Australian Engineering & Mining Services Weekly Research

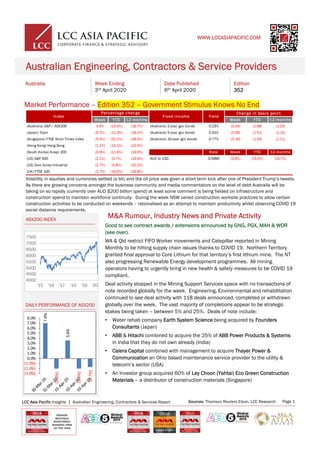

- 1. ASX200 INDEX Australia Week Ending 3rd April 2020 Date Published 6th April 2020 Edition 352 Australian Engineering, Contractors & Service Providers Market Performance – Edition 352 – Government Stimulus Knows No End M&A Rumour, Industry News and Private Activity DAILY PERFORMANCE OF ASX200 Good to see contract awards / extensions announced by GNG, PGX, MAH & WOR (see over). WA & Qld restrict FIFO Worker movements and Catepillar reported in Mining Monthly to be hitting supply chain issues thanks to COVID 19. Northern Territory granted final approval to Core Lithium for that territory’s first lithium mine. The NT also progressing Renewable Energy development programmes. All mining operators having to urgently bring in new health & safety measures to be COVID 19 compliant. Deal activity stopped in the Mining Support Services space with no transactions of note recorded globally for the week. Engineering, Environmental and rehabilitation continued to see deal activity with 118 deals announced, completed or withdrawn globally over the week. The vast majority of completions appear to be strategic stakes being taken – between 5% and 25%. Deals of note include: • Water rehab company Earth System Science being acquired by Founders Consultants (Japan) • ABB & Hitachi combined to acquire the 25% of ABB Power Products & Systems in India that they do not own already (India) • Calera Capital combined with management to acquire Thayer Power & Communication an Ohio based maintenance service provider to the utility & telecom’s sector (USA) • An Investor group acquired 60% of Ley Choon (Yahtai) Eco Green Construction Materials – a distributor of construction materials (Singapore) WWW.LCCASIAPACIFIC.COM WINNER: BOUTIQUE INVESTMENT BANKING FIRM OF THE YEAR LCC Asia Pacific Insights | Australian Engineering, Contractors & Services Report Page 1Sources: Thomson Reuters Eikon, LCC Research Volatility in equities and currencies settled (a bit) and the oil price was given a short term kick after one of President Trump’s tweets. As there are growing concerns amongst the business community and media commentators on the level of debt Australia will be taking on so rapidly (currently over AUD $200 billion spend) at least some comment is being fielded on infrastructure and construction spend to maintain workforce continuity. During the week NSW varied construction worksite practices to allow certain construction activities to be conducted on weekends – rationalised as an attempt to maintain productivity whilst observing COVID 19 social distance requirements. Change in basis point Week YTD 12-months Week YTD 12-months (Australia) S&P / ASX200 4.6% (10.3%) (18.7%) (Australia) 2-year gov bonds 0.23% (0.04) (1.68) (1.25) (Japan) Topix (9.2%) (11.3%) (18.2%) (Australia) 5-year gov bonds 0.41% (0.08) (1.51) (1.10) (Singapore) FTSE Strait Times Index (5.5%) (22.1%) (28.0%) (Australia) 10-year gov bonds 0.77% (0.16) (1.55) (1.11) (Hong Kong) Hang Seng (1.1%) (10.1%) (22.4%) (South Korea) Kospi 200 (0.9%) (11.6%) (19.0%) Rate Week YTD 12-months (US) S&P 500 (2.1%) (0.7%) (13.6%) AUD to USD 0.5995 (2.8%) (15.0%) (15.7%) (US) Dow Jones Industrial (2.7%) (9.8%) (20.2%) (UK) FTSE 100 (1.7%) (19.5%) (26.8%) Percentage change Index Fixed income Yield

- 2. Offshore & Oilfield Oil & Gas Services News – Australia & Abroad • Rystad projected that global exploration & production CAPEX would reach a 13 year low – expecting 2020 to fall by US $100 billion – down 17% from 2019 levels • Gazprom Neft’s Omsk refinery advances biological closed loop wastewater treatment plant • Tullow Oil continues to cot cut CAPEX and Decommissioning budgets – dropping CAPEX to $300m from $350m and Decommissioning to $65m from $100m (all USD) Sources: Thomson Reuters Eikon, Company Announcements, LCC research Ticker News/ Event Ticker News/ Event ACF Announced revised debt repayment schedule & cancelled dividend VRS Provides COVID19response including board & leadership team cost reductions CIM Continues on market buyback WOR Awarded 2 contracts in relation to sulfuric acid plants in Indonesia DCG BlackRock ceases to be Substantial Shareholder ALQ Updates on Independent Investigation FWD MUFG increases shareholding to 9.28% ANG Moves interim dividend payment date to 30 September GNG Enters 3 year O & M Contract with Triangle Energy BLY Defers AGM to 22 July MND Notes performance rights and options forfeited EHL Directors shares vest under incentive scheme PGX Notes Contract Additions of A$20m MAH Extends underground contract with Silver Lake adding approx. $200m to order book SRG Delays dividend payment from 29 April to 29 October TPP Issues Annual Report News Headlines and Key Sector Developments WWW.LCCASIAPACIFIC.COM LCC Asia Pacific Insights | Australian Engineering, Contractors & Services Report WINNER: BOUTIQUE INVESTMENT BANKING FIRM OF THE YEAR We are driven to improve our technical knowledge of the Resource Services, Oilfield Services, Electrical Services, Infrastructure Services, Engineering and Resources Sectors, and seek to be an active member within key industry peak bodies. Not only does this strategy reinforce our fundamental enjoyment and drive to better service clients within these Sectors, but it allows us to continually build deep operational and business knowledge of both broad and niche industries. This differentiates LCC from other Advisory Firms as we deliver much more to the Client Leadership Team and Board of Directors than “commoditised” transactional experience and “general advice” LCC’s Sector Association Involvement Page 2

- 3. LCC Australian Contractors & Service Providers Index® (LCCACSPI) WWW.LCCASIAPACIFIC.COM The LCCACSPI Index shows the damage done in this rout vs the ASX 200 over the long term Market Data Since 2011 Rolling 1 Year Market Data Market Data Since 2011 Rolling 1 Year Market Data Both the LCCACSPI and the ASX now strongly in negative performance territory All sectors tracking negative – and will likely continue to do so during the extended period of flight restrictions and lockdowns Some recovery from “shock falls” seen – hopefully not a “dead cat bounce” WINNER: BOUTIQUE INVESTMENT BANKING FIRM OF THE YEAR LCC Asia Pacific Insights | Australian Engineering, Contractors & Services Report Sources: Thomson Reuters Eikon, LCC Research Page 3

- 4. ASX-Listed Companies – as at close Friday 3rd April 2020 LCC Asia Pacific Insights | Australian Engineering, Contractors & Services Report Sources: Thomson Reuters Eikon, LCC Research WWW.LCCASIAPACIFIC.COM WINNER: BOUTIQUE INVESTMENT BANKING FIRM OF THE YEAR Page 4 Ticker Company Name Market Cap (A$ m) Open Price (A$) Close Price (A$) Week High (A$) Week Low (A$) Volume Trend EV/ EBITDA EV/ EBIT Engineering Services ACF.AX Acrow Formwork and Construction Services 54 0.17 0.25 0.28 0.17 ▲ 38.9% 8.5x 20.2x AJL.AX AJ Lucas Group Ltd 44 0.04 0.04 0.04 0.04 ▲ 2.9% 6.9x 11.0x BOL.AX Boom Logistics Ltd 38 0.08 0.09 0.09 0.08 ▼ (1.1%) 4.7x n.m. BPP.AX Babylon Pump & Power Ltd 13 0.01 0.02 0.02 0.01 ▲ 15.4% 11.3x n.m. BSA.AX BSA Ltd 114 0.26 0.26 0.27 0.26 ▲ 2.0% 3.1x 4.0x CDD.AX Cardno Ltd 117 0.25 0.26 0.25 0.24 ▲ 13.0% 4.4x 9.7x CIM.AX CIMIC Group Ltd 7,478 21.28 23.10 22.93 19.77 ▲ 6.5% 3.8x 6.6x CVL.AX Civmec Ltd 164 0.43 0.42 0.42 0.35 ▼ (2.4%) 10.2x 16.2x DCG.AX Decmil Group Ltd 26 0.20 0.11 0.13 0.07 ▼ (73.2%) 0.8x 0.9x DOW.AX Downer EDI Ltd 1,873 2.81 3.15 3.22 2.66 ▲ 11.7% 5.3x 11.4x EGN.AX Engenco Ltd 133 0.41 0.42 0.42 0.41 ▲ 9.1% 10.2x 16.8x FWD.AX Fleetwood Corp Ltd 111 1.17 1.16 1.19 1.15 ▼ (1.3%) 2.8x 6.1x GNG.AX GR Engineering Services Ltd 112 0.70 0.72 0.70 0.60 ▼ (4.0%) n.m. n.m. JLG.AX Johns Lyng Group Ltd 484 2.01 2.18 2.16 2.01 ▲ 7.4% 15.8x 19.1x LCM.AX LogiCamms Ltd 28 0.14 0.14 0.14 0.13 ▲ 7.7% 5.1x 6.9x LLC.AX LendLease Group 5,840 9.50 10.34 10.43 9.50 ▲ 8.5% 11.2x 13.4x LYL.AX Lycopodium Ltd 157 3.90 3.90 3.92 3.73 ▼ (3.7%) 1.4x 1.6x MCE.AX Matrix Composites & Engineering Ltd 21 0.19 0.20 0.20 0.18 ▲ 5.3% 14.8x n.m. MND.AX Monadelphous Group Ltd 905 9.00 9.58 10.40 8.00 ▲ 2.4% 8.4x 11.3x PGX.AX Primero Group Ltd 30 0.16 0.17 0.18 0.15 ▲ 21.4% 3.7x 4.5x RDG.AX Resource Development Group Ltd 10 0.02 0.02 0.02 0.02 — 0.0% 1.3x n.m. SND.AX Saunders International Ltd 39 0.38 0.38 0.38 0.38 — 0.0% n.m. n.m. SRG.AX SRG Global Ltd 104 0.21 0.23 0.22 0.21 ▲ 9.5% 7.2x n.m. SSM.AX Service Stream Ltd 754 1.74 1.85 1.83 1.70 ▲ 4.8% 7.1x 9.4x SXE.AX Southern Cross Electrical Engineering Ltd 105 0.43 0.42 0.44 0.42 ▲ 2.4% 2.3x 2.9x SOP.AX SML Corporation Ltd 6 0.02 0.03 0.03 0.02 ▲ 13.0% n.m. n.m. TPP.AX Tempo Australia Ltd 10 0.03 0.03 0.03 0.03 ▲ 9.7% n.m. n.m. VMG.AX VDM Group Ltd 14 0.00 0.00 0.00 0.00 — 0.0% n.m. n.m. VMX.AX Valmec Ltd 19 0.18 0.15 0.18 0.15 ▼ (14.3%) 2.4x 3.3x VRS.AX Veris Ltd 10 0.02 0.03 0.03 0.02 ▲ 23.8% 8.6x n.m. WOR.AX Worley Ltd 3,429 5.79 6.59 6.57 5.48 ▲ 13.8% 8.0x 10.2x ZGL.AX Zicom Group Ltd 9 0.05 0.04 0.04 0.04 — 0.0% n.m. n.m. Mining Services AMX.AX Aerometrex Ltd 113 1.07 1.18 1.16 1.06 ▲ 12.4% 23.5x 39.7x ALQ.AX ALS Ltd 2,721 5.28 5.64 5.63 5.13 ▲ 4.6% 9.9x 12.6x ANG.AX Austin Engineering Ltd 73 0.12 0.13 0.13 0.12 ▲ 4.2% 6.7x 19.2x BLY.AX Boart Longyear Ltd 53 0.48 0.60 0.57 0.40 ▲ 25.0% 10.5x 21.8x EHL.AX Emeco Holdings Ltd 311 0.70 0.85 0.83 0.69 ▲ 15.0% 3.5x 6.7x IMD.AX Imdex Ltd 329 0.86 0.84 0.83 0.78 ▼ (5.6%) 5.8x 8.5x IPL.AX Incitec Pivot Ltd 3,308 1.88 2.05 2.03 1.82 ▲ 7.9% 10.3x 24.3x MAH.AX Macmahon Holdings Ltd 436 0.18 0.20 0.20 0.16 ▲ 21.2% 2.8x 7.6x MIN.AX Mineral Resources Ltd 2,850 13.76 15.12 14.91 13.35 ▲ 10.0% 4.3x 5.6x MLD.AX MACA Ltd 190 0.62 0.71 0.68 0.58 ▲ 15.4% 4.1x 39.6x MSV.AX Mitchell Services Ltd 59 0.32 0.30 0.30 0.30 ▼ (7.8%) 4.5x 9.2x MYE.AX Mastermyne Group Ltd 72 0.57 0.70 0.68 0.57 ▲ 22.8% 3.4x 5.8x NWH.AX NRW Holdings Ltd 614 1.21 1.44 1.42 1.15 ▲ 17.6% 5.0x 9.8x ORI.AX Orica Ltd 6,531 15.21 16.10 15.92 14.82 ▲ 4.3% 9.7x 14.3x PPK.AX PPK Group Ltd 201 1.90 2.33 2.10 1.90 ▲ 29.4% 85.6x 268.0x PRN.AX Perenti Global Ltd 392 0.56 0.57 0.58 0.50 — 0.0% 2.5x 6.5x RUL.AX RPMGlobal Holdings Ltd 183 0.72 0.81 0.80 0.68 ▲ 11.0% 17.4x 40.0x SWK.AX Swick Mining Services Ltd 32 0.10 0.11 0.10 0.10 ▲ 5.0% 2.6x n.m. Facilities Management & Services AEI.AX Aeris Environmental Ltd 136 0.45 0.63 0.55 0.45 ▲ 43.2% n.m. n.m. ALQ.AX ALS Ltd 2,721 5.28 5.64 5.63 5.13 ▲ 4.6% 9.9x 12.6x HIL.AX Hills Ltd 48 0.19 0.21 0.21 0.17 ▲ 20.6% 8.1x 33.2x MIL.AX Millennium Services Group Ltd 11 0.24 0.24 0.24 0.22 — 0.0% 10.4x n.m. ENE.AX Enevis Ltd 11 0.17 0.16 0.16 0.16 — 0.0% n.m. n.m. TPS.AX Threat Protect Australia Ltd 12 0.05 0.05 0.05 0.05 — 0.0% 11.8x n.m. Source: Thomson Reuters, LCC research Weekly change (%)

- 5. lccasiapacific.com.au SYDNEY | BRISBANE | NEW YORK LCC Asia Pacific is a boutique investment banking practice, providing independent corporate finance & strategy advice to clients in Australia and across Asia Pacific markets. We have acted for ambitious clients ranging from “emerging” companies, up to Fortune 100 & “Mega” Asian listed entities. LCC Asia Pacific provides clear, unbiased counsel to CEOs and Boards of Directors considering growth strategies, business transformation and challenging corporate decisions. We understand that to service such clients requires a high performance approach, and a tenacity to deliver results. For more information, visit www.lccasiapacific.com.au. © 2019 LCC Asia Pacific Founded in 2004, LCC Asia Pacific is an award-winning boutique investment banking & strategic advisory firm that specializes in the engineering & contracting sector as well as general & specialised services – including mining, drilling, energy & oilfield (onshore & offshore) We provide our clients with key insights on the Engineering, Contracting and Oil Field Services Sectors – assisting with in depth strategy formulation and execution of both organic and M & A engagements About LCC Asia Pacific – we deliver Deal Craft™ Disclaimer This general information has been prepared by LCC Asia Pacific Pty. Limited ("LCC"). The research is based on public information obtained from sources believed to be accurate and reliable. LCC does not guarantee the accuracy, reliability, completeness or suitability of any such information and makes no warranty, guarantee or representation, expressly or impliedly about this research. LCC accepts no obligation to correct or update the information. No opinion or recommendation is made within this research. This report is not intended to be, nor should it be relied on, as a substitute for professional advice. This report should not be relied upon as the sole basis for any investment decision or planning, and LCC does not accept any responsibility on this basis for actions made. Investment Banking Services Strategic Advisory Consulting Mergers, Acquisitions & Divestments Equity Capital & Debt Capital Advisory Balance Sheet Review & Optimisation Project & Infrastructure Financing Yellow Metal Financing Strategic Corporate Investment Planning & Implementation Consortia Development & Deal Structuring Joint Venture Design, Partner Selection & Commercial Structuring Shareholder Disputes & Activism Independent and experienced advice to Leadership teams and Boards of Directors – including through crisis management Complex Negotiation Planning & Execution Including For Commercial Contracts & Dispute Resolution Financial Modelling, Scenario Analysis & Business Case Development Analysis Of Commercial Arrangements Including Tolling, “Services For Equity” & Royalty Agreements Tender Research & Preparation Support Bespoke Industry Specific Research & Data Analysis, including “Benchmarking” Domestic & Cross Border Market Entry & Exit Planning & Analysis Mining Technology Research, Recommendations & Implementation China Belt & Road Initiative Strategies & Responses WWW.LCCASIAPACIFIC.COM Nicholas Assef Engineering, Contracting & Services Sector Lead + 61 498 115 054 naa@lccapac.com