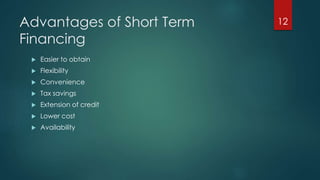

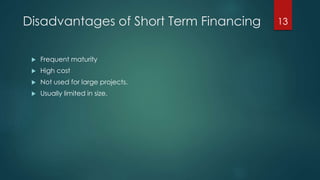

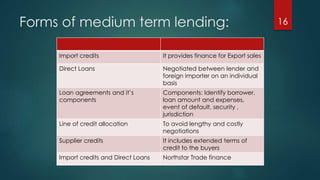

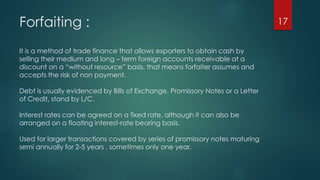

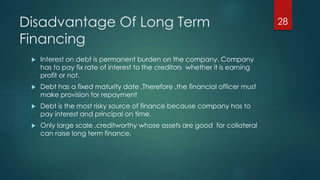

This document discusses various types of bank financing including short term, medium term, and long term financing. It provides details on the key elements that banks look for when approving financing requests. The different types of financing are used to fund different time periods, from less than one year for short term financing, 1-7 years for medium term, and 15-20 years for long term financing. The document also outlines the sources, advantages, disadvantages and purposes of each type of financing.