This document provides questions for an assignment covering chapters 8-9 on intellectual property. It includes 24 multiple choice and short answer questions about various intellectual property concepts such as trademarks, copyrights, patents, trade secrets, and international agreements. Key topics covered are definitions of trademarks, copyright and patent infringement, fair use exceptions, and protections under international treaties like the Berne Convention and TRIPS agreement. Students are asked to email their answers in Word format to the provided email address.

![ASSIGNMENT 3 (CHAPTERS 8-9) QUESTIONS

Name:

MTMAIL Address:

Type accurate, detailed, and explanatory answers in the spaces

below. Email them in Word document to [email protected] (Do

not use D2L). Feel free to email me or call me at 615-292-3030

or 615-585-5353 (leave message if no answer; do not text) if

you have any questions.

Chapter 8 (Intellectual Property)

1. What are some aspects of branding that can be trademarked?

A trademark is a distinctive mark, motto, device, or implement

that a manufacturer stamps, prints, or otherwise affixes to the

goods it produces so that they can be identified on the market

and their origins made known.

2. What is trademark infringement?

When registering for a trademark with the U.S. Patent and

Trademark office, they give a notice on a nationwide basis that

the trademark belongs exclusively to the registrant. The

registrant then uses the trademark symbol on their mark to

indicate that it belongs to them. Whenever that trademark is

copied to a substantial degree, or used in its entirety by another,

whether intentionally or unintentionally, the trademark is

infringed. In other words, the trademark has been used without

authorization. The owner of the mark can take legal action

against the infringer by showing that the defendant’s use of the

mark created a likelihood of confusion about the origin of the](https://image.slidesharecdn.com/assignment3chapters8-9questionsname-220914183729-e670a767/75/ASSIGNMENT-3-CHAPTERS-8-9-QUESTIONS-Name-docx-1-2048.jpg)

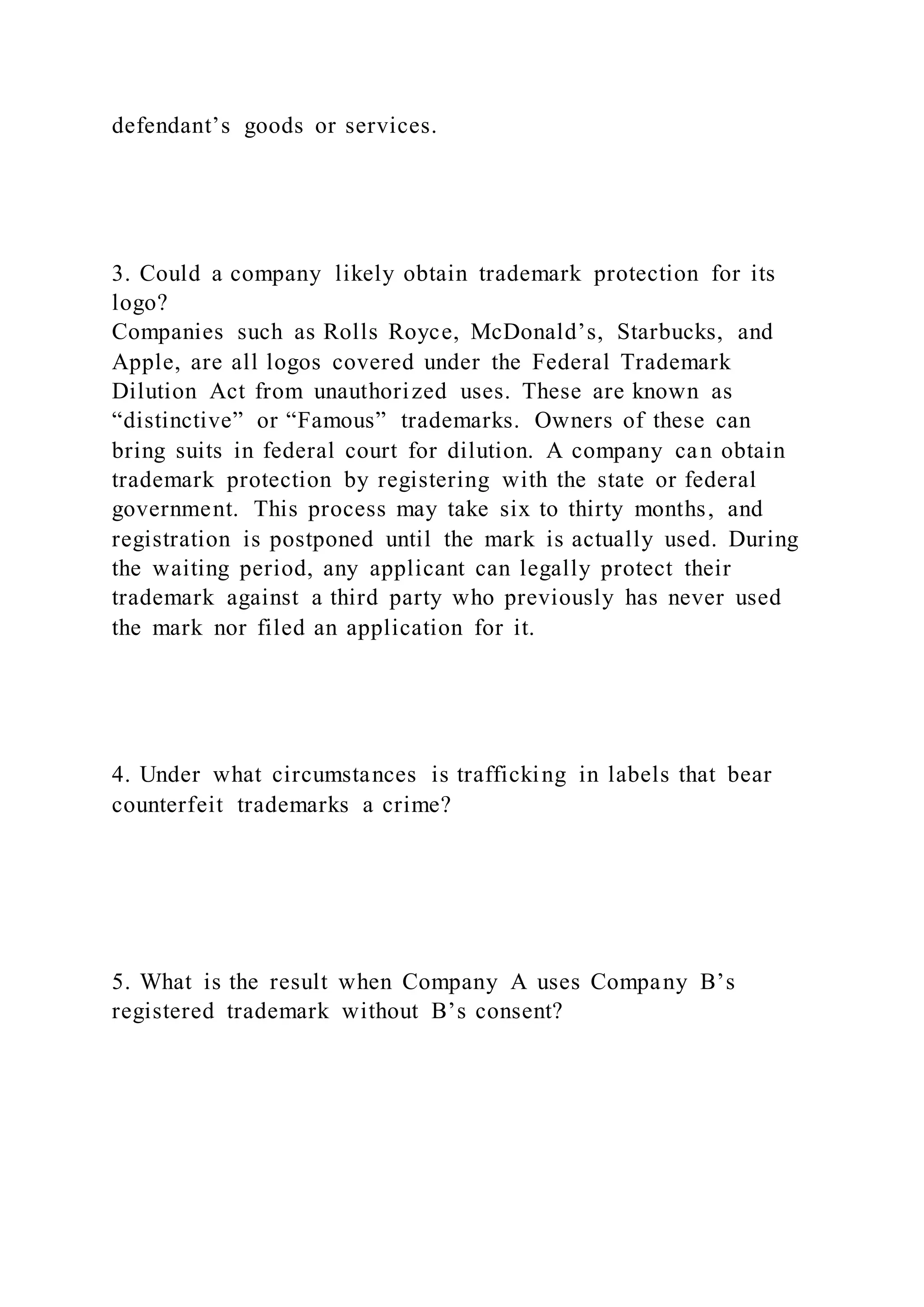

![“A” reorganization) by BiggerCo. All of BigCo’s former assets

and operations now make up just another one of Bigger’s

several divisions.

Ms. Executive was fired the day after the merger closed –

Bigger had a CFO and didn’t need two.

But there was some happy news . . . because Ms.

Executive had been smart enough to negotiate for a generous

golden parachute provision in her CFO contract. The merger

pulled the ripcord on that parachute and she collected a pre-tax

lump-sum $4.4 million in September 2019. Can’t be sad about

that!

“Wow, close call!”, you had said to her at the time. “You

almost had to pay that nasty 20% excise tax!”

In 2021 Ms. Executive accepted a job in Hawaii and moved.

She’d said at that point that although she “love[d] you to death”

she felt the need for a local CPA. You agreed that that made

sense, and she found one…

* * *

Out of the blue today Ms. Executive called you and she’s

really angry. The IRS audited her 2019 return (the audit

handled by her new CPA) and no sooner was the IRS finished

than they handed Ms. Executive a tax deficiency notice saying

“$580,000 excise tax, please.”

“You told me that I wouldn’t have pay any excise tax! Now the

IRS says that I do owe it. Not happy with you!” (You can’t

blame her for being upset, you only wish that you’d been](https://image.slidesharecdn.com/assignment3chapters8-9questionsname-220914183729-e670a767/75/ASSIGNMENT-3-CHAPTERS-8-9-QUESTIONS-Name-docx-16-2048.jpg)