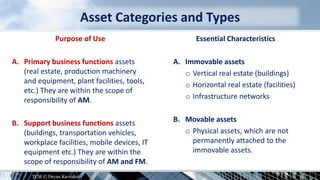

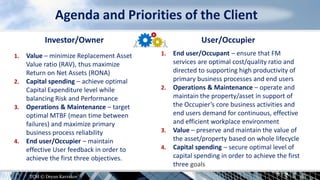

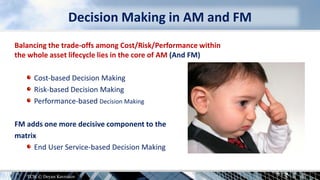

Asset management and facility management have both differences and converging aspects. While asset managers focus on maximizing return on assets and utilization for investors, facility managers focus on optimizing the work environment for occupants. Both roles manage physical assets and work to minimize costs over the asset lifecycle, but their priorities and stakeholders differ. There is a trend toward greater integration of asset and facility management roles and services through standards, integrated service delivery models, and industry consolidation.