Bafm income taxation syllabus(shared)

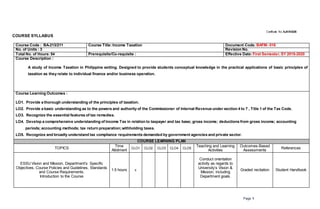

- 1. Page 1 Certificate No. AJA19-0226 COURSE SYLLABUS Course Code : BA-213/211 Course Title:Income Taxation Document Code. BAFM- 016 No. of Units : 3 Revision No. Total No. of Hours: 54 Prerequisite/Co-requisite : Effective Date:First Semester, SY 2019-2020 Course Description : A study of Income Taxation in Philippine setting. Designed to provide students conceptual knowledge in the practical applications of basic principles of taxation as they relate to individual finance and/or business operation. Course Learning Outcomes : LO1. Provide a thorough understanding of the principles of taxation. LO2. Provide a basic understanding as to the powers and authority of the Commissioner of Internal Revenue under section 4 to 7 , Title 1 of the Tax Code. LO3. Recognize the essential features of tax remedies. LO4. Develop a comprehensive understanding of Income Tax in relation to taxpayer and tax base; gross income; deductions from gross income; accounting periods; accounting methods; tax return preparation;withholding taxes. LO5. Recognize and broadly understand tax compliance requirements demanded by government agencies and private sector. COURSE LEARNING PLAN TOPICS Time Allotment CLO1 CLO2 CLO3 CLO4 CLO5 Teaching and Learning Activities Outcomes-Based Assessments References ESSU Vision and Mission, Department’s Specific Objectives, Course Policies and Guidelines, Standards and Course Requirements. Introduction to the Course 1.5 hours x Conduct orientation activity as regards to University’s Vision & Mission, including Department goals. Graded recitation Student Handbook

- 2. Page 2 Certificate No. AJA19-0226 Principles of taxation Nature, scope, classification, and essential characteristics Principles of sound tax system Limitations of the power of taxation (inherent limitations and constitutional limitations) Differences between taxation and police power; differences between taxation and eminent domain; similarities among taxation, police power and eminent domain Tax evasion vs. tax avoidance Site/place of taxation Double taxation (direct and indirect) Taxes i.e., characteristics, classifications, tax vs. other charges (e.g., to, special assessment, license fee, debt) 9 hours x x Pre-assign topical items for group research and study Teacher- moderated group oral report Teacher- facilitated Q & A Written examination Graded group presentation Valencia, Edwin G. and Roxas, Gregorio F. (2016-2017) 7th edition Income Taxation Powers and authority of the Commissioner of Internal Revenue Under section 4 to 7, title 1 of the tax code To compromise tax payments, abate or cancel tax liability and refund or credit taxes 3 hours x x Pre-assign topical items for group research and study Teacher- moderated group oral report Teacher- facilitated Q & A Written examination Graded group presentation Valencia, Edwin G. and Roxas, Gregorio F. (2016-2017) 7th edition Income Taxation Tax Remedies Remedies of the government (State); definition, scope, prescriptive period Administrative remedies (tax lien, compromise, levy and distraint) Judicial actions (civil or criminal) Remedies of taxpayer (prescriptive period, administrative remedies i.e., against an assessment, request for refund or credit of taxes Expanded jurisdiction of the Court of Tax Appeal (limited to jurisdiction) 6 hours x x x Pre-assign topical items for group research and study Teacher- moderated group oral report Teacher- facilitated Q & A Written examination Graded group presentation Valencia, Edwin G. and Roxas, Gregorio F. (2016-2017) 7th edition Income Taxation

- 3. Page 3 Certificate No. AJA19-0226 Income Tax Taxpayer and tax base (i.e., individuals, corporations, special corporations) Gross income (i.e. inclusions, exclusions, passive income) Capital gain tax and final income tax on fringe benefits Deductions from gross income (i.e., itemized or optional) Accounting periods (calendar or fiscal) Tax return preparation and tax payments Withholding taxes 33 hours x x x x Pre-assign topical items for group research and study Teacher- moderated group oral report Teacher- facilitated Q & A Written examination Graded group presentation Valencia, Edwin G. and Roxas, Gregorio F. (2016-2017) 7th edition Income Taxation Compliance requirements Administrative requirements Attachments to income tax return Keeping books of accounts and records Prescriptive period of books of accounts 1.5 hours x x x x x Pre-assign topical items for group research and study Teacher- moderated group oral report Teacher- facilitated Q & A Written examination Graded group presentation Valencia, Edwin G. and Roxas, Gregorio F. (2016-2017) 7th edition Income Taxation