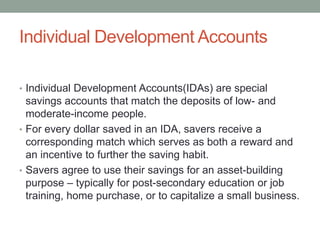

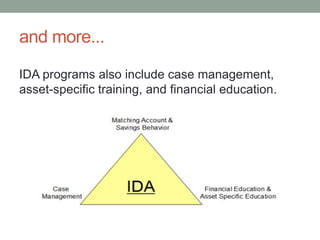

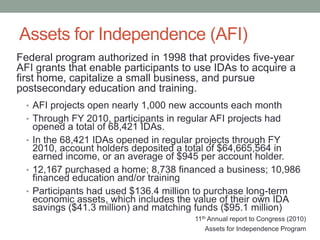

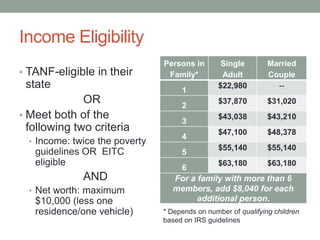

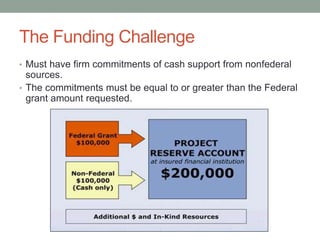

The document discusses asset building strategies to help low-income households build wealth. It defines asset building as long-term saving and investment to increase economic independence. Research shows that assets provide stability during hard times and encourage future orientation. While income measures getting by, assets measure getting ahead. Many low-income households want to save but lack opportunities. Individual Development Accounts (IDAs) match savings for goals like education, homes, or businesses. The Assets for Independence program also uses IDAs. However, the funding challenge is getting non-federal matching commitments. Employer-based IDAs could help more working poor individuals by providing savings incentives and financial education at work. Case studies show examples of employers doubling scholarships or assistance for home