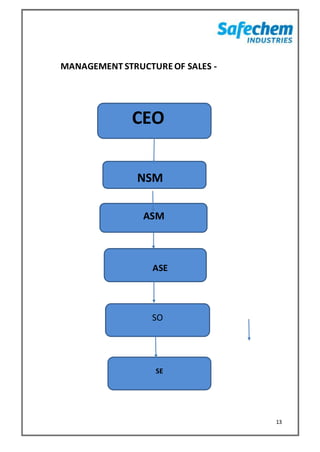

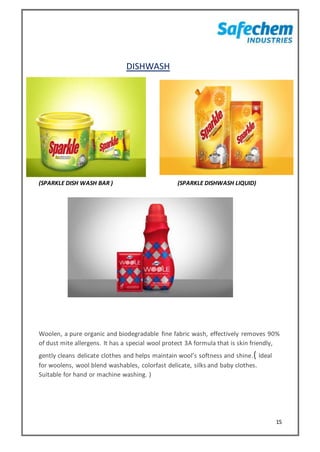

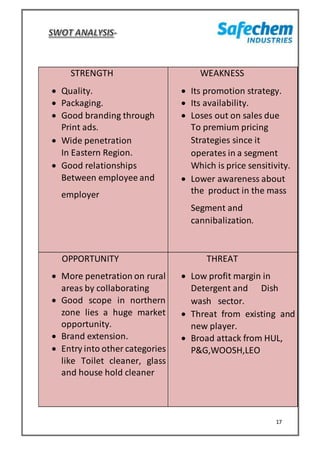

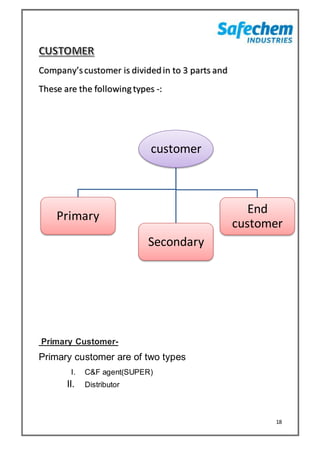

This document provides information about Safed, a detergent brand produced by Safechem Industries in Eastern India. It discusses Safechem's history, vision, product portfolio including Safed detergent powder and Sparkle dishwashing products. It also outlines Safechem's management structure, strengths as a leading detergent brand in Eastern India, and main competitors like HUL and Ghari. The document analyzes the Indian detergent market size and market shares of top players like HUL, Nirma, Jyothy Labs and others.