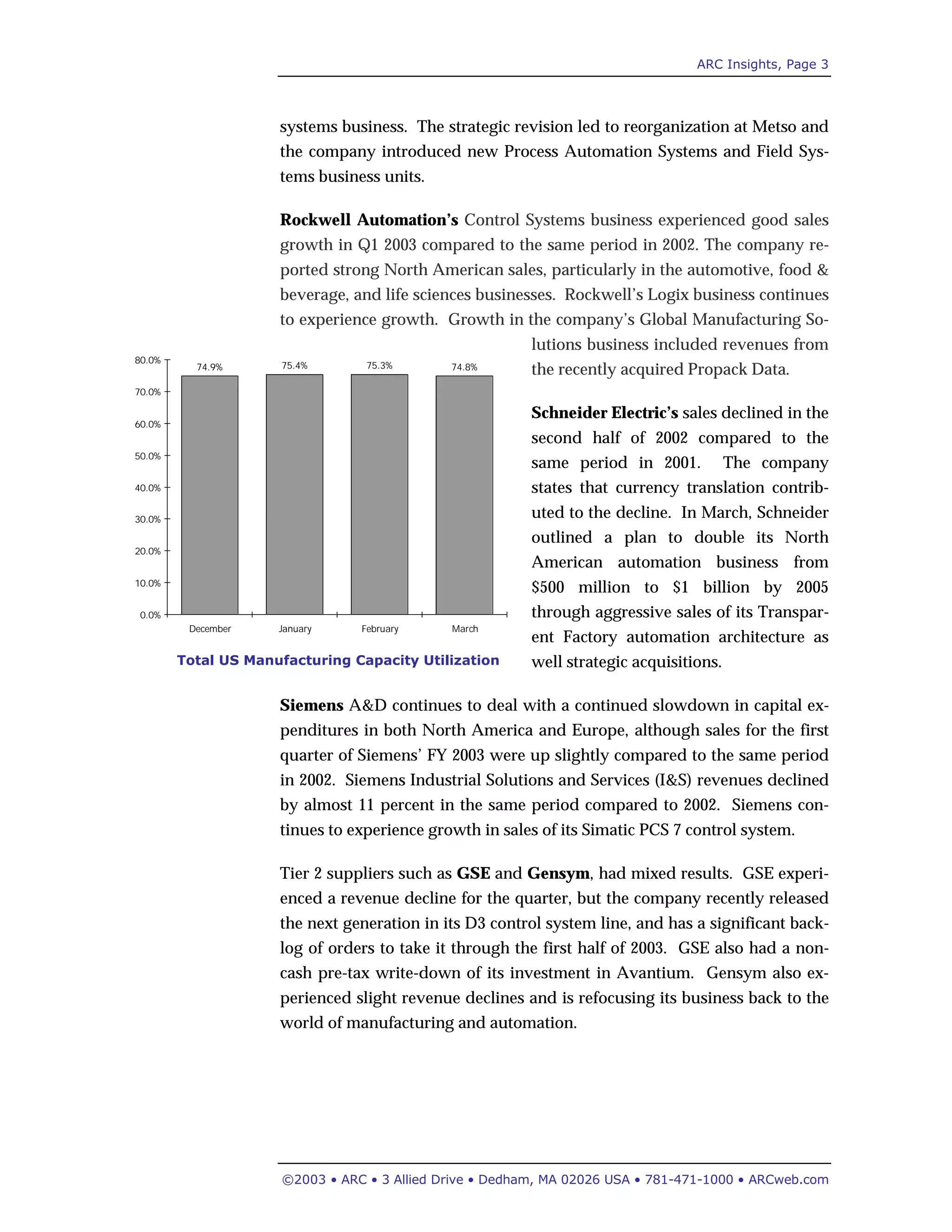

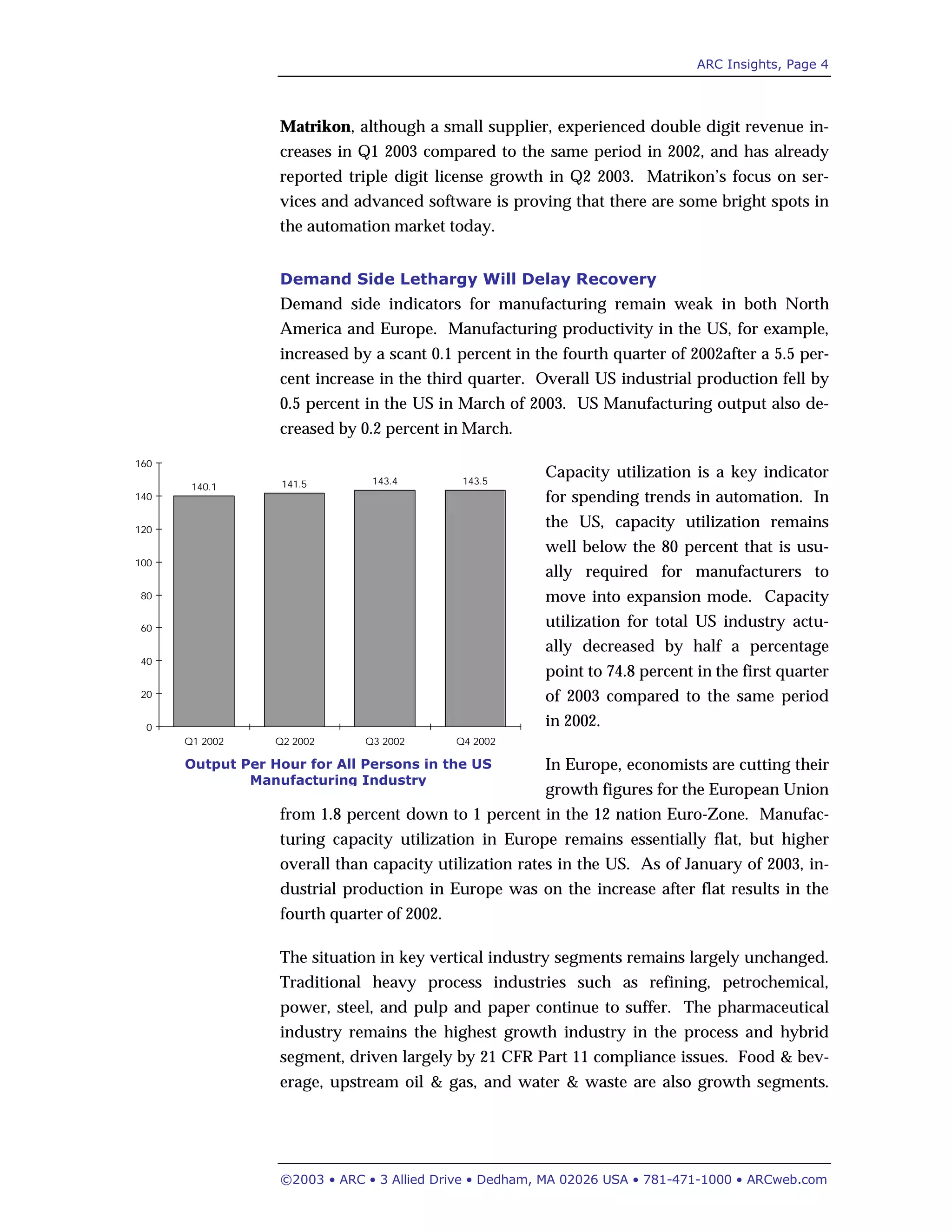

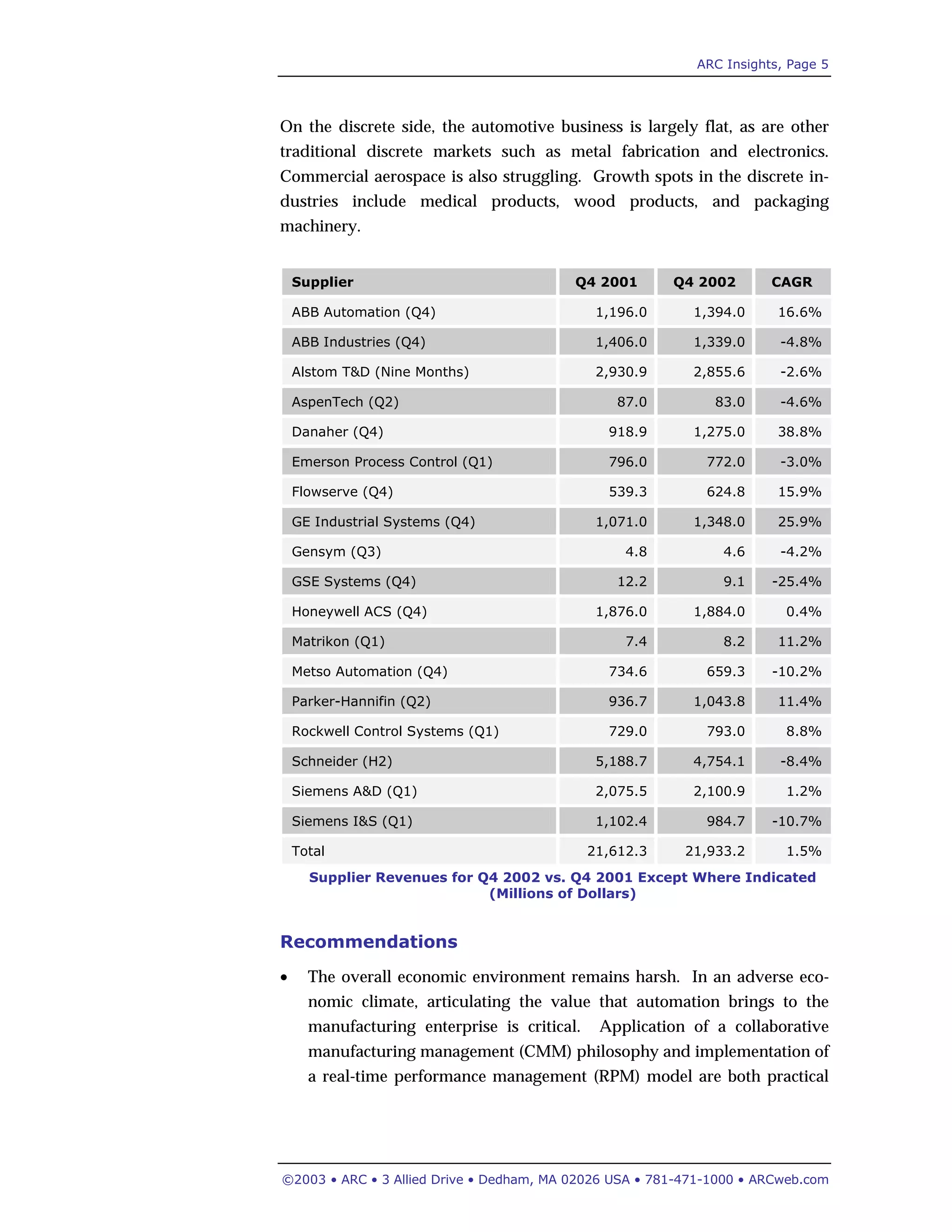

The document summarizes the state of the automation market in early 2003. It finds that the market remains sluggish due to global economic uncertainty, lower oil prices, reduced capital spending, and low capacity utilization. While some suppliers are experiencing growth through acquisitions, the overall market is flat or declining slightly. The analysis reports mixed financial results among major automation suppliers and recommends that suppliers emphasize the value of automation during the difficult economy. It concludes the demand side issues will delay recovery until capacity utilization increases above 80%.