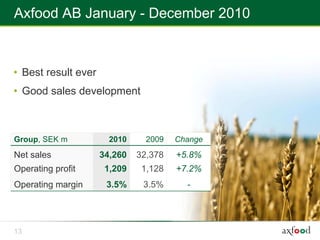

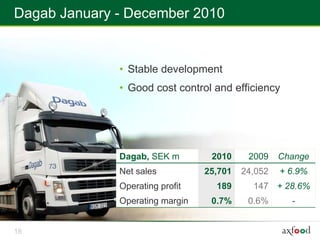

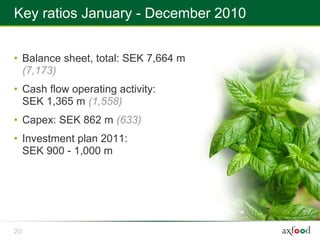

Axfood AB reported its best results ever for 2010, with operating profit increasing 7.2% over 2009. Key objectives of operating profit maintaining 2009 levels and profitable growth were achieved, with sales growth of 5.8%. The board proposed a dividend of SEK 12 per share, representing 73% of profit after tax in line with the company's 50% minimum dividend policy. Looking ahead, Axfood aims to maintain at least 2010 operating profit levels through store optimization, sales growth stimulation, cost control and increased private label sales.