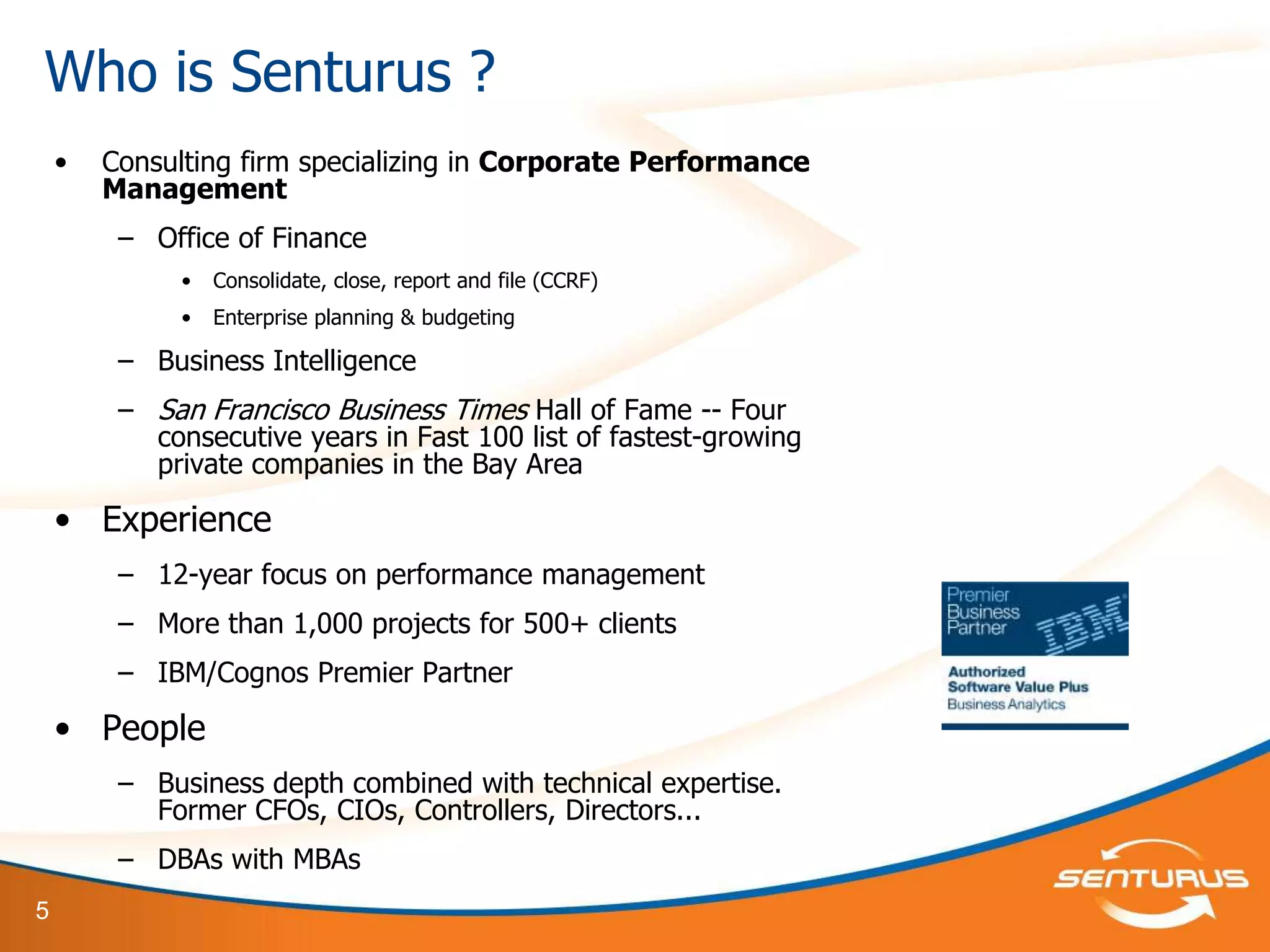

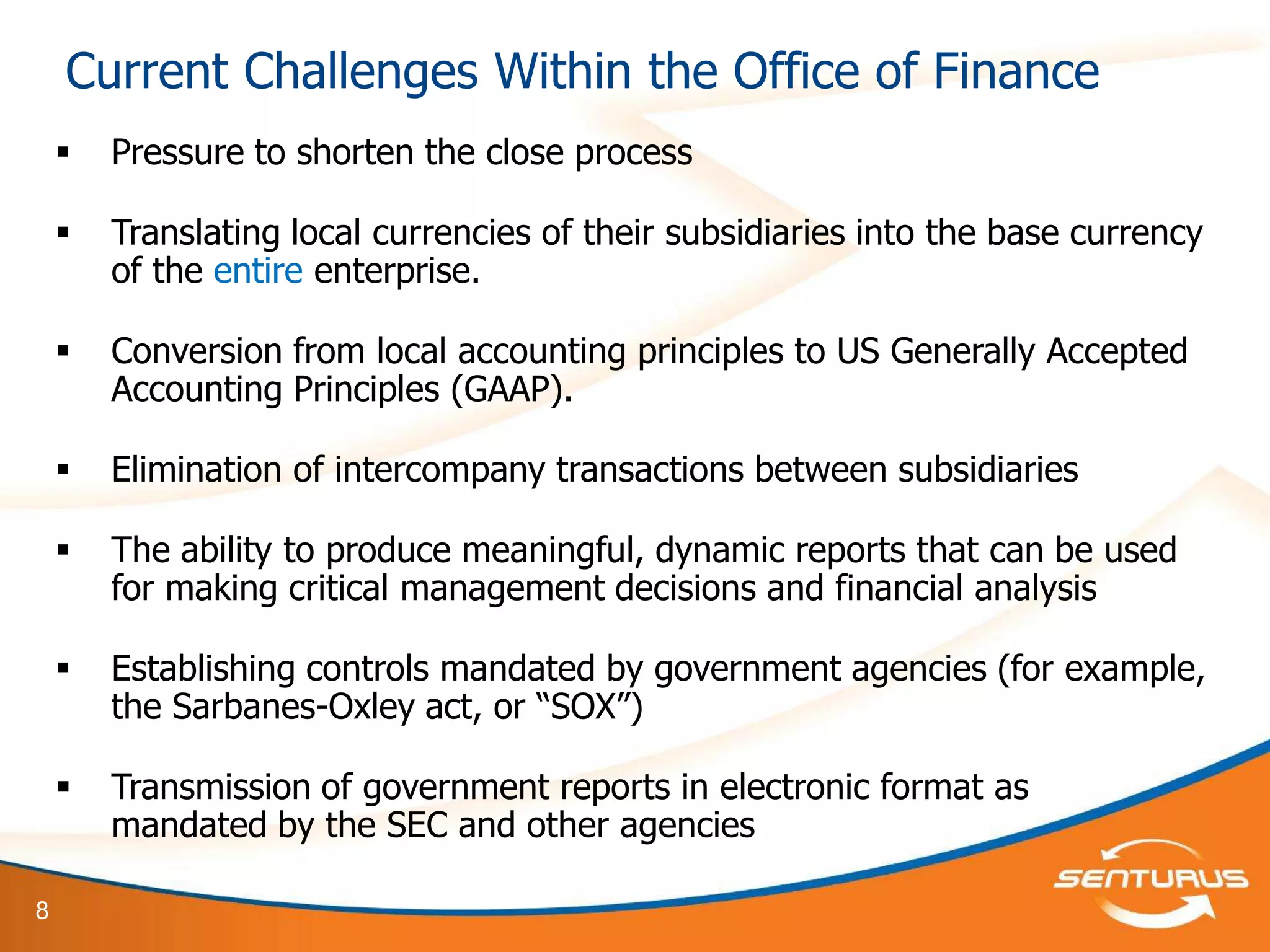

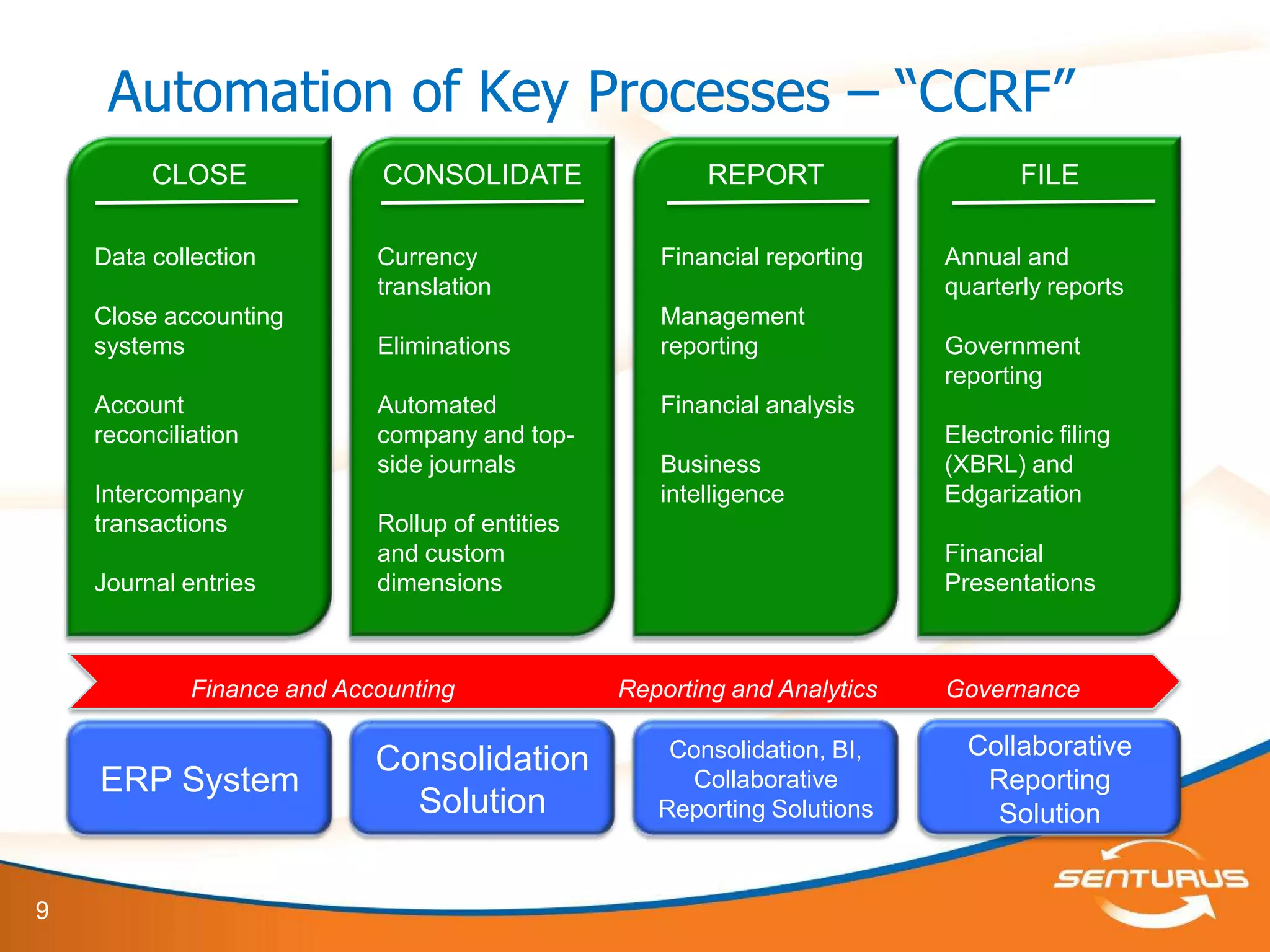

This document is a financial statement reporting on the close, consolidate, report, and file (CCRF) process, highlighting the challenges faced by finance offices and the benefits of automation in financial reporting. The presentation includes an overview of CCRF, a demonstration of IBM Cognos Financial Statement Reporting (FSR), and upcoming events related to corporate performance management. Senturus, the consulting firm behind the webinar, emphasizes their expertise and experience in transforming financial processes.