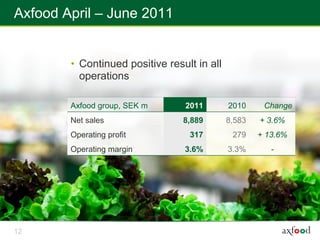

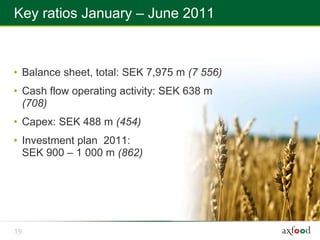

Axfood reported stable sales growth of 3.6% for the second quarter of 2011 with net sales of SEK 8,889 million. The operating profit increased 13.6% to SEK 317 million and the operating margin improved to 3.6%. All of Axfood's operations, including Willys, Hemköp, PrisXtra, Axfood Närlivs and Dagab, delivered continued positive results. Axfood aims to achieve an operating profit in 2011 at least equal to the level achieved in 2010 through high rates of store establishments and modernization, good cost control and efficiency measures, and stimulating sales growth.