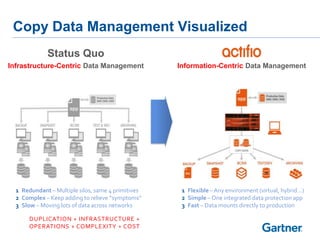

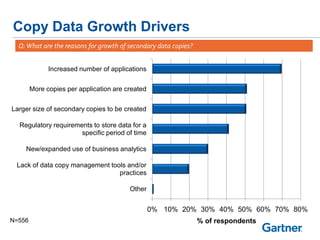

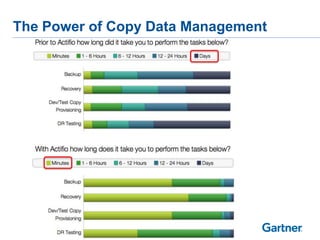

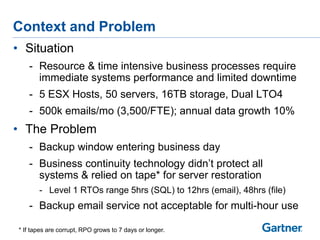

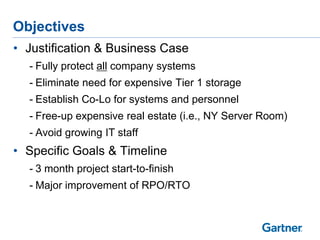

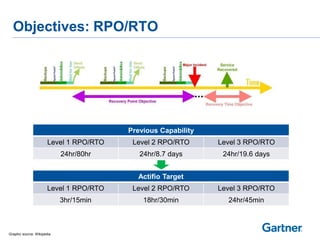

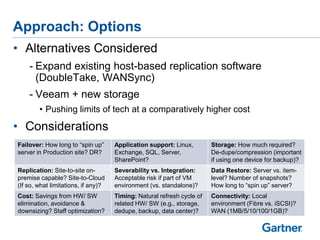

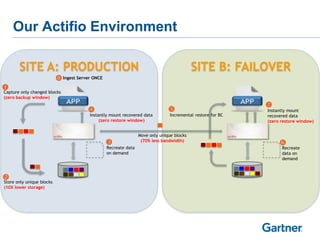

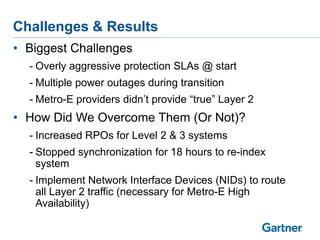

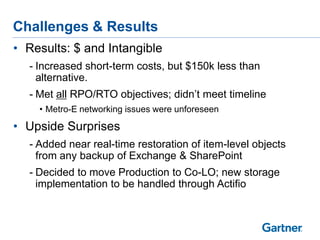

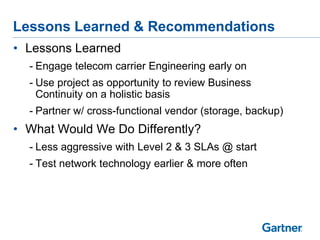

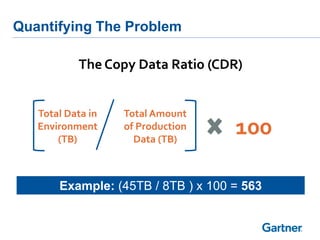

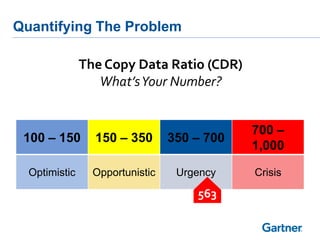

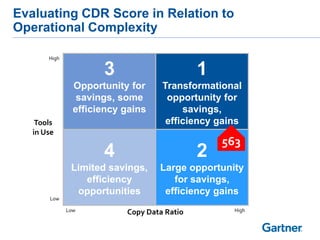

The document discusses the challenges and opportunities presented by the management of copy data in enterprise environments, highlighting inefficiencies caused by data redundancy and complexity. It outlines a case study involving a transition to advanced copy data management tools to improve system performance, reduce costs, and meet key recovery objectives. The final recommendations emphasize engaging management in process changes and assessing telecom infrastructure early in the implementation phase.