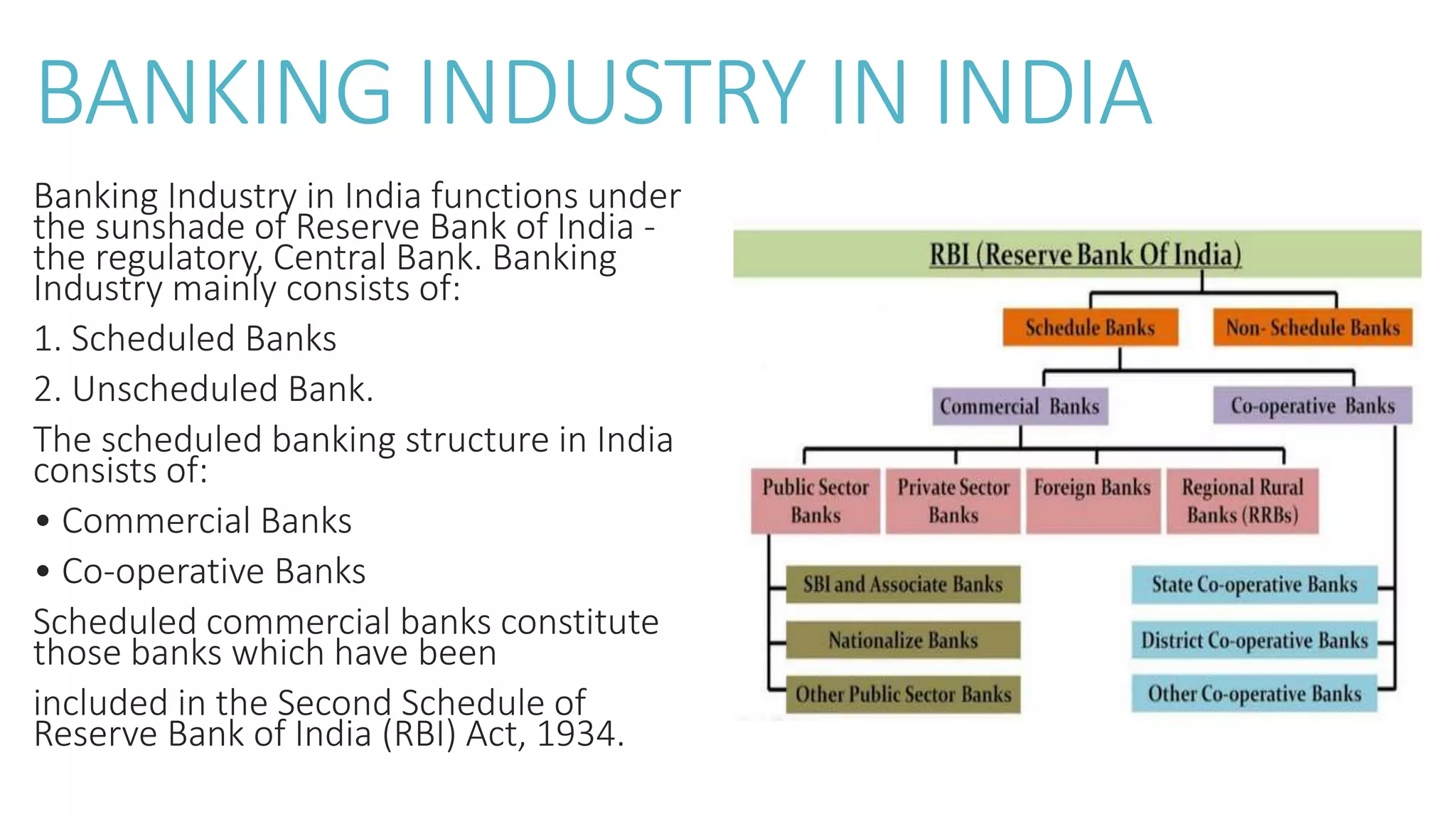

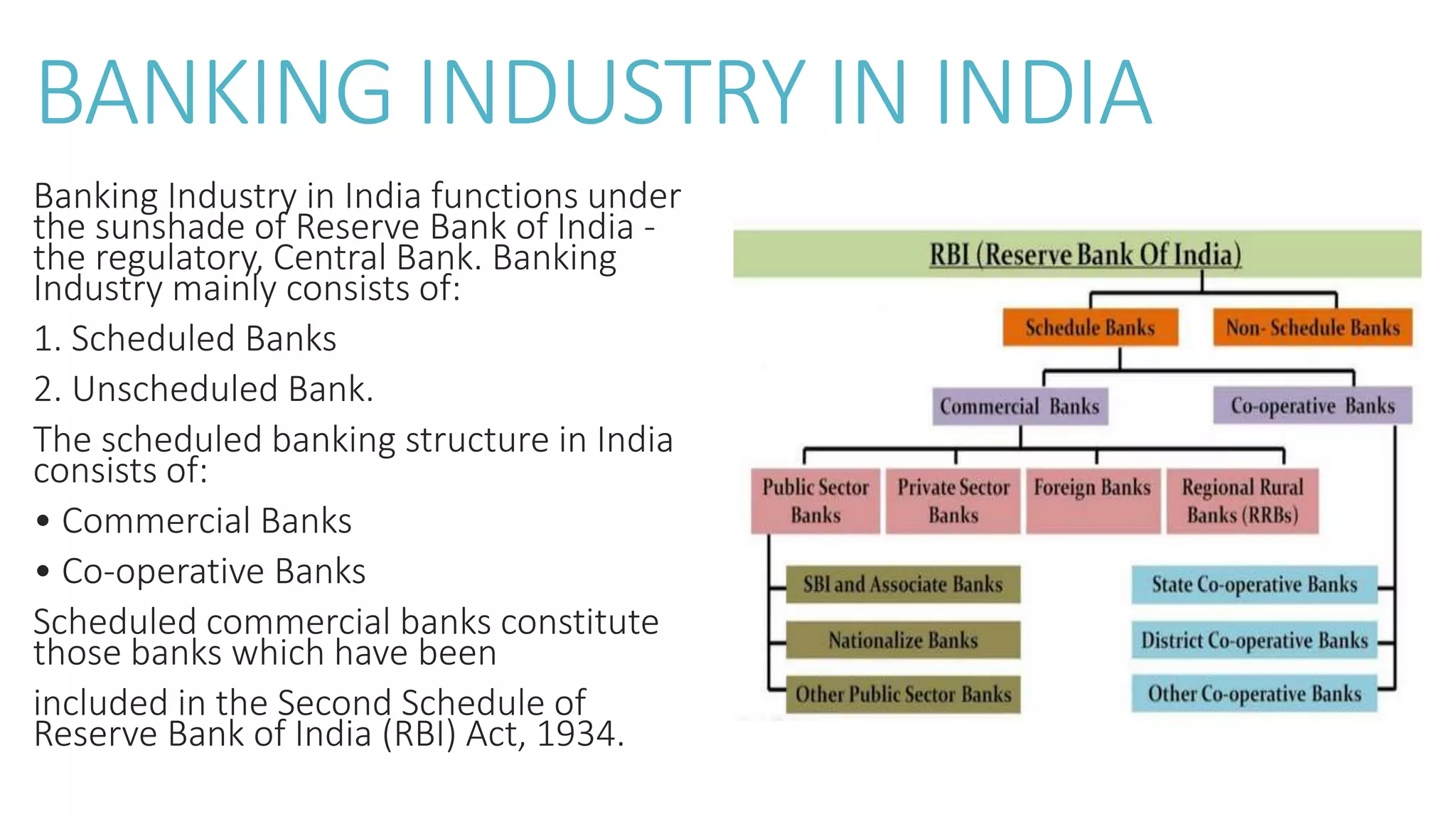

The banking sector in India functions under the oversight of the Reserve Bank of India. The banking industry consists of scheduled and unscheduled banks. Scheduled banks include commercial and co-operative banks, which are included in the Second Schedule of the RBI Act of 1934. The government has made the Pradhan Mantri Jan Dhan Yojana scheme open-ended and added incentives to promote financial inclusion. Macroeconomic factors like GDP, inflation, interest rates, exchange rates, FDI, and government/RBI policies all impact the banking industry in India.